This is how Intesa Sanpaolo will not snore

What will be the impacts and decisions of Intesa Sanpaolo for the exhibition in Russia. Facts, numbers and reports

According to the forecasts of the analysts of the investment bank Banca Akros, Intesa Sanpaolo's profit in the first quarter of 2022 will be halved compared to a year ago due to strong growth in provisions, mainly attributable to the presence of the group in Russia.

COVERAGE AND NET PROFIT

In the period January-March 2022, Intesa Sanpaolo's coverage will amount to 723 million euros, compared to 402 million a year ago. Net profit, on the other hand, will be 740 million, compared to 1.5 billion in the first quarter of 2021.

THE REPORT ON INTESA SANPAOLO

Akros analysts lowered both Intesa Sanpaolo's rating (from accumulated to buy ) and the target price (from 2.9 euros to 2.5).

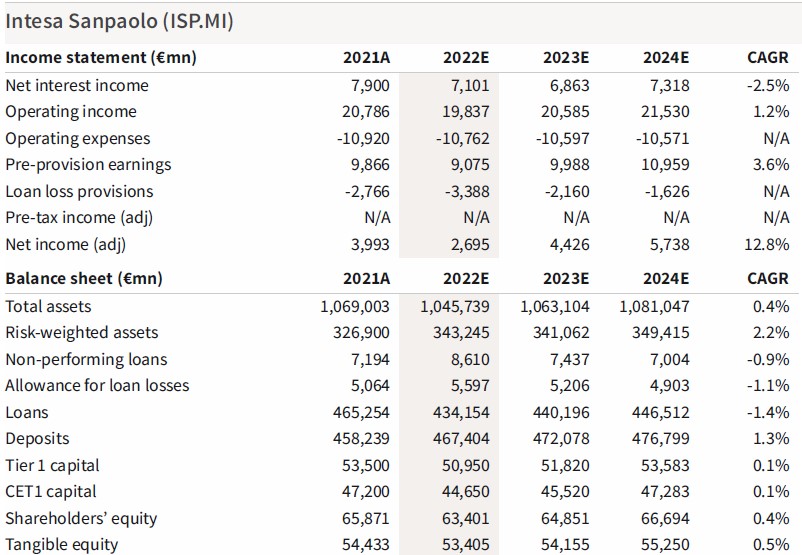

For 2022, the banking group's earnings per share are expected to be 0.23 euros, instead of 0.26; for 2023 it will instead be 0.27 euros, against the 0.29 euros of previous estimates.

FORECASTS FOR THE ENTIRE 2022

Considering the whole of 2022, Banca Akros thinks that Intesa Sanpaolo's revenues will drop by 11 percent on an annual basis (4.89 billion); operating costs will be 2.5 billion; the gross operating margin of 2.3 billion (a drop of 20.5 per cent); the net profit will be halved. Trading on the markets will be reduced by two thirds: in March it amounted to 300 million euros, compared to 800 million in the first quarter of 2021.

Akros expects a decrease (of 2.5 per cent) also in the interest margin of Intesa Sanpaolo, for 1.9 billion on an annual basis due to the sale of non-performing loans. Net commissions (€ 2.3 billion), insurance revenues (€ 373 million) and operating costs (€ 2.6 billion), on the other hand, remained stable. On the other hand, the decline in gross operating profit was more marked, 20 per cent down to 2.3 billion.

HOW MUCH INTESA SANPAOLO WILL WRITE

Akros writes – as reported by MF-Milano Finanza – that Intesa Sanpaolo will address "in advance, in line with its traditional prudence" the issue of exposure to Russia, which will affect the write-down of loans with € 300 million (+80 per cent , for 723 million).

Akros analysts expect “further provisions for risks of 200 million euros, of which around half are related to the conflict [in Ukraine, ed .]. In addition, € 200 million of net systemic charges are expected for this quarter ".

THE INTESA SANPAOLO COMMUNICATION ON RUSSIA AND UKRAINE

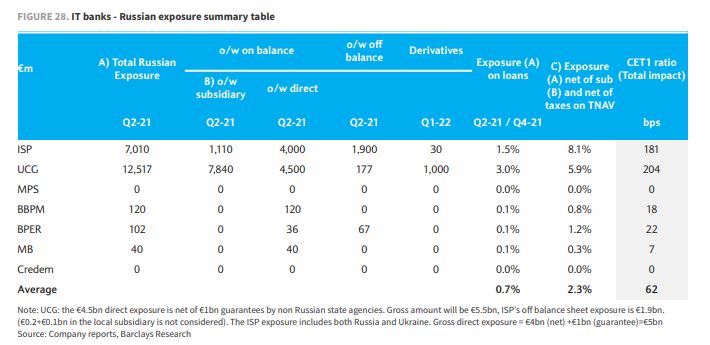

Intesa Sanpaolo announced in recent days that the exposure to Russian counterparties currently included in the lists of entities to which the part applies is equal to 0.2 billion euro and that the amount of the exposure to Russia and Ukraine, in analytical evaluation course for the purposes of better monitoring the prospective evolution of the risk profile, corresponds to loans to customers and banks of the subsidiaries equal to approximately 1.1 billion euros and the rest of the Group equal to approximately 4 billion euros.

(HERE IS THE INTESA SANPAOLO INTEGRAL PRESS RELEASE ON EXHIBITION IN RUSSIA)

THE INTESA SANPAOLO-RUSSIA RELATIONS

Intesa Sanpaolo alone manages more than half of the commercial relations between Italy and Russia, where it owns 1 billion euro of assets. Its subsidiary in the country, Banca Intesa Russia, has twenty-eight branches and is chaired by Antonio Fallico, also president of the Conoscere Eurasia Association, and defined as “ the most powerful Italian in Moscow ”. Phallic considers himself a “nostalgic communist. It is impossible not to feel regret for the values of the USSR, despite the mistakes made ”, he said in an interview with ItaliaOggi .

Intesa Sanpaolo is also part of an equal joint venture with the Russian bank Gazprombank, the third largest in the country, relating to the private equity fund Mir Capital. At the beginning of April, an Intesa Sanpaolo spokesperson had declared that "the local presence of the Intesa Sanpaolo group in Russia is undergoing a strategic review".

Intesa Sanpaolo is also the only Italian bank present in Ukraine, where it controls the Pravex bank: it has forty-five branches and 780 workers. Between Russia and Ukraine, the group's exposure as loans amounts to € 5.5 billion.

THE OPINION OF BARCLAYS

British bank Barclays has released a report on the state of Italian banks. Intesa Sanpaolo is classified as overweight , for three reasons: because the diversification of revenues leads to higher growth, because the return of capital derives from a solid balance sheet and low-capital-intensive activities, and because – finally – the recent mergers and acquisitions contributed to the improvement of efficiency.

Intesa Sanpaolo's price target , according to Barclays, is 2.7 euros; currently the value of the stock is 1.9 euros.

As also indicated by the Barclays scheme, Intesa Sanpaolo is the second Italian bank by exposure to Russia, preceded by UniCredit. The UK bank says it expects higher levels of NPLs, and consequently higher loan loss provisions (LLP), for banks exposed to Russia.

With regard to Intesa Sanpaolo and UniCredit, Barclays states that the buyback / capital return plans of the two institutions “could be supportive for both securities”.

“For Q1 we expect a transfer of Russian loans to phase 2, and very marginal effects from the revisions of the model on the rest of the portfolio; however, we think that banks could recover in H2, when we could have more visibility on the geopolitical situation ”.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/intesa-sanpaolo-russiaa-akros-barclays/ on Tue, 26 Apr 2022 13:23:15 +0000.