This is why the telecommunications sector is recovering in Europe, except in Italy

EU telecommunications sector improving slightly but the Italian market is contracting the most. What emerges from Mediobanca's annual report

In 2022 the telecommunications sector in Europe is slightly improving, but not in our country.

This is what emerges from the annual survey of the major global and Italian groups in the telco sector drawn up by the Mediobanca Research Area.

The first market is Germany with revenues of 59.1 billion euros, followed by France (36.7 billion), the United Kingdom (36 billion) and Spain (30 billion). Italy occupies fifth position with 26.9 billion euros, down by 3.3% on 2021 and by 13.8% in the five-year period, in both cases the largest reduction in the Old Continent.

All the details.

GERMANY MAIN TLC MARKET

In 2022, among the main countries of the Old Continent, the TLC sector is recovering compared to 2021 everywhere, except in Italy (revenues at -3.3%).

Analyzing the five-year period 2022-18, the TLC sector grew in France (+3.4%) and Germany (+3.7%).

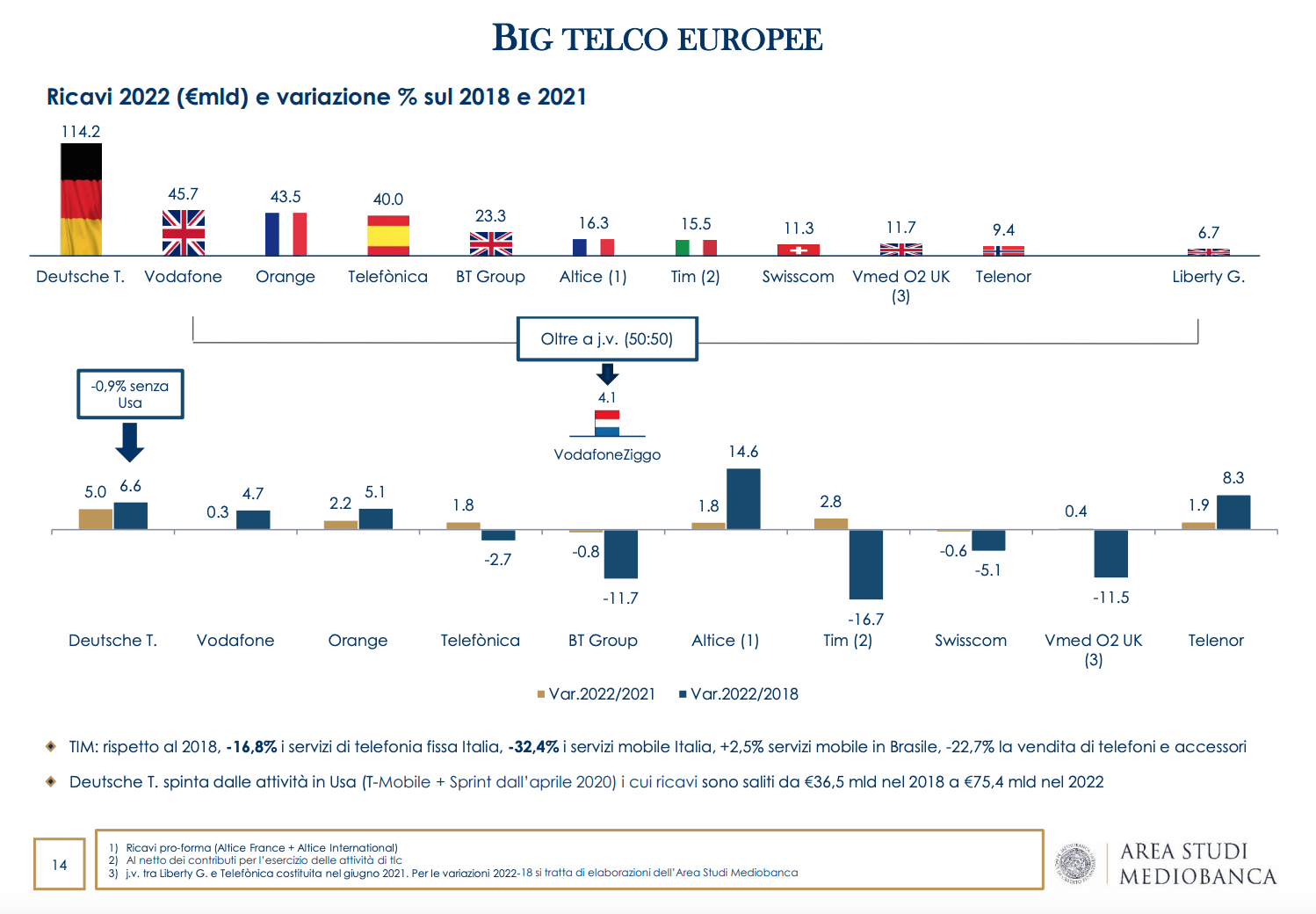

DEUTSCHE TELEKOM FIRST IN REVENUES, FOLLOWED BY THE BRITISH VODAFONE AND THE FRENCH ORANGE

On the revenue front, in the first half of 2023 Deutsche Telekom dominates the European ranking with 55 billion euros (-0.9% on the first half of 2022), followed by Vodafone (22 billion euros, -2% on 2022), Orange ( 21.5 billion euros; +1.2%), Telefònica (20.2 billion euros; +3.7%), BT Group (10.3 billion euros; +2.4%), Altice (8 billion euros; +0.9% on a pro-forma basis) and TIM (7.8 billion euros; +3.8%).

