Pfizer (and not only), Big Pharma’s passion for tax havens

Did Pfizer hide 1.2 billion in profits from the Italian tax authorities to evade taxes? The Guardia di Finanza and Agenzia delle Entrate will respond to this but, in the meantime, the relationship between Big Pharma and tax havens seems to be well established regardless. Facts, numbers and old stories

Blitz by the Guardia di Finanza and Agenzia delle Entrate in the Italian office of Pfizer just outside Rome. The multinational is under investigation in our country for alleged transfers of profits to divisions in other states to avoid paying taxes on profits.

A procedure that does not seem new to Big Pharma in general, which for years have been declaring their love for certain tax havens.

BLOOMBERG'S INDISCRIPTION

According to Bloomberg , who was the first to give the news , Pfizer Italia is in the crosshairs of the local authorities as the Guardia di Finanza, in collaboration with the Revenue Agency, has launched a tax audit, the outcome of which is not yet defined. .

Bloomberg claims that Pfizer Italy has transferred 1.2 billion euros to the Pfizer Production and Pfizer Manufacturing affiliated divisions in the United States and the Netherlands with the aim of avoiding the payment of taxes on profits – which could go up to 26%.

However, it is necessary to remember that the investigations are still ongoing and that, therefore, everything still needs to be demonstrated.

THE INVESTIGATION

Also according to information reported by Bloomberg , the investigation – which began last February – concerns a period prior to the pandemic. It is in fact an investigation of what happened in the years 2017, 2018 and 2019.

According to Repubblica , the joint work of the Guardia di Finanza and the Revenue Agency stems from "a sample work" that "in recent years they have been carrying out on large multinationals (…) precisely to avoid these intragroup transactions between Italy and foreign offices, mostly in tax havens ".

The episode that now involves Pfizer Italia recalls, in fact, the case of the international luxury group Kering, owner of the Gucci brand, which paid the tax authorities 1.25 billion euros for the same charges.

THE HYPOTHESIS OF GDF

The Guardia di Finanza, according to Bloomberg , argues that "Pfizer would have decided not to distribute dividends during the investigation period, remunerating its shareholders by reducing the company's share capital".

In the time span covered by the survey, Pfizer generated a total of $ 33 billion in adjusted net income globally.

WHAT HAPPENS NOW

The investigation by the Guardia di Finanza does not necessarily mean that Pfizer has committed an offense, Bloomberg specifies. Once the work is completed, the results will be reviewed by the Revenue Agency, which has the power to assess any fines and tax payments if it deems them justified.

HOW DOES PFIZER DEFEND ITSELF

"The Italian tax authorities routinely check and investigate Pfizer's taxes and Pfizer cooperates with such checks and investigations." This is the comment released by company spokesperson Pamela Eisele, who added: "Pfizer respects the laws and tax requirements of Italy".

THE REACTION OF THE BAG

"Pfizer shares – Bloomberg wrote yesterday – fell briefly before regaining ground and climbing 1.3% at 3:51 pm on Wednesday in New York".

A SICK SYSTEM: THE OXFAM SURVEY

A 2018 Oxfam survey states that four pharmaceutical companies – Abbott, Johnson & Johnson, Merck and Pfizer – "systematically hide their profits in tax havens overseas", widening the gap between rich and poor , men and women, and between economies. advanced and developing.

