This is how the gap between industry and service sector widens. Intesa Sanpaolo Report

The divergence between industry in the broader sense and the tertiary sector widened in March. The comment by Paolo Mameli, senior economist in the direction of studies and research at Intesa Sanpaolo, on the confidence indexes released today by Istat.

The divergence between industry in the broader sense and the tertiary sector widened in March. In our view, the risks on GDP remain on the downside throughout the first half of the year. Conversely, the risks over the forecast horizon appear to be on the upside over the medium term.

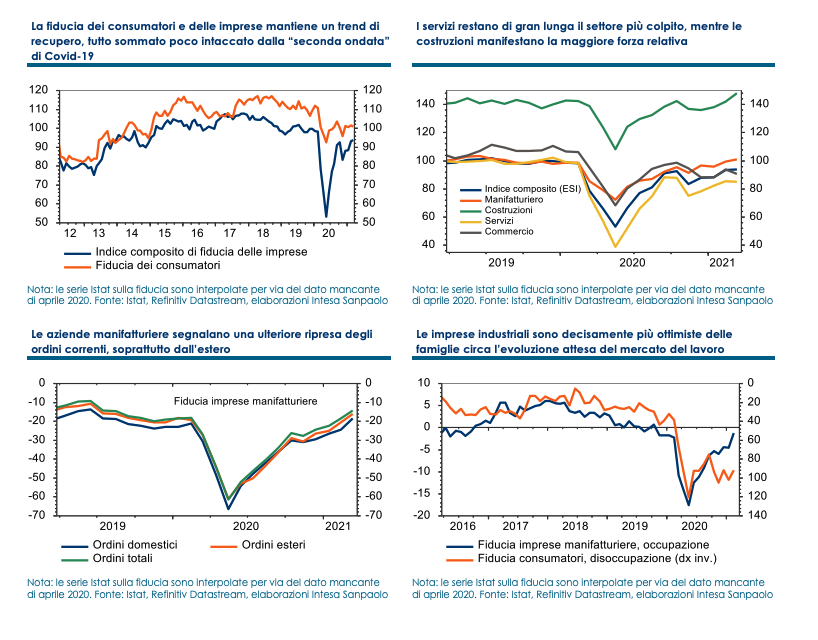

The data on the confidence of households and businesses communicated by Istat and relating to the month of March were mixed: consumer morale has decreased, business confidence has risen (the latter, with a divergent trend between manufacturing and construction from a on the other hand, and services and commerce on the other).

Household confidence fell to 100.9 from 101.4 last month, returning to levels in line with the average recorded between December and January. All the main components of the survey recorded a deterioration, which was more marked for the national economic climate and the current condition, than for the personal situation of the interviewees and expectations for the future. Household concerns about the employment situation remained unchanged at high levels. However, there are some signs of optimism regarding the current economic situation of households, future savings opportunities and opportunities to purchase durable goods.

The Istat composite index on business confidence (IESI) increased for the fourth consecutive month, to 93.9 from the previous 93.3: this is a maximum since the outbreak of Covid-19. However, there is a clear divergence between the tertiary sector, which is affected by the tightening of anti-Covid restrictions (confidence in services fell to 85.3 from the previous 85.7, that in commerce to 90.9 from 93.7) , and industry in a broad sense, which, on the other hand, shows an improvement in morale. In particular, confidence in construction rose from 141.9 to 147.9, the highest level in nearly 18 years.

In the manufacturing sector, corporate morale rose more-than-expected to 101.2 from 99.5 previously (revised up from 99 in the first estimate): this is a high since July 2019. All major components of the survey they showed an improvement, particularly strong for expectations on orders (at their highest since January last year). Inventories remained stable at one of the lowest levels since 2014 (this is a positive sign for future production). Hiring intentions rose to their highest since October 2019. The only sector to experience a drop in morale during the month was consumer goods producers. Also noteworthy is a sharp increase in three-month expectations on the level of sales prices, which have jumped to their highest levels in more than two years, which signals the growing temptation for industrial companies to pass a greater share of the cost increases downstream (recorded in particular, in recent months, on the raw materials component).

In summary, the March surveys show a widening of the divergence between manufacturing and construction, on the one hand, which continue their recovery trend, and services and retail trade on the other, penalized by the crackdown on anti-Covid restrictions recorded. this month. Unfortunately, the resilience of the industrial sector should not be sufficient to compensate for the weakness of services in the first quarter, with the result of a still negative GDP at the beginning of 2021 (but the contraction is likely to be less marked than the -1.9% qoq. seen at the end of 2020). A moderate rebound is possible in the second quarter, but given the possibility of an extension, at least partially, of the current restrictions beyond the deadline today (6 April), the risks appear clearly to the downside. Basically, the GDP could be little changed in the first half of the year. A significant recovery (with economic growth rates probably higher than 1% qoq) is expected, at best, only starting from the summer quarter (thanks also to climatic factors, as well as to the effects of containment measures and intensification of the vaccination campaign).

Precisely in consideration of the weak start to the year, last month we revised down the growth estimate for the Italian economy in 2021, to 3.7%. The peak for the annual growth rate is now seen no longer in 2021 but in 2022 (at 3.9%); the growth rate should remain above potential also in subsequent years (in our scenario, at least until 2024). The smaller-than-expected rebound in 2021 leaves more room to recover pre-crisis levels in subsequent years; moreover, in 2022 the expansionary impact of the Recovery Plan should be maximum, which we estimate on average equal to half an additional point of annual growth in 2022-23. Furthermore, the possibility that the implementation of the plan is accompanied by structural reforms would amplify the positive effects on GDP not only in the short-medium term but also in the long term, although it takes years to recover the pre-crisis levels (in our forecast profile, the GDP on a quarterly basis will exceed the levels of the end of 2019 only in the 2nd quarter of 2023). In summary, the risks on the forecast horizon for the Italian economy appear to us to be downward in the short term, but upward in the medium term.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-come-si-amplia-la-forbice-fra-industria-e-terziario-report-intesa-sanpaolo/ on Fri, 26 Mar 2021 11:08:00 +0000.