Semi-conductors: Amd with Xilinx in the US will challenge Intel. The role of Blackrock

US semiconductor giant Advanced Micro Devices (AMD) has signed an agreement to acquire Californian rival Xilinx. The major shareholder in the two companies is the American fund Blackrock

Advanced Micro Devices (AMD) announced it has reached an agreement to take over California rival Xilinx for $ 35 billion.

Thanks to this operation, the US chip giant AMD significantly increases its critical mass by throwing the gauntlet on Intel, especially in the fields of microprocessors for data centers and applications for the cloud.

The deal comes as extensive consolidation is underway in the US semiconductor industry, which the pandemic has strengthened. Thanks to the boom in laptops and playstations, all devices using AMD chips.

A few weeks ago, graphics chip manufacturing giant Nvidia offered $ 40 billion for Arm Holdings, the British mobile phone chip design giant controlled by Japan's SoftBank. In what, if it goes through, will be the biggest deal in the industry.

Shares of AMD are down 3.5% in Tuesday morning trading, while shares of Xilinx are up 9%. AMD also announced the quarterly that was due to come out after the close of the markets. The company made an adjusted earnings per share of 41 cents on revenue of $ 2.8 billion, up from 18 cents and $ 1.8 billion, respectively, a year earlier. However, FactSet analysts were expecting 35 cents in earnings per share and $ 2.56 billion in revenue.

All the details.

THE AGREEMENT BETWEEN THE TWO COMPANIES

The operation, according to a statement, involves exclusively an exchange of shares and has a value of 35 billion dollars. Shareholders of Xilinx will receive 1.7234 AMD shares for every Xilinx share, at a 25% premium.

Their shares are valued at $ 143, about 25% higher than the $ 114.55 at yesterday's close. With the exchange, a new holding will be born of which the AMD shareholders will hold 74% and those of Xilinx the remaining 26%.

The companies said the deal is expected to be completed by the end of 2021. Victor Peng, chief executive of Xilinx, will continue to lead the deal after the deal is closed, the companies said.

