The grain rally between climate and war in Ukraine

The analysis by Ole Hansen, Head of Commodity Strategy for BG SAXO on global food price inflation

Global food price inflation remains a key concern with supplies becoming increasingly limited. The weather conditions and war in Ukraine are the two factors that are determining the reduction of supplies for the coming winter in the Northern Hemisphere.

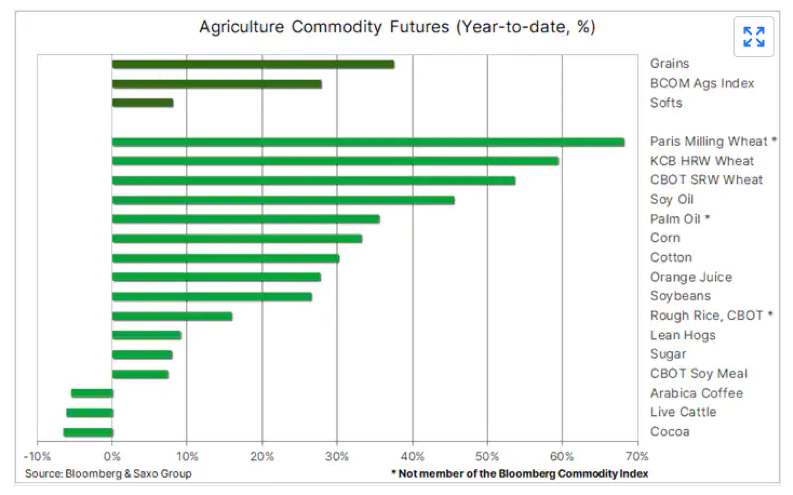

The chart below shows that wheat and edible oils are under stress and are seeing a steady rise in prices. Both were affected by Putin's war in Ukraine which had to drastically reduce Ukraine's ability to export its production through the main export hub on the Black Sea coast. The American Farm Bureau wrote in a recent update: "Ukraine has six primary products with over $ 1 billion in export sales: corn ($ 5.8 billion), sunflower seeds ($ 5.7 billion), wheat ($ 5.1 billion), rapeseed. ($ 1.7 billion), barley ($ 1.3 billion) and sunflower meal ($ 1.2 billion) ".

Due to tight market conditions and rising prices, governments are increasingly intervening to protect domestic supplies and curb food price inflation. More recently, an Indonesian export ban on palm oil, partly caused by rising sunflower oil prices, was followed by a surprise Indian brake on grain exports.

This is just weeks after analysts predicted a near-doubling of India's wheat exports from an already record high in 2021. However, a heatwave last month drastically cut recent forecasts for a bumper wheat export. . In addition, an announcement came from India itself that it plans to limit sugar exports to ten million tons for the current season. A measure seen as very precautionary given the current projections on production and on the levels of available stocks.

