Telcos, the big Asian companies drive the growth of the sector. Mediobanca report

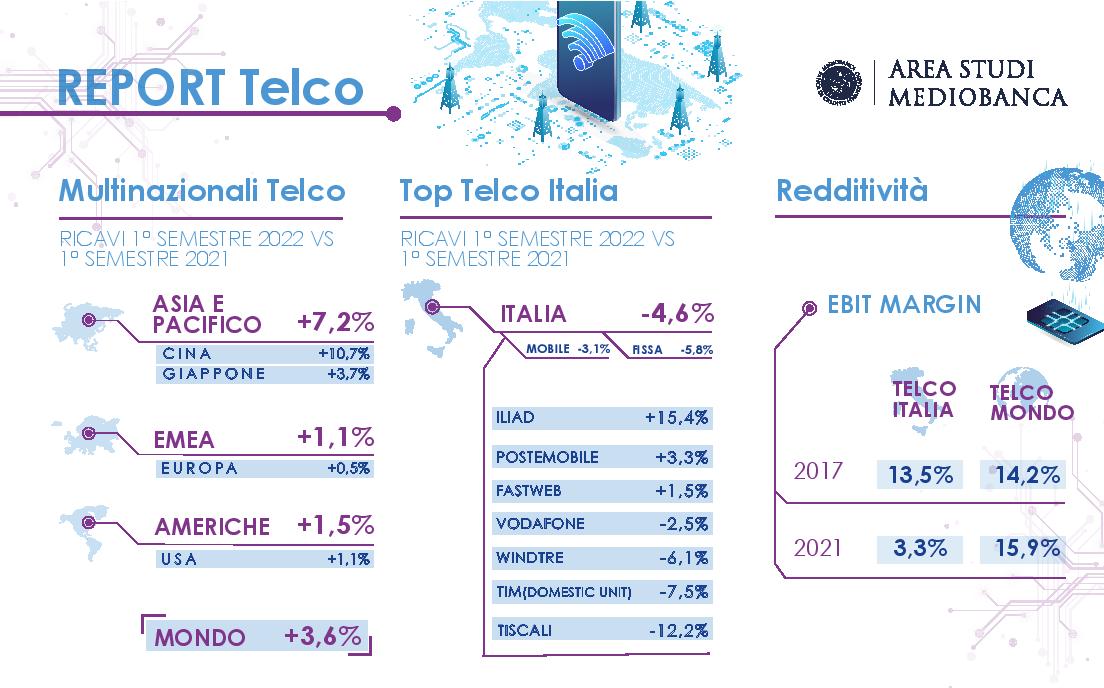

For the global telco sector, revenues grow by +3.6% in the first half of 2022. This is what emerges from the Mediobanca annual report

Chinese companies are driving the growth of the global telco sector.