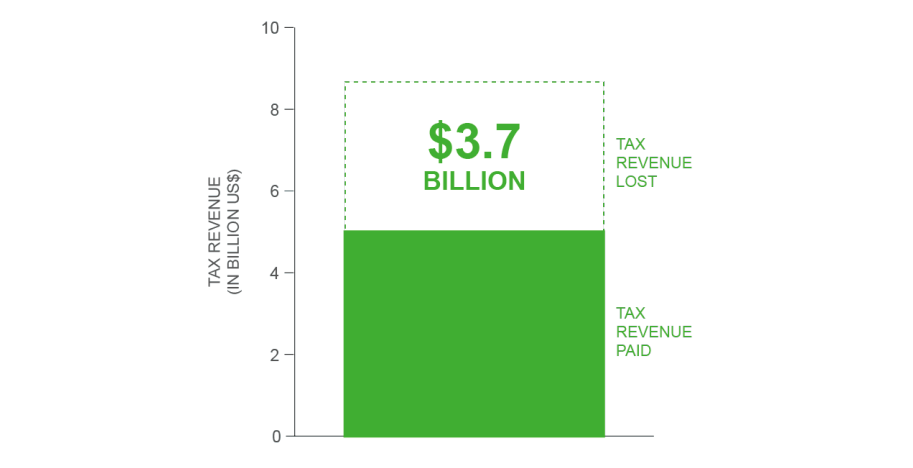

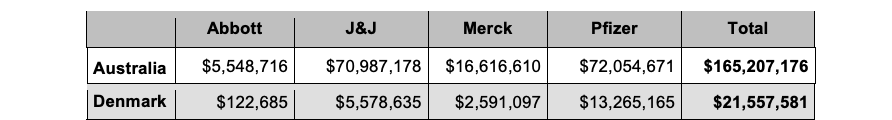

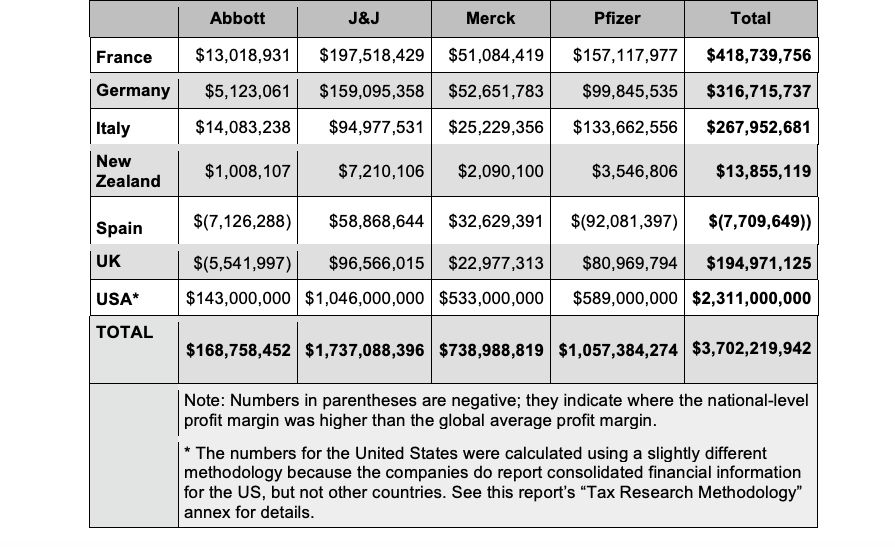

Translating the thesis into numbers: these four corporate giants, the report reads, "seem to deprive the United States of 2.3 billion dollars a year and deny other advanced economies 1.4 billion dollars".

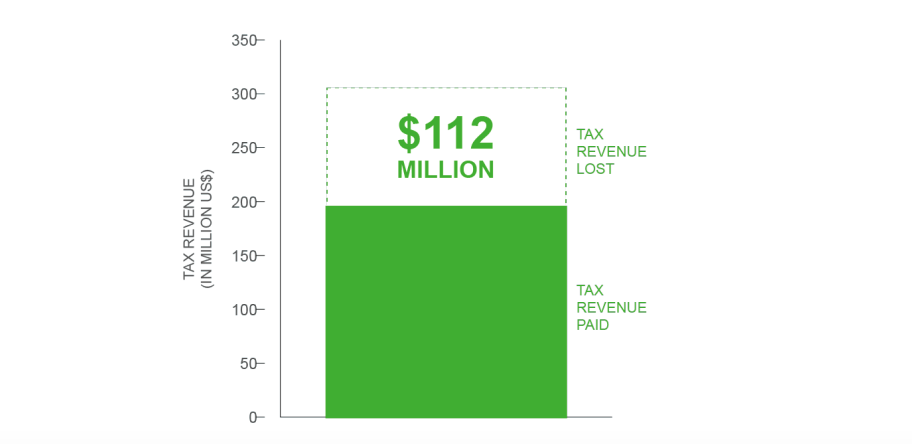

This approach would also deprive “the governments of developing countries, afflicted by liquidity problems, of about 112 million dollars a year, which could be spent on vaccines, midwives or rural clinics”.

Oxfam states, however, not to accuse Big Pharma of doing anything illegal. In confirmation of what is hypothesized even now by the Guardia di Finanza, it would be, in fact, more than a ploy made possible by "a sophisticated tax planning to take advantage of a faulty system that allows multinationals of many different sectors to get away with avoiding taxes ".

THE TRICK OF THE BIG PHARMA

By examining publicly available data on these four US pharmaceutical companies, Oxfam discovered "a surprising pattern".

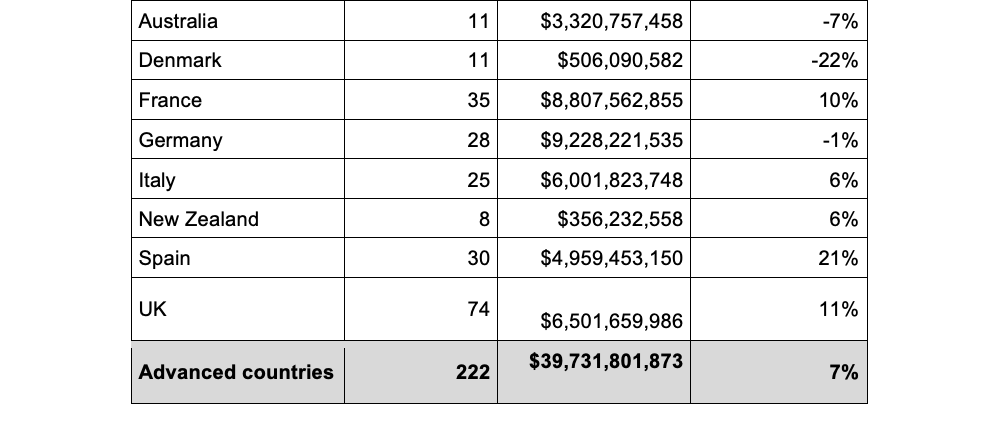

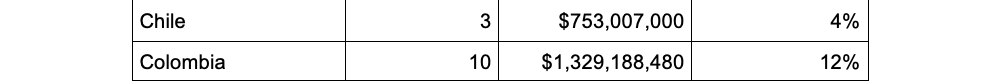

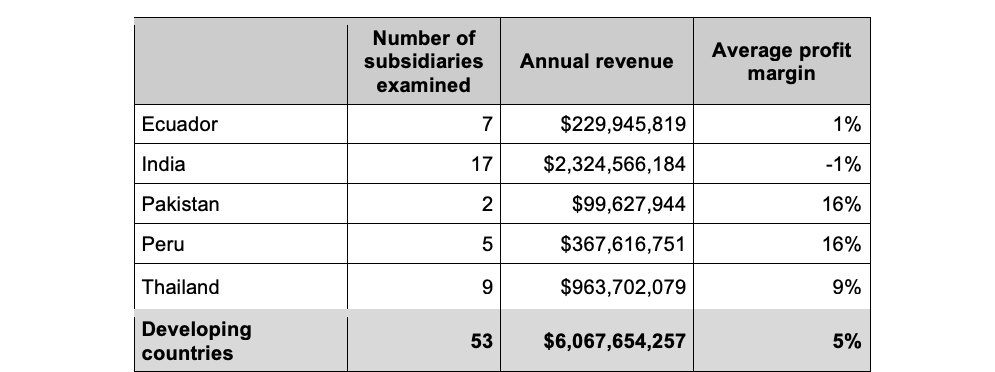

“In the countries analyzed that have standard corporate tax rates, rich or poor, corporate pre-tax profits were low. In eight advanced economies [including Italy, ed ], the profits of pharmaceutical companies averaged 7%, while in seven developing countries they averaged 5% ”.

However, globally, these companies have posted global annual profits of up to 30%. And so Oxfam wonders: where were the high profits then? Answer: in tax havens.

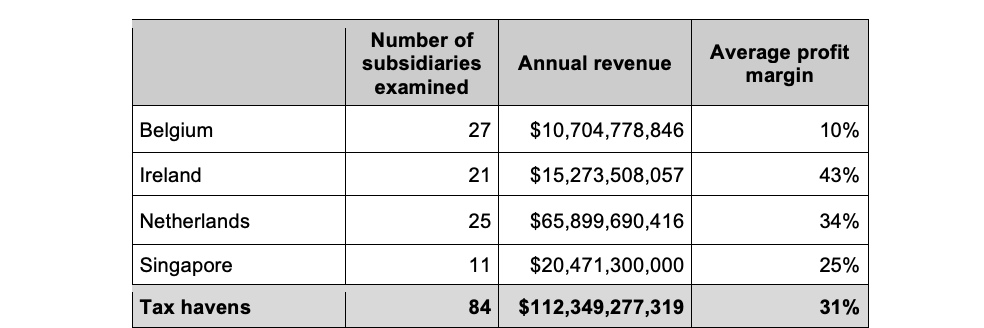

"In four countries that apply low or zero tax rates, these companies have seen skyrocketing profit margins of 31%." In particular, the four countries indicated are: Belgium, Ireland, the Netherlands and Singapore.

According to the calculations, in Italy, the tax under-contribution could have generated a loss of almost 268 million dollars. And it fared even worse in France (418 million) and Germany (316 million).

HOW MUCH THE LOVE OF BIG PHARMA IS WORTH TAX HAVEN

“Pfizer, Merck and Abbott – concludes the report – are among the 20 US companies with the largest number of branches in tax havens; Johnson & Johnson is not very far. All four are among the US companies with the largest amount of money deposited overseas: at the end of 2016, these four companies alone held a whopping $ 352 billion offshore. "

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/sanita/pfizer-e-non-solo-la-passione-delle-big-pharma-per-i-paradisi-fiscali/ on Thu, 27 Oct 2022 10:02:05 +0000.