Non-life business in Assicurazioni Generali (which will raise rates)

What emerges from the quarterly report of Assicurazioni Generali. Numbers, comparisons and trends (for tariffs and flood impact in Romagna)

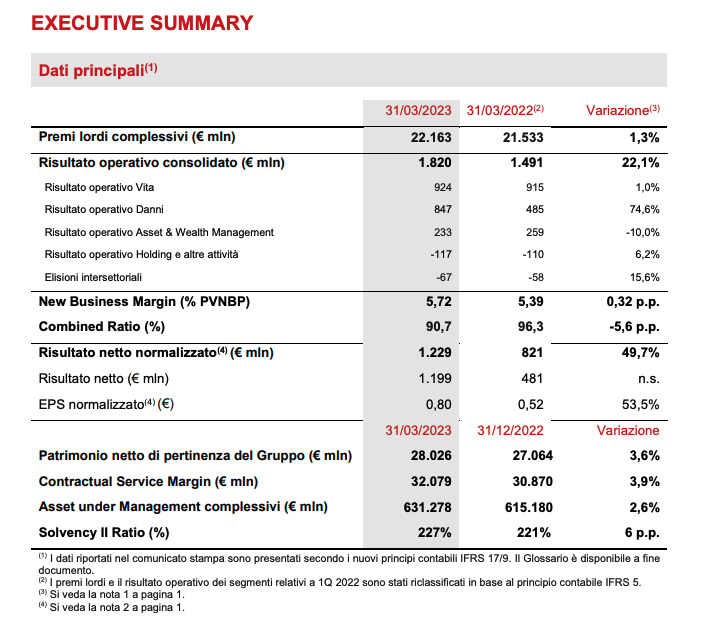

Another excellent quarter for Generali Assicurazioni which closes the first quarter of 2023 with a net profit of 1,199 million (from 481 million in the same period of 2022) and a net result that increases by 49.7% to 1,229 million. Above all, the Non-Life business (premiums at +10.1%) pushed the accounts, which helped to raise the operating result to 1,820 million (+22.1%). The Lion of Trieste, who speaks of "strong and profitable growth" in line with the plan, also begins to do the math on the investment in Cattolica from which he expects a return of over 20%.

HOW THE QUARTERLY OF INSURANCE GENERALI WENT

Looking at the individual sectors, the life operating result was practically stable at 924 million (+1%) while in the non-life it increased to 847 million (+74.6%). The operating result of the asset & wealth management segment decreased to 233 million (-10%), despite the improvement of Banca Generali.

In terms of gross premiums, it must be said that they increased by 1.3% to 22.2 billion thanks mostly to the non-life segment (+10.1%) while in the life segment they amounted to 13,238 million (-3.7%) penalized from the unit-linked line (-17.4%) especially in Italy, Germany and France. The group's assets under management increased to €631.3 billion (+2.6% compared to the whole of 2022) and shareholders' equity to €28 billion (+3.6% compared to the end of last year).

The insurance group continues its solid capital position, with the Solvency Ratio at 227% (it was 221% at the end of 2022).

THE WORDS OF BOREAN (CFO GENERALI)

Satisfied the leadership of Leo. “Thanks to the quarterly results showing strong and profitable growth, Generali confirms its position to successfully achieve the objectives of the 'Lifetime Partner 24: Driving Growth' strategy” commented Cristiano Borean, CFO of the group. “The performance of the Non-Life segment reflects our commitment to maintaining technical excellence – he added -, while in the Life segment, despite the complex context, the rebalancing of our production mix continues towards the most profitable business lines. The group also confirms its extremely solid capital position, thanks to strong organic capital generation". Furthermore, Borean highlighted during the conference call with journalists – as reported by Radiocor -, the Solvency Ratio as of May 19 had risen to 228%.

Borean then recalled that "for the first time we are presenting our results according to the new accounting standards, which allow us to significantly improve the visibility and predictability of the sources of profit, as well as provide a better representation of the intrinsic value of our Life business" .

FLOOD EFFECT FOR GENERAL INSURANCE

As regards Cattolica, the CFO reported that “we are beyond the benefits initially envisaged in the acquisition plan. This allows us to achieve a return on investment which will ultimately exceed 20% and which makes it an excellent industrial and financial operation”. Finally, a few words on the damage caused by bad weather in Emilia Romagna. “If there should be no further deterioration, also thanks to our reinsurance policies, we can hope not to exceed 100 million in impact” clarified Borean who underlined how the group has taken steps “to get closer to the population in difficulty, starting for example from the suspension of the payment of premiums".

