This is how Germany pampers Lufthansa

Who won and who lost in liberalized air transport. The Lufthansa case according to the economist Ugo Arrigo. The analysis on Lavoce.info

The European liberalization of air transport, completed in the second half of the 1990s, has produced very different results in national markets. In the Italian case , they were at the same time the best from the point of view of travelers and market growth and the worst for the national airline, no longer able to achieve budgetary profits and obliged to ask the taxpayer, an involuntary shareholder, periodicals contributions.

The differentiated outcomes of liberalization have two causes. On the one hand, opening up a market to competition does not automatically eliminate or reduce the advantageous position of those who were already on the competition ground. With appropriate strategies, a dominant operator can defend its position and even strengthen itself. This is particularly the case with Lufthansa on the German market.

On the other hand, in the specific case of air transport, a pre-existing unitary and homogeneous market has not been liberalized, but a set of differentiated national markets. As a result, new players were able to enter and grow in the segments in which there was more space, those less and worse protected by weak and unwary incumbents.

In air transport, there are many markets: not only are they national, but within them they also differ in terms of destination (long-haul intercontinental, medium-haul European, short-haul national) and origin (from large hubs or secondary airports). The second is the most important aspect: the activities of the pre-existing dominant national operators were concentrated – and still are – in a few hubs in which the residual space, available for new entrants, was usually limited to slots at times of lesser interest. . The incumbents who managed not to leave free spaces in their hubs proved to be unassailable by new entrants and therefore have not weakened over time, indeed in some cases they have strengthened.

