The three lessons of the Credit Suisse disaster (semi-nationalised)

Credit Suisse: the rescue of Ubs with guarantees and liquidity from the Swiss central bank, the crux of subordinated bonds penalized with respect to shareholders, the reaction of the markets. The comment by Giuseppe Sersale, strategist of Anthilia Capital Partners Sgr

Weekend decidedly full of surprises, the past one. We entered with the idea that the authorities should have taken care of the "Credit Suisse affair" and the forecast proved to be correct, but the modalities reserved robust twists.

In the end, securing the Swiss bank can be considered a sort of half-nationalization , in disguise. The institute is taken over by UBS for around CHF 3 bln in shares, but this happens with a lot of State assistance, which takes the form of 9 bln of guarantees, against losses, 100 bln of emergency liquidity line, and the addition of the cancellation of 16.7 bln of subordinated debt, the famous Additional Tier1, which are zeroed.

The most surprising and disconcerting aspect is that for the first time the bond/equity hierarchy is being subverted, in the sense that the former are zeroed while the latter is given a value, albeit with a marked depreciation compared to the levels prevailing on Friday. The fact is that Swiss law and the prospectuses of these capital instruments provide for it, and leave a very broad discretion to the regulators, who have used it all right. It's hard to say what prompted them: perhaps the need to justify the use of public money for a deal that places the bank in private hands. Does the involvement therefore respond to the need for "burden sharing", while has giving some money to the shareholders had the function of softening resistance? I would not know.

THE THREE CONSEQUENCES OF THE CREDIT SUISSE DEAL

That said, I personally believe that the practical consequences of this affair can be grouped under three distinct aspects:

- By now the market has been able to realize the speed with which, in 2023, banking crises develop. All it takes is an event capable of eroding confidence, and the situation evolves towards collapse at the speed of light. Of course, Credit Suisse had been in dire straits for some time, an almost unique case on the European scene. But it had recently recapitalised, it enjoyed robust ratios, ratios that were worthless once the confidence faded. It seems reasonable to expect that the market will take any upcoming crash that a financial institution experiences very seriously. The rapid development of the crisis is a problem.

- The zeroing of the AT1. First of all, this is an important event because it affects a high percentage of the total, more than 6/7% according to some estimates. Today the European and UK regulators have hastened to underline that this cannot happen in Europe ( link ), because it is not envisaged by the Bank Resolution & Recovery Directive, which provides for at most temporary write downs or conversion into equity, but only after that this has been reset and after an evaluation process.

Everything ok then? In short.

Meanwhile, the market has experienced first-hand how easy it is to modify the laws to obtain the desired effects (see also the non-submission of the deal to the UBS shareholders' meeting). But more importantly, even treatment under European or UK law would not have been so benign to AT1s. The authorities could have chosen whether to convert the equity into super-depreciated values, or to zero the equity and with it the At1s. It is a fact that these instruments remain vulnerable to very strong depreciation if the capital falls below regulatory levels, and in recent days we have had more than one demonstration of how this can happen. It seems sensible to imagine that investors' attitude towards this instrument will become more cautious: it is difficult for institutions of low standing to issue at convenient levels. In other words, the market for junior subordinated debt (ie the highest subordination level) has suffered damage that will be difficult to undo. And many institutional investors will have been badly burned. - the macroeconomic impact of the affair. It seems clear that the cost of capital for banks and the cost of funding will suffer from these events. Let's also consider the situation in the US where stress is spreading to other institutions, and the rules of engagement are being kept opaque (see Yellen who stated on Friday that deposits will only be guaranteed if there is systemic risk, implying that depositors of banquets have to make do). What will the institutes do? They will tighten credit conditions and become more risk adverse. The result is an increase in the tightening of financial conditions, which adds to that carried out by central banks.

Incredible to think that just last week the ECB lifted by 50 bps. I observe that after seeing rates rise by 450 bps in 1 year in the USA and 350 in 8 months in the EU, there was really no need for further tightening. Even central banks themselves seem to be aware of this. It is no coincidence that they have restored the swap lines to facilitate funding in Dollars, in case this becomes scarce/difficult. A move that is very “2008”.