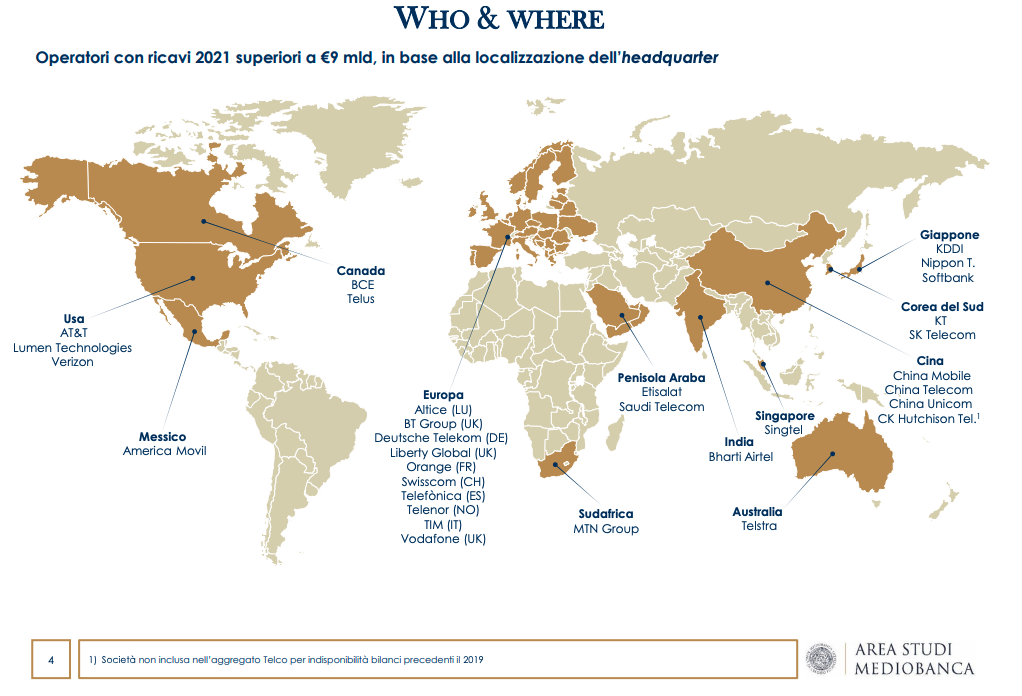

This is what emerges from the annual survey of the major world and Italian groups in the telecommunications sector carried out by the Mediobanca Studies Area, which analyzes the data of the 30 major international telcos with revenues exceeding nine billion euros, 13 of which are based in the EMEA , 11 in Asia & Pacific and the remaining 6 in the Americas. During the period, the boost to data traffic linked to the Covid-19 pandemic eased, but did not end.

The global telecommunications sector has resisted the worsening geopolitical context, recording an aggregate turnover of 3.6% annual growth in the first half of 2022. And the Chinese companies are driving the group (+10.7%) , highlights Mediobanca.

TELCO REVENUES

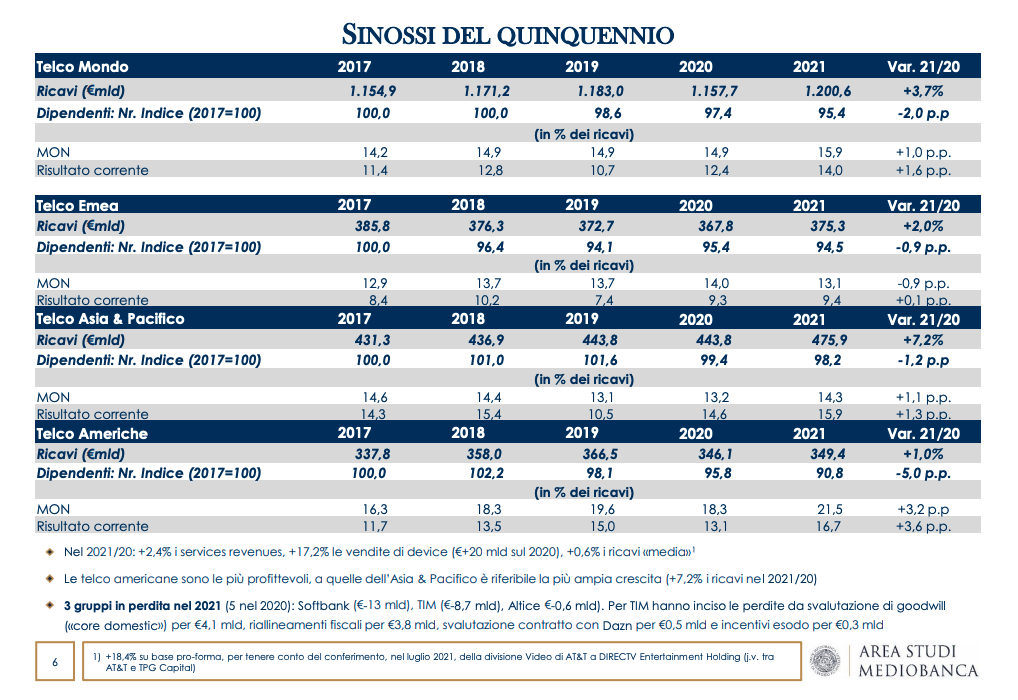

In 2021, the aggregate revenues of the 30 major world operators recorded growth of +3.7% on 2020, thanks to the rebound in device sales (+17.2%) and the Media&Entertainment divisions (+18.4%), with revenues from services grew by 2.4%. The Asian telcos appeared more effervescent, closing the 12 months of 2021 with an increase of +7.2%, while for the American groups (+1.0%) and EMEA (+2.0%) the increases are more content, observes Mediobanca.