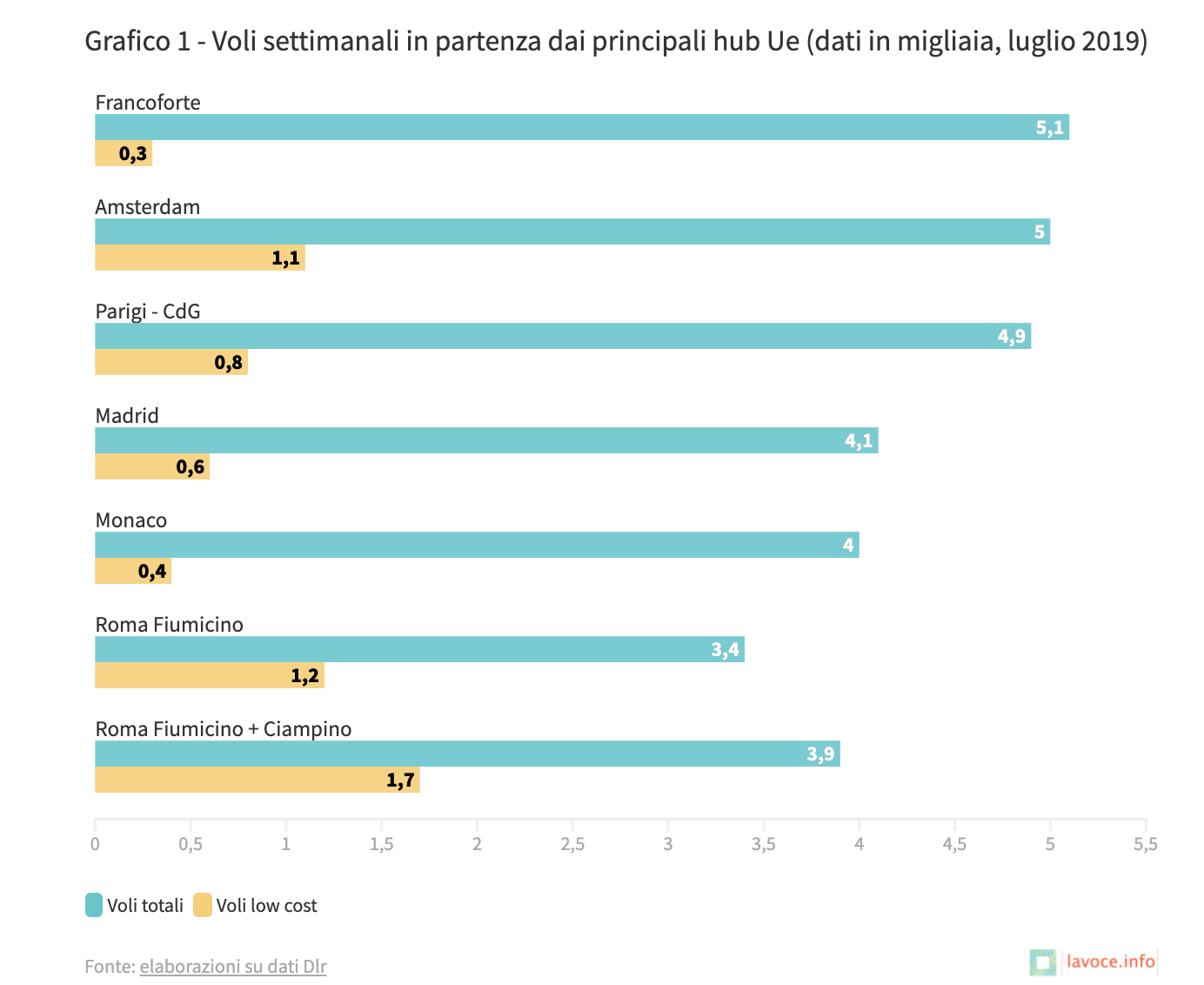

Graph 1 illustrates the presence of low-cost flights in the main European hubs in mid-2019 and shows the different success of the flag carriers in containing their most formidable competitors.

The one who has succeeded most is Lufthansa, given the lower low-cost odds in the two German hubs. The presence of low cost is still limited in Madrid and Paris, while it is higher in Amsterdam and, above all, in Rome Fiumicino, where it exceeds a third of total flights. If we consider the two Roman airports as a whole – and Ciampino, almost exclusively used by low cost, is even closer to the city center – low cost flights are approaching half of the total and should soon, probably as early as next summer. , become a majority.

A further factor to consider is that, in the Italian case, the low cost carriers are all competitors of the national airline, while in the other countries they are partly controlled by it, as happens for Eurowings in Germany, Vueling in Spain and Transavia for the Netherlands and France. If graph 1 could separate the shares of competing low cost from those of controlled low cost, the differences between Italy and other countries would be even more marked.

WHAT HAPPENED ON THE GERMAN MARKET

Lufthansa is the flag carrier that has best managed to defend its position in national hubs, so let's deepen the examination of the German market and the position that the flag carrier holds there.

