Tim networks and Open Fiber: what to do?

Tim, Open Fiber and more. facts, numbers and scenarios about networks. The speech by Francesco Vatalaro, full professor of Telecommunications at the University of Rome Tor Vergata

The first hundred days of the new government have already passed, those of the traditional "honeymoon". From the telecommunications perspective, unfortunately, the hoped-for and desirable change of pace is still not visible. Of course, the legacy left by political and technical governments of the past, at least since the middle of the last decade, is really heavy, but so far one has the unpleasant impression that ideas are lacking and that we wearily continue with the old inconclusive practice of "tables, tables and stalls” (copyright: Vito Gamberale, year: 2011).

Given that the recipes of the past have not only failed but have systematically aggravated the overall picture, now close to the catastrophe of the business system (as in a perverse domino effect, the crisis is now systemic and has expanded from Telecom Italia, to Open Fiber, and gradually to all the alternative operators), the basic question is: what to do? In such cases, it is necessary to rewind the tape, throw away the old preconceived ideas and start again with new ideas and with courage.

Let's try without too many pretensions to line up some of the main aspects that should be examined, clarifying immediately that both European and national factors are at the root of the problems and that it cannot be enough to address the latter without at least bearing in mind the importance of first.

THE CHRONIC PROBLEMS OF EUROPEAN TELECOMMUNICATIONS

The much-vaunted strategic role of telecommunications in European society is not reflected in market performance. The revenues of the major telcos generally indicate that, as an industry, telecommunications are heavily underperforming the market.

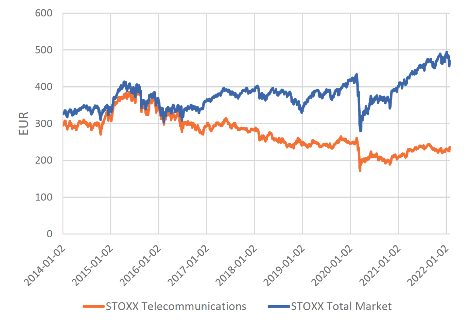

Figure 1 shows the comparison between the average market returns and the returns of the telecommunications sector in Europe based on the STOXX index over the last eight years (2014-2022): it can be observed that European telecommunications have not only always remained at below the average values but also that the range grows over time; in the period considered, the average market value of telecommunications in Europe decreased by 24%.

Indicators such as the average long-term stock market value are among the most significant and robust in a case such as the one examined of companies that operate under a regulated regime, such as those in the telecommunications sector. On the other hand, they are amply confirmed by other macroeconomic indices, for example the return on investment in telecommunications which, compared with the average market discount rate, shows that until 2010 it was still convenient to invest in telecommunications; since that date, however, the situation has drastically changed as documented by the surveys of high finance (see Credit Suisse, Telecommunications & Media – Winners and Loosers in a Converging Landscape, 2022).

A cumulative decrease in the value of the business system, such as the one that is now steadily manifesting itself in Europe, the removal of capital from European operators, who have to pay more and more for their infrastructure investments, in a rigorously regulated sector which should at the contrary to ensure certainty in the medium-long term, are clear signs of suffering, a phenomenon which, on the contrary, is not evident in the case of the USA.

So it is wrong to believe that the decline of Italian telecommunications has (only) national roots. All the main European operators have been suffering from the unfavorable market situation for about ten years, with consequences also in comparison with their international peers. This is not a negligible aspect in a global market such as that of telecommunications which cannot hope to prosper closing itself within national borders but which, on the contrary, if it is not virtuous, recoils in geostrategic competition and therefore also risks losing the necessary autonomy within the same national borders.

Let's try to better understand this aspect in comparison with the corresponding US players through an example involving the market evolution of the leading European operator, Deutsche Telekom (DT), which has well understood for some time that in order to survive in an asphyxiated market like the European one it had to be open to confrontation directly in the United States.

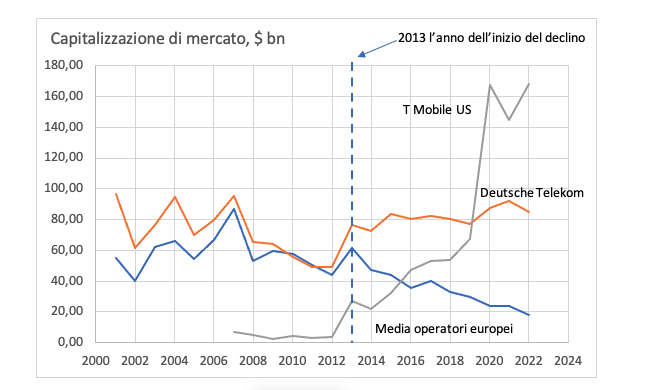

As shown in Figure 2, in the two-year period 2001-2022, the value on the Stock Exchange of DT fluctuated but essentially held around ~ $80 bn. In the first decade, the average market capitalization of the first European operators,[2] although small compared to DT, closely followed its fluctuating trend.

In the 2010s, the average value on the Stock Exchange decreased significantly continuously. In 2013 the average capitalization was $62bn and in 2022, after ten years, it fell 3.4 times, to $18bn. The question we have to ask ourselves is: why did DT hold while the other operators on average dropped a lot in value?

In fact, in 2013 DT capitalized $76 bn and in 2022 it capitalized $85 bn, 10% more. In the 2010s DT held by virtue of the dividends secured by the majority stake (~50%) in T Mobile US, founded by DT in the early 2000s, which in recent years has become the first operator in the United States. With 120 million customers, T Mobile US has surpassed both AT&T and Verizon, the traditional telecommunications giants in the US, which now each serve about 100 million customers. It is evident that the American regulator FCC allows these dynamics, also through the tool of corporate consolidations.

