Porsche, here are the strengths and weaknesses of the IPO

Porsche IPO: can you close the gap with Ferrari? The analysis by Simone Di Biase, Head of Relationship Management for BG SAXO

Volkswagen has just announced that its Porsche AG IPO has been fully underwritten. Porsche will form the price on September 28, with the first trading day on September 29 under the symbol P911. The company is worth around € 75 billion for a public offering that will make it the fifth largest IPO in European history. Porsche is a strong automotive company with revenues up 8% in the first half of 2022 and an EBITDA margin of 24.5%. This figure is certainly high for the sector but is still lower than that of the Italian rival Ferrari: right here we can see the potential interest for future Porsche shareholders, which consists in the possibility of bridging the valuation and operational gap from the Maranello house.

The labyrinth of Porsche and Volkswagen

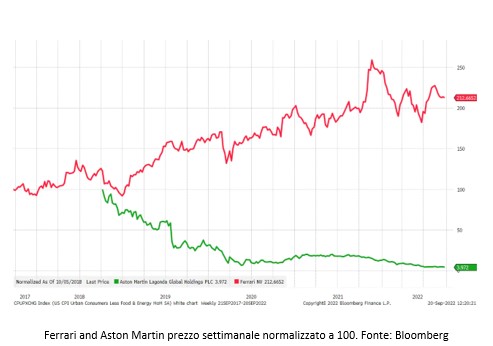

In recent years, luxury automakers such as Ferrari and Aston Martin have been publicly listed with very different outcomes. Ferrari was a resounding success while the fate of Aston Martin is nearing decline as it has already happened in the history of this historic British car brand. Now Volkswagen arrives and puts the car manufacturer and therefore the Porsche brand on sale with the IPO price that will be formed on September 28 with the first trading day set for the next day.

One reason for the IPO's interest is the company-owned facility, similar to a maze with Volkswagen owning the Porsche brand and automotive production, but itself owned by the Austrian Porsche-Piech family.

The history of this strange ownership structure began with the privatization of Volkswagen in 1960 when laws were enacted that any shareholder with more than 20% would veto any decision.

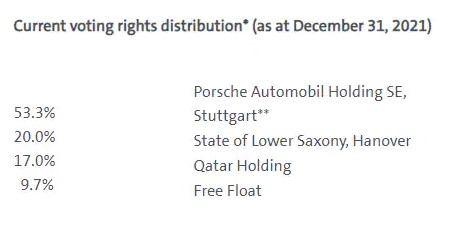

Since then, the German government has retained 20.1% and thus control over Volkswagen. In 2005 Porsche SE (the holding company of the Porsche family) began to accumulate a stake in Volkswagen and in 2006 it controlled 25.1%. In October 2008, Porsche SE announced that it had acquired 42.6% with options for another 31.5% as it wanted to move up to 75% to consolidate Volkswagen's cash position in its balance sheet. With the government still holding 20.1%, short sellers were quick to hedge their shorts and Volkswagen's share price briefly went above € 1,000, making it the most valuable company in the world. In this turmoil, Porsche SE ended up controlling 53.3% according to the latest shareholder data.

In 2011, Porsche and Volkswagen merged and Porsche AG was qualified as a subsidiary of Volkswagen AG. The mirror below shows the distribution of Volkswagen's voting rights.

The details of the IPO

In the prospectus of the IPO it is specified that Porsche AG will divide its share capital into two parts of 455.5 million shares each, between ordinary and preferred (for a total of 911 million shares, a game on its iconic model of car precisely 911 ), with the previous class of shares providing voting rights.

The class of shares that will be listed on the Frankfurt stock exchange with the ticker symbol P911 is the preferred class which does not have voting rights but is entitled to a dividend of 0.01 euro per share more than ordinary shares.

Volkswagen plans to sell 25% plus a stake in Porsche AG to Porsche SE, thus passing on the right to block minorities to the Porsche family.

Furthermore, Volkswagen plans to sell 25% of the preferred shares on the market thanks to the news that the offer has already been fully subscribed in the entire price range from € 76.50 to € 82.50 with Qatar Investment Authority, the Sovereign Wealth Fund of Norway and T. Rowe Price already involved in the IPO.

The price range indicated brings Porsche AG's valuation to 75 billion euros, a value close to Volkswagen's market value of 91.6 billion euros today. These numbers make Porsche AG's IPO potentially the fifth largest IPO in the history of Europe.

Volkswagen sells Porsche AG shares to the public to achieve two goals. Reduce the valuation discount on Volkswagen shares from cross-holdings and unlock more value from a pure luxury brand like Porsche. Furthermore, the public offering will raise capital for Volkswagen's transition to becoming a fully electric vehicle over the next decade. Volkswagen is expected to raise around € 19.5 billion from the IPO in which it promises to pay around € 9.6 billion in a special dividend by early 2023.

The fundamentals

Porsche is a well-managed company generating 33.1 billion euros in revenues in 2011 with an operating profit of 5.3 billion euros and an EBITDA of 7.4 billion euros which translates into an EBITDA margin of 24, 5%, which is certainly an excellent figure but not on a par with Ferrari's 35.7% in 2021. It must be said that the Maranello house is a company that can guarantee even more profits thanks to its status as an even more prestigious brand with an estimated market value of 75 billion euros and EBITDA of 7.4 billion euros in 2021, translates into a multiple of 10.1x which is significantly less than the Ferrari multiple of 22.2x, suggesting that Volkswagen and the Porsche family want a successful IPO and are aware of the current market volatility.

Porsche's revenues grew 8% in the first half of 2022 with strong cash generation of € 3.9 billion, a strong result given the general weakness of the auto industry, but still lower than Ferrari, which saw its revenues grow 17.3% yoy and 24.9% yoy in the first and second quarters respectively.

The main question for potential Porsche shareholders is whether the company can make a successful transition to becoming fully EV while preserving or even expanding margins. It is clear when comparing Porsche to Ferrari that there is room for improvement and a potential benefit if Porsche were to improve its operations and further expand its brand. Volkswagen has promised that synergies will continue to exist between the Volkswagen group and Porsche, but for Porsche's future success we believe that the key is its greater autonomy.

The risks

One of the absolute key risks for the Porsche stock is the growing cost of living crisis as rising energy costs are reducing disposable income in Europe. The sector most at risk, due to falling demand during this difficult period, is the luxury goods sector in which the automaker is located. Porsche is clearly on the high end with sales of up to 1% of income and wealth distribution and could also significantly reduce its consumption during the ongoing energy and inflationary crisis. Since Porsche buyers are wealthy individuals, it is reasonable to assume that the decline in equity and bond markets could have a major impact on sentiment among the richest 1% in the world. Another risk for Porsche is given by a scenario in which the Euro starts to grow again, which would reduce the value of international sales and its competitiveness abroad. The war in Ukraine or the new Covid outbreaks may ultimately have an impact on supply chains and demand for Porsche cars.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/smartcity/ipo-porsche-pregi-difetti/ on Sun, 25 Sep 2022 13:52:03 +0000.