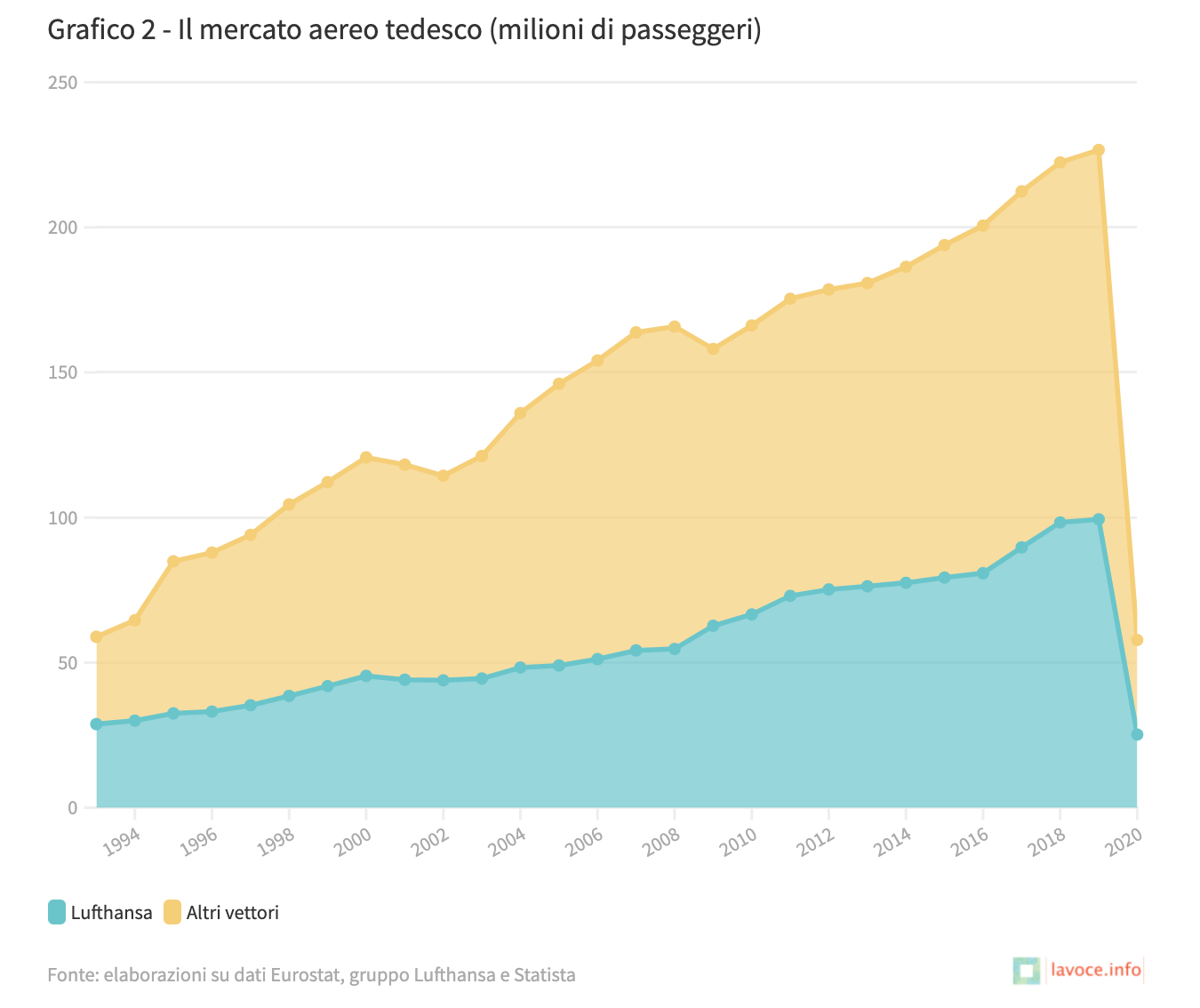

The evolution of passenger traffic in the German market and that of the carrier – including the regional subsidiaries, such as Air Dolomiti , and of the low-cost subsidiaries Germanwings and Eurowings in the years in which the participation was majority – is described in graph 2. Differently than what happened for Alitalia, after the liberalization Lufthansa first managed to limit the reduction in market share and then to recover it almost entirely. The growth of the company in parallel with that of the market took place not only through an internal increase in the capacity offered, but above all through acquisition processes that allowed, over time, some recovery steps, visible in graph 2. In 2008 it acquired from the investee Eurowings the low cost carrier Germanwings and in 2011 control of Eurowings itself. And in 2017 it takes over much of the activities of the Air Berlin company following its bankruptcy.

Alongside the acquisitions within the German market, there was also the purchase of the flag carriers of three neighboring countries: that of the company Swiss was completed in 2007, in 2009 by Austrian Airlines and in 2017 by Brussels Airlines. However, the data of these latter companies are not included in graph 2, as those transported to and from German cities cannot be separated from their total passengers. The traffic attributed to Lufthansa therefore concerns only the national carrier and its German subsidiaries, but not the entire corporate group.

