Pnrr: opportunities and unknowns for Italy

Why simplification is urgently needed for the success of the NRP. The analysis of Professor Francesco Vatalaro, Professor of Telecommunications at the Engineering Department of the "Mario Lucertini" Company of the University of Rome Tor Vergata

Let's see what are the opportunities and risks that could affect our country which, as we know, relies on its National Recovery and Resilience Plan (PNRR) not only to recover from the economic setback generated in 2020 by the pandemic but even to reduce imbalances pre-existing so as to gain positions in the European ranking. [1] The European Commission itself is confident that, by virtue of this plan, Italy will be able to regulate its economy which is the third in Europe and to which many entrust the responsibility for the stability of the entire EU.

Let's start with a brief summary of the characteristics of the Italian plan and then examine some of the related problems.

THE STRUCTURE OF THE PNRR

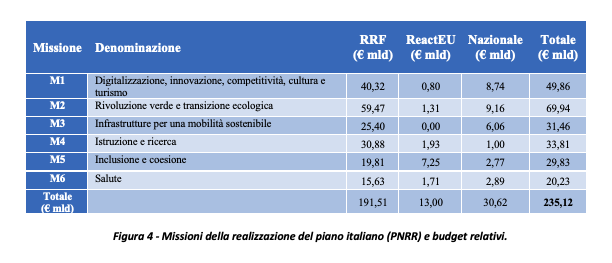

The PNRR is the document that the Italian Government sent to the European Commission on April 30, 2021 to illustrate how it intends to invest the funds that will arrive under the NGEU element called “Recovery and Resilience Facility” (RRF). The Italian Plan, prepared following the guidelines of the European Commission, presents a " complete and coherent package of reforms and investments " [2] and is divided into three 'axes': digitization and innovation; ecological transition; social inclusion. The PNRR groups investment projects into 16 'components' (a sort of macro-projects) grouped into six 'missions' (table in Figure 4).

The Government has made a request to the EU for the maximum allowed RRF resources available to Italy, equal to 191.5 billion euros (28.5%), of which 122.6 billion in loans and 68.9 billion in grants. To these resources are added 13 billion euros from the ReactEU program (the bridge mechanism between the current cohesion policy and the new programming with approximately 8.5 billion for the South) and, finally, 30.62 billion euros from the "Plan national for complementary investments "to be integrated with European interventions. Therefore, the total envelope of the resources mobilized in the period 2021-26 amounts to approximately 235.12 billion euros.

According to MEF estimates, through the reforms and investments envisaged in the plan, the growth rate of the Italian economy could increase by 0.8 percentage points – of which 0.5 due to higher spending and 0.3 due to reforms – bringing the potential growth rate to 1.4% in the final year (2026), 0.8% points more than estimated in the absence of PNRR. As a result, the overall impact on nominal GDP in 2026 is estimated at 3.6 percentage points in terms of deviation from the baseline scenario. This will make it possible to reduce both the public debt / GDP ratio and the unemployment rate, the two parameters that show the greatest critical issues for Italy in the analyzes of the European Commission.

According to the provisions of Regulation (EU) 2021/241, a share of at least 37% of the RRF resources available to Italy must be allocated to the green transition and a share of at least 20% to the digital transition. In the PNRR, the interventions intended for this are distributed over all six missions: those for the ecological transition are 78.2 billion (40.8%) and those for the digital transition are 51.4 billion (26.9%). The table also provides the economic details for the six missions to be spent over the six years.

ANALYSIS OF THE ITALIAN PLAN

It is confirmed that the infrastructural investments, although not limited to the M3 mission alone (for example, the investments foreseen in the second component of M1 are of an infrastructural nature), are minor compared to the accumulation of foreseen expenses. If we exclude those addressed to social purposes (mission "inclusion and cohesion"), most of the expenses should be able to mobilize the dormant private resources with a robust multiplier, but any possible a priori analysis (which should have however direct programmatic choices) aimed at pushing in this direction. This is one of the first serious concerns to emerge from the examination of the plan. Taking up from the IBL analysis already mentioned above, " investments are heterogeneous and often appear more the result of actions by stakeholders, than the result of a reasoned analysis on the needs of the country ".

The recovery effect of “ projects in the drawer ”, already mentioned above, is evident, with choices of the destinations of the expenses trying a posteriori to carry out the impact estimate: the macroeconomic effect risks being far from being optimized. On the other hand, the determinants of choices appear more political than economic. The structure of the Italian plan then highlights a strong role, certainly proactive and in an implementation perspective, on the part of large state or semi-state industrial groups. The heavy influence on the drafting of the plan of publicly controlled enterprises, explicitly sought, not only highlights a marginal role of ideas and proposals originating from the private sector (even of large companies) but also suggests an outflow of limited proportions of the resources mobilized towards the medium and small enterprises in the country, especially those of young people.

The lack of in-depth analysis, also due to an evident lack of time, of a high-level programming of interventions, as well as of the conditions suitable for mobilizing private resources, emerges from many examples of which the plan is dotted and which are, unfortunately, materializing in public tenders.

