The Pepp of the ECB? Good and right thing, here’s how much and why. Bank of Italy report

The in-depth analysis on the new public and private bond purchase program for the pandemic emergency (Pandemic Emergency Purchase Program, Pepp) contained in the 2020 Annual Report of the Bank of Italy

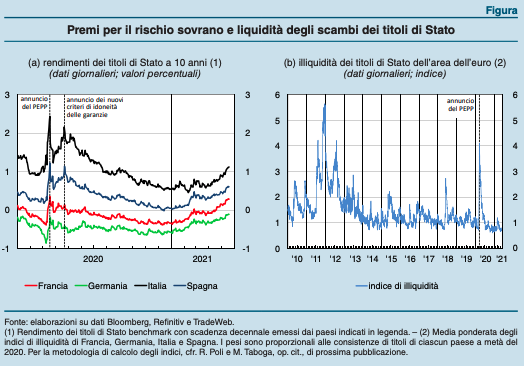

In March 2020, the spread of the Covid-19 pandemic and the associated deterioration in growth prospects triggered strong tensions on the financial markets. In the euro area, there was a sudden increase in government bond yields which also affected the most solid economies (figure, panel a); the liquidity of trading in the government bond market decreased significantly. According to an index relating to the four largest euro area countries, the deterioration in liquidity conditions was comparable to that observed in the most acute phases of the sovereign debt crisis (figure, panel b).

The tensions also affected the stock markets, with marked increases in volatility and decreases in prices, and those of private debt, where risk premiums increased significantly.

In order to counter the risks for the monetary policy transmission mechanism and prevent the health emergency from triggering a serious financial crisis, with dangerous consequences on the availability of credit to the real economy, the Governing Council of the ECB, in the context of of a broader set of measures, it strengthened its interventions in the public and private securities markets. On 12 March 2020, it strengthened the already existing Asset Purchase Program (APP) with an additional budget of 120 billion euros; on 18 March it introduced a new program for the purchase of public and private securities for the pandemic emergency (Pandemic Emergency Purchase Program, Pepp), with an initial endowment of 750 billion, increased to 1,350 on 4 June and 1,850 on 10 December. In addition to making monetary stance more accommodative, the Pepp contributes to stabilizing financial markets and reducing their fragmentation, ensuring the orderly transmission of monetary policy in all euro area countries. This function is pursued through a flexible management of purchases over time, between types of activities and between jurisdictions.

Pepp had rapid and very pronounced effects on the financial markets: in the days following its announcement, long-term government bond yields and risk premia fell significantly across the euro area, particularly in the smaller economies. affected by the turmoil, and trading liquidity has improved significantly (figure); a gradual easing of the conditions on the stock markets and private debt has also begun. The positive impact of Pepp on securities prices was reinforced by the relaxation in April of the eligibility criteria applied to collateral assets in Eurosystem refinancing operations; In particular, the decision to continue to accept bonds that, following the pandemic, had been downgraded to high yield, provided that their rating did not fall below a predetermined threshold, contributed to this in particular.

The subsequent implementation of the purchases under the Pepp consolidated the stabilization of the financial markets. An econometric analysis conducted with high-frequency data relating to the Italian market shows that purchases by the Eurosystem exert downward pressure on government bond yields on the days they are executed, leading to a squeeze of risk premiums sovereign along the yield curve and helping to improve market liquidity. These effects – in addition to those deriving from the announcements of the launch of the program and its subsequent enhancements – are more marked in phases of high tension, especially in those characterized by low levels of liquidity. This suggests that the effectiveness of purchases is enhanced by their flexible management, which allows them to increase their volume where and when market conditions require it.

In the first phase of the pandemic crisis, the Pepp played a fundamental role in addressing the accentuated tensions that emerged on the financial markets, restoring their stability and ensuring smooth financing conditions throughout the euro area. In the current context, the primary role of Pepp is to ensure that these conditions remain favorable, in order to counter the negative effects of the pandemic on economic activity and inflation. In this way, the program reduces uncertainty and increases the confidence of economic operators, thus supporting the recovery and the achievement of the price stability objective.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/pepp-bce-bankitalia/ on Mon, 31 May 2021 12:52:50 +0000.