Not only Ukraine, what will simmer in the bond market

Bond market: what to observe this week (not only for Ukraine). The analysis by Althea Spinozzi, senior fixed income strategist for BG SAXO

This just started is another week that sees the market focused on a possible escalation of tensions in Ukraine. The situation is unclear, with reports showing that Russia is ready to invade Ukraine at any time on the one hand and Emmanuel Macron mediating to organize a summit between Vladimir Putin and Joe Biden on the other. One thing is certain: volatility is likely to be high until Russian troops pull back from the Ukrainian border. Until then, we can expect the equity market to remain vulnerable and US Treasuries and gold to be the safe haven.

However, geopolitical tensions are not the only ones driving the US Treasury market. Expectations of a more aggressive Federal Reserve continue to adjust, pushing the front of the yield curve forward or reducing interest rate hikes. While early last week markets were pricing in a 50bps rate hike next month, expectations dropped to 25bps on Friday. Official Fed speeches contribute to the uncertainty in the rate market, as they do not provide explicit guidance. As highlighted in recent research by money market guru Zoltan Pozsar, uncertainty could help the Federal Reserve's aim to tighten financial conditions more efficiently to combat inflationary pressures. He explains that one way to do this is to trigger a market crash, the high valuations of which are the main cause of job rigidity.

Even if the Fed does not want to cause a sell-off voluntarily, it may be nearly impossible to avoid fluctuations. On the one hand, if it doesn't do enough to curb inflation, it could trigger an inflation tantrum . On the other hand, if she is too aggressive, a taper tantrum could ensue.

This week, investors will need to focus on the Personal Consumer Spending Index released on Friday, which is expected to hit 6%. A breach could revive expectations of more aggressive interest rate hikes. Prior to Friday, the focus will be on 2-year, 5-year and 7-year US Treasury auctions and speeches from Federal Reserve officials.

What do the ECB and the Bank of England do?

In Europe, the focus is on the February PMI data released this morning, which shows that the recovery is underway following the winter lockdown. This could encourage central banks to withdraw the pandemic stimulus faster than expected. Therefore, the focus will be on central bank officials and their speeches this week. In the UK, Bailey will speak before Parliament's Treasury Committee to answer questions about the economy and inflation. In the eurozone, de Cos, Guindos, Schnabel and Panetta will speak several times during the week.

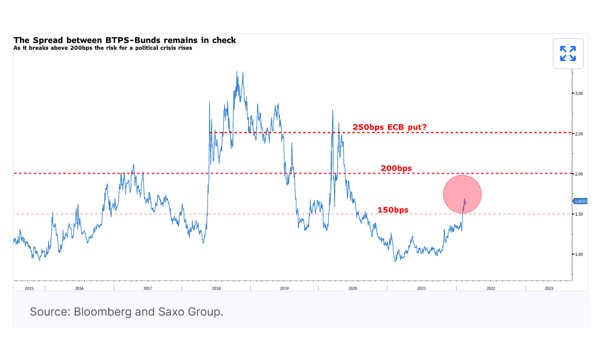

While it is inevitable that the ECB will take a less dovish stance with the BOE and Federal Reserve raising interest rates aggressively, we believe the BTPS-Bund spread is a good indicator of how far the ECB can go. So far the BTP-Bund spread remains below 200bps, leaving the central bank with no worries. However, as it rises above this level, we expect ECB officials to become more cautious.

The geopolitical tensions in Ukraine will also be the center of attention in the euro area. Rising tensions could see energy prices skyrocket, contributing to even more aggressive monetary policies.

Economic calendar

Monday 21 February

- UK: Rightmove House Price Index (February), Markit Manufacturing PMI, Services PMI

- Japan: Jibun Bank manufacturing PMI (February)

- China: PBoC Interest Rate Decision, House Price Index (January)

- Germany: Producer Price Index (January), Markit Manufacturing PMI, Services PMI, and Composite PMI (February) Prel, German Buba monthly report

- France: Markit Manufacturing PMI, Services PMI and Composite PMI (February) Prel

- Eurozone: Markit Manufacturing PMI, Services PMI and Composite PMI (February) Prel

- United States: President's Day

Tuesday 22nd February

- New Zealand: Credit Card Spend (January)

- Italy: Consumer Price Index (January)

- Germany: IFO – Business Climate (February), IFO – Current Assessment (February), IFO – Expectations (February)

- UK: BOE's Ramsden speech

- United States: Redbook Index, House Price Index (Dec), S & P / Case-Shiller House Price Index (Dec), Markit Manufacturing PMI, Services PMI, and Composite PMI (Feb) Prel, Consumer Confidence (Feb), Markit Manufacturing PMI, Services PMI and Composite PMI (February) Prel, 3 Month Banknote Auction, 52 Week Banknote Auction, 6 Month Banknote Auction, 2 Year Banknote Auction

Wednesday 23 February

- Australia: Wage Price Index (Q4)

- New Zealand: RBNZ interest rate decision and press conference

- Germany: Gfk consumer confidence survey (March)

- France: Business sentiment in the manufacturing sector (February)

- Switzerland: ZEW Survey – Expectations (February)

- Eurozone: HICP (January)

- United Kingdom: BOE monetary policy report hearings

- United States: MBA Mortgage Applications, 5-Year Banknote Auction

Thursday 24 February

- Australia: Private Capital Spending (Q4)

- Switzerland: level of employment (Q4)

- France: consumer confidence (February)

- Italy: Industrial Sales (Dec)

- United States: Chicago Fed National Activity Index (January), Major Personal Consumption Spending (Q4) Prel, Change in New Home Sales (January), 7-Year Banknote Auction

Friday 25 February

- New Zealand: Retail Sales (Q4)

- Japan: Tokyo Consumer Price Index (February), Tokyo CPI ex food, energy (February), investment in foreign bonds, foreign investment in Japanese equities

- Germany: Gross Domestic Product (Q4), Import Price Index (Q4)

- France: Consumer Price Index (February) Prel, Consumer Spending (January), Gross Domestic Product (4th quarter)

- Italy: business confidence (February), consumer confidence (February)

- Eurozone: M3 money supply (January), private lending (January), business climate (February), consumer confidence (February)

- United States: Major Personal Consumption Spending (January), Durable Goods Orders (January), Personal Income (January), Personal Spending (January), Michigan Consumer Sentiment (February), Pending Home Sales (January).

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/mercato-bond-cosa-succede/ on Tue, 22 Feb 2022 07:00:11 +0000.