SOME FIRST SIGNS NOT REALLY COMFORTABLE

Unfortunately, the example of the first public calls issued in recent days seems to confirm the concerns. Their structure highlights that to the historical level of bureaucratization of the Italian calls, the PNRR adds a further layer of rules and limitations that could discourage the adhesion by those private subjects who, actively engaged on the market, aim to operate with high levels of efficiency and who can hardly afford to be trapped in complex 'Byzantine' schemes. Conversely, the incoming rain of public money could incentivize subjects, far from the logic of the market and the generation of lasting value, who aim to obtain the public contribution with the minimum effort, even respecting all the formalisms, without taking care, however, to give production continuity. to the effort made, as it is not really finalized.

To better understand the type of difficulty you are about to encounter, some examples might be useful.

A first public announcement has already gone deserted. [3] This is the intervention envisaged by the Ministry for Technological Innovation and Digital Transition (MITD) to create the optical fiber connection between the continent and some smaller islands which so far cannot be equipped with broadband. The causes that have kept private companies in the sector away concern some severe constraints: heavy obligations of surety guarantees and penalties on the execution times of the works.

Other calls have been issued and will expire in the coming months. For example, the Ministry for University and Research (MUR) has launched two calls for network research and innovation laboratories that have rules that are difficult to interpret and satisfy. Especially in one of the two calls, in which a significant participation of private companies is desired, the expected economic leverage (51%, of which at least 31% in financial resources) combined with the claim of a vision at 15 years, could lead to a limited participation against a large available budget (500 million euros).

Overall, it is clear that the strong bureaucratization, the tangle of constraints of all kinds and the requests for co-financing in the face of penalizing conditions for private companies (for example the renunciation of industrial property rights and the full opening to the knowledge market), they can undermine many components of the PNRR.

Another category of problematic examples relates to the mechanisms chosen for complying with state aid rules. In the field of 5G technology, which is expensive because it requires a widespread distribution of radio transmission infrastructures, it is necessary to commit to starting from the most densely populated areas so that the return on investment can reasonably materialize. But these areas are by their nature competitive and therefore do not lend themselves to public interventions in forms that could prove to be distorting existing or at least potential competition: it would have been appropriate to hypothesize areas and intervention mechanisms that are at the same time respectful of the European principle and criteria of investment effectiveness. The projects selected in the 5G field concern the coverage of state or provincial roads, therefore with very low data traffic which, obviously, are of little interest, and suggest a low impact on GDP.

In this sector, namely 5G, there was no lack of market proposals aimed at a more effective approach, indicating both areas of intervention and subsidy mechanisms capable of creating a higher economic multiplier. For example Ericsson had provided estimates of the multiplicative impact of 5G on GDP in various use cases including: urban hotspots including public transport (seven times), public services (six), smart factory (five), smart agriculture (five ) [4].

CONCLUSIONS

There is still widespread approval – which at times turns into genuine enthusiasm – for the European NGEU plan. While the plan represented a useful turning point from a political point of view, a detailed examination of its economic prospects may generate some reasonable perplexity. Beyond appearances, this is not a Keynesian plan – much less a liberal approach in economics – but rather a rigid and non-adaptable mechanism that centralizes, in the close dialogue between the European Commission and governments, measures often incapable of generate an appreciable macroeconomic multiplier and which will hardly be able to involve national industrial systems in a capillary way, especially in its Italian version which takes the name of PNRR.

It is also well known that the Italian system is unable to access European funds. At a time when a vast plan of the scale of the PNRR was launched, to which many are entrusting hopes of economic recovery that should go well beyond the recovery of the serious damage caused by the pandemic, the ability to truly mobilize industry and private capital it should have been a priority and an overriding goal. The historic bureaucratization of the Italian public system seems even reinforced in the first calls of the PNRR – with an unimaginable amount of ex-ante rules and ex-post checks and penalties – and this raises serious concerns about the real effectiveness of the plan, which are added to the presumable little value of the multiplication effect of the resources that will actually be invested.

Before it is late, simplification measures " for the PNRR" would be desirable. Its institutive rule [5] provides in art. 5 the establishment at the Presidency of the Council of a "Unit for the rationalization and improvement of regulation and the Office for simplification" with the task of " identifying [re] the obstacles to the correct and timely implementation of the reforms and investments envisaged in the PNRR deriving from the regulatory provisions and the respective implementation measures and proposes remedies . " It is essential that this Unit, in an already emergency perspective, is activated without delay and that it gives clear and immediate provisions for the simplification of the rules for public tenders, as well as perhaps revising some of the notices already published.

[1] In particular, we plan to respond to the Country Specific Recommendations (CSRs) addressed to Italy by the Council of the European Union in 2019 and 2020.

[2] Study Centers of the Chamber of Deputies and Senate of the Republic, "Reading cards: the National Recovery and Resilience Plan", May 27, 2021, http://documenti.camera.it/leg18/dossier/pdf/DFP28. pdf

[3] Carmine Fotina, “Ultra-broadband, too many constraints: the first Pnrr race is deserted”, Sole 24 Ore, 9 January 2022.

[4] Ericsson Italia, “Next Generation Italia, A proposal with a multiplicative impact on the Country System”, slide, 22 October 2020.

[5] Law no. 108/2021.

(Third and last part, here the first and here the second)

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/pnrr-italia/ on Sun, 23 Jan 2022 07:45:51 +0000.