Next Generation EU, because bonds will calm spreads

The analysis by Althea Spinozzi, Senior Fixed Income Strategy, for BG Saxo , on the recent demand for Next Generation EU bonds

There are new bonds in the city, which are already in the spotlight. We are talking about the joint European debt issued to finance the Next Generation EU (NGEU) fund. While this is not the first time that Europe has sold joint liability bonds, the scale at which this type of issuance is increasing will lead to a necessary change within the European sovereign market.

The European debt has more than doubled since last summer, since the EU is facing the economic shock caused by the Coronavirus pandemic.

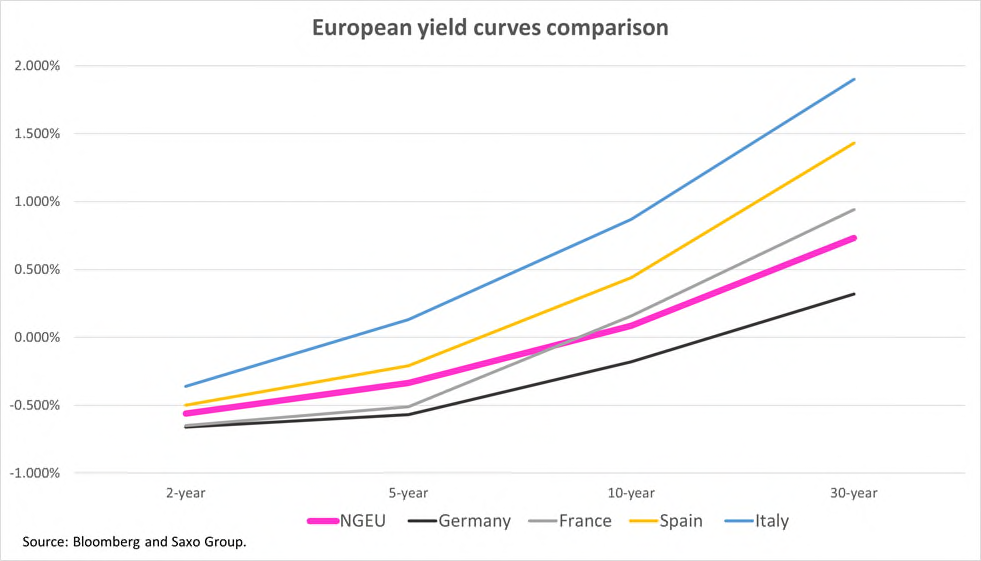

Before the new bond issues under the NGEU fund, the total amount of the joint debt issued by the European Union was approximately € 140 billion. Now we are working on an issue of bonds on a larger scale: 800 billion euros, distributed with a share of 150-200 billion euros per year from now until 2026. This will bring profound changes in the European sovereign space. For the first time in history, a European yield curve will be provided which can be used as a benchmark in the valuation of euro bonds.

The harmonization of financing costs in Europe will be uneven

The large European joint debt issuance will provide stability and standardization in the European market by compressing the spread of various European countries vis-à-vis the Bund.

While the bonds will be financed by the application of taxes within the entire area of the European Union, the disbursements under the NGEU fund will be different and directed to the countries that need them most to recover from the Covid pandemic.

Italy, for example, will be the largest beneficiary of these funds and has recently obtained 191.5 billion euros. It is also the highest performing country in the euro area, above even Greece. Therefore, Rome will benefit most from spread compression. The BTP / Bund spread is expected to tighten faster than any other country, as highlighted in our recently published quarterly outlook.

Conversely, we are less optimistic about the French debt. The credit situation in Paris has deteriorated significantly over the past year, with public and private debt spiking faster than in any other European state. In nominal terms, the French debt has surpassed the Italian one, and the country will benefit from a quarter of the financing package that Italy has obtained from the NGEU fund.

While France's credit fundamentals remain much stronger than Italy's, French government bonds rank second among the lowest-yielding sovereigns in Europe, right after Bunds, and pay a negative yield up to at nine years old.

By comparing French government bonds with newly issued NGEU bonds, it can be seen that the front of France's yield curve is priced lower than European common debt for up to five years. This implies that the market believes that French debt is safer than NGEU bonds.

Research by Goldman Sachs points out that one of the risks behind NGEU bonds is the lack of protection from extreme scenarios such as a eurozone breakout. However, now that the EU is making important steps towards better European integration, this scenario seems unlikely. However, French government bonds at the front of the yield curve appear to be a market distortion caused by ECB policies. For the same reason, the yields on Greek government bonds are now lower than those of Italy.

Increased issuance of NGEU bonds and exponential demand for these bonds expected

So far, Europe has issued 5-, 10- and 30-year bonds under the NGEU fund to great success, but plans to sell more before the August summer hiatus. While demand exceeded the sale of € 20 billion of 10-year bonds by seven times, the combined order book for 5- and 30-year bonds exceeded € 170 billion, covering the sale of fourteen times.

Long-term investors will want to buy more of this type of bond, as it is an opportunity to buy a safe haven and at the same time make a sizeable gain over German Bunds. This explains why the 30-year tranche has seen the highest demand in recent bond sales: it offers around 40 bps on top of a 30-year Bund with a yield of 0.732%.

The spread of green bonds will allow the EU to save

The decision to issue a third of the NGEU bonds as green bonds is not accidental. ESG investments have a longer long-term horizon than traditional investments. In this way, politicians make sure that the fiscal stimulus will support the next generation (of European citizens), just as the name of the fund suggests.

Furthermore, the EU would save a lot of money by issuing green bonds. In fact, the “greenium” spread that the latter pay with respect to their benchmark is currently between -2 and -6bps. Over 240 billion euros of debt represent savings ranging from 48 to 144 million euros. Now the question is whether this “greenium” can be compressed further, as ESG investors are hungry for supply and more new investors are drawn to the new European green benchmark.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/next-generation-eu-perche-i-bond-calmeranno-gli-spread/ on Sun, 11 Jul 2021 05:03:35 +0000.