The damage caused by the crisis and where Italy will go in 2021. Bank of Italy report

This is how the Bank of Italy greatly downsizes the government's estimates. All the most interesting aspects (and neglected by the media and political debate) in the Via Nazionale bulletin

The economic bulletin published by the Bank of Italy on Friday 15 January constitutes the first complete picture of the trend of the economy for the whole of 2020 and offers the most updated forecasts for 2021. It was unfortunately overwhelmed by the background noise of a detached political debate from reality and not at ease with the facts represented by the numbers. So let's try to offer a summary, commenting on the most significant tables and graphs.

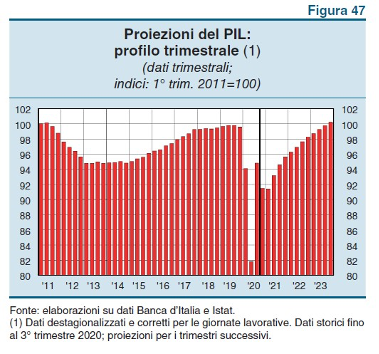

In this graph we observe the trend in quarterly GDP, set at 100 in the first quarter of 2011. We understand the depth of the decline that occurred in the first and second quarters of 2020, followed by the recovery in the third quarter and the further decline in the fourth, in which GDP quarterly is still 9% lower than the starting level. The first quarter of 2021 is expected to continue with a slight decline, to then end 2021 at an even lower level of 4%. It will be necessary to wait until the end of 2023, to return to the GDP level of 2019.

In this graph we observe the trend in quarterly GDP, set at 100 in the first quarter of 2011. We understand the depth of the decline that occurred in the first and second quarters of 2020, followed by the recovery in the third quarter and the further decline in the fourth, in which GDP quarterly is still 9% lower than the starting level. The first quarter of 2021 is expected to continue with a slight decline, to then end 2021 at an even lower level of 4%. It will be necessary to wait until the end of 2023, to return to the GDP level of 2019.

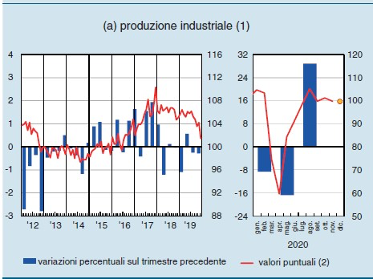

The trend of industrial production – which had already begun to slow down in the second half of 2019, in parallel with the slowdown in trade and international growth – shows a return to the levels of the pre-Covid months. This confirms that it is the service sector that is paying the price of the crisis.

The trend of industrial production – which had already begun to slow down in the second half of 2019, in parallel with the slowdown in trade and international growth – shows a return to the levels of the pre-Covid months. This confirms that it is the service sector that is paying the price of the crisis.

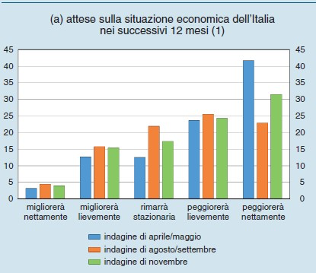

The outcome of this sample survey is very interesting:

The outcome of this sample survey is very interesting:

About 55% foresee a (slight or net) worsening of Italy's economic situation in 2021. With the aggravating circumstance that their percentage increased sharply from September to November.

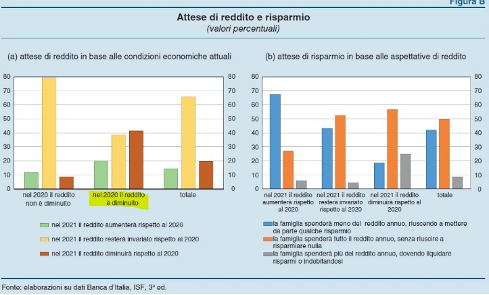

The asymmetric impact of the crisis is confirmed. There is a profoundly impacted segment of the population (the one linked to the sectors affected by the closures) and another that is holding up.

The asymmetric impact of the crisis is confirmed. There is a profoundly impacted segment of the population (the one linked to the sectors affected by the closures) and another that is holding up.

- Those who have not lost income in 2020 expect not to lose income in 2021 as well; are the protected.

- 40% of those who lost income in 2020 expect to lose more in 2021; are those exposed to closures.

Same trend in terms of savings expectations: those lucky enough to increase income in 2021 will be able to save; a sign of an economy blocked by fear. But there is also a strong tendency to save on the part of those who will keep income unchanged.