TARIFF PROSPECTS ACCORDING TO GENERALI

“In the Non-Life segment – reads the press release – the Group's objective for the mature insurance markets in which it operates is to maximize profitable growth, mainly in the non-motor sector, and to continue to strengthen in markets with high growth potential , expanding its presence and offer. Considering the current inflationary context, the Group envisages further tariff adjustments, in addition to those already undertaken”.

++++++

THE PRESS RELEASE OF ASSICURAZIONI GENERALI

Generali achieves strong profitable growth and confirms an extremely solid capital position • Gross premiums up to €22.2bn (+1.3%) driven by robust growth in the P&C segment (+10.1%). Life net income entirely concentrated on unit-linked lines and pure risk and health, in line with the Group's strategy • Operating result up to € 1,820 million (+22.1%), thanks in particular to the strong contribution of the Non-Life segment; the Life segment is resilient. Combined Ratio improving to 90.7% (-5.6 pp). Excellent New Business Margin at 5.72% (+0.32 pp) • Normalised2 net profit significantly up to € 1,229 million (+49.7%), thanks to the benefit deriving from diversified sources of income • Extremely solid Solvency Ratio at 227% (221% FY 2022) The Group CFO of Generali, Cristiano Borean, stated: “Thanks to the quarterly results showing strong and profitable growth, Generali is confirmed in line to successfully achieve the objectives of the strategy 'Lifetime Partner 24: Driving Growth'. The performance of the P&C segment reflects our commitment to maintaining technical excellence, while in the Life segment, despite the complex context, the rebalancing of our production mix continues towards the most profitable business lines. The Group also confirms its extremely solid capital position, thanks to strong organic capital generation. For the first time we present our results according to the new accounting standards, which allow us to significantly improve the visibility and predictability of the sources of profit, as well as provide a better representation of the intrinsic value of our Life business. I would like to thank all the colleagues of the Group who contributed to the IFRS 17 and 9 project”.

The Board of Directors of Assicurazioni Generali, which met under the chairmanship of Andrea Sironi, approved the Financial Information as at 31 March 2023 3 of the Generali Group. Group gross premiums grew by 1.3% to € 22,163 million, thanks to robust growth in the Non-Life segment. Life net inflows amounted to € -190 million. The positive net inflows of the unit-linked and pure risk and health lines partly offset the net outflows from the savings line, in line with the Group's portfolio repositioning strategy, and also reflecting, in particular, the dynamics observed in the banking channel in Italy and France.

The operating result grew to € 1,820 million (+22.1%), mainly due to the contribution of the Non-Life segment. The Life operating result was confirmed as solid at € 924 million (+1.0%); the New Business Margin is growing and amounts to 5.72% (+0.32 pp). The operating result of the Non-Life segment increased to € 847 million (+74.6%). The Combined Ratio improves to 90.7% (-5.6 pp), supported by a lower loss ratio. The operating result of the Asset & Wealth Management segment amounted to € 233 million (-10.0%), thanks to a strong improvement by Banca Generali. The change in the Asset Management result reflects the comparison with a particularly strong 1Q 2022.

The operating result of the Holding and other businesses sector amounted to € -117 million (+6.2%). To better reflect the underlying business dynamics, as already announced in December 2022, starting from the first quarter of 2023, the Group introduces a new definition of normalized net result, which neutralizes the following impacts: the volatility deriving from gains or losses on financial instruments measured at fair value through profit or loss held on portfolios other than profit sharing portfolios, the effect of hyperinflation under IAS 29, the amortization of intangible assets related to mergers and acquisitions and the impact of profits and losses deriving from acquisitions and disposals.

