The Retirement Manifesto

Second part of the speech by Michele Poerio, National President of FEDER.SPeV. and general secretary of CONFEDIR, Pietro Gonella, coordinator of the Centro Studi, Stefano Biasioli, secretary of APS-Leonida and organizational secretary of FEDER.SPe V.

CONFEDIR, FEDER.SPeV. and APS-Leonida as representative Associations:

- of the former ruling class of the country (Senior Officers of the Armed Forces; Army Generals/Navy Admirals/Air Force Generals, Generals of the Carabinieri and the Guardia di Finanza; Magistrates; Prefects, Quaestors; Ambassadors, Consuls; General Managers, Health and Administrative staff of ASL; Medical/Primary Directors; University professors; Public and private managers, etc.),

- former other managers (managers: doctors, pharmacists, veterinarians, chemists, physicists, biologists, psychologists of the NHS; technical, professional, administrative managers of the NHS, the State, the Regions, the Local Authorities, the economic and non-economic parastatal Entities; executives of private companies, etc.) and related officers/managers,

group of workers who, in a state of retirement, are recipients of pensions exceeding 10 times the TM, present – with reference to them – the elements/evidence shown below:

to). They are former workers/citizens, both public and private employees/professionals, recipients of annual pensions exceeding 10 times the minimum, adequate/commensurate treatment with the contribution payments made in service activities, former workers who – particularly in recent years – have been the subject of a press campaign characterized by preconceived opposing positions regardless of their legal correctness.

b). They are former workers/citizens who in the forty years of working activity have paid social security contributions for a substantial amount, even though the amount of the pension treatment has been determined/paid with the salary system in application of the provisions of article 1, paragraph 13, of the law 335/1995, in force on the date of termination of the service.

c). They are former workers/citizens to whom, in addition to the substantial "quantum" of contributions accumulated in the course of working activity, the equally substantial "quantum" of IRPEF paid for a total amount must be ascribed/added – with reference to the average duration of the working period equal to 37 years – not less than an average of 800,000 euros, thus contributing to guaranteeing the continuous and regular provision of public services essential for the well-being and progress of the national community (education, health, etc.).

d). They are a category of pensioners/taxpayers over 55,000 euros/year – 337,000 subjects, no more than 2.10% of pensioners/taxpayers – who pay over 18.00% of the entire IRPEF, a total of over 9 billion euros a year, with an individual annual average of over 27,000 euros! Explanatory comparisons:

Pensioners over 100,000 euros – n. Approximately 33,000 units (0.20%) – pay 3.50%, individual annual average of 50,000 euros.

Pensioners up to 15,000 euros – n. Approximately 6,150,000 units (38.20%) – pay 7.50%, individual annual average of 700 euros.

Pensioners from 15 to 35,000 euros – n. Approximately 6,150,000 (38.20%) – pay 54.50%, individual annual average of 5,200 euros.

Pensioners from 35 to 100,000 euros – n. approximately 1,150,000 (7.20%) – pay 34.50%, individual annual average of 17,400 euros.

Pensioners from 0 to 7,500 euros – n. Approximately 2,600,000 (16.20%) – pay ZERO!

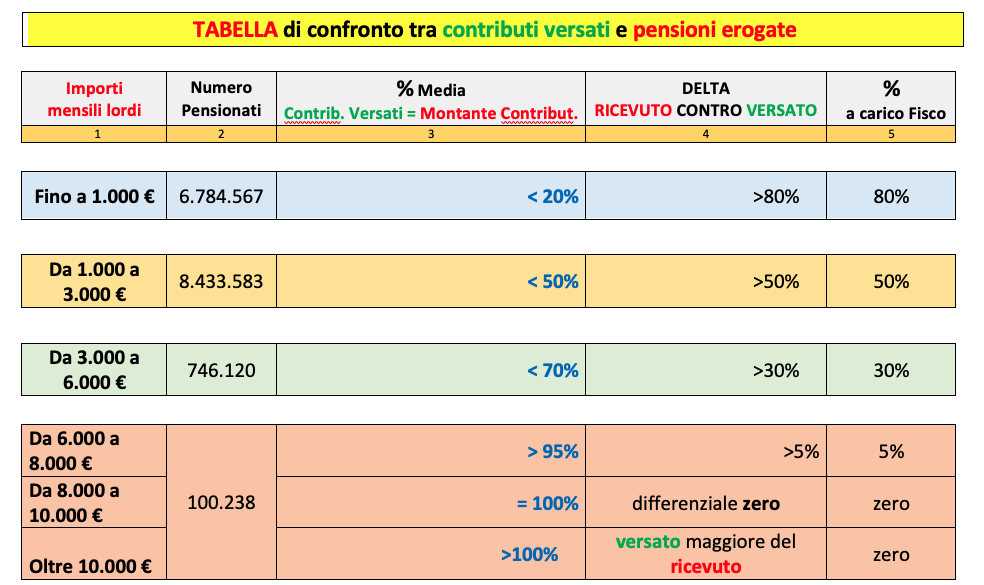

and). They are a category of retirees/taxpayers which – it must be strongly reiterated – is the one which on the one hand continues to discount the progressive nature of taxation by paying the maximum marginal rate of IRPEF = 43%, for a further tax revenue equal on average ( with reference to an average duration of the pension period of 20 years) to no less than 500,000 euros, on the other hand it records the highest rates of coverage of the contributions paid as can be seen from the attached table.

f). They are a category of pensioners/taxpayers who suffer from a triple progressiveness in force in Italy (a truth that is little known and also considered by the Government and Parliament, a truth which, perhaps – indeed certainly – inconvenient, is so immanent and pervasive in the social context that affects medium-high and large incomes and therefore also pensions):

- the first progressiveness concerns the fact that the more a subject earns, the more he pays;

- the second progressiveness (equally legitimate) is given by the increase in the tax rate, with the marginal rate attesting to 43%;

- the third progressiveness is a "hidden progressiveness", because it exists but is never highlighted by the proponents of tax reduction, and above all dangerous, because the more taxes you pay, the less services you receive, since as income increases, in fact, they decrease, up to disappear, the deductions, in fact going to encourage citizens to declare what is really needed in order to thus be able to benefit from social benefits and other concessions from both the State and the Regions and Municipalities.

g). With regard to the aforementioned "hidden progressiveness" it should be noted that with an annual gross income exceeding 55,000 euros (50,000 from 1 January 2022) one is not entitled to the benefit of the tax deduction for tax purposes for the production of income, provided for by the 'art. 13, paragraph 3 bis, of Presidential Decree 917 of 1986. This omitted deduction is commensurable with an increase of at least 5 points in the tax rate of 41% or 43%. Basically, the rates of 41% and 43% are virtual rates, because a total of 10% must be added to them for the above deduction (income-producing expenses), and regional and local taxes must also be added requiring an additional IRPEF payment.

h). The yellow-green and yellow-red Governments, in continuation of what the Letta Government did, continued to attack only one category of pensions, the so-called "gold" ones, forgetting – deliberately in order not to record losses/drainage of popular consensus – that the so-called "diamond pensions" are also available in the social security sector, benefits that have a differential received/collected against paid in excess of 50% (early retirements due to company crises or for other social reasons, exodus, former railway workers, former postal workers, pensions baby, etc.).

Second and last part. ( Here to read the first part ).

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/manifesto-dei-percettori-delle-pensioni-di-importo-medio-alto-e-di-importo-elevato/ on Sun, 18 Dec 2022 06:52:17 +0000.