Not only Didi. Here are the real reasons for China’s tightening on big tech

Beijing draws up new lines for an IT security plan while regulators tighten on the Didi ride sharing app and Chinese technology companies that intend to go public in the United States. Facts, numbers, comments and analysis

After the crackdown on China's Didi Chuxing ride sharing app and data protection, China draws up a new plan for the cybersecurity industry.

The draft was announced by the Ministry of Industry and Information Technology, according to which the cyber-security sector could be worth more than 250 billion yuan (32.53 billion euros) by 2023.

The goal, reports the Global Times tabloid, is to "strengthen the research and application of data security technologies to further optimize data security management and other functions."

Beijing's move comes after the crackdown on computer data security initiated in the aftermath of the investigation into China's Uber , Didi Chuxing, which went public last month on Wall Street.

Today Didi confirmed that the Cyberspace Administration of China has notified app stores to remove the company's 25 apps, confirming that the Chinese government is stepping up checks on the company.

In addition, over the weekend, Beijing issued draft guidelines to strengthen the cybersecurity review of tech companies that have over one million users and intend to go public overseas.

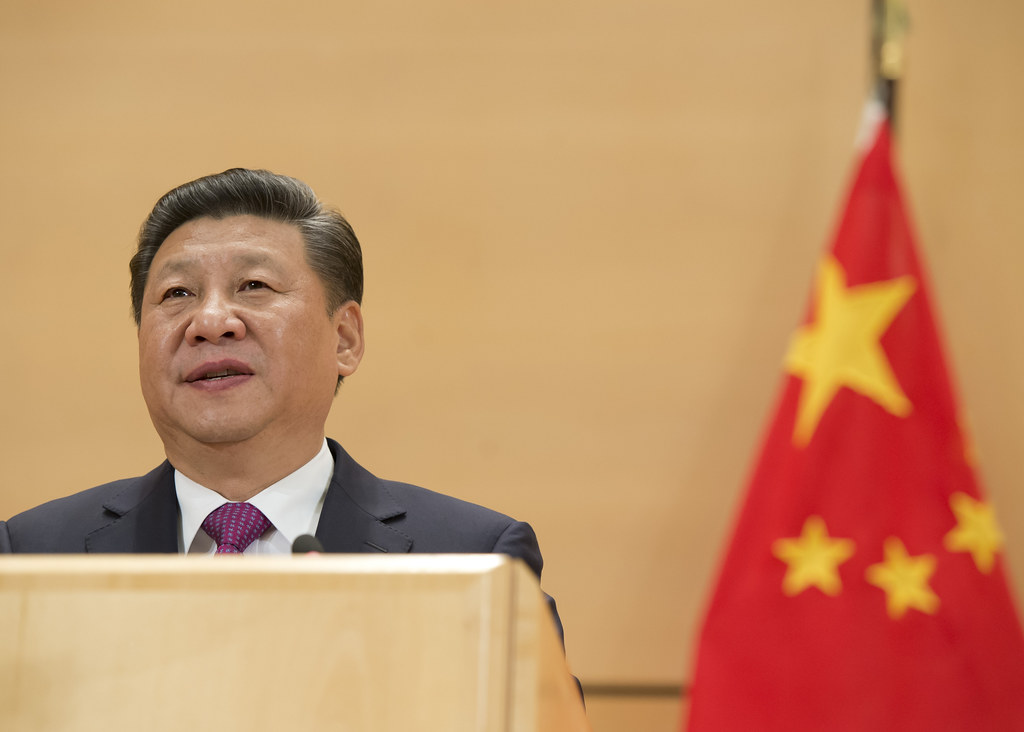

“China's attacks on technology are a losing strategy in the Second Cold War. Forcing Didi and Alibaba to follow the Communist Party line may help Xi build a police state, but it will block the nation's dynamic industry, ”historian Niall Ferguson commented on Bloomberg .

The stakes are high. There are currently 244 Chinese companies listed in the United States with a total market capitalization of approximately $ 1.8 trillion, which is nearly 4% of the US stock market capitalization.

All the details.

THE DRAFT ACTION PLAN FOR THE DEVELOPMENT OF THE COMPUTER SECURITY INDUSTRY

On Monday, China's Ministry of Industry and Information Technology said it had released a draft three-year action plan to develop the country's cybersecurity industry.

The draft comes as Chinese authorities step up efforts to draft regulations to better govern data storage, data transfer and personal data privacy.

THE RULES FOR THE LISTING OF TECH INDUSTRIES ABROAD

Over the weekend, the Cyberspace Administration of China (Cac) proposed a draft of rules that invite all technology companies that have data of at least one million users to undergo security reviews before being listed abroad. A very low threshold in a country that touches one billion people who surf the internet (989 million at the last count).

In this way, Beijing makes IPO approval and fundraising in the United States more complicated. According to the national cybersecurity review mechanism at the heart of the draft law, which consists of 23 articles, "every operator who has personal information of more than one million users and who is quoted abroad must undergo a verification of IT security ".

RISK ASSESSMENT FOR NATIONAL SECURITY

The review of IT security, reads the text of the new rules, will focus on the assessment of national security risks that can be caused by procurement and data processing activities. In particular, some aspects will be examined, including the risks of illegal data control or interference in their management, compliance with Chinese laws, the risk of theft, disclosure or destruction of fundamental data and the risk that the IT infrastructure and data can be “attacked, controlled or used maliciously by foreign governments after being listed abroad”.

CLOSE ON DIDI

Meanwhile, a Chinese tech firm just listed on Wall Street has already begun to suffer the backlash of this regulatory push.

In fact, Didi Chuxing came under investigation by the CAC two days after its debut on Wall Street with a 4.4 billion dollar IPO, the largest of a Chinese group on the NYSE , after the listing of Alibaba (25 billion dollars) in 2014.

As soon as investors acquired Didi's shares, the Cyberspace Administration said the company was suspected of "serious violations of laws and regulations in the collection and use of personal information."

In a few days, the value of Didi collapsed on the US price lists and the Beijing squeeze also led to the removal from the Chinese app stores of the app of the ride-hailing giant and of 25 other companies controlled by the Chinese Uber.

AND NOT ONLY

The Chinese internet supervisory agency later revealed that it was also investigating two other Chinese companies listed in the United States : BossZhipin, which on June 11 went public in New York as Kanzhun Ltd. and Yunmanman and Huochebang, two apps of truck logistics and booking managed by Full Truck Alliance Co., which went public on June 22nd. Inevitably, this bad news triggered a sell-off in Chinese tech stocks. It has also led many other Chinese tech companies to abruptly abandon their plans for US IPOs, including the Keep fitness app, China's largest podcasting platform, Ximalaya, and medical data company LinkDoc Technology Ltd.

Without forgetting the barrage offines imposed by the Chinese antitrust for violations of competition rules on national tech giants Alibaba and Tencent. Or that last November the regulators have sent smoke into the IPO record 37 billion dollars of Ant Group, the Fintech arm of Alibaba.

FERGUSON: "STRATEGIC DECOUPLING IS THE OFFICIAL POLICY OF CHINA"

“For several years, I have been told by numerous alleged experts in US-China relations that a cold war is impossible when two economies are intertwined like the Chinese and the American and that decoupling [the financial decoupling between the two superpowers] will not happen. because it's not in anyone's interest, ”historian Niall Ferguson outlined in Bloomberg . “But strategic decoupling has long been China's official policy. Last year's crackdown on financial technology companies, which led to the sudden shelving of Ant Group Co.'s IPO, was just one of many precursors to last week's carnage, ”Ferguson said.

THE CASE ANT

“If you thought the Communist Party of China's top priority was global economic dominance, canceling Ant's IPO made no sense,” the historian notes. "Ant had the potential to become the most powerful financial services platform in the world, its AI technology honed on the vast treasure trove of Chinese data collected by the Alipay app, its simple but ingenious game plan, as one explained to me. turns its CEO Eric Jing over to dinner in Hangzhou: making Ant the default online marketplace for all financial products in the world's emerging markets. So why did Beijing decide to abort this potentially global mission? The answer is that the top priority of the CCP is national: in particular, the preservation of its power ”Niall Ferguson points out.

DECOUPLING IS CLOSER TRIGGERED (SURPRISE) FROM BEIJING

Even in the Italian newspapers we can see decoupling "a step closer". Like Filippo Santelli, sent to China by the Republic, who points out that " instead of being triggered by the United States, it comes on Chinese initiative".

"The Beijing authorities fear that, by going public on Wall Street, domestic companies will expose sensitive data to the US government and so are in fact claiming a right of final approval on any placement abroad, a right that until now they could only exercise on domestic quotes. . Is it a sign of strength or a gigantic own goal? Difficult to say ”, wrote the correspondent of Repubblica today in an article for the Business & Finance insert. “Undoubtedly the Chinese regime wants to incentivize the national hi-tech champions to choose the Chinese stock exchanges, that of Shanghai or that of Hong Kong. The listing of the former British colony – among the largest in the world – is a viable alternative to Wall Street. On the other hand, this strengthened control on cross-border prices risks discouraging Chinese companies from the big leap, depriving them of an important channel of capital and internalization. But above all it risks weakening the link between China Spa and American big finance, a precious lever of soft power in relations with the United States. A balance of this operation can only be defined in the coming months ".

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/non-solo-didi-ecco-i-veri-motivi-della-stretta-cinese-su-big-tech/ on Mon, 12 Jul 2021 13:42:18 +0000.