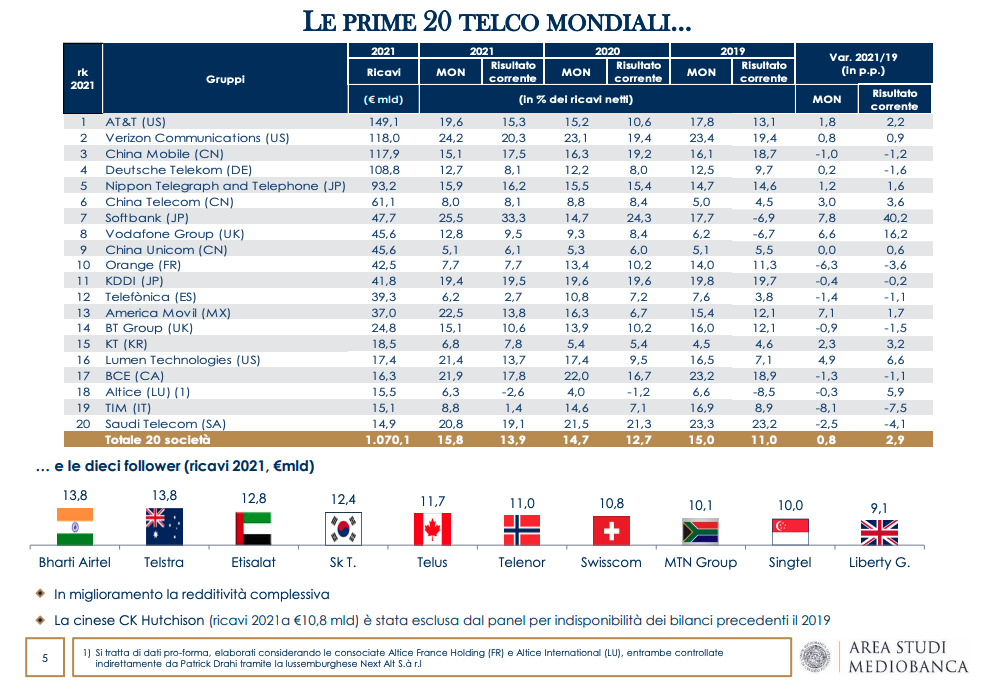

ON THE PODIUM THE AMERICAN AT&T AND VERIZON FOLLOWED BY CHINA MOBILE

In the world ranking by revenues, the first two positions are both occupied by US groups (AT&T at 149.1 billion and Verizon at 118 billion), followed by China Mobile (with 117.9 billion) which has ousted Deutsche Telekom (108, 8 billion) from the last step of the podium. The centrality of Asian players is confirmed by the presence of five of them among the top ten operators. The Italian Tim dropped to 19th position, overtaken by the Canadian BCE.