So DT held out by virtue of the amazing growth of the subsidiary DT Mobile US: it thus managed to avoid the sad fate of all the main European operators. Without a correction of the regulation, European telecommunications companies are destined to become irrelevant on the international scene and no national intervention, however well thought out, will be able to bear the hoped-for results.

Urgently reviewing, together with the European Commission, the corpus of telecommunications rules – both sectoral and antitrust – is not only in Italy's interest, but would be a strategic task for the entire Union. This would be a significant example of a revision of European policy to be implemented in a constructive spirit also in close collaboration with the other Member States.

THE ERRORS OF ITALIAN GOVERNMENTS

Given the European regulatory framework which penalizes telecommunications, it is indisputable that the national situation is aggravated by local factors rooted in wrong choices made over the past decade.

In fact, in an already considerably problematic European framework, Italy represents a singularity: the first decade that followed the liberalization of telecommunications (1997-2006) was characterized by the squandering of an industrial heritage that had led Italian telecommunications to to excel on the world stage with presence on all continents. By now, no one denies the errors of the Prodi I Government (1996 -1998) in the privatization mechanism of the Telecom Group which led to several changes of hands between entrepreneurs in a few years also due to the lack of regulation and supervision by Consob which allowed, in a case, even to discharge the debts contracted by the buyer onto the subsidiary company. In a few years as an international champion, Telecom Italia took on a substantial debt and began to sell its subsidiaries by reducing its perimeter. Thus we arrive at 2006 when the Prodi II Government (2006-2008) intervenes asking for help from Telefónica to prevent ownership from passing to AT&T and the Mexican raider Slim. It is from this moment, almost ten years after privatisation, that the Italian State begins to make its presence felt on Telecom Italia, not always with respectful and virtuous methods. But what happened in the first decade of the liberalized regime today matters little (although many "nostalgics" of the good old days still shed warm tears). A well-managed company, under the watchful eye, responsible – but also respectful – of political institutions, and operating in a virtuous regulated regime, in about ten years can return to excel, recovering lost positions (see, again, the growth curve of T Mobile US which in the decade 2013-2022 grew more than six times going from a small startup to a national and world champion).

Instead, since 2006 the grip of politics has tightened more and more on Telecom Italia: the pretext for the intrusion on a private industrial group is represented by the pressing request to develop the optical access network, to follow the European indications (in line with the other OECD countries) to acquire a modern ultra broadband network (BUL). In fact, for several years, until around 2014, Italy (and therefore, in particular, Telecom Italia) lagged behind the other major Member States, but the situation began to change and indeed, in the following years, the recovery is clear: but the then Renzi government (2014-2016) is not willing to recognize it, on the basis of erroneous assessments often dictated by small stakeholder groups; in fact, there is insistent talk and, then, considerable European funds, already destined for the Regions, are redirected from other sectors to the TLCs to create fiber optic coverage. To understand the effective dimension of the evaluation error made in removing the task of optical innovation from the market and bringing it into the state channel, it is enough to look at the data from a by now “historical” perspective.

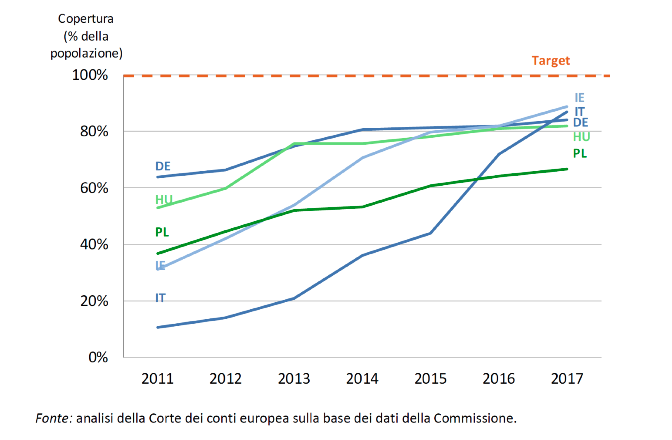

In this regard, it may be useful to observe the strong growth of Italian BUL coverage at at least 30 Mbps certified by the European Court of Auditors on the basis of data collected by the European Commission from Italian institutions and operators (Figure 3). The data show the strong impact of the choice made by the market and the good results achieved, a unique case in Europe at the time, ie just when the Italian government was launching a very intrusive policy.

The government, therefore, decides to implement a very aggressive strategic plan, which will soon prove to be unfeasible in the foreseen times and ways. The interference with the market is massive, with a wide-ranging industrial policy that shifts the pendulum of the achievements in the field of public initiatives with more challenging objectives than the European ones: guaranteeing 100 Mbps to 85% of citizens and 30 Mbps to all rest of the population. The claim to solve a problem that is entrusted to the market throughout Europe with a central planning logic, first prompted the government to found, in December 2015, Enel Open Fiber SpA, a publicly controlled company exclusively dedicated to the business of all-optical networks (FTTH, fiber-to-the-home) with a "wholesale-only" model (i.e. business-to-business type, without direct sales to end customers), and then in the following months to launch public tenders for the BUL coverage of so-called "white areas" of the country, i.e. areas artfully redefined (in defiance of international recommendations) to maximize the application of the European definition of market failure, culpