The war between Russia and Ukraine breaks down the entire automotive sector

What is happening in the automotive sector for the Russia-Ukraine war

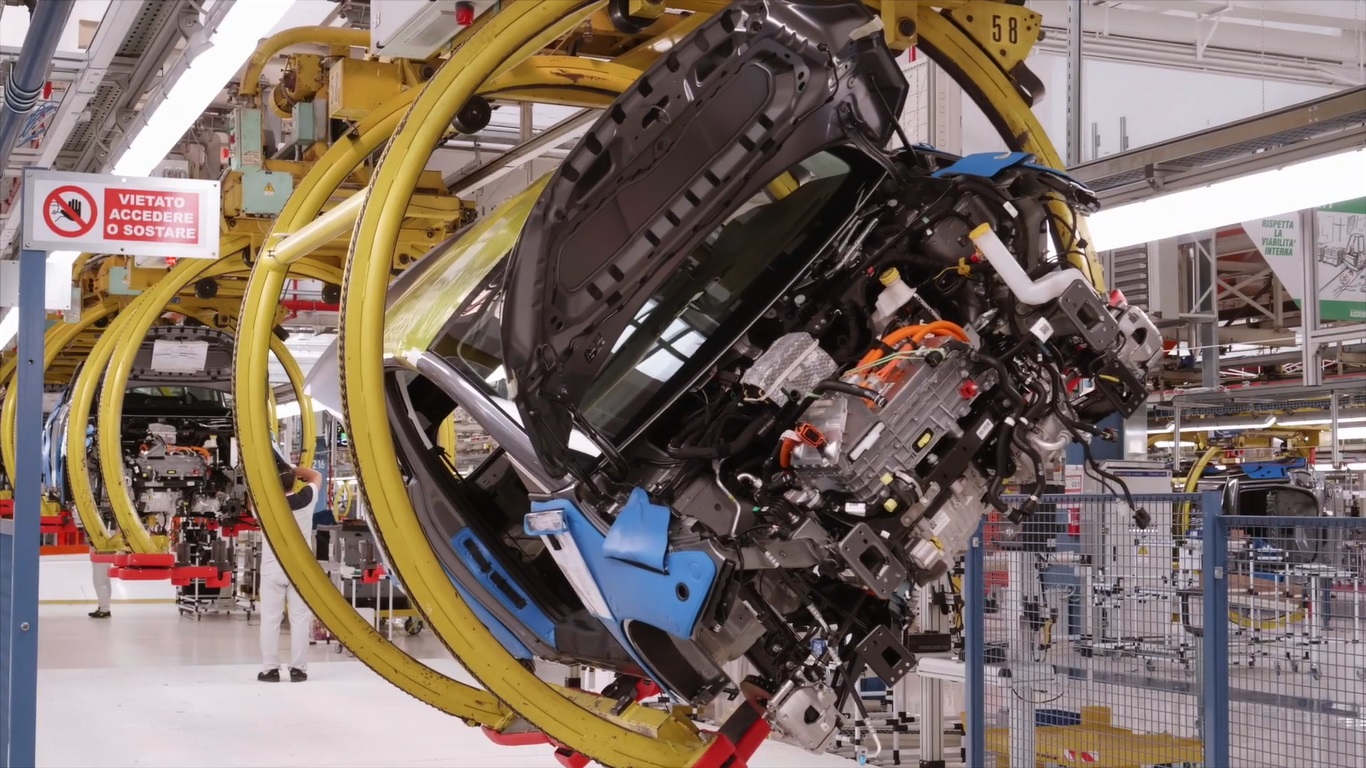

The term "perfect storm" is certainly overused, especially in the journalistic field. Never as in this case, however, is it fitting to indicate yet another blow to an entire sector, that of the car, which more than many others in the last 24 months has served lockdowns, production stops for Covid, the shortage of raw materials and semiconductors , the need to quickly reconvert the factories for the rules on sustainable mobility and, now, also a conflict of proportions and consequences that are still difficult to understand. It is now well established that the war between Russia and Ukraine affects everyone and any economic sector, but it will be precisely the automotive sector, according to initial estimates, that will suffer the worst repercussions.

