Pos costs: everything you need to know

The costs of Pos have fallen overall by about 20% in the last 5 years. These figures are not enough to satisfy some merchants who continue to battle electronic money. Here are numbers, comparisons and comments

Why do some traders not like the Pos? Among the reasons , the merchants complain about the costs for a payment instrument which, according to some, is exclusively to the advantage of the buyers. But what are the real costs of electronic payments?

ACCORDING TO CONFESERCENTI, POS COSTS RETAILERS 772 MILLION EUROS A YEAR

The costs of electronic payments are divided into two categories: on the one hand there are the costs of renting or purchasing the physical support , the POS on which the card is swiped, on the other there is the cost for each single transaction. Confesercenti complains of an overall cost, including commissions and the purchase or loan of the device, which reaches 772 million euros a year between commissions and the purchase/free loan of the device.

HOW MUCH DOES A POS COST?

Costs depend on the bank, the service requested, the amount of turnover. In our country, the payments market sees some main players: Nexi , in partnership with Intesa Sanpaolo, Unicredit , SumUp and Banca Sella. As mentioned , merchants have two obligations to meet: the purchase or rental of the device and the commissions on payments received . A device can cost, if purchased, from a minimum of 29 euros (such as the basic model of SumUp ), to over 100 euros for the more sophisticated ones. The monthly fee also varies, and not a little. For example, Nexi offers its customers a solution at 27.5 euros per month (which includes Pos and cash). Unicredit has an active promotion that guarantees the rental of the Pos at 2.9 euros per month , zero commissions for amounts below 10 euros, and 0.9% for higher ones. Furthermore, to compare all the offers on the market there is a simulator, SignorPos , which helps to guide the choices.

THE COSTS OF THE COMMISSIONS OF THE POS

The costs for the physical support do not exhaust the expenses of the merchants for the use of the Pos. According to what was revealed by a joint report by the sites specialized in the comparison of offers Observatory compare accounts and Sostariffe , the expenses for commissions vary between the '1.7% and 1.4%. Unicredit offers a commission of 0.9% on its website, Intesa Sanpaolo , on the other hand, resets the monthly fee but sets a commission at 1.80%, Nexi has offers that start from commissions at 0.79%. Younger operators, such as Satispay , have no transaction costs up to 10 euros, and beyond this threshold the cost is fixed at 20 cents regardless of the amount.

FABI'S DATA: THE DECLINE IN POS COSTS

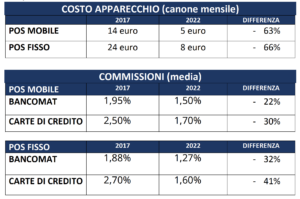

According to data from FABI , the Federation of Italian Bankers led by Lando Maria Sileoni, the cost of Pos rental and commissions has undergone a significant decline over the last 5 years. If in 2017 the monthly fee for a mobile POS was 14 euros and for a fixed one it was 24 euros, in 2022 they reached 5 and 8 euros respectively . The same goes for commissions. If in 2017 mobile Pos transactions with ATMs cost the merchant 1.95%, in 2022 it costs, on average, 1.5%. There was an even more significant drop in transactions from fixed POS with credit cards , which went from 2.70% in 2017 to 1.60% today (a drop of 41%).

ANNUAL COSTS OF DIGITAL TRANSACTIONS DOWN BY AROUND 40% IN 5 YEARS

If we look at the aggregate figures, the decline is even more evident. In 2017 it cost 4,400 euros for a shop or restaurant to accept payments with ATMs, in 2022 it costs 2,700, 40% less . Credit cards go even better, in 2017 the total cost reached 6,300 euros, in 2022 it does not exceed 3,500 with a drop of 44%.

SILEONI (FABI): "UNCONSTITUTIONAL A REGULATION THAT ZEROES THE COSTS OF POS COMMISSIONS"

FABI also intervened on the rumors that the Executive is studying a rule that eliminates the POS commissions . “A state rule aimed at eliminating the commissions on payments with credit cards and debit cards would be unconstitutional: those commissions are paid to the banks that offer the service with the POS to merchants and VAT numbers, each transaction has a cost for the same banks that , therefore, being private companies, they cannot reset prices in one fell swoop – said the general secretary of Fabi, Lando Maria Sileon i -. Any initiative that aims to reduce or, in some specific cases, eliminate commissions should therefore be taken by the banks . The government, this is my advice, should convene the ABI and its president Antonio Patuelli to understand if there is room for the sector to make its contribution in this sense. Certainly we can discuss and find a shared solution”.

GOVERNMENT INTERVENTIONS TO FACILITATE THE PURCHASE OF POS

Over the last few years the government has intervened to mitigate the costs associated with the use of the POS . For example, until next year, a tax credit of up to 50 euros is recognized for the purchase of devices. To this is added a further tax credit, for those who invoice up to 400 thousand euros, which covers 30% of the expenses incurred for commissions.

TAX EVASION IN CASH AND DIGITAL

According to Valeria Portale , Director of the Innovative Payments Observatory and of the Blockchain & Distributed Ledger Observatory of the Milan Polytechnic (interviewed by Ruggero Po in our podcast ), “ for every 10 euros paid in cash, 3.4 are in black ”. A number that drops to 1.2 for digital payments”. Therefore, the propensity for tax evasion is reduced by a third with digital payments.

ITALIANS AND DIGITAL PAYMENTS: A GROWING LOVE

The Innovative Payments Observatory of the School of Management of the Politecnico di Milano found that in the first six months of 2022, digital payments in Italy reached a total value of 182 billion euros with a 22% growth compared to the same period last year year. A trend destined to grow: by the end of the year, digital payments could grow between 15% and 22%, reaching a value between 390 and 405 billion .

THE EFFECT OF STATE CASHBACK ON ELECTRONIC PAYMENTS

This trend was fueled by the measure of the State Cashback which in the first half of 2021 revived the purchasing sector, leading, according to data from the European Central Bank, Italy to mark one of the highest growth values of electronic transactions in Europe ( +41% against an average of +18%). To increase are the amounts transacted with prepaid cards , which grow by +19% , with debit cards up by +24%, and credit cards, up by +21% .

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia-on-demand/costi-pos-tutto-quello-che-ce-da-sapere/ on Sun, 11 Dec 2022 07:27:47 +0000.