Tabor, all about the American fund that makes shoes for Tod’s

Who is behind the Tabor hedge fund which holds 1.1% of the Tod's group shares and which recently opposed (for the second time) Diego Della Valle's takeover bid. Facts, names and numbers

Tabor Asset Management, whose name takes inspiration from the Lower Galilee mountain, is an investment fund based in New York which, among other things, owns 1.1% of the ordinary shares of the Tod's group from the Marche.

In 2022 he opposed a first public takeover offer (OPA) of the group led by Diego Della Valle and in recent days he has done so again while the second attempt is underway .

Here's what he does and who's behind it.

A NAME WITH A MEANING

Tabor Asset Management, as it specifies on its website, chose its name recalling the mountain where, according to the Hebrew Bible, a famous battle took place between the Israelite and Canaanite armies – “much stronger”, states the fund, but that the Israelites won “thanks to their fortitude, perseverance and confidence.”

FOUNDER AND STRATEGY

Formed in 2018 by Jonathan Jacoby, Chief Information Officer (CIO), it claims to have the "belief that we can generate better returns with a risk philosophy similar to that employed at Millennium and UBS O'Connor", where Jacoby also worked as Portfolio manager.

Millennium posted the fourth-highest net gains in 2022 of any hedge fund since its inception in 1989.

Tabor's flagship strategy "is a low-cost strategy with a clear focus on technology, media, telecom and consumer stocks."

Jacoby, who has a bachelor's degree in political science from Yeshiva University and a master's degree in international affairs from Columbia Sipa, is responsible for Tabor's portfolio and risk management.

THE TEAM

In addition to Jacoby, the fund's investment team includes co-founder Chris Chapple, who has been an analyst and head of communications, pay TV and associated subsectors for ten years. He worked together with Jacoby in Millennium.

At the head of the internet/tech sector is Brian Mansfield, who before landing in Tabor worked for Goldman Sachs among others; while closing the circle are Stella Shin (consumer analyst, graduated from Stanford and with six years' experience at the hedge fund Valinor Management) and Meron ME Amar (investment analyst with focus on Travel&Leisure and an MBA from the Escp Business School in Paris) .

The business team also includes President Ankur Jain, who oversees all of Tabor's non-investment activities, including operations, compliance and investor relations; and Vice President Pierce de Boisblanc.

TABOR FUND NUMBERS AND PORTFOLIO

Nothing else appears on the site except the two letters sent in February and March of this year to Tod's to oppose the takeover bid. However, according to Wallmine , Tabor manages over $213 billion.

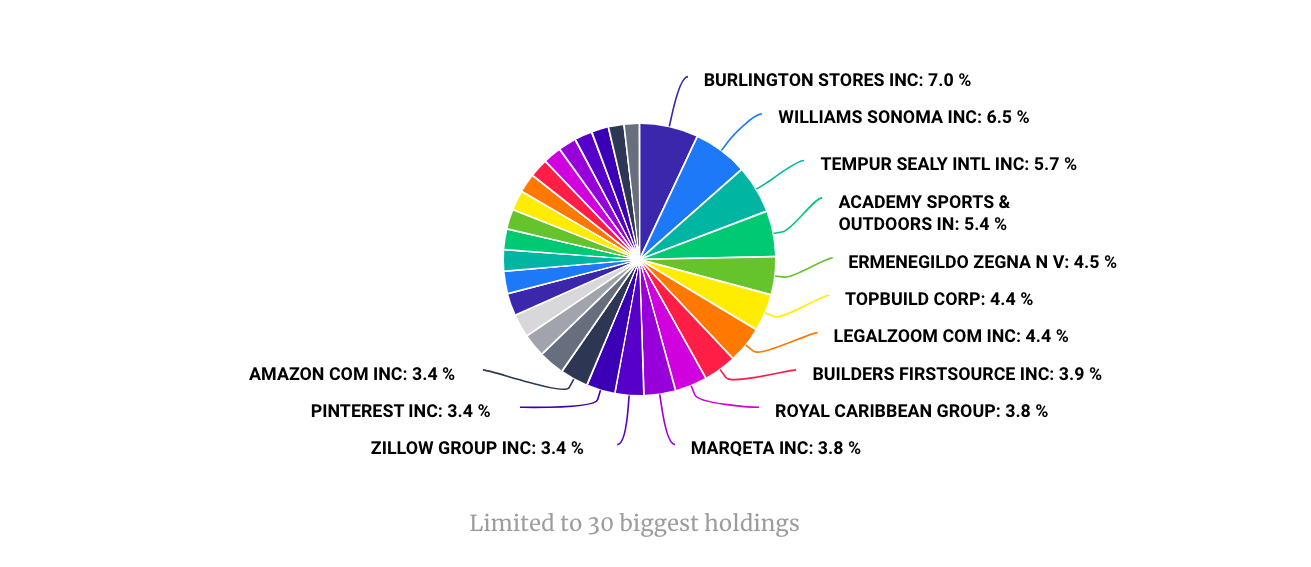

Its portfolio, which includes 40 companies, is diversified across 8 sectors with consumer discretionary being the most important as it represents 33.8% of the total value.

The fund's investments are concentrated in the United States, considering that 67.5% of the companies in the portfolio are based in the USA and among the largest are those in Burlington Stores and Williams-Sonoma, for a total value of 25.5 billion dollars.

In particular, its shares of Burlington Stores are currently worth over 13.2 billion dollars and represent 6.2% of the value of the portfolio, while those of Williams-Sonoma have a value that has grown by 70.2% in the last six months , and today equal to 12.3 billion dollars. Tempur Sealy International follows with a value of $10.8 billion and Academy Sports & Outdoors In with a value of $10.3 billion.

For Wallmine, Tabor is one of the smaller hedge funds and ranks alongside Blacksheep Fund Management and Detalus Advisors.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/tabor-tutto-sul-fondo-americano-che-fa-le-scarpe-a-tods/ on Mon, 01 Apr 2024 05:47:48 +0000.