THE COLLAPSE OF THE MARKET IN NUMBERS

To give an example, S&P Global Mobility has just changed, in peius , the estimates on global car production for 2022 and 2023: this year, 81.6 million vehicles are expected and the next 88.5 million, with a decrease, in both cases, of 2.6 million compared to previous estimates. The funnel for the automotive sector is obviously the war between Russia and Ukraine. In Europe alone, the decline will be 1.7 million units in 2022, limited to the loss of demand, due to embargoes, sanctions or economies to be rebuilt, in Russia and Ukraine. The US will better weather the storm, with a decline of 480,000 vehicles produced for 2022 and 549,000 for 2023. At the worst part, however, S&P Global Mobility comes to hypothesize cuts of up to 4 million units for both years due to the absence of materials from Ukraine and any deterioration on the chip front, without considering any tail blows of Covid-19.

ALSO JAPAN WILL BE EXHIBITED

According to data from the Japanese Ministry of Finance, the automotive market and its related industries accounted for more than half of all Japanese exports to Russia in 2020. Mazda, which sold around 30,000 vehicles in Russia in 2021, announced the will to stop supplying spare parts to a local Vladivostok company, while Toyota, Mitsubishi, Nissan and Subaru have already closed factories and stores on Russian soil. Honda decided to stop sending their cars to Russia.

HOW MUCH THE WAR BETWEEN RUSSIA AND UKRAINE HAPPENS IN THE AUTOMOTIVE

Leaving the cold numbers to come to concrete examples, S&P Global Mobility reiterates the fears for the shortage of neon gas, speaks, on the wiring side, of the difficulty of being able to find alternatives in the supply of components to Ukrainian suppliers (Alix Partners estimated for Il Sole 24 Ore that in 2019 the European car industry imported insulating cables and other electrical conductors from Ukraine for about 1 billion dollars, mainly in Germany, Poland and Romania) and addresses the issue of Russian palladium (40% of the market comes from Moscow), also used in semiconductor processing but, above all, in catalytic converters for the treatment of exhaust gases. In short, the 'green' mufflers.

THE UKRAINE MINE COMES LESS

And then there are all the metals mined in Ukraine, a country with which we Europeans had a very strong exchange. In 9th place for steel production, among the top ten for production and export of precious metals, Ukraine boasts the only European deposit of mineral sands, zircon deposits (sixth world producer), huge resources of uranium, kaolin , plastic clays and refractory clays which constituted 70% of the reserves of the former Soviet Union.

WILL THE EU BLOCK THE EXPORT OF LUXURY BERLIN?

As if all this were not enough, under the scrutiny of the European Commission, in the fourth round of sanctions, there would be the blocking of the export of cars above 50 thousand euros. If confirmed, the measure shouldn't hurt the Old Continent brands too much as that market accounts for only 2% of global sales of major European luxury model brands. Ferrari, for example, has confirmed that in Russia it sells just 60 and 70 cars a year and, since the waiting list for the Italian supercar is long, it can easily distract the cars destined for Moscow to other markets.

THE UNKNOWN RENAULT

We said that the automotive of the Old Continent will suffer more than the stars and stripes war of Russia in Ukraine. To all this is added the unknown Renault, the most exposed group, given that in 2007, under the leadership of the 'rumored' CEO Carlos Ghosn , it acquired 25% of Avtovaz, builder of Lada, and then became the owner, with a share of approximately 67%, in 2012, while the minority shareholder is Rostec, a Russian company specializing in business development. On March 3, the French company stopped production due to a shortage of electronic components, while the Moscow factory was closed in compliance with the sanctions since Monday, February 28. For the House of Losanga, Russia is the second market after France, with 38% of the market share, 22.4% of Avtovaz with 350 thousand cars registered last year.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/smartcity/la-guerra-tra-russia-e-ucraina-manda-in-panne-lintero-automotive/ on Sun, 20 Mar 2022 06:54:17 +0000.