The normalized net result is growing strongly to €1,229 million (€821 million in 1Q 2022). This is mainly due to the improvement in the operating result, which highlights the benefit of diversified sources of income, the non-recurring profit relating to the sale of a London property complex (for € 193 million after tax), the impact of the write-downs for €96 million on Russian fixed income securities recorded as of 1Q 2022. Net result improves to €1,199 million (€481 million 1Q 2022). The Group's shareholders' equity stood at € 28.0 billion (+3.6% FY 2022), thanks to the net result for the period. The Contractual Service Margin (CSM), which is the liability introduced in the financial statements by IFRS 17 and which consists of the discounted future profits of the existing portfolio, is equal to €32.1 billion (€30.9 billion FY 2022). The Group's total Assets Under Management increase to €631.3 billion (+2.6% FY 2022), reflecting the positive market effect on the main asset classes.

The Group maintains an extremely solid capital position, with the Solvency Ratio at 227% (221% FY 2022). The increase of 6 pp mainly reflects the strong contribution of normalized capital generation which, together with the positive impact of market variances (in particular the narrowing of spreads on government bonds, the recovery of equity markets and reduced volatility), has more than offset the impacts deriving from the accrual of the dividend for the period and the buyback linked to the Group's long-term incentive plan.

LIFE SEGMENT

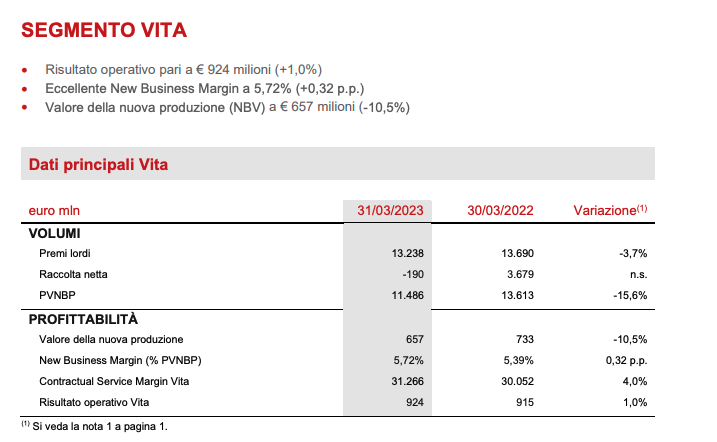

Gross premiums in the Life segment amounted to €13,238m (-3.7%). The change is attributable to the unit-linked line (-17.4%), particularly in Italy, Germany and France. The pure risk and health line recorded good growth (+6.4%), led in particular by France and International. In savings lines (-1.2%) the positive trends in Germany and Asia were more than offset by the dynamics recorded in Italy and France.

Life net inflows amounted to € -190 million. The unit-linked and pure risk and health lines recorded positive flows, with the pure risk and health line at €1,333 million, led by Italy and International, while the unit-linked line (€1,449 million) proved to be resilient compared to the current context of the insurance market.

New business (expressed in terms of present value of future premiums – PVNBP) amounted to €11,486 million (-15.6%), reflecting the economic context and the evolution of interest rates, which impacted new business in all the main areas of operation of the Group. This effect was magnified by the greater impact of discounting future premiums. These trends are visible for the unit-linked and savings business lines (-27.0% and -14.9% respectively), with the protection line proving to be very resilient (+1.0%).

The profitability of new business on PVNBP (New Business Margin) stands at an excellent 5.72%, growing by 0.32 pp compared to 1Q 2022. This result reflects an important improvement in the profitability of new business, thanks to the quality of the mix of product and the increase in interest rates. The trend in volumes more than compensated for the higher profitability, with a new business value (NBV) of € 657 million (-10.5%). The Contractual Service Margin Vita (CSM Vita) in the first quarter increased to € 31,266 million (€ 30,052 million FY 2022). This result derives from the contribution of the New Business CSM Vita equal to € 824 million and reflects the release of CSM Vita equal to € 743 million. The latter represents the main contribution (approximately 80%) to the Life operating result, which amounts to €924m (€915m 1Q 2022).