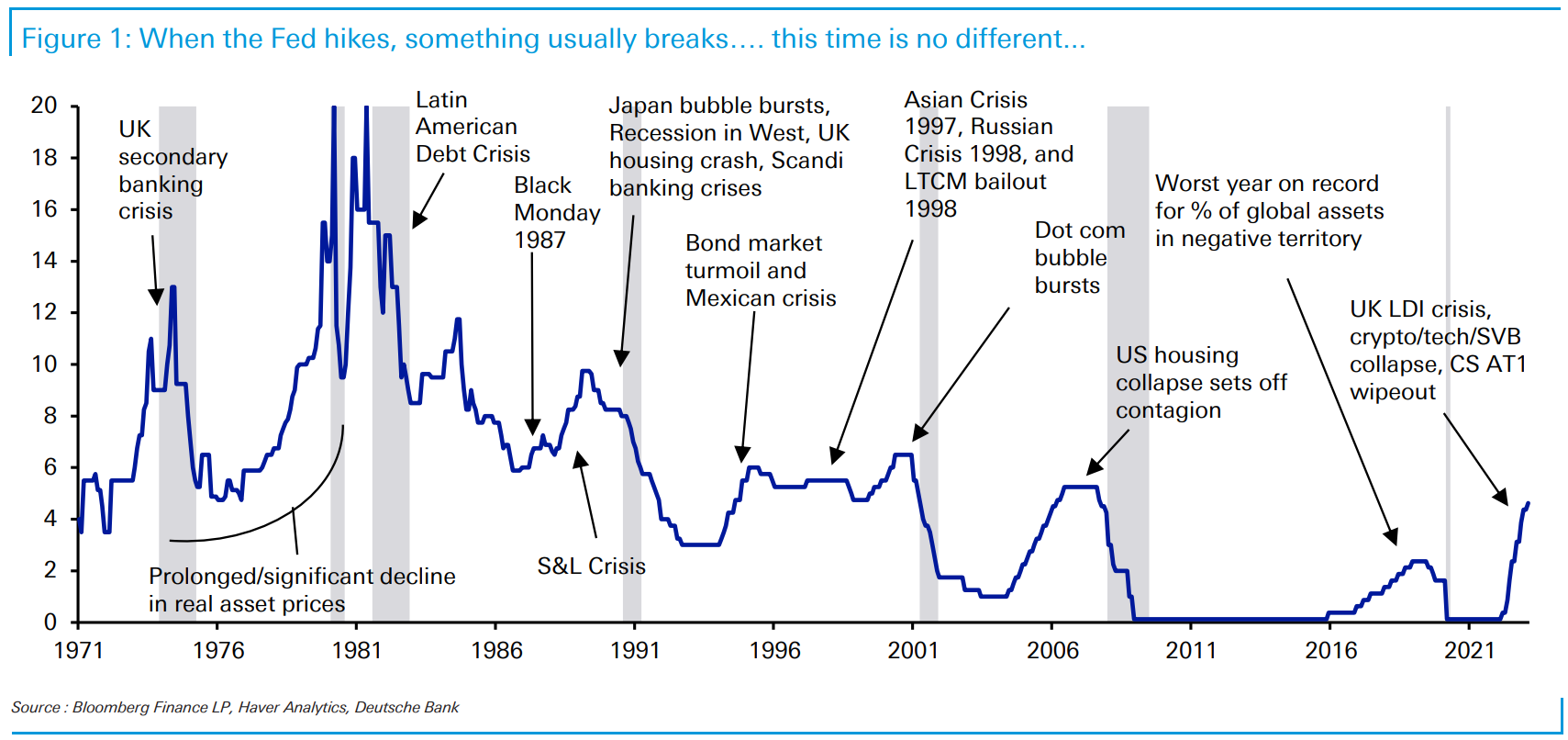

Is there any positive aspect to highlight from this story? For example, the speed with which the authorities are extinguishing, sometimes in questionable ways, but always decisively and determinedly, the hotbeds of systemic crisis that have emerged. In this the situation is different from 2008, when many support schemes did not exist and the authorities were operating in a much stricter legal context. In this sense, the Great Financial Crisis did not go in vain. And then, do you ever see that this abrupt wake-up call brings monetary policies back to milder advice. Deutsche bank in its chart of the day showed how all the Fed tightenings evolved sooner or later in some accident.

This cycle is the most violent since the early 1980s (without considering the reduction of the balance sheet) and has occurred with the most modest growth, and the greatest inversion of the curve.