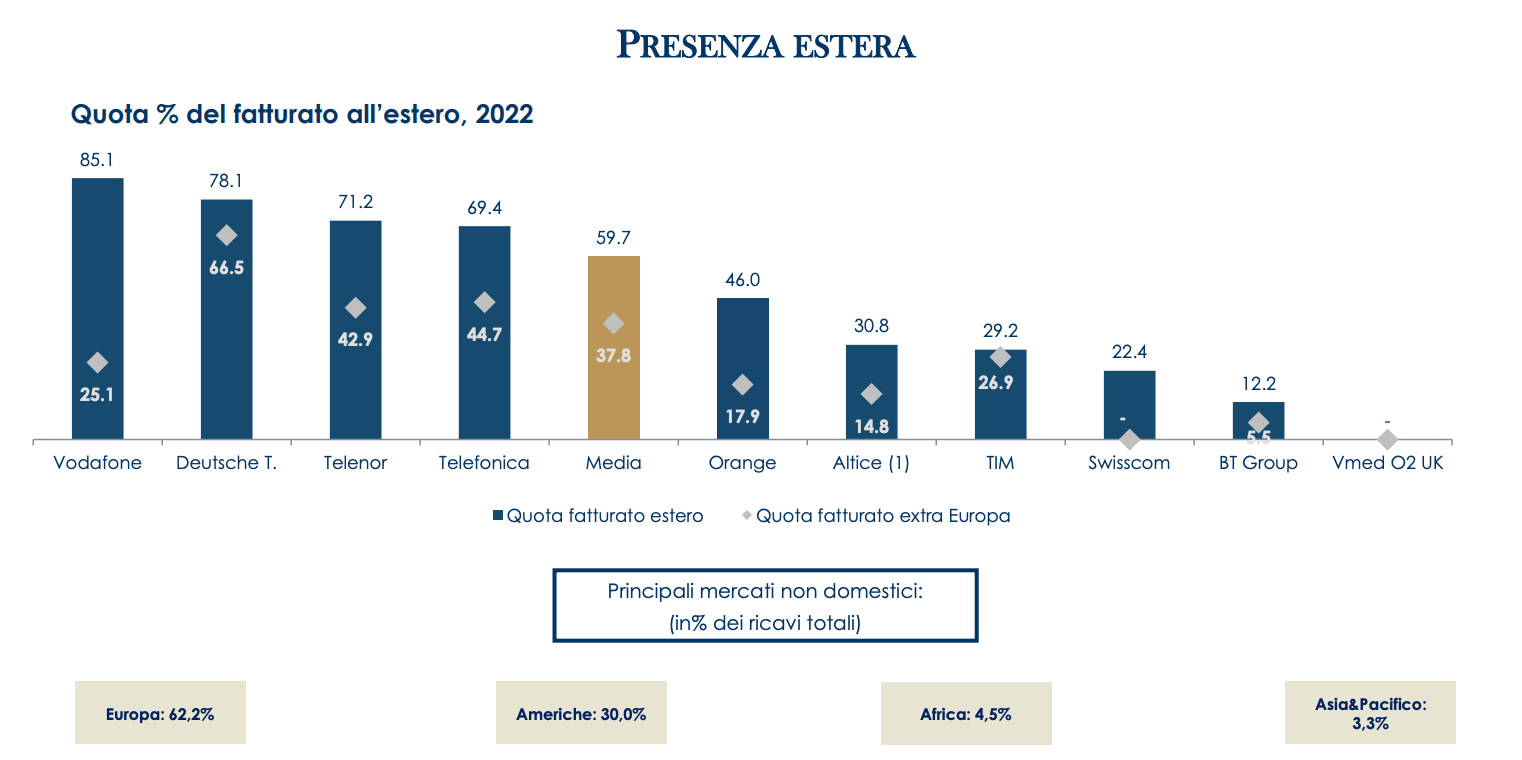

VODAFONE FIRST FOR FOREIGN SCREENING

From Mediobanca's analysis it emerges that the greatest foreign projection is that of Vodafone (85.1%), with African activities (Vodacom + Vodafone Egypt) accounting for 18% of consolidated revenues; Vmed O2 UK is only active domestically.

In this regard, analysts recall that in June 2023 Vodafone and CK Hutchison announced the merger of their activities in the United Kingdom (pro-forma revenues of €9.5 billion). The new company (51% Vodafone, 49% CK Hutchison) "will have the scale necessary to continue to invest, grow and compete in the market".

The highest incidence of non-European revenues is of Deutsche T. with 66.5% in 2022, almost entirely relating to the US subsidiary T-Mobile.

DEUTSCHE TELEKOM AND TELEFONICA PRIME IN NET RESULTS OVER THE FIVE-YEAR PERIOD

Moving on to the net results in the period 2018-2022, Deutsche Telekom tops the ranking with 22.4 billion euros, followed by the Spanish Telefonica with 16.2 billion euros: the results of the Spanish operator include 4.5 billion in capital gains in 2021 relating to the establishment of Vmed O2 UK (jv with Liberty Global) and 6.1 billion in capital gains on the sale of Telxius (telephone towers).

Vodafone's numbers are influenced by the loss of 8 billion euros for the 2018 financial year (ended 31 March 2019) following the write-down of goodwill of 3.5 billion euros (mainly Spain) and write-downs of 3.4 billion euro on Vodafone India (now Vodafone Idea), in addition to the profit of 11.8 billion for the 2022 financial year (closed in March 2023) following the capital gain of 8.6 billion that emerged from the deconsolidation of Vantage Towers.

As regards the Italian Tim, the company wrote down goodwill on the division for 4.1 billion euros in 2021 and 2.6 billion in 2018 (from 2010 the impairments rose to €21 billion) and recognized charges for incentives for 'exodus of around 1.5 billion. In 2020, the operator had also recognized deferred tax assets (net of substitute taxes) for 5.9 billion euros pursuant to art. 110 of Legislative Decree 104/20204, continues the Mediobanca analysis.

WHY THE SECTOR IS CONTRACTING IN ITALY

Finally, extending the comparison to 2010, in Italy the turnover of the sector decreased by approximately 15 billion euros (-3.7% annual average), with the mobile network in greater difficulty (-5.1%) compared to fixed income (-2.4%). These dynamics are influenced by numerous variables.

Among these, the regulatory effects, with mobile termination rates constantly decreasing (in Italy going from €0.76 in 2020, to €0.67 in 2021, €0.55 in 2022 and €0.4 in 2023) and the competitive pressures which in Italy have caused the most marked contraction in the prices of telephone services (-17.6%) compared to the European average -3.2% in the five-year period 2018-2022, underline Mediobanca analysts.

But if in the two-year period 2022-2023 inflation reached its peaks almost everywhere, in Italy telephone tariffs have remained almost stable, despite there being no shortage of attempts to introduce mechanisms for adjusting the cost of monthly fees to the cost of living, especially with reference to new contracts , concludes Mediobanca.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/ecco-perche-il-settore-tlc-e-in-recupero-in-europa-tranne-che-in-italia/ on Fri, 17 Nov 2023 06:45:36 +0000.