DAMAGE SEGMENT

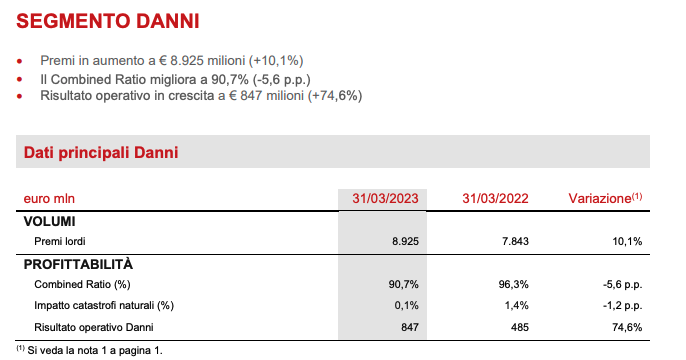

Gross premiums in the Non-Life segment amounted to €8,925m (+10.1%), driven by the performance of both business lines. The non-motor line recorded strong growth (+12.1%), with widespread development in all the main operating areas of the Group. Europ Assistance premium income increased by 55.7%, thanks to the continued growth of the travel line. The automotive line grew by 9.2%, thanks to positive trends in Italy, France, CEE countries and Argentina. Excluding the contribution of Argentina, a country impacted by a context of hyperinflation, the total premiums of the segment would register an increase of 4.8%. The Combined Ratio is 90.7% compared to 96.3% in the first quarter of 2022, thanks to the improvement in the loss ratio which drops to 60.6% (-7.2 pp), partially offset by an increase in the expense ratio at 30.1% (+1.6 pp). The positive dynamics of the loss ratio benefited from fewer natural catastrophes (0.1% down by 1.2 pp compared to 1Q 2022) and from a greater impact of the discounting effect.

The impact of large man-made claims increased by 0.7 pp. The positive contribution of previous generations was -2.0%, with an improvement of 1.9 pp compared to 1Q 2022, a quarter that recorded a strengthening of reserves to better face the inflationary scenario. The undiscounted combined ratio – which excludes the impact of the discounting of claims – recorded an improvement to 93.8%, from 97.4% in 1Q 2022. The operating result of insurance services amounted to € 669 million ( €233 million in 1Q2022), benefiting from €223 million due to discounting compared to €70 million in 1Q2022, with an undiscounted operating result of insurance services equal to €446 million. The result of investments amounted to €178 million (-29.2%), reflecting higher financial expenses mainly due to the increase in interest rates during 2022.

ASSET & WEALTH MANAGEMENT SEGMENT

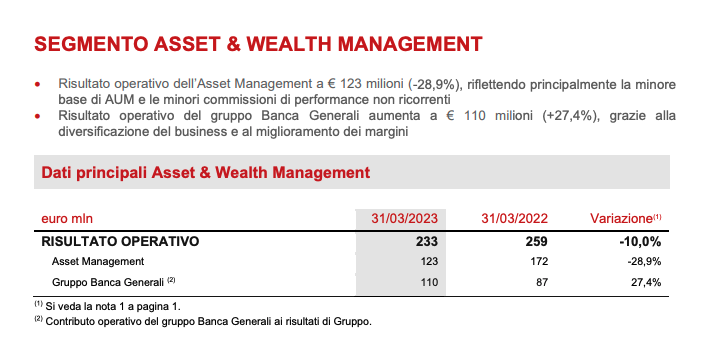

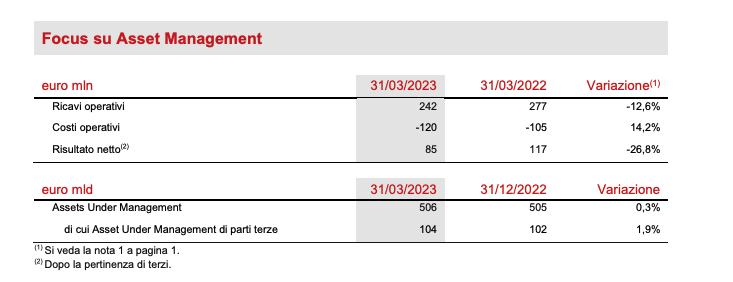

The operating result of the Asset & Wealth Management segment amounted to € 233 million (-10.0%). In particular, the operating result of Asset Management activities amounted to € 123 million (-28.9%). This reflects both the reduction of recurring fees to €206 million (-5.2%), due to the market performance on Assets Under Management in 2022, and the absence of non-recurring performance fees equal to €38 million Q1 2022. Transaction fees deriving from real estate and infrastructure investments stand at €16 million in 1Q 2023. Operating costs increase to €120 million (+14.2%), also reflecting the launch of initiatives aimed at optimizing of the operating machine.