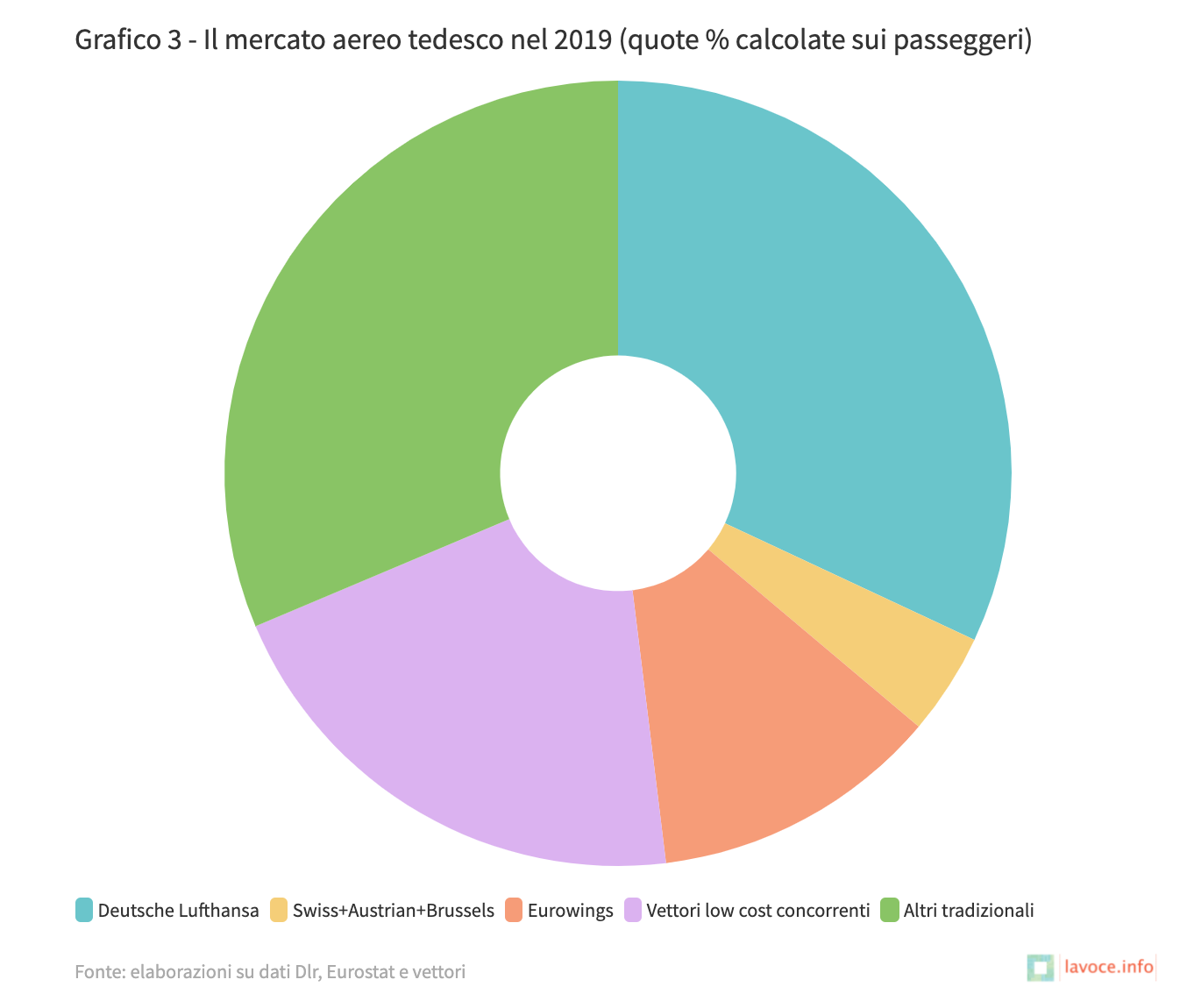

A remedy for this lack of data consists in estimating the passengers carried by them on the basis of the number of flights performed, which is instead obtainable from official sources. In September 2019, for example, by cross-referencing the data on total flights published by the Dfs-Deutsche Flugsicherung air traffic control company with those of individual carriers, published by the Dlr research center ( Deutsches Zentrum für Luft- und Raumfahrt ), it is inferred that: (1) 32 percent of the 98,000 total take-offs assisted by Dfs were by Deutsche Lufthansa or its Italian subsidiary Air Dolomiti; (2) the percentage rises to 46 per cent if we add 14 per cent of the low cost subsidiary Eurowings and to 50 per cent if we also include the flights of the non-German-flagged subsidiaries Swiss, Austrian and Brussels Airlines; (3) it still rises to 52.5 per cent if we also attribute to the group the flights of the leisure carrier SunExpress, a German-Turkish joint venture in which Lufthansa has 50 per cent of the shares; (4) the group's low-cost competitors, on the other hand, have a limited share of 15 per cent of flights, very little higher overall than Eurowings'.

Basically, Lufthansa also controls about half of the flights in the low-cost segment. Based on these flight data, the entire year of 2019 can be estimated, however, referring to passengers carried.

Considering passengers for the whole year, rather than flights for a single month, the picture changes only slightly. The Lufthansa group falls slightly below half of the market, more precisely to 48 per cent, mainly because the share of Eurowings, which uses smaller aircraft, with which it carries fewer passengers than its low-cost competitors, is lowered.

