Not only Visibilia by Santanché, what does the Negma Arabic background combine?

The operations of the Negma fund based in Dubai and companies in difficulty (such as Visibilia): this is how the cum warrant convertible bonds work at the center of a complaint by a minority shareholder of the company managed for years by the current minister Santanché

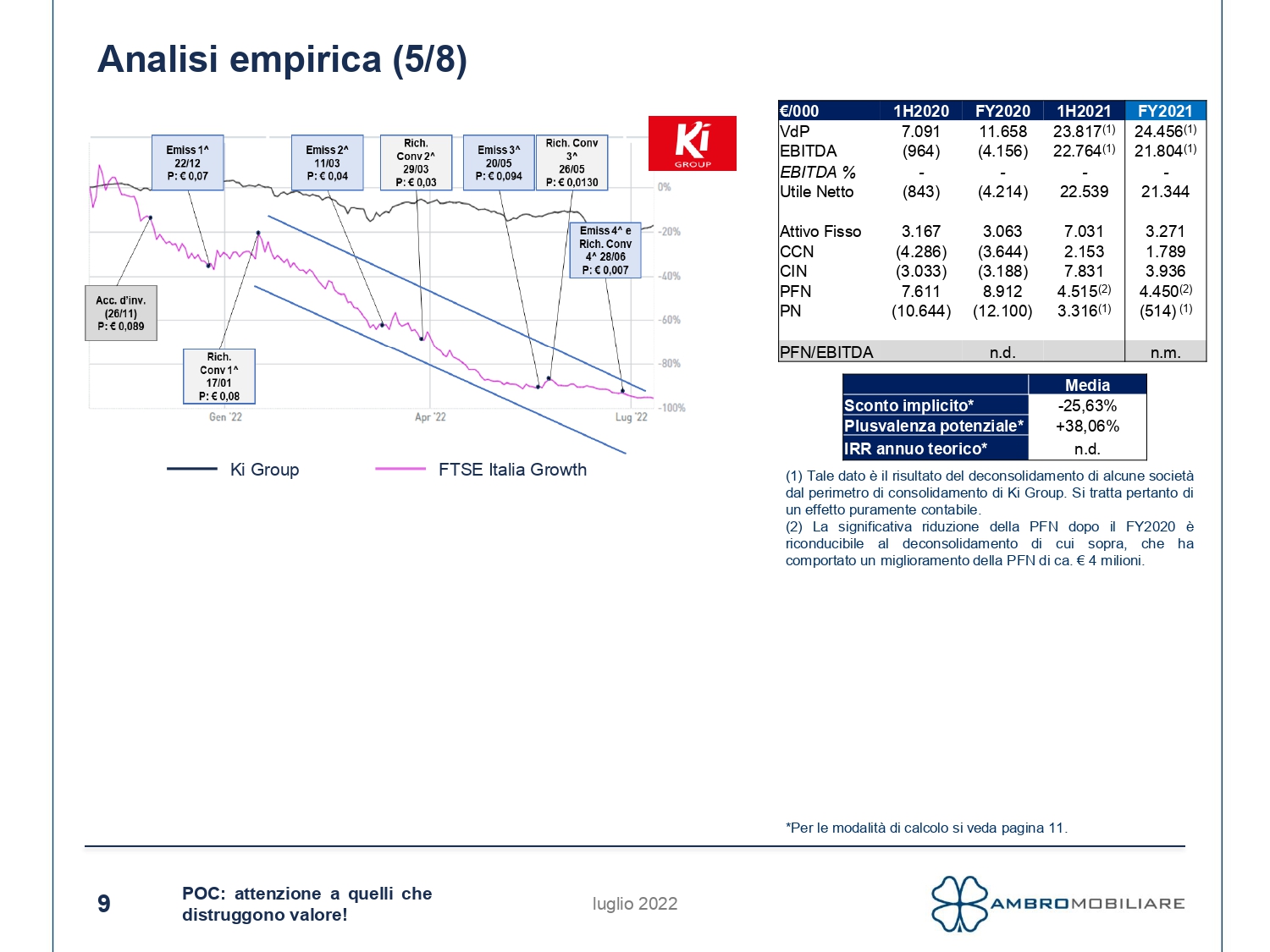

The latest episode of Report turned the spotlight on the entrepreneurial activities of Tourism Minister Daniela Santanchè and on the financial difficulties of KiGroup and Visibilia. The first is an organic food distribution company, managed in the past by the ex-husband of Minister Santanchè , Canio Mazzaro, and chaired by Santanchè herself who resigned years ago, while the second has been administered since birth by the current Minister of Tourism which, however, resigned and sold its shares.

THE DIFFICULTIES OF DI KIGROUP AND VISIBILIA AND THE INTERVENTION OF THE NEGMA FUND

The difficulties of the companies have had negative repercussions on the employees of the two companies but not only. The companies, in serious liquidity crisis, ended up in the orbit of the Arab fund Negma Group Ltd , located in Dubai and domiciled in an offshore paradise. The results, however, have not been profitable for the companies, the values of the securities of both have plummeted causing damage to the companies' employees and shareholders. The intervention as a lender of the Negma fund envisaged the disbursement of convertible debenture loans cum warrants which the companies in difficulty subscribed. The Negma fund converted the bonds into shares of the financed companies, which were then sold on the market. The deal was everything for Negma since the conversion took place at discounted prices compared to market values and Negma obtained a capital gain from the sale on the stock exchange.