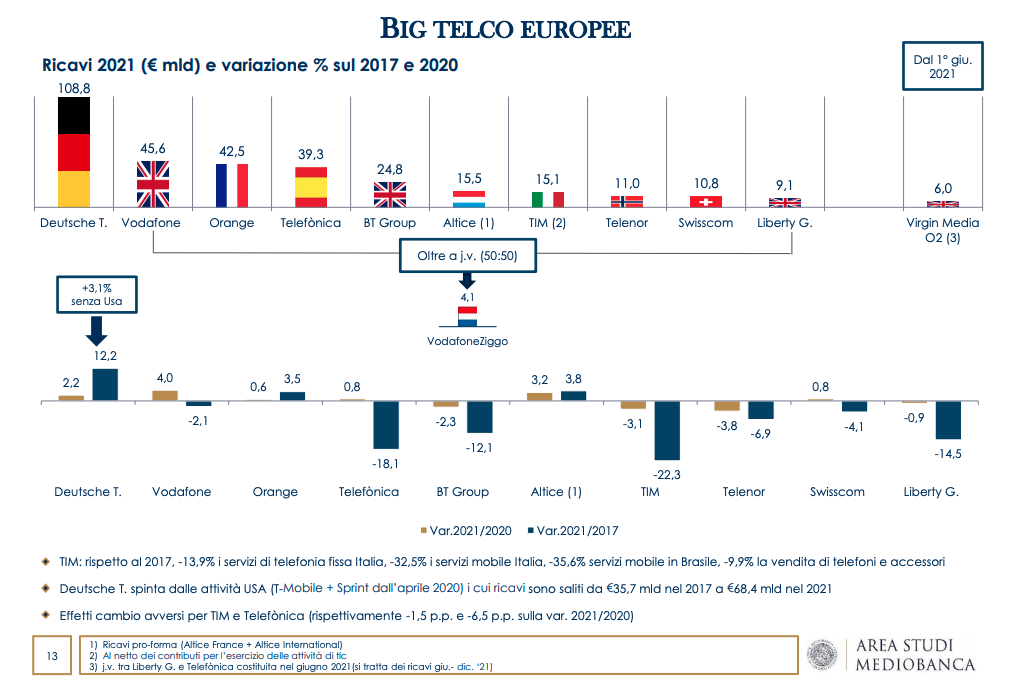

WHAT'S HAPPENING IN THE EUROPEAN MARKET

At European level, in terms of revenues, the first market is Germany with 58.1 billion (+1.6% on 2020), followed by the United Kingdom (37 billion, -4.1%), France (36.1 billion, +2.5%) and Spain (29.6 billion, +1.6%). Italy occupies fifth position with 27.8 billion, down by 2.8% on 2020 and by 13.7% in the last five years, 'the largest in Europe'.

Italy suffers the greatest reduction in the five-year period (-13.7%), with mobile telephony suffering the most (-21.3%) compared to fixed telephony (-6.1%); extending the comparison to 2010, the sector burned over €14 bn (including -2 bn in revenues from SMS, almost zero, -5.6 and -6.3 bn in voice revenues, respectively, from the fixed and mobile networks) , contracting at a weighted average rate of 3.7%, confirming the greater difficulties of the mobile sector (-5%) compared to the fixed sector (-2.5%) Again in 2021-17, TLCs in France are stable and slightly down in Spain, a market still very loyal even if the "quintuple play" packages have dropped to 5.5 million (-660 thousand units), with a high number of accesses in FTTH technology, equal to 79% of the total lines.

In 2021, high investments in France, also significant in Italy, mainly "following the infrastructure for the offer of ultrabroadband services".