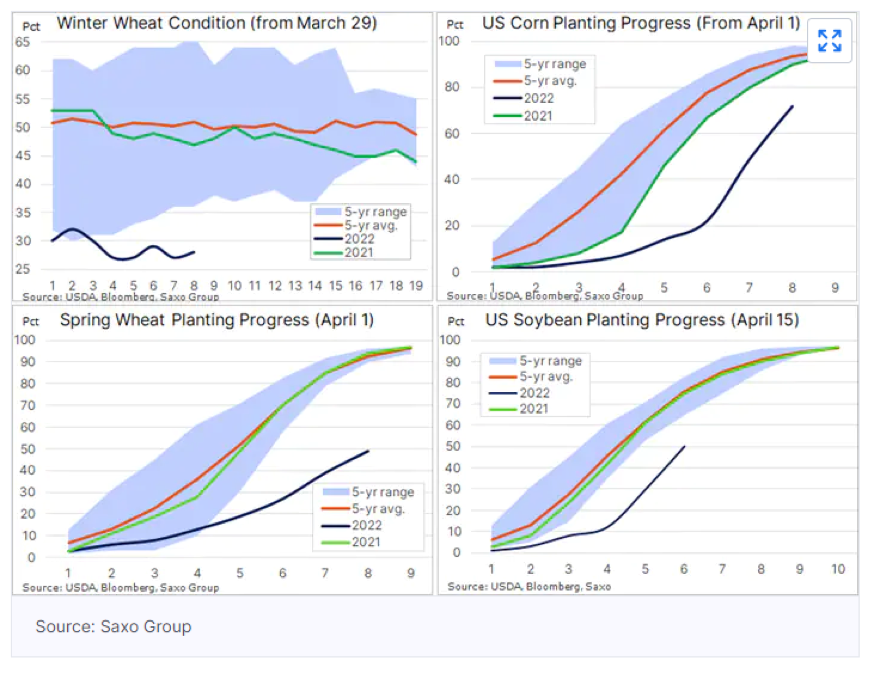

On the other side of the world, the US Department of Agriculture's weekly update on Monday highlighted the precarious state of the US grain market. While corn and soybean planting has gained momentum, the outlook for spring wheat planting is unfavorable with only 49 percent of the grain in the ground compared to 93 percent a year ago – the slowest pace in 20 years. In addition, the drought has damaged the quality of US winter wheat.

North Dakota grows half of the protein-rich spring wheat in the United States, and after the wettest second April and coldest eight in history, the fields received regular doses of water that did not allow the fields to be adequately maintained. equipped for sowing.

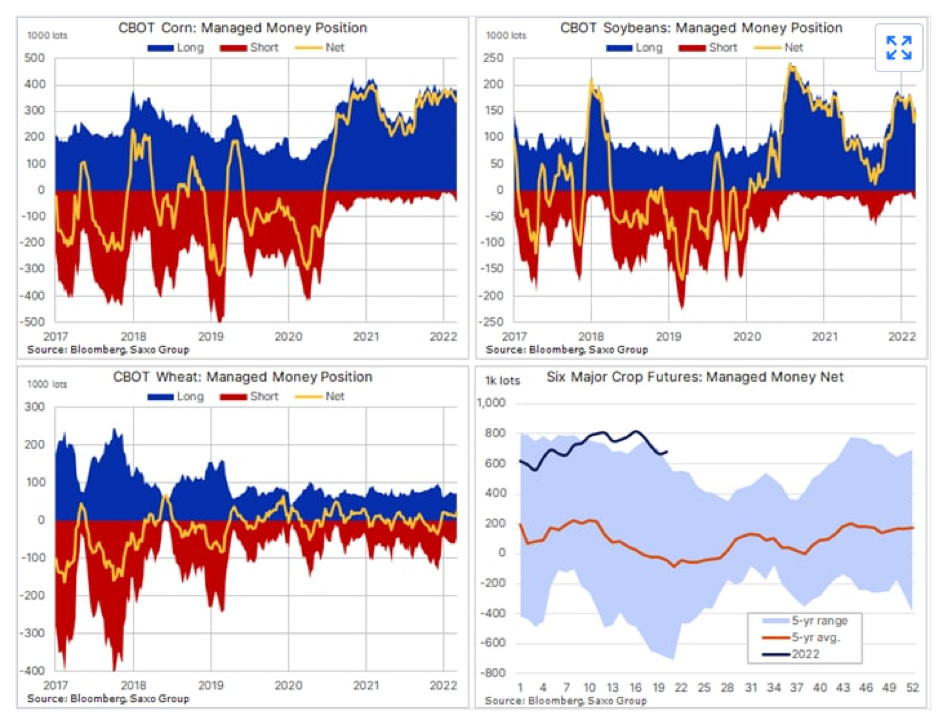

In the week through May 17, speculators or managed money accounts raised bullish bets on Chicago wheat to a 14-month high, but at “only” 26,586 lots, the impact on prices remains relatively small. Overall, however, exposure on the six major wheat futures trading in Chicago remains high at 683,000 lots, with a face value of $ 37 billion, with the majority held in corn (340,000 lots) and soy (147,000 lots). Over the past 20 years the net long has surpassed 800,000 lots on just four occasions, the last two in January last year and just five weeks ago. On the first three occasions, prices plummeted to such an extent that the net length went back to zero on two occasions while last year triggered a 60% reduction.

Whether history can repeat itself is all down to short-term weather developments, not only in the US but also in Europe, where several large French-led producers are struggling with hot, dry weather. The end of the war in Ukraine could represent a relief correction through the crop market but the damage already done to this year's crop is a certainty: the prospect of high food prices over a long period unfortunately remains a risk.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/il-rally-del-grano-tra-clima-e-guerra-in-ucraina/ on Sat, 28 May 2022 06:11:44 +0000.