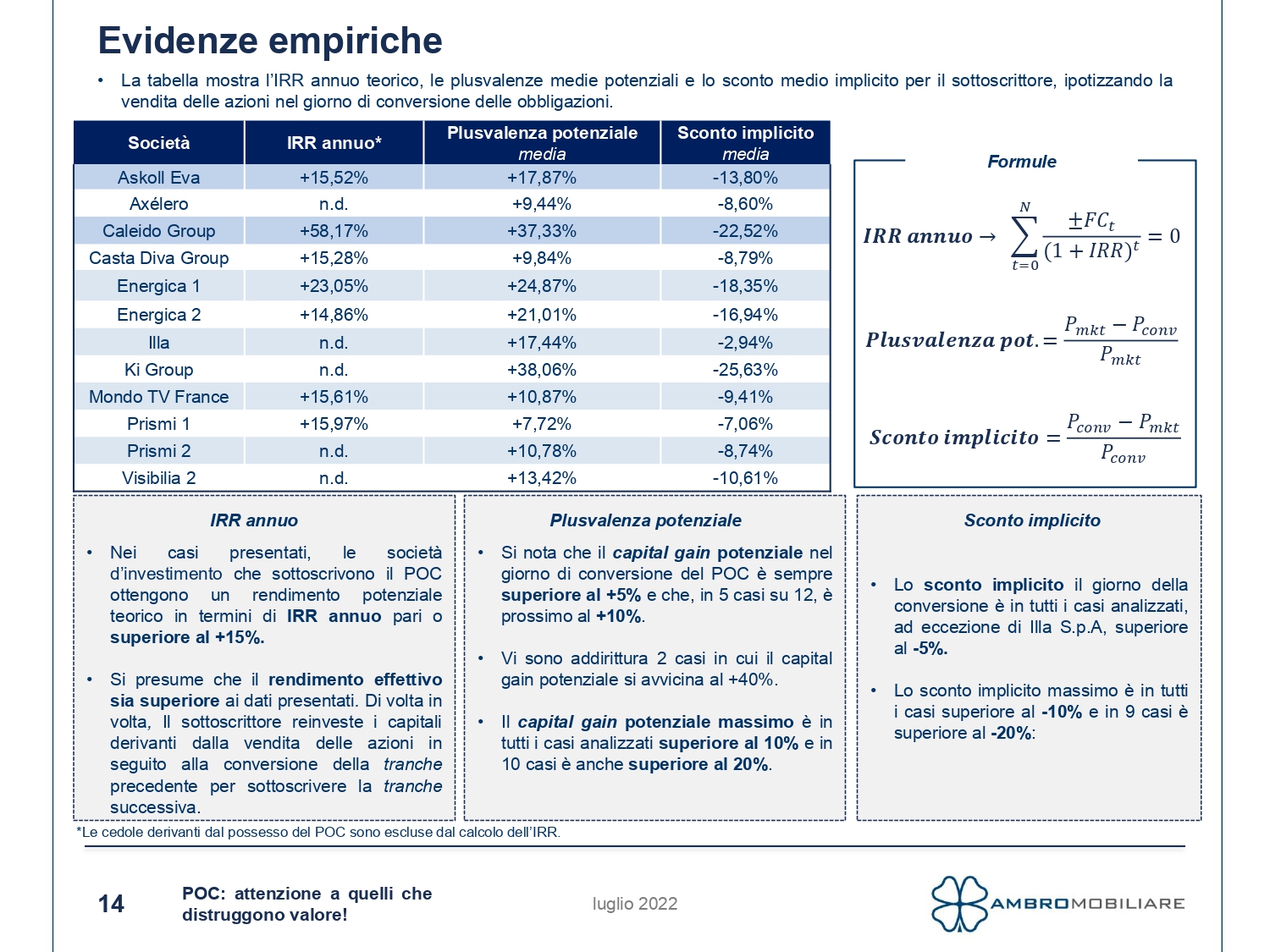

AMBROMOBILIARE'S ANALYSIS: THE COMPANIES THAT HAVE USED THE NEGMA FUND

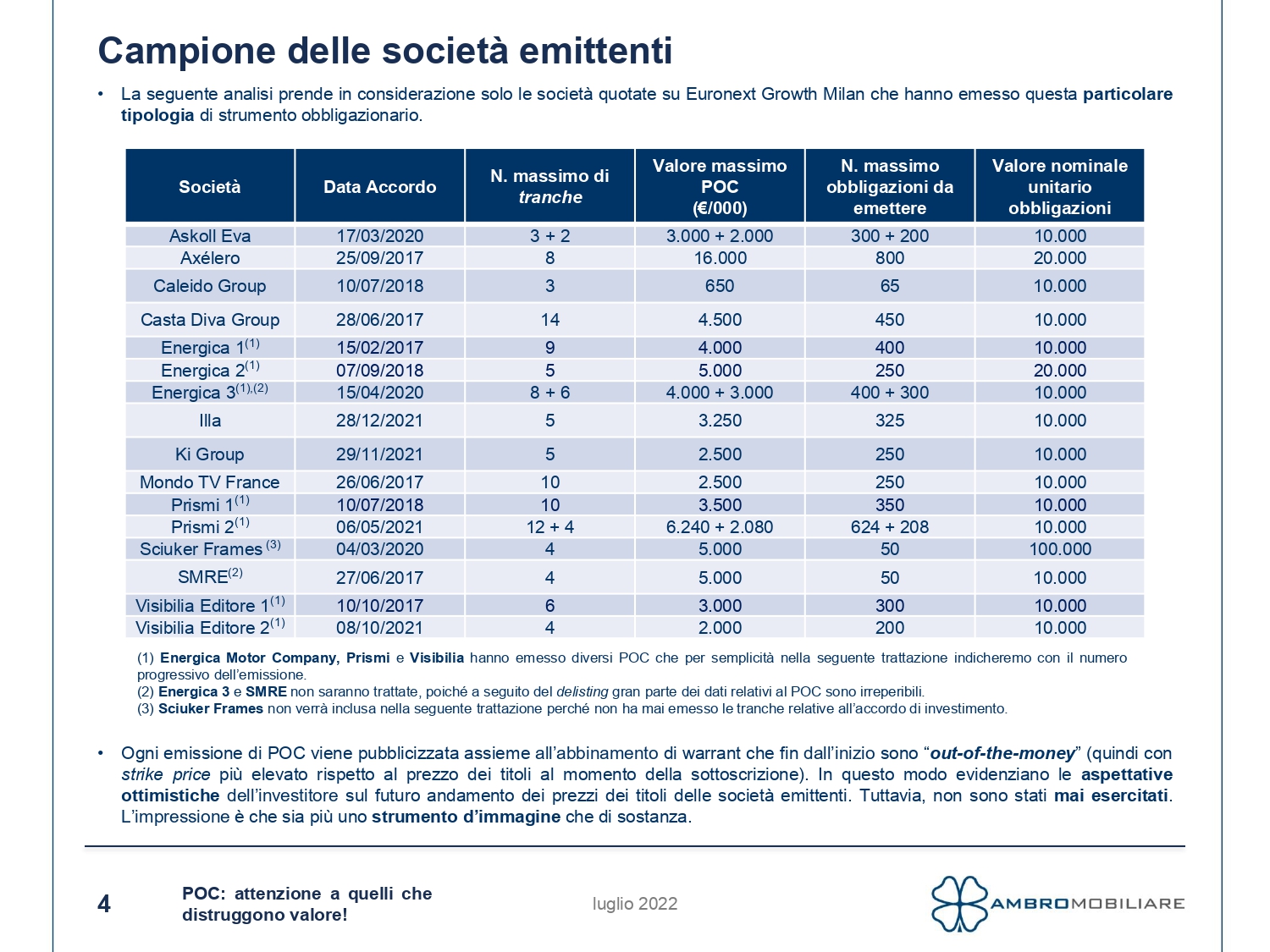

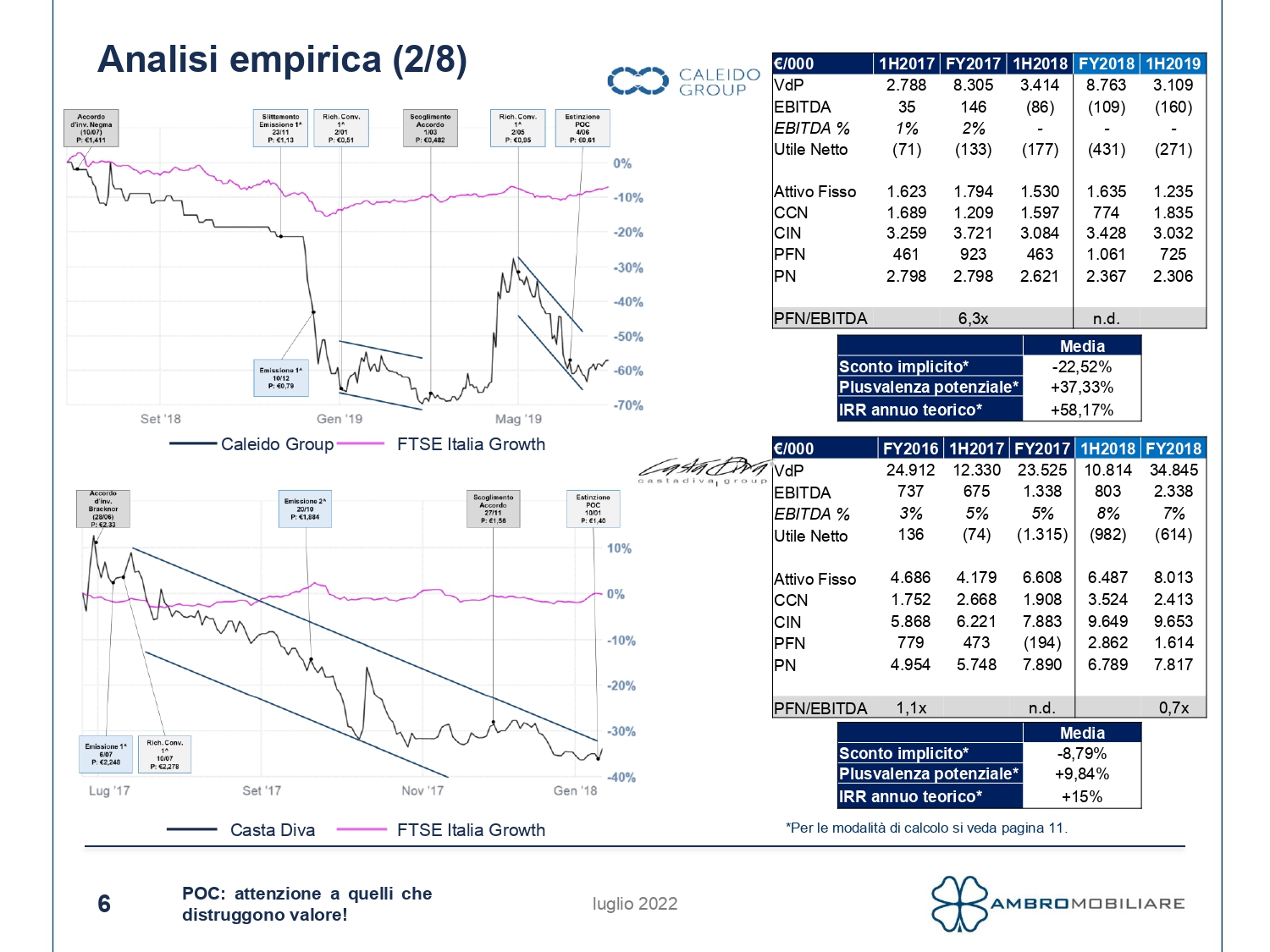

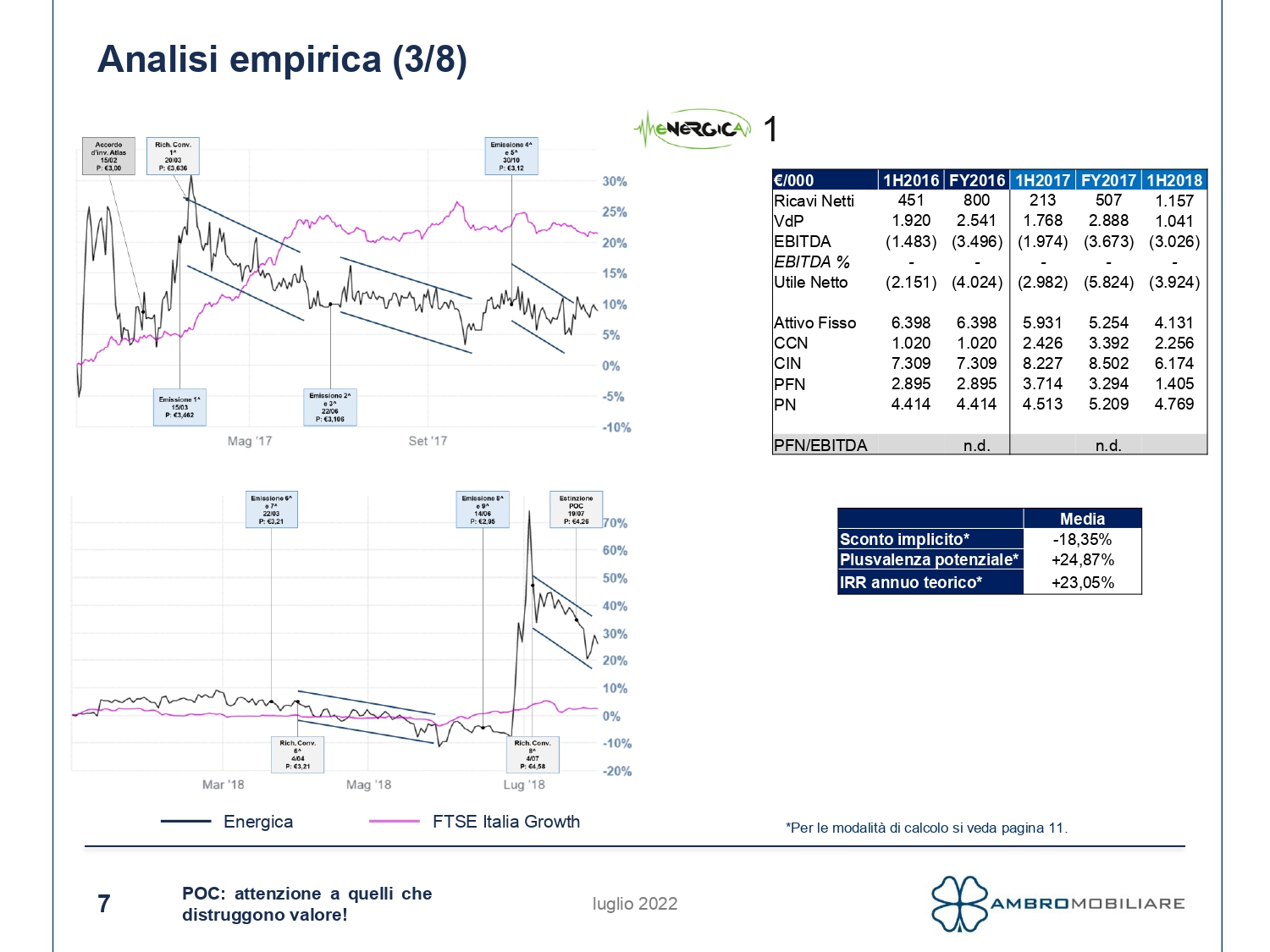

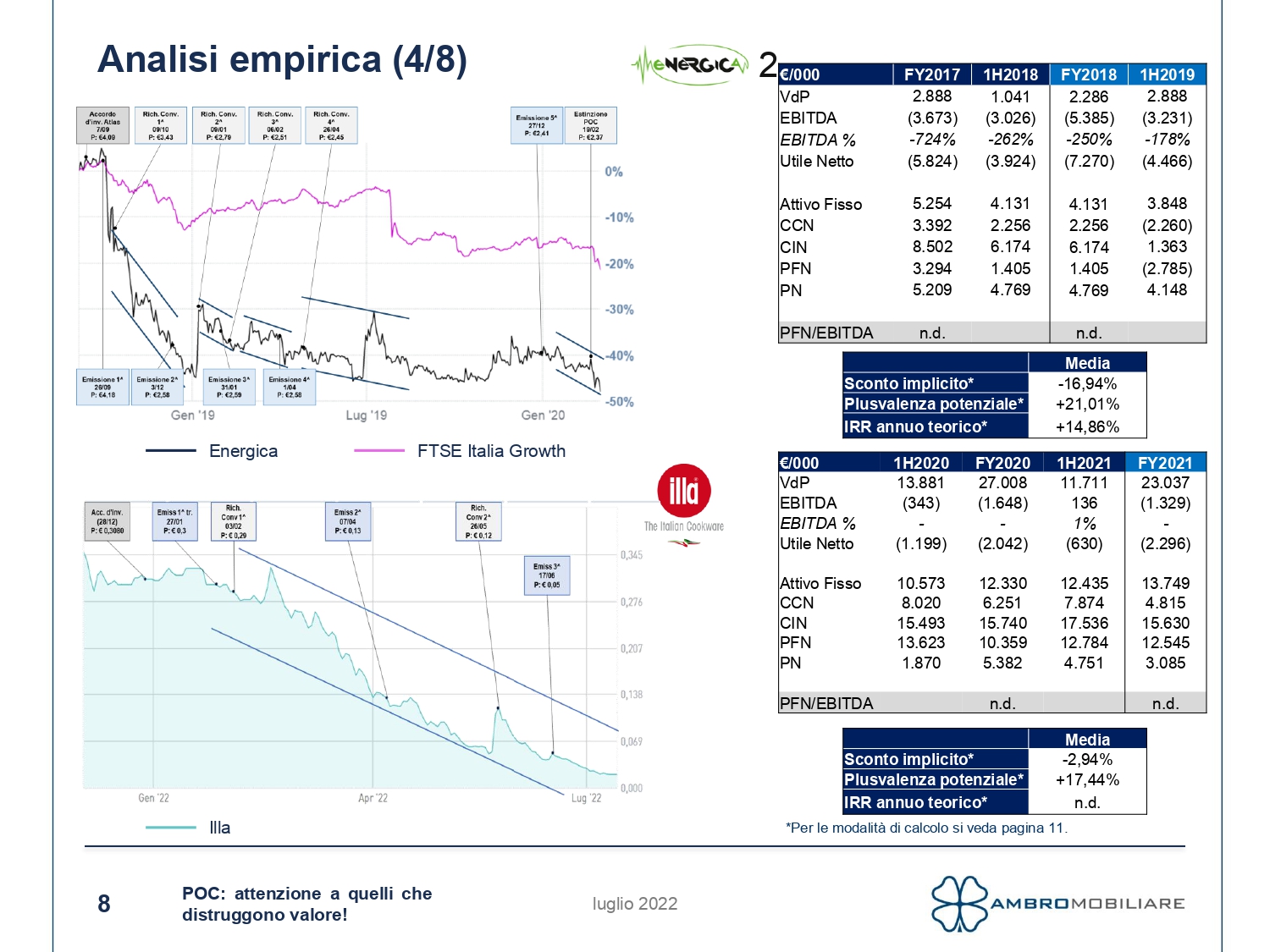

