Not just electric cars, the plug revolution electrifies all vehicles: land, sky and sea. Report

The ecological transition is revolutionizing the technology of all the means available today (even those still absent on the market, such as eVTOLs): the mobility of the future will be electric, but in some sectors there is still a long way to go, as the report reveals. by IDTechEx "Electric vehicles: Land, sea and air 2022-2042"

When it comes to electric vehicles, EV cars immediately come to mind, which European and US legislators intend to focus on to revolutionize the entire mobility of the two continents from a green perspective. But in reality all sectors are facing the energy and technological transition that will lead to the disposal of the now obsolete internal combustion engine.

AN INCREASINGLY ELECTRIC MOBILITY

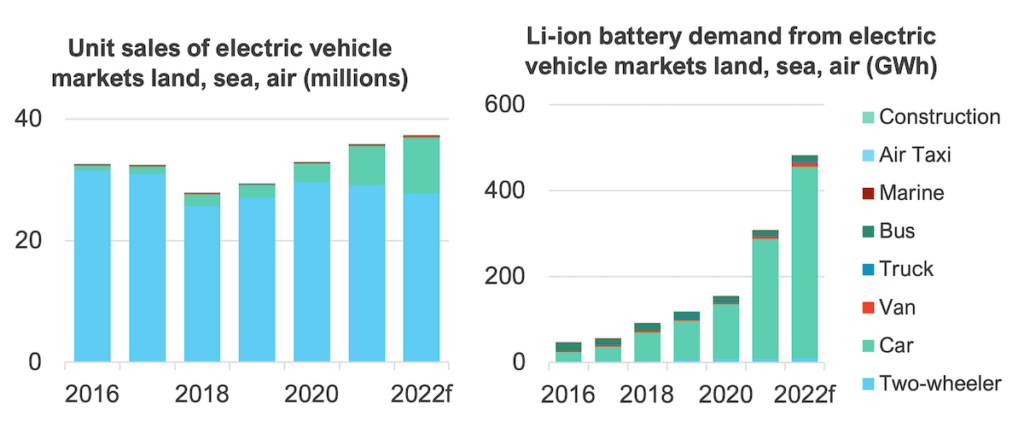

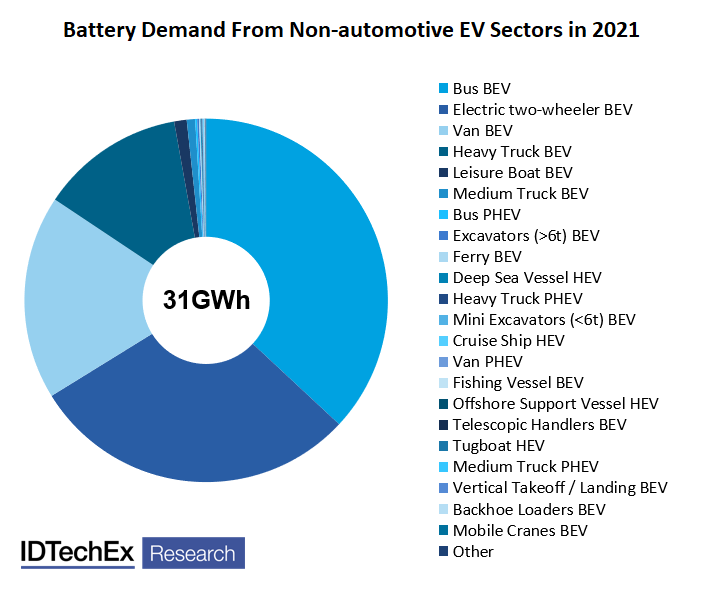

The latest IDTechEx report, " Electric Vehicles: Land, Sea and Air 2022-2042 ", summarizes the main developments in the non-automotive sectors, starting from the global demand for batteries of each sector in 2021 and developing a hypothetical model of development in relation to it .

THE TWO WHEELS CLEAR, ESPECIALLY IN EMERGING COUNTRIES – 9GWh

Sales of electric two-wheelers have long been dominated by the approximately 25-30 million units of low-powered lead-acid motorcycles annually in China, but this is a saturated market. Historic growth outside of China is led by Europe and India, markets hit by the pandemic in 2020 but bounced back in 2021.

Equipped with small batteries, typically less than 4 kWh (compared to the over 50 kWh of a battery electric car), they have a relatively low initial cost for consumers and are therefore well suited to emerging markets, such as the 15 millions of motorcycles sold annually in India. Overall, the demand for lithium-ion batteries for electric two-wheelers in 2021 was 9 GWh and IDTechEx expects rapid growth as China moves away from lead-acid batteries and accelerates growth in other parts of the world.

TRUCKS AND TRUCKS FINALLY LESS POLLUTING – 4.3GWh

On the opposite side we have heavy vehicles, trucks and trucks, historically identified as the most polluting vehicles on our roads. Tesla, Daimler, VW and Volvo are investing heavily in battery electric trucks. Tesla announced a Class 8 battery electric truck for long-haul transportation: CEO Elon Musk recently stated that the first deliveries will be made to Pepsi by the end of 2022. Although the number of trucks to convert to electric is Far lower than that of passenger cars globally, they use much larger batteries (several hundred kWh) and represent 4.3 GWh per year in 2021.