The operating result of the Banca Generali group increased to € 110 million (+27.4%) thanks to the diversification of the business, which made it possible to seize the opportunities that emerged on the markets during the first quarter. Performance was also supported by improved net interest margin and disciplined cost management. Banca Generali's overall net inflows in Q1 2023 amounted to €1.5 billion, confirming a solid commercial performance in terms of volumes.

The net result of the Asset Management segment amounted to € 85 million (-26.8%). The total value of Assets Under Management managed by Asset Management companies is equal to €506 billion (+0.3% compared to FY 2022). Third-party Assets Under Management managed by Asset Management companies increase to €104 billion (+1.9% compared to FY 2022). The change reflects the positive performance of the financial markets during the quarter and positive net inflows from third-party customers of €144 million.

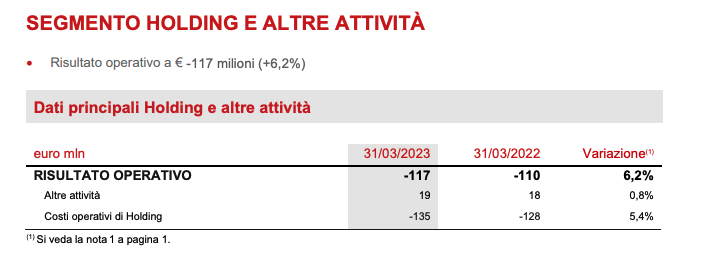

The operating result of the Holding and other businesses segment reaches € -117 million (€ -110 million 1Q 2022). The contribution of Other Activities is stable at €19 million. Operating costs of the Holding amounted to €135 million, up by 5.4% compared to 1Q 2022.

OUTLOOKS

At the beginning of 2023, some economic indicators, including those relating to the European labor market, pointed to positive signs regarding the hypothesis of a slowdown in the global economy. Inflation data and central bank comments raised expectations on short-term money market rates. At the same time, the economic impact linked to the fragility of US regional banks that emerged at the beginning of March remains to be assessed. During the first half of 2023, government bond yields are expected to remain around the levels observed in the second half of 2022, before declining during the course of the year, reflecting fewer inflation concerns. The implications of the macroeconomic situation described above could affect the global insurance market.

Generali confirms the continuous rebalancing of the Life portfolio to further increase profitability, with a more efficient capital allocation. Simplification and innovation will continue to be key, with the introduction of a range of modular product solutions, designed for specific needs and new customer needs, and marketed through the most suitable, efficient and advanced distribution channels. In the P&C segment, the Group's objective for the mature insurance markets in which it operates is to maximize profitable growth, mainly in the non-motor segment, and to continue to strengthen in markets with high growth potential, expanding its presence and offer . Considering the current inflationary context, the Group envisages further tariff adjustments, in addition to those already undertaken. In the Asset & Wealth Management segment, the activities identified in the Group's strategic plan will continue to be implemented, with the aim of expanding the product catalog and strengthening distribution skills.

With these clear priorities and thanks to the results achieved, the Group confirms all the objectives of the strategic plan 'Lifetime Partner 24: Driving Growth', focused on a solid financial performance, an excellent customer experience and an even greater social impact, thanks the contribution of all Generali employees. The Group intends to pursue sustainable growth, improve its earnings profile and drive innovation to achieve a compound annual growth rate of earnings per share5 of between 6% and 8% over the period 2021-2024, generate net cash at Parent Company level6 exceeding €8.5 billion in the period 2022-2024 and distribute to shareholders cumulative dividends in the period 2022-2024 between €5.2 and €5.6 billion, with a ratchet on the dividend for action.

SIGNIFICANT EVENTS AFTER MARCH 31, 2023

On April 20, Generali announced that it had successfully completed a liability management operation which involved the repurchase of €499,563,000 of perpetual bonds and the placement of its fourth green bond for an amount equal to €500,000,000. On 4 May Generali reached an agreement with Frankfurter Leben for the sale of Generali Deutschland Pensionskasse AG, subject to approval by the supervisory authority. The transaction is in line with Generali's strategy 'Lifetime Partner 24: Driving Growth' and will increase the Group's Solvency II Ratio by 1 pp. The other significant events that occurred after the end of the period are available on the website.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/il-ramo-danni-non-fa-danni-in-assicurazioni-generali-che-alzera-le-tariffe/ on Thu, 25 May 2023 08:05:00 +0000.