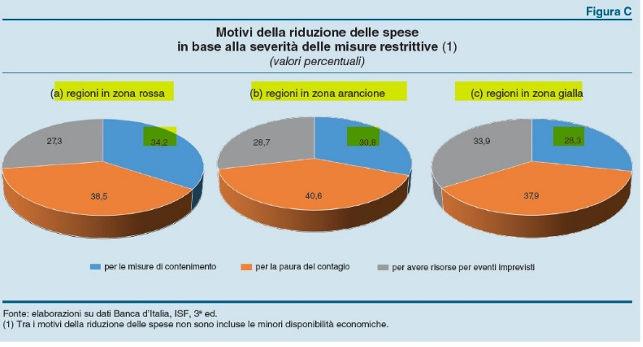

Fear of contagion stands out among the reasons for reducing expenses, with a modest difference between regions in the red, orange or yellow zone. The containment measures certainly have an impact and it is curious to note that even in the yellow area it has a significant relative weight.

Fear of contagion stands out among the reasons for reducing expenses, with a modest difference between regions in the red, orange or yellow zone. The containment measures certainly have an impact and it is curious to note that even in the yellow area it has a significant relative weight.

This offers us confirmation of the substantial ineffectiveness of the containment regime adopted. Be it yellow, orange or red, people have reduced their spending anyway.

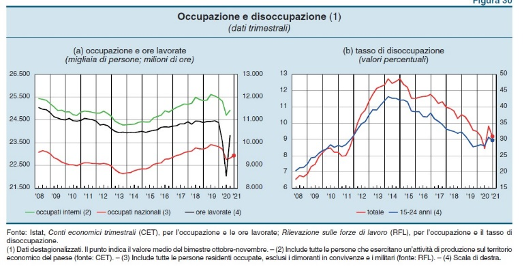

The employment picture is dramatic:

it is not so much to look at the unemployment rate – positively influenced by the number of those who are so discouraged that they no longer declare themselves looking for work – as at the number of employed persons and hours worked. The hours worked are still far below the pre-Covid level, as are the employed. On the contrary, there is a stronger recovery in the hours than in the number of employees. Sad confirmation of the fact that, with the summer recovery, companies have preferred to increase the work of those who were already in the company (perhaps part time), rather than hiring new staff.

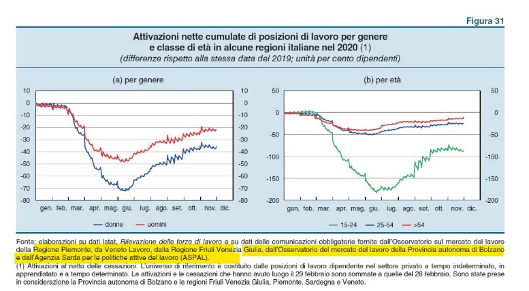

This sample analysis relating only to some regions, shows us that those who have paid the price of the crisis are young people, although there has also been a penalty for women. The 15-24 age group was literally wiped out in terms of net activations of employment relationships.

This sample analysis relating only to some regions, shows us that those who have paid the price of the crisis are young people, although there has also been a penalty for women. The 15-24 age group was literally wiped out in terms of net activations of employment relationships.

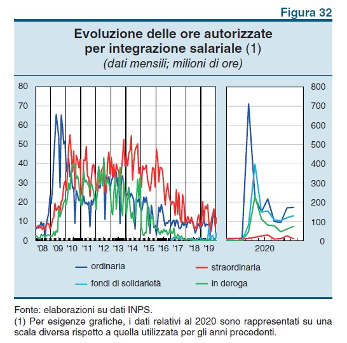

The redundancy fund data is equally impressive: before Covid, people traveled around 10/20 million hours per month. In the spring peak we reached 700 million hours, just for ordinary cash. And still at the end of the year, we travel around 200 million hours per month, a level 10 times higher than the pre-crisis level. To testify that the crisis has hit hard precisely in sectors with a very high intensity of work such as tourism, cultural and recreational services.

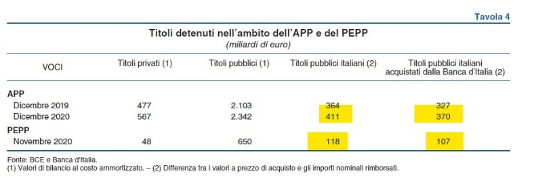

These are the numbers that illustrate the work of the ECB: the previous APP program has risen to 411 billion in purchases, in addition to 118 billion from the new PEPP program . As much as 165 billion more (of which 150 held directly by the Bank of Italy) which practically met all the Treasury's net issuance needs.

These are the numbers that illustrate the work of the ECB: the previous APP program has risen to 411 billion in purchases, in addition to 118 billion from the new PEPP program . As much as 165 billion more (of which 150 held directly by the Bank of Italy) which practically met all the Treasury's net issuance needs.