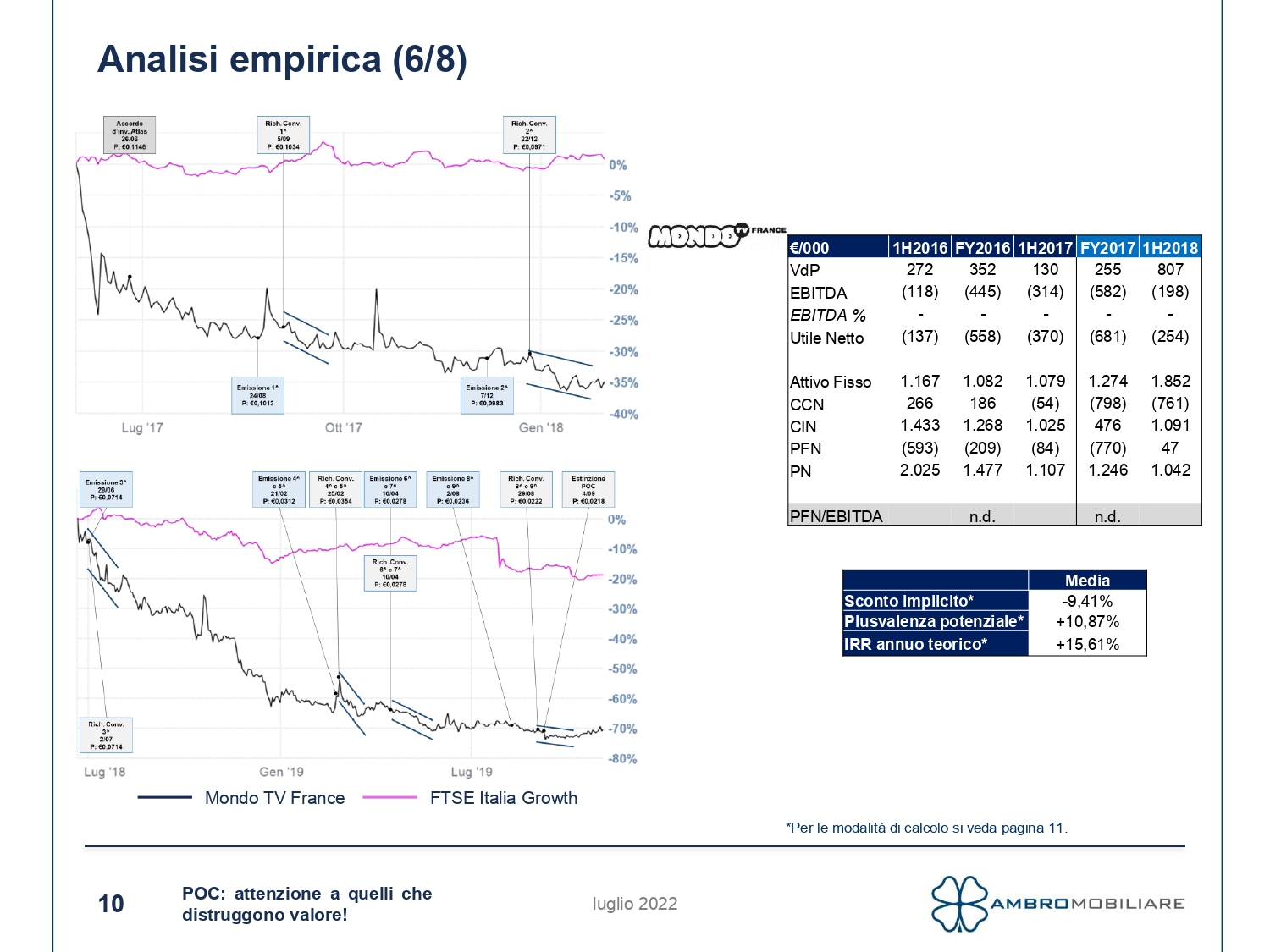

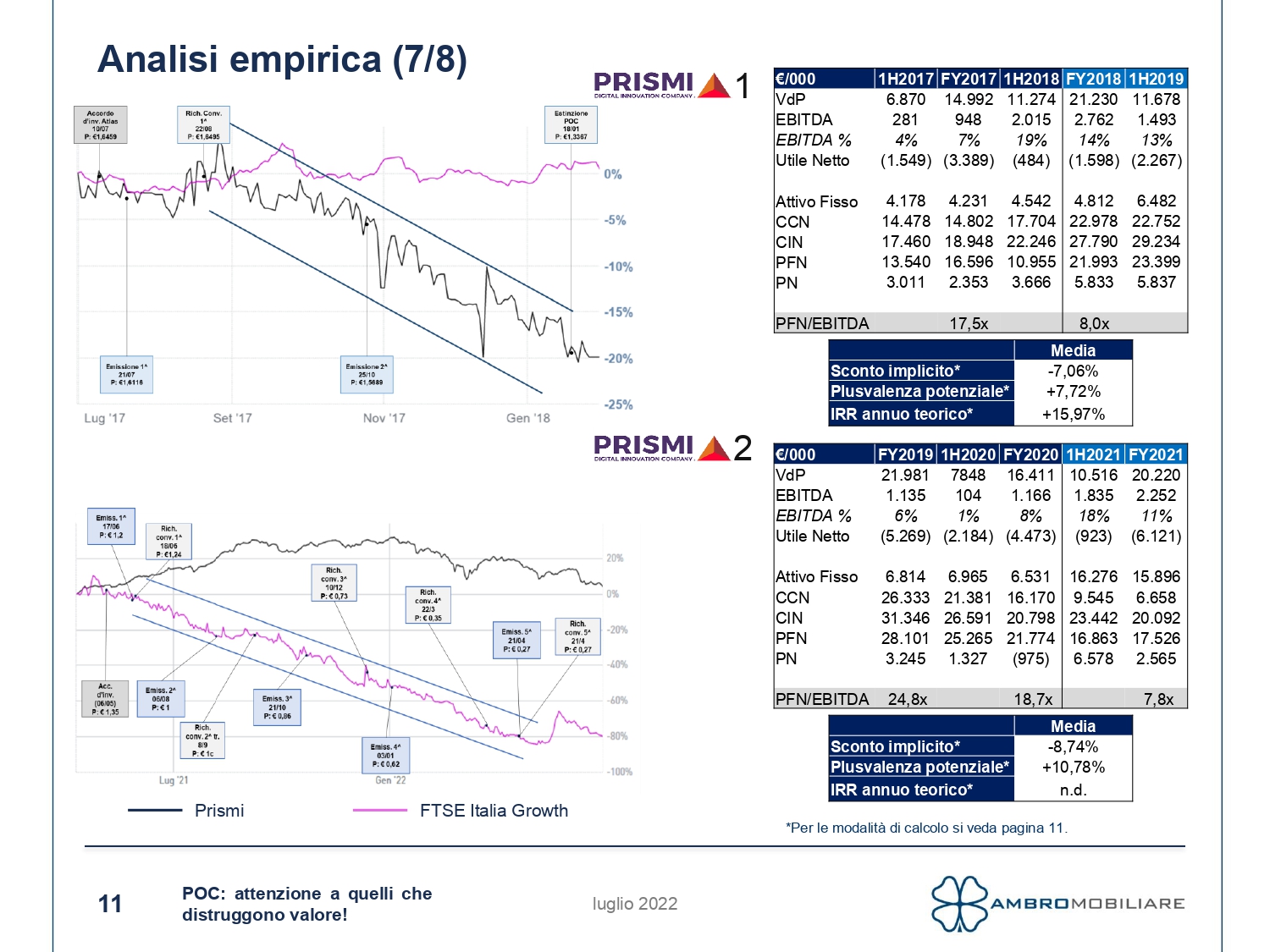

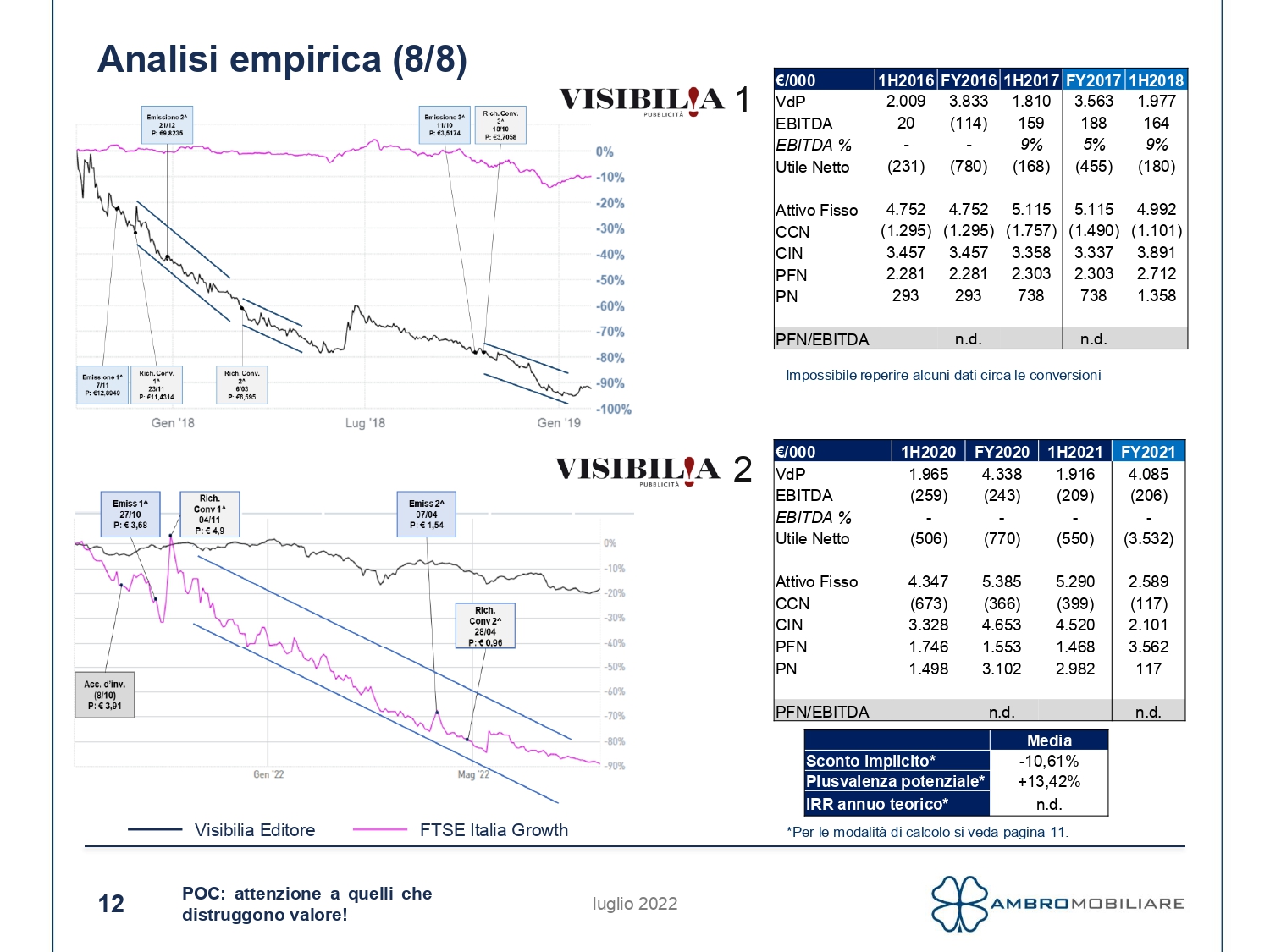

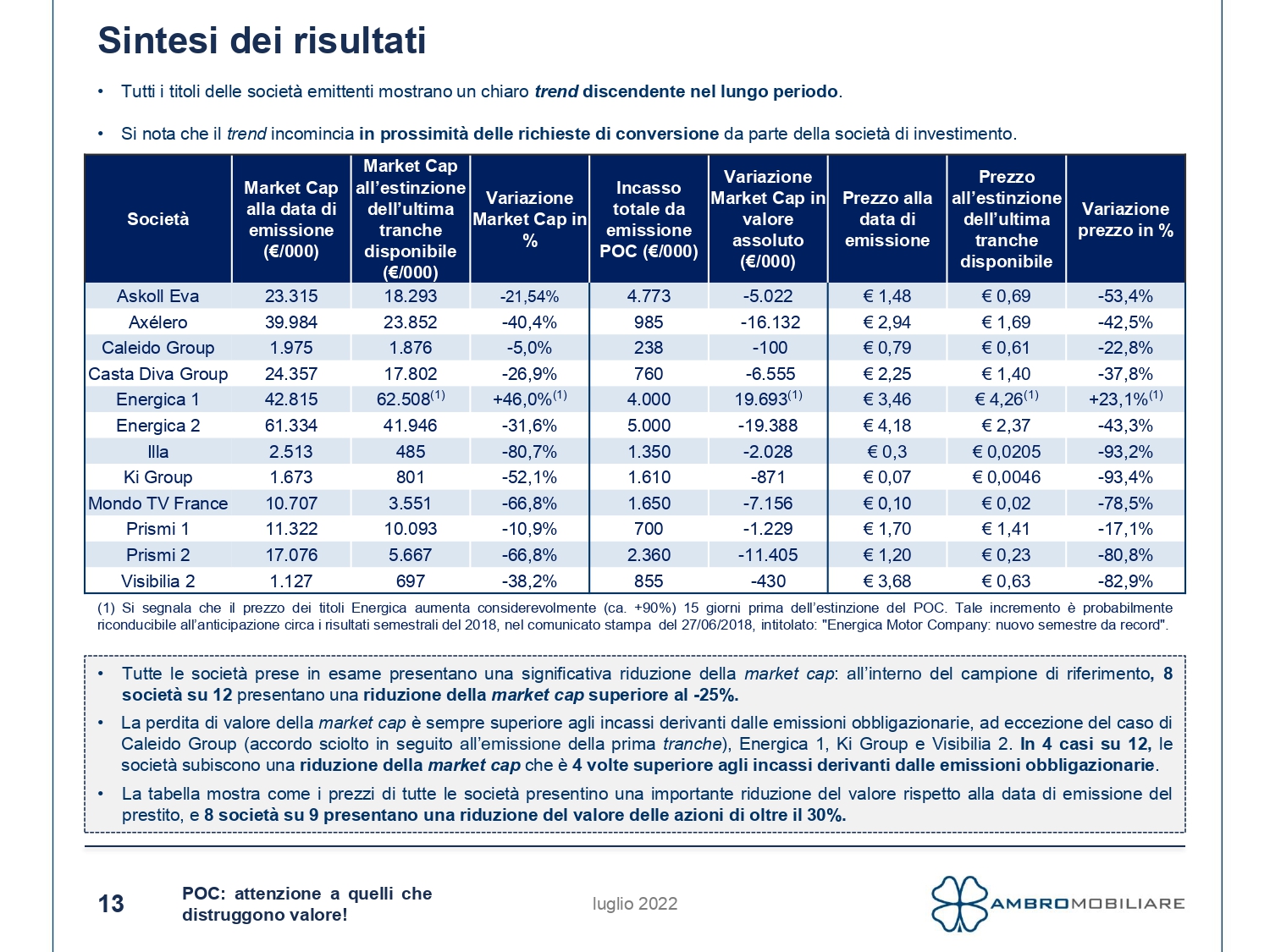

These movements have not only involved the companies KiGroup and Visibilia. A study by Ambromobiliare examined the trend in convertible bond loans cum warrants involving various companies between 2017 and 2021. The analysis examined the companies listed on Euronext Growth Milano. The companies analyzed by Ambromobiliare are: Askoll Eva , an Italian motorcycle manufacturer that produces electric scooters, pedal assisted bicycles and electric scooters, Axélero , a digital marketing company, Casta Diva Group, a communication company, Caleido Groum, a of tourism, Energica Motor Company , a company that manufactures electric motor vehicles, Illa , a company that manufactures kitchen utensils, Prismi , a communications company, Sciuker Frames, a company that produces fixtures, SMRE, a construction company, the broadcaster Mondo TV France , KiGroup , a company active in the sector of distribution and production of organic and natural foods and Visibilia Editore. Another company that has had dealings with the Arab fund for a Poc is Fenix Enterteinement .