COMPARISON WITH THE ITALIAN MARKET

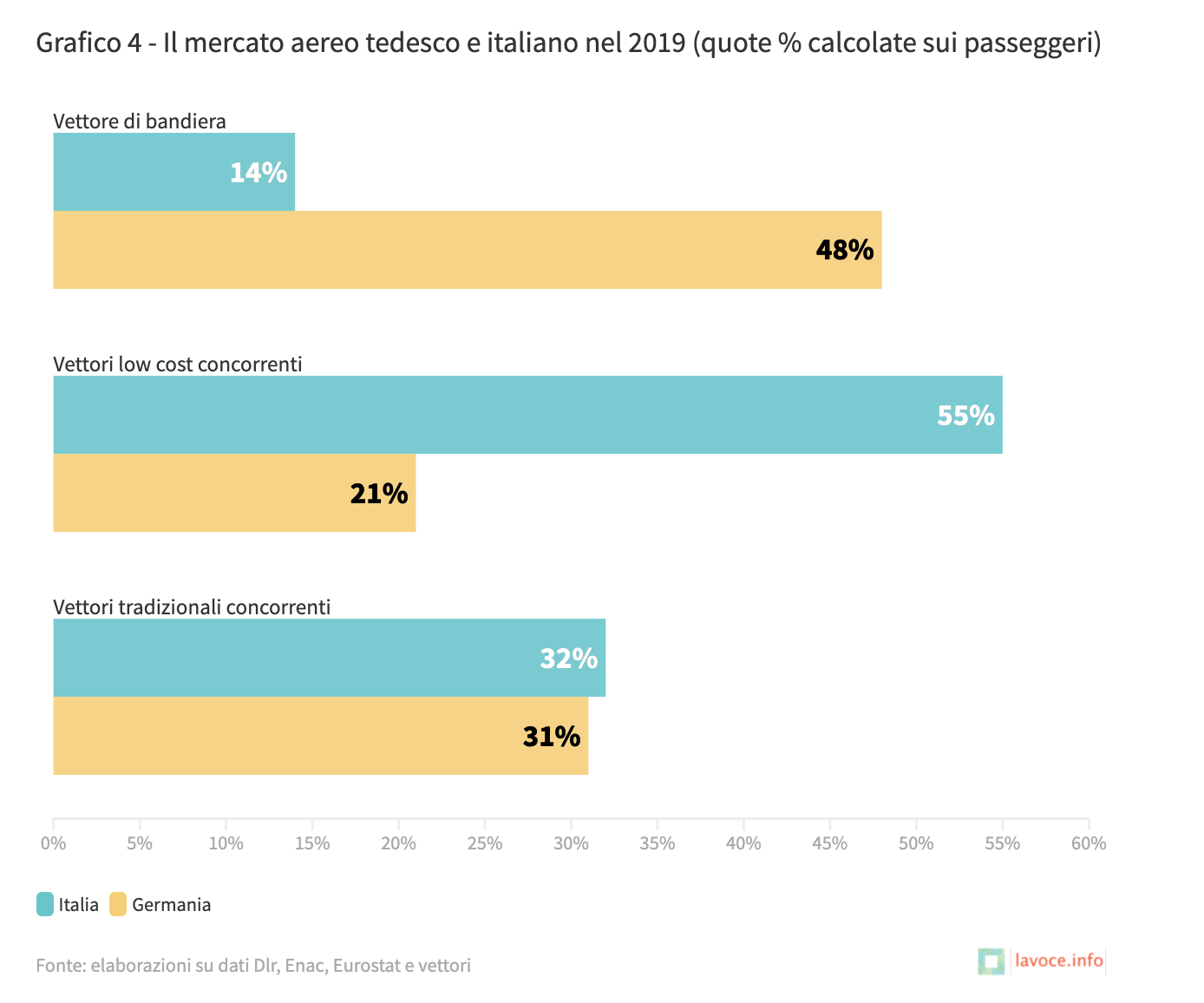

At this point, the German market in 2019 can be compared with the Italian one in the same year, already examined in a previous contribution. The differences that emerge are enormous, despite the fact that the rules of the market, defined over a quarter of a century ago by the European Union, are the same.

Before the pandemic grounded air transport, Alitalia did not reach 14 percent of the Italian market, while the Lufthansa group controlled almost half of the German one. In 2019, the difference between the two market shares, equal to 34 percentage points, was entirely covered in Italy by the greater presence of low cost carriers, which reached 55 percent of our market against 21 percent of the German one. The presence of traditional competitors, mainly foreign in the German case and almost exclusively foreign in the Italian one, was instead identical and just over 30 per cent.