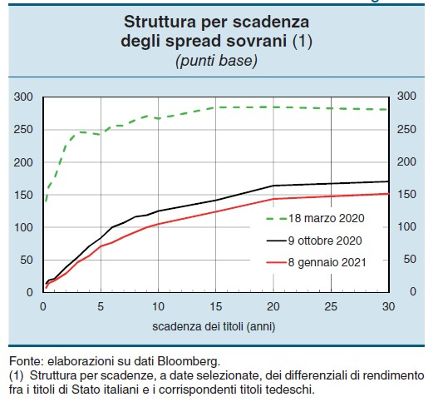

The effect on spreads is impressive: from 18 March (the day of the start of the PEPP purchase program) the spread over the ten-year period has decreased by about 150 basis points. Proof of the fact that when the ECB decides to do its job, the market celebrates and certainly does not push in the opposite direction. And also a lesson to the supporters of the ESM: a modest rate saving is irrelevant compared to a debt contracted without conditions with a market swollen with liquidity and thirsty for good returns.

The effect on spreads is impressive: from 18 March (the day of the start of the PEPP purchase program) the spread over the ten-year period has decreased by about 150 basis points. Proof of the fact that when the ECB decides to do its job, the market celebrates and certainly does not push in the opposite direction. And also a lesson to the supporters of the ESM: a modest rate saving is irrelevant compared to a debt contracted without conditions with a market swollen with liquidity and thirsty for good returns.

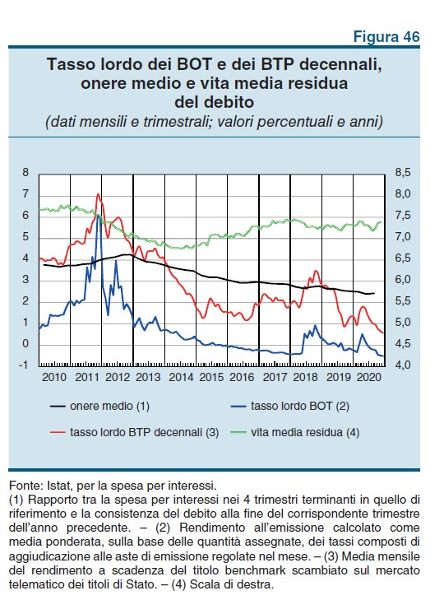

It is interesting to note the increase in the average residual life of the debt in the last months of 2020 and the continuous decline in the average cost, today very close to 2%. The 10-year BTP also broke the 1% threshold downwards.

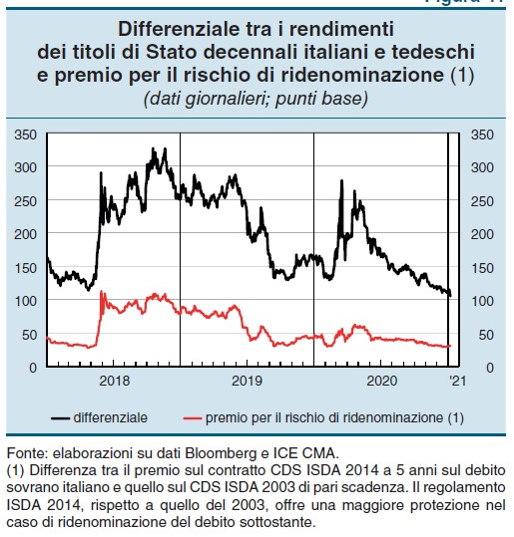

This chart makes us understand what lies behind the spread that has dropped significantly since March 2020. In fact, the difference between the CDS (contract that offers protection to the investor in the event of the issuer's default) that protects against the risk of renaming and default and what protects only from default has remained substantially stable. A sign that all the decline in the spread is reasonably attributable to the perception by the market of a lower default risk, while the risk of redenomination has remained in the background and is priced modestly.

This chart makes us understand what lies behind the spread that has dropped significantly since March 2020. In fact, the difference between the CDS (contract that offers protection to the investor in the event of the issuer's default) that protects against the risk of renaming and default and what protects only from default has remained substantially stable. A sign that all the decline in the spread is reasonably attributable to the perception by the market of a lower default risk, while the risk of redenomination has remained in the background and is priced modestly.

Once again, when there is the ECB there is everything.

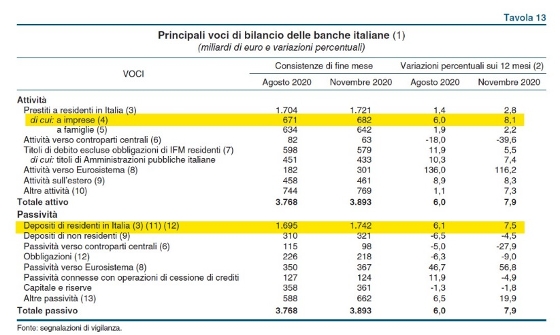

This table gives us evidence of a new but unsurprising phenomenon: households and businesses increase their bank deposits, preferring to hoard rather than spend. There is also an increase in bank loans to businesses (11 billion more, certainly not the billions of firepower announced in April 2020).