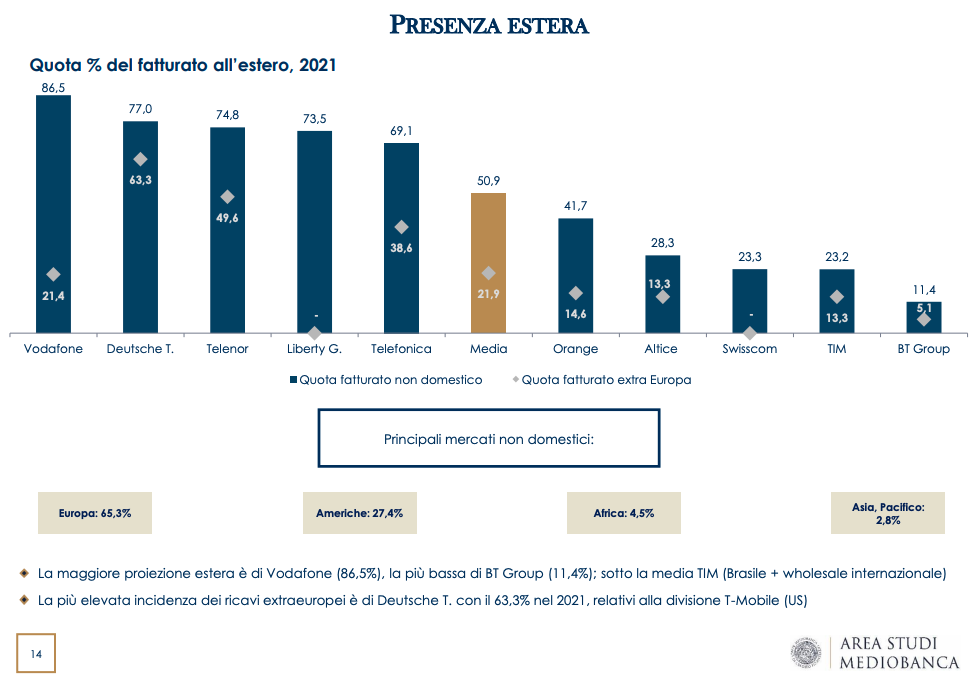

VODAFONE IN POLE FOR FOREIGN PRESENCE

As regards the foreign projection, the highest is by Vodafone (86.5%), the lowest by BT Group (11.4%); below the TIM average (Brazil + international wholesale) The highest incidence of non-European revenues is of Deutsche T. with 63.3% in 2021, relating to the T-Mobile division (US).

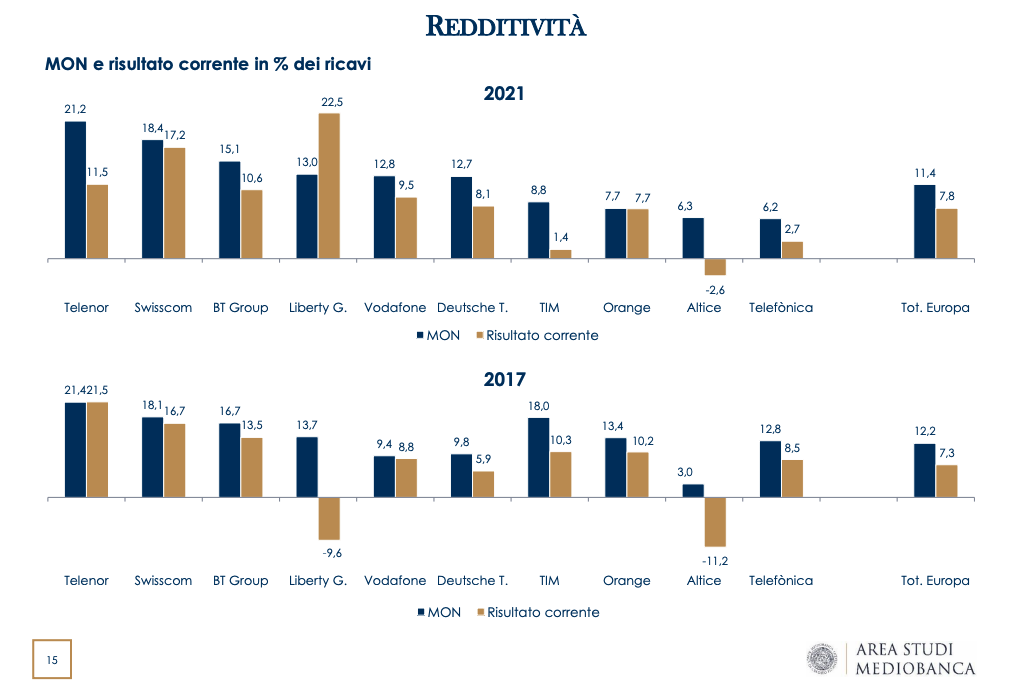

PROFITABILITY OF EUROPEAN TELCOs

Finally, Mediobanca reports that the industrial profitability of European telcos decreased slightly between 2017 and 2021 with an Ebit margin of 11.4%, down 80 basis points compared to 12.2% in 2017.

In Europe, Telenor (ebit at 21.2%), Swisscom (18.4%) and BT Group (15.1%) rise on the profitability podium in 2021.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/telco-le-big-asiatiche-guidano-la-crescita-del-settore-report-mediobanca/ on Mon, 16 Jan 2023 06:15:56 +0000.