HOW THE NEGMA FUND OPERATES

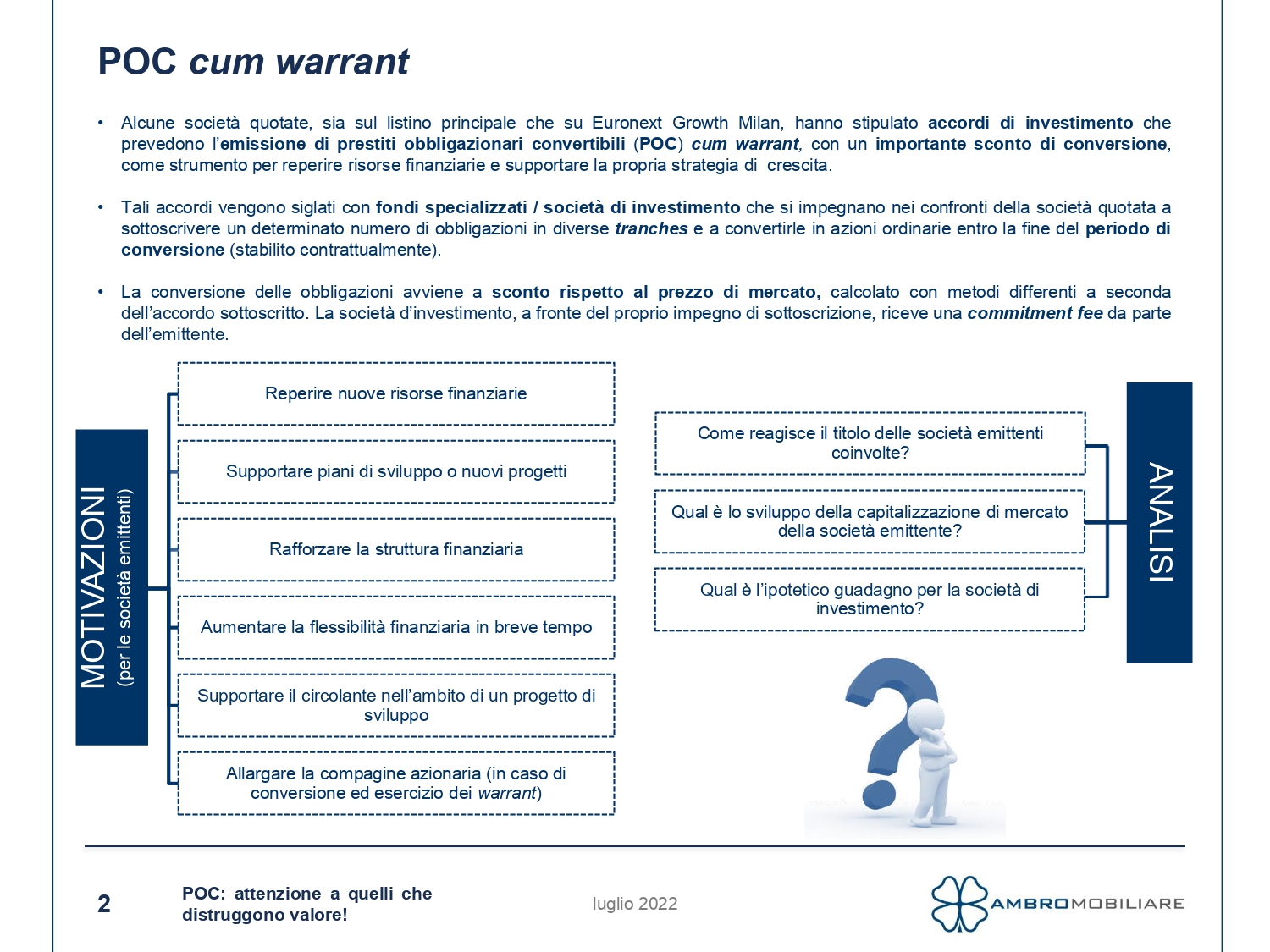

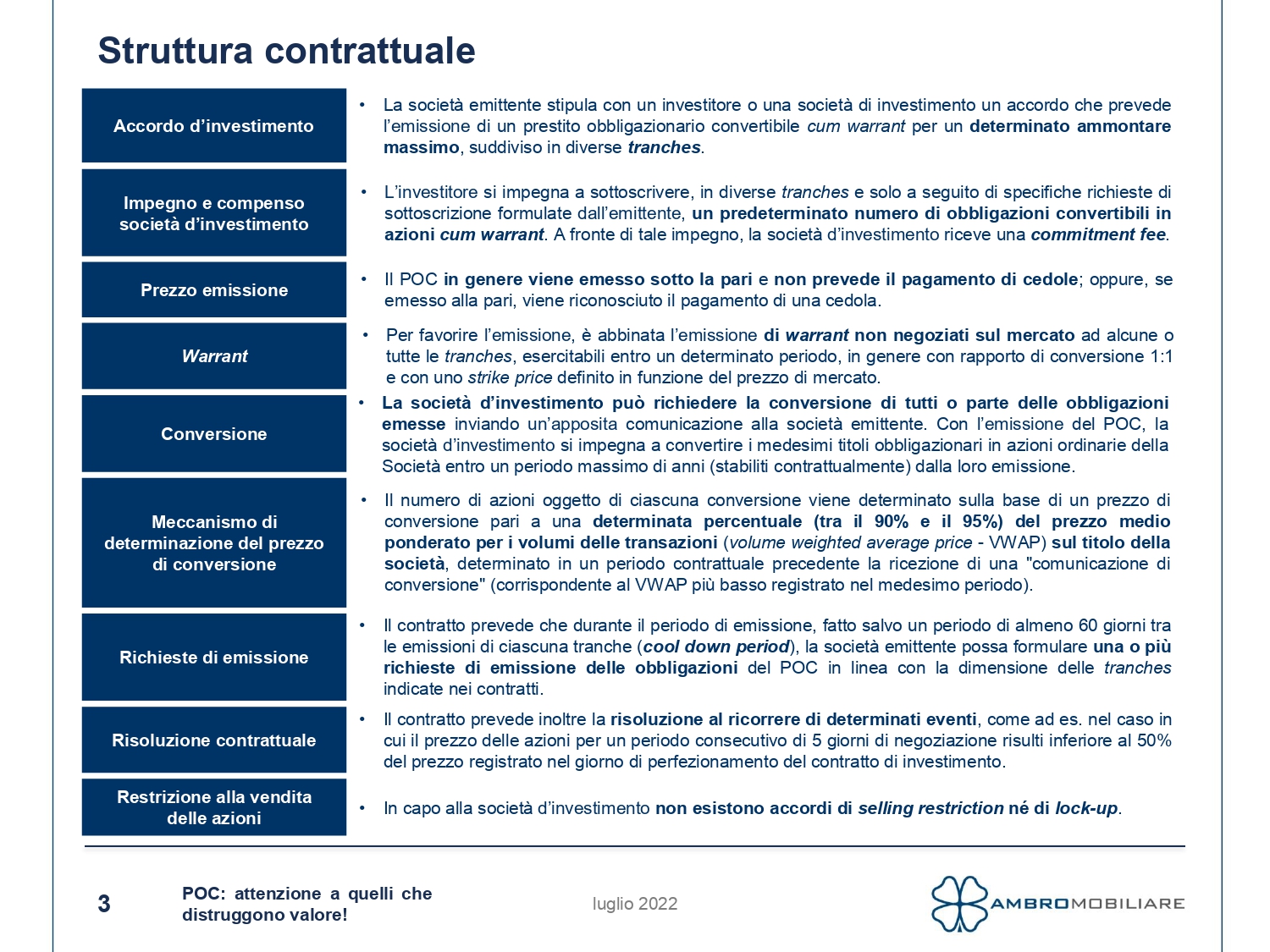

At this point we need to make some clarifications. Companies in liquidity crisis sign agreements with specialized funds and investment companies, such as the Negma fund, which provide for the issue of convertible bonds cum warrants . The bond loans issued are " below par ", which means that the price is lower than the nominal value of the bond. To this it should be added that, usually, there is no coupon payment. Conversely, if the POC is issued at par, a coupon payment is recognised. Furthermore, to facilitate the issue, the POC is combined with a warrant which is nothing more than an instrument which guarantees the holder of the bond the possibility of buying or selling, to be exercised within a certain deadline. The warrant is often used to make one's bonds more attractive.

THE ADVANTAGES OF PURCHASE FOR THE NEGMA FUND

The number of shares involved in each conversion is determined on the basis of a conversion price equal to a certain percentage (between 90 and 95 of the volume weighted average price of the transactions (VWAP) on the company's stock. Therefore, the convenience for the fund lies in the fact that the conversion of the bonds takes place at a discount with respect to the market price, furthermore the investment company, against its subscription commitment, receives a commitment fee from the issuer. Finally, the contract provides for its termination if certain events occur, such as the case in which the share price for a consecutive period of 5 trading days is less than 50% of the price recorded on the day on which the investment contract was signed.