Chinese brands are also rampant in this sector, given the strong support of the Beijing government for the entire electric vehicle sector: according to analysts, it is likely that in the next few years there will be the most significant spread of electric trucks. "With the progressive abandonment of diesel and petrol vehicles by an increasing number of cities and nations around the world by 2030 and with the demonstration of the cost advantages and the ability of the technology to guarantee the required daily duty cycles , the electrification of truck fleets is likely to happen quickly ”.

But there are also those who look to alternative fuels. “A small minority – Toyota , Hyundai and Nikola – have chosen to focus their efforts on fuel cell trucks as the powertrain of the future. Despite the problems related to the efficiency and cost of hydrogen as a fuel, FCEV technology remains under discussion as a technology for long-haul trucking applications, where greater range is required, even if the feasibility of this technology depends on production. of low cost green hydrogen ".

THE ELECTRIC BUSES DEPARTED ON TIME – 12GWh

Speaking of heavy vehicles, there is also the development of electric buses. In China, already on the occasion of the Olympics, several cities that hosted the Games adopted exclusively electric buses, causing rapid growth in the sector between 2012 and 2016, but now many of these markets are saturated. In 2018, Beijing and Shanghai had 9,368 pure electric buses which made up 55% of the combined fleet, all initially powered by a 50% purchase subsidy. The saturation of cities in China has caused a drop in electric bus sales globally over the past five years, offset only slightly by the growth of Tier 2 and 3 cities in China. Subsidies have been significantly reduced today.

Short-term future growth is led by Europe, analysts say. The European electric bus market is very fragmented and, in recent years, it has relied on Chinese OEMs, which still accounted for a quarter of units sold in 2021. A local supply chain backed by European OEMs will be key and will slowly drive the medium-term growth of global electric bus markets starting at 12GWh.

STOP THE BUILDING SECTOR – 1GWh

Staying on the front of heavy vehicles, little or nothing is moving in the construction sector, as highlighted in the report: "Broader commitments to climate change are pushing some countries, such as Norway and Holland, or companies, such as Volvo, to set your goals. Health and safety concerns, such as the impact of diesel particulate emissions on construction workers' health and noise, could be equally important factors. However, much of the early EV developments for construction vehicles were achieved through retrofitting, a necessary development stage but not a long-term economically viable strategy. OEMs have to design large electric vehicles from scratch and mass-produce them to make savings in terms of economy of scale ”.

The market sectors of the largest construction machinery from now to twenty years – the report reads – are mini excavators, excavators and loaders, but the development of electrification initially focuses on smaller compact machines (mini excavators / compact loaders ). These machines have relatively short operating hours and low power consumption, which explains the relatively low battery demand today (~ 1GWh).

WHAT HAPPENS IN THE NAUTICAL SECTOR? – <1GWh

In the commercial boating sector, the analysts of the IDTechEx report explain, " Electric vehicles: Land, sea and air 2022-2042 ", batteries are starting to saturate the most advanced market segments, such as ferries, and are reaching their limits in others, such as short and deep-range vessels (which produce most of the sector's emissions). While the demand for batteries is set to grow – adding a battery to any powerplant for load management is generally beneficial – it cannot be the only solution in the maritime sectors.

Meanwhile, the report highlights, political attention is shifting from localized emissions to greenhouse gases, with new technical and operational requirements for ships starting in 2023. The next IMO policies include an "Energy Efficiency Index of Existing Ships (EEXI) ”and the Carbon Intensity Indicator (CII). EEXI ensures that a ship is taking technical measures, in terms of equipment and retrofitting, to reduce greenhouse gas emissions. The CII is a measure of carbon emissions per amount of cargo carried per mile and aims to reduce emissions at an operational level. The measures are expected to become mandatory from 2023 and the first ship classifications are expected to take place in 2024.

The new regulations, always reads in the IDTechEx report, “ Electric vehicles: Land, sea and air 2022-2042 ”, are stimulating interest in electronic fuels, ammonia and hydrogen. Indeed, fuel cell projects are gaining momentum, with system deliveries up to 3.2 MW and some potential supplier orders reaching 200 MW. Most of the projects so far have involved inland waterway vessels and some short-sea vessels. The biggest challenge is the same one facing the adoption of fuel cells in the automotive market: creating low-cost infrastructure for green hydrogen.

WILL eVTOLS REALLY TAKE OFF? – << 1GWh

And then there is the most futuristic sector and, precisely for this reason, also the least easily predictable, as the authors of the report themselves admit: the future of electric air taxis, or electric vertical take-off and landing (eVTOL), is perhaps the most uncertain. due to high regulatory and technical barriers. This is a low-volume, high-value market where aircraft will rely on cutting-edge, high-cost technologies to achieve new heights in performance and safety. For example, IDTechEx expects lithium and solid state batteries, axial flux motors and carbon fiber materials to play an important role in the eVTOL markets.

From IDTechEx's review of the most promising eVTOL companies, 21 presented timeline information on when they intend to begin commercial production of eVTOLs, plans that heavily depend on flight certification. Several companies have stated that they have started what they believe to be a five-year certification process a couple of years ago. However, certification standards are not yet fully in place and significant technological and funding problems create uncertainty. Most eVTOL manufacturers are aiming for 2023 to begin commercial operations, and the IDTechEx report provides forecasts for unit sales and battery demand through 2042.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/smartcity/non-solo-auto-elettriche-la-rivoluzione-della-spina-elettrizza-tutti-i-veicoli-di-terra-di-cielo-e-di-mare-report/ on Thu, 03 Nov 2022 08:53:35 +0000.