This table gives us evidence of a new but unsurprising phenomenon: households and businesses increase their bank deposits, preferring to hoard rather than spend. There is also an increase in bank loans to businesses (11 billion more, certainly not the billions of firepower announced in April 2020).

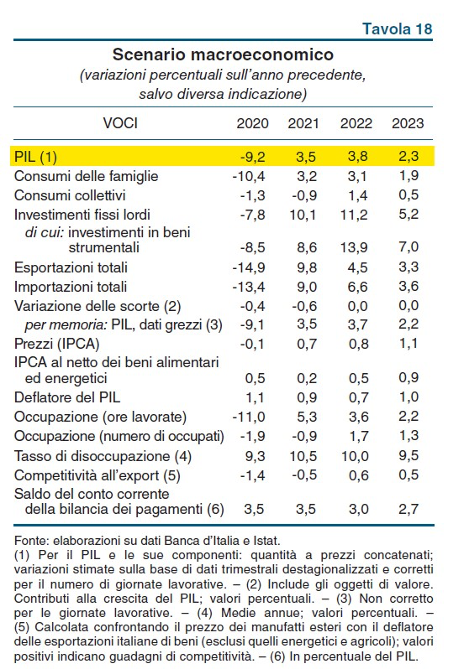

This table is the most important of the Bank of Italy document. It shows us the prospects for "growth" for the next three years: the figure of + 3.5% in 2021 stands out, against the 6% still forecast by the government which, probably, will soon have to adjust its too optimistic forecast. Investments and exports will be the main components that drive growth.

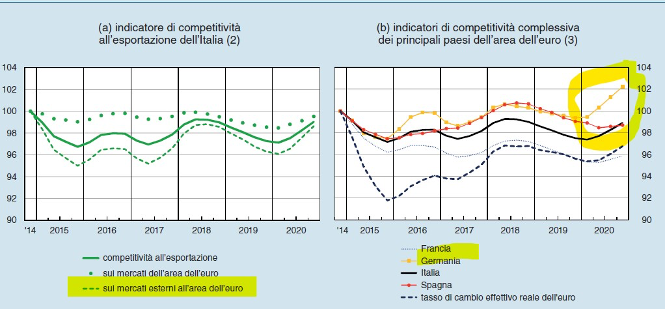

Here is what could be good news for Italy. A graph showing a deterioration in Italy's export competitiveness, mainly attributable to the revaluation of the real effective exchange rate of the euro. The relative worsening of Germany (probably due to higher domestic inflation, compared to other countries almost in deflation) should be noted. In other words, we are losing competitiveness but Germany even more. And this could give us relative help in competing on international markets.

Here is what could be good news for Italy. A graph showing a deterioration in Italy's export competitiveness, mainly attributable to the revaluation of the real effective exchange rate of the euro. The relative worsening of Germany (probably due to higher domestic inflation, compared to other countries almost in deflation) should be noted. In other words, we are losing competitiveness but Germany even more. And this could give us relative help in competing on international markets.

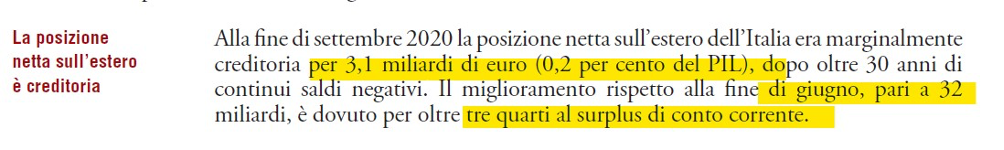

To close, a very relevant fact. The net foreign credit position, i.e. the difference between financial assets held by residents abroad and financial assets held by non-residents in Italy, finally became positive already at the end of the third quarter of 2020.

It is a fact that confirms the absence of dependence on the part of foreign lenders, who could always hastily flee, putting the country in difficulty. It is also the confirmation of the mass of financial assets set up abroad by Italians thanks to the liquidity generated with Mario Draghi's public bond purchase program (QE) and is also the result of the accumulation of an important trade surplus towards foreign countries . Phenomenon in place since 2012.

In conclusion:

- Government growth forecasts set to be scaled back;

- The ECB, with its purchases, dominates the fate of the Italian public debt;

- The blockage of economic activities for Covid has destroyed employment in services that will not be easily recovered;

- The industry holds and clings to exports.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/i-danni-della-crisi-e-dove-andra-italia-nel-2021-report-bankitalia/ on Tue, 19 Jan 2021 09:06:40 +0000.