THE STARTING CONDITIONS OF THE COMPANIES CONSIDERED BY AMBROMOBILIARE'S ANALYSIS

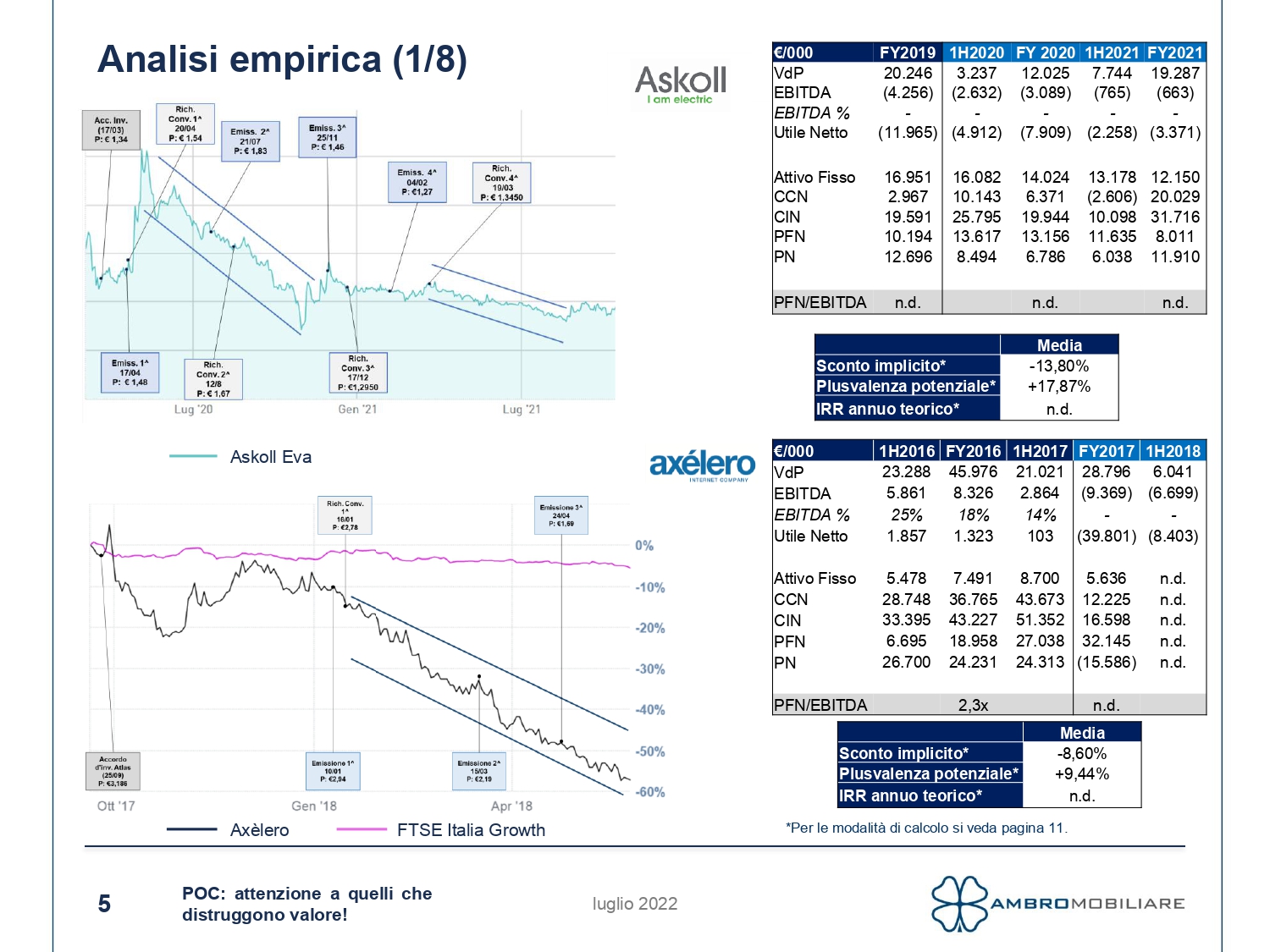

All the companies analyzed presented situations of financial imbalances. One of the hypotheses put forward by the study is that the issuance of POCs was one of the few tools available to raise liquid resources. In fact, the study of the financial statements carried out by Ambromobiliare shows that all the issuing companies (except Axélero) suffer losses and EBITDA is negative in 8 cases out of 12. Things do not improve even after the first issue: all the companies are still making a loss and the operating result deteriorates in 8 out of 11 cases.

THE RESULTS OF THE STUDY: THE COMPANIES THAT SUBSCRIBE TO THE POC ARE THE WINNER

The result of the study makes it clear that all the securities of the issuing companies undergo a clear downward trend in the long term, a trend that begins in the vicinity of the conversion requests by the investment company. The conversion of the bonds, therefore, has a negative effect on the performance of the share : the share prices of all the companies show a significant reduction in value compared to the issue date of the loan, and 8 out of 9 companies show a reduction in the value of the shares of more than 30%. Those who really earn are the investment companies (therefore in the case analyzed by the Report the Negma fund) who subscribe to the POC and who obtain a potential return equal to or greater than 15%. The shareholders, on the other hand, find in their hands a stock that loses from a minimum of 35 up to even 80% of its value.

In 2019, to deal with a serious liquidity crisis, Daniela Santanché's company Visibilia asked for a loan from the Dubai investment company Negma. But who is behind the fund that saved the company? Follow #Report now live on #Rai3

https://t.co/ncB8yhNKKR pic.twitter.com/nQPoph2r6l

— Report (@reportrai3) June 19, 2023

HOW THE NEGMA FUND HAS EARNED ON VISIBILIA

Report , in the last episode, said that the Negma fund, after converting the Visibilia bonds into shares, got rid of them by selling them. Result? The company's stock sank and lost 98% of its value, going from 3.68 euros to 20 cents . The minority shareholder of Visibilia, Giuseppe Zeno, filed a complaint with the prosecutor, according to which the profits obtained by Negma with the conversion operations would have been the consequence of a criminal manipulation of the stock market. As demonstrated by the study carried out by Ambromobiliare, Negma managed to convert the shares when the title was very low and sold them shortly after, when the value of the Visibilia share recovered. The Dubai Fund managed to earn almost 600,000 euros on the three million loan. The question posed by the Rai 3 broadcast conducted by Sigrido Ranucci is who can find the purchase of shares in a company profitable for the attention of the Public Prosecutor's Office and which it has always lost every year. Last November the Court of Milan had asked for its bankruptcy.

THE REPORT ASSUMPTIONS ON THE LINKS BETWEEN VISIBILIA AND THE NEGMA FUND

The hypothesis not mentioned in the transmission is that there is a link between the Negma Fund and Visibilia , as also reported by the Fatto Quotidiano of last November 24th. This hypothesis was immediately rejected by the former CEO of Visibilia and partner of Daniela Santanché, Dimitri Kurz. The only link between the two companies is the President of the Senate Ignazio La Russa, who on 15 February 2021 attended a meeting of the Visibilia board of statutory auditors by telephone, as the company's lawyer. In the same period La Russa also carried out legal activities for the Negma Fund. In fact, on behalf of the Dubai company, the current president of the Senate sent the online newspaper Milano Today a warning with his signature at the bottom.

Minister Santanchè's companion and trusted man Dimitri Kunz: blue blood by birth or by self-certification? Review the #Report investigation here https://t.co/gQJNlIAiT5 pic.twitter.com/VVBotfnmMv

— Report (@reportrai3) June 20, 2023

THE AMBROMOBILIARE STUDIO

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/non-solo-visibilia-di-santanche-cosa-combina-il-fondo-arabo-negma/ on Sat, 24 Jun 2023 06:02:47 +0000.