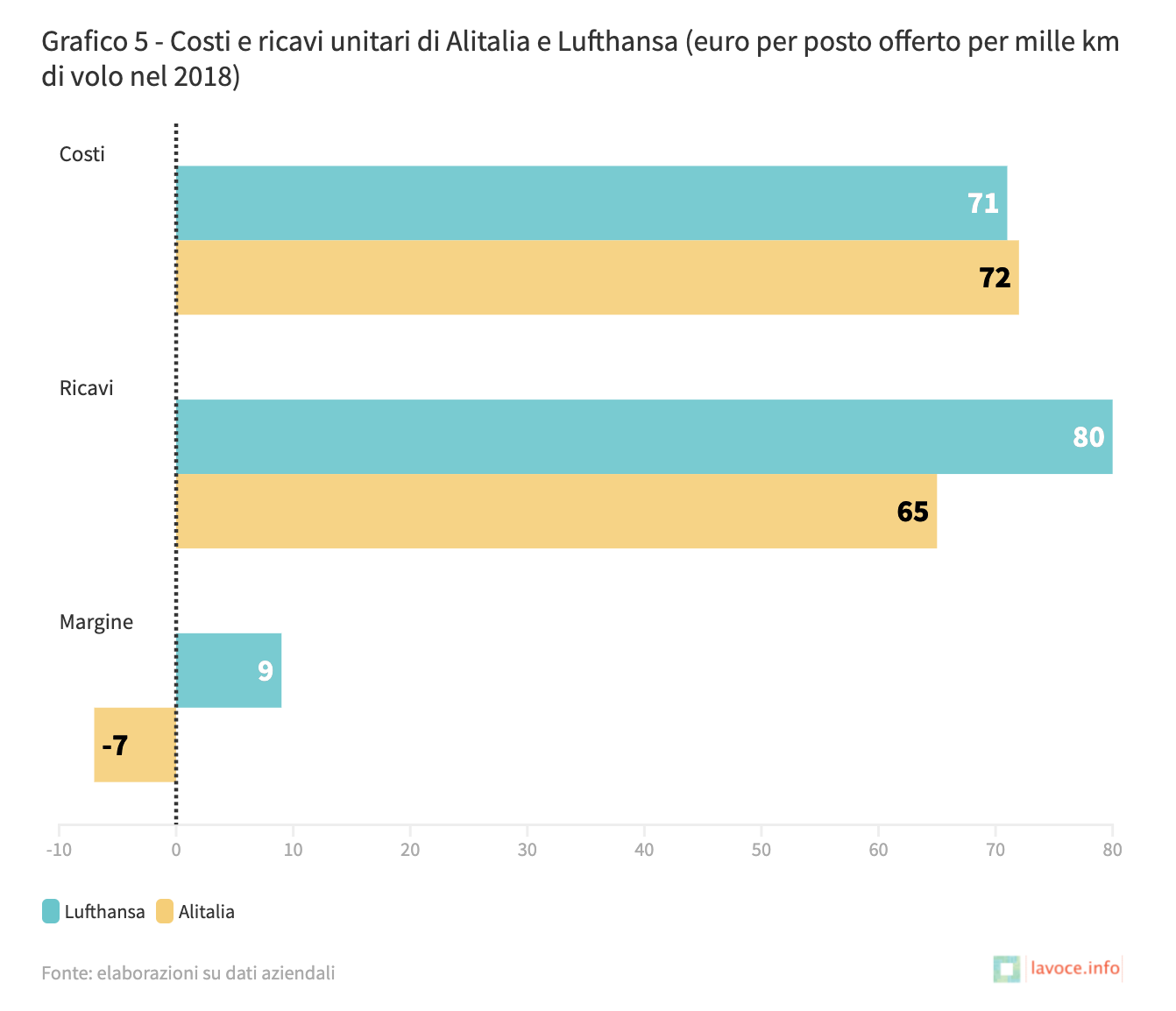

From the different shares in its national markets and from the different protection from competition in its reference hubs, it is evident that a different market power can derive, the effects of which should manifest themselves in the average prices applied to customers and in the unitary income deriving from them. Graph 5 shows, for the two carriers, the operating costs and the corresponding revenues per seat offered for a flight of one thousand km. The calculation refers to the year 2018 due to the lack of industrial data for 2019 for Italy.

While the unit industrial costs of offering seats were substantially identical for Alitalia and for all the network carriers of the Lufthansa group, the difference that leads to a negative margin for the former and a positive margin for the latter is evident on the revenue front. A good 15 euros is in fact the distance between the unitary revenues of Lufthansa and those of Alitalia. In the first case they exceed the costs of 9 euros, while in the second they remain below for 7 euros. It is difficult to think that Lufthansa would have managed to maintain an identical margin with more fierce competition in its national market and in its reference hubs.

In this way we arrive at the main lessons of analysis:

- the success of a carrier in a highly liberalized market is not necessarily a sign of its merit, understood as its ability to compete with competitors, but may be the result of its ability to retain market power by keeping aspiring competitors out of the competition;

- Alitalia, with its costs in line with Lufthansa, could have a fair chance of success if it were a German carrier and operated on that market. Operating on the Italian skies, on the other hand, its costs are out of the market, given the low unit revenues, and it must face a competitor in particular, Ryanair, which is able to carry more than double its passengers at less than half its unit cost.

Article published on lavoce.info

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/smartcity/ecco-come-la-germania-coccola-lufthansa/ on Sun, 23 May 2021 13:44:02 +0000.