The Asian session had a rough ride, with all major indices down moderately. On the other hand, he also had to factor in Friday's negative session (Eurostoxx 50 -1.26%, S&P 500 -1.1% Nasdaq 100 -0.49%) and then the heavy climate of this morning's European opening.

Yes, because since the first exchanges the equity indices have plunged, with the banks leading the decline (UBS – at 9.30 it lost 16%) the devastated bank subordinates, rates further down compared to Friday etc etc.

Risk aversion culminated in the first hour, and then a recovery began, at first volatile, and then gradually more regular. The aforementioned utterances of the European authorities also contributed to the improvement in sentiment, the perception that the deal offered to UBS, to become the Swiss champion with a guarantee, state guarantee on losses and abundant liquidity, was not really to tear one's hair out. Losses on subordinated bonds also visibly reduced, with the dedicated ETF starting at -11/12%, then closing at -5%.

THE WORDS OF LAGARDE

In the afternoon there was also Lagarde's hearing in the European Parliament, in which the ECB president tried to use reassuring tones.

*LAGARDE: INFLATION IS PROJECTED TO REMAIN TOO HIGH FOR TOO LONG

*LAGARDE: KEY ECB INTEREST RATES REMAIN OUR PRIMARY TOOL

*LAGARDE: FUTURE ECB MOVES TO DEPEND ON DATA

*LAGARDE: MARKET TENSIONS ADD UNCERTAINTY TO FORECASTS

*LAGARDE: WELCOME SWIFT ACTION TAKEN BY SWISS AUTHORITIES

*LAGARDE: READY TO ACT AS NEEDED ON PRICE, FINANCIAL STABILITY

*LAGARDE: EURO-AREA BANKING SECTOR IS RESILIENT

*LAGARDE: ECB TOOLKIT EQUIPPED TO OFFER LIQUIDITY IF NEEDED

*LAGARDE: NO TRADEOFF BETWEEN PRICE, FINANCIAL STABILITY

*LAGARDE: VERY CONFIDENT IN BANKS' LIQUIDITY, CAPITAL LEVELS

*LAGARDE: ECB HAS MORE GROUND TO COVER BASED ON CURRENT BASELINE

*LAGARDE: VERY CONFIDENT EURO-AREA BANKING SECTOR IS SOLID

*LAGARDE: ALREADY SEEING POLICY HAVING IMPACT ON FIN CONDITIONS

*LAGARDE: ECB CURRENTLY PROVIDING SUFFICIENT FINANCING TO BANKS

*LAGARDE: BANKS HAVE BENEFITED FROM INTEREST-RATE NORMALIZATION

*LAGARDE: EURO-AREA BANKS' EXPOSURE TO CREDIT SUISSE IS LIMITED

*LAGARDE: PECKING ORDER FOR ANY WRITE-DOWNS IN EUROPE VERY CLEAR

The European close sees the main indices show a good rebound, albeit at a moderate distance from the maximum levels marked in the afternoon. Banks have recovered well even if there is some internal dispersion. UBS closed at +1% with a daily range of 27% (at times it was +7%) The recovery of sentiment also drove the €, while core yields gave up the declines of the morning. The BTP, on the other hand, kept part of the gains. Commodities have also reversed course, except for gas which remains heavy. One hour after the closing, Wall Street also retains gains, even if this does not prevent First Republic bank from losing 40%, with JP Morgan trying to orchestrate the rescue by assuming to transform the 30 bln contributed by the consortium into capital banks by way of deposits (link)

The personal idea is that one of the main drivers of the rebound is the short-term oversold. It is no coincidence that the Nasdaq 100, which had been the best index, is now sluggish. I believe we will have more volatility, also because in the US the situation is far from clear for regional banks.

- The week is full of important appointments:

Tomorrow we have the existing home sales of February in the US, in Europe we have the Zew of March, and the speeches by Lagarde again and Villeroy. - On Wednesday we have the FOMC dominating the session, and then again Lagarde, Lane, Rehn, Wunchm Nagel and Panetta.

- Thursday we have the Chicago Fed and the Kansas City Fed manufacturing in March, February new home sales in the US, unemployment benefits, and then the bank of England meeting,

- We close Friday with flash manufacturing PMIs from Australia, Japan, EU, France, Germany, UK and US. However, I believe that to understand the effects of the latest news it will be necessary to wait for the revisions at the end of the month.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/crisi-credit-suisse-tre-lezioni/ on Tue, 21 Mar 2023 06:45:11 +0000.