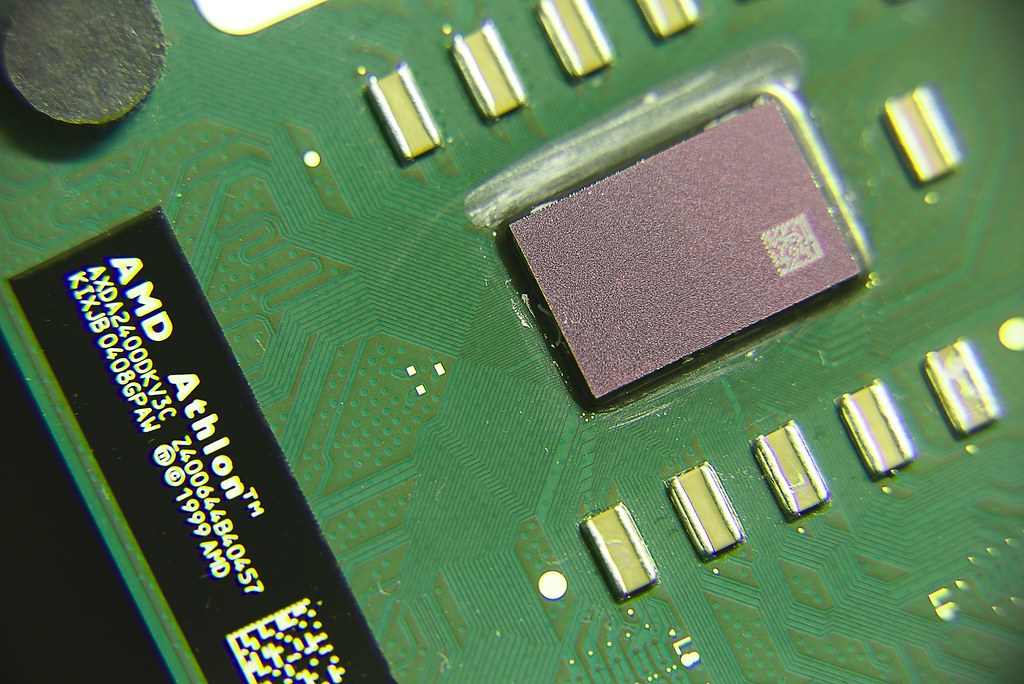

The Santa Clara behemoth relies heavily on external manufacturing partners, as does Xilinx, most notably Taiwan Semiconductor Manufacturing Company , which has gained an edge in packing smaller transistors on each chip.

Both companies have also introduced new technologies for creating new products by packaging multiple chips together.

THE MAJOR ACQUISITIONS IN THE CHIP INDUSTRY

With this deal, AMD would be close to the most valuable acquisition in the history of the chip industry. Currently on the podium is American Nvidia for the $ 40 billion offer for the British microprocessor giant Arm, announced last month.

WHAT AMD DOES

Founded in 1969, AMD is best known as Intel's longtime rival in the microprocessors that power most computers. The Santa Clara-based company plans to use the acquisition to expand its chip business for markets such as 5G wireless communications and automotive electronics. The transaction could also help AMD grab a larger share of data center component sales and thwart a major rival, Nvidia, which is also increasing.

THE ACQUISITIONS OF AMD

The proposed transaction dwarfs AMD's most significant past acquisition, a $ 5.4 billion deal for ATI Technologies in 2006 that put the company in competition with Nvidia for chips that render images in video games. That graphics technology would make AMD a major supplier of video game console chips. But it also burdened AMD with a stock of debt that took more than a decade to clear.

BLACKROCK AND JP MORGAN INVESTMENT MANAGEMENT AMONG THE SHAREHOLDERS OF THE COMPANY

Amd's main shareholders include: BlackRock, The Vanguard Group, SSgA Funds Management, Capital Research & Management, T. Rowe Price Associates, Fidelity Management & Research, JPMorgan Investment Management, Wellington Management, Geode Capital Management and Northern Trust Investments.

THE PERFORMANCE OF THE SANTA CLARA CHIPMAKER ON THE STOCK EXCHANGE

As reported by the New York Times , Intel posted a 29% decline in quarterly profits last Thursday, which caused its shares to drop by more than 10%. AMD, in contrast, reported Tuesday that its quarterly profit was up 148%.

Shares of AMD, which traded five years ago at around $ 2 per share, were up nearly 80% this year and closed on Monday at just over $ 82. AMD's market value is now nearly $ 100 billion. dollars.

WHAT XILINX DOES

Xilinx, founded in 1984, is the largest manufacturer of a class of chips that can be reconfigured for a variety of specialized tasks after leaving the factory. Xilinx was also one of the largest chip companies damaged by the commercial limitations of China's Huawei , a major network equipment manufacturer that is one of Xilinx's largest customers.

The company last week said revenue was down 8%. The market value of Xilinx currently stands at around $ 28 billion, reflecting a strong jump after the Wall Street Journal reported on settlement talks between the companies on Oct.8.

BLACKROCK, VANGUARD AND SSGA AMONG THE MAIN SHAREHOLDERS ALSO OF XILINX

As with Amd, The Vanguard Group, BlackRock and SSgA Funds Management are among the main shareholders of Xilinx as well. Also included: Alliance Bernstein, T. Rowe Price Associates, Janus Capital Management, Canada Pension Plan Investment, FIL Investment Advisors, Geode Capital Management, Nikko Asset Management

The Amd-Xilinx operation has been approved by the respective Board of Directors, but must receive the final approval from the shareholders and the supervisory authorities. It will take 18 months for the transaction to close.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/seminconduttori-amd-con-xilinx-negli-usa-sfidera-intel/ on Tue, 27 Oct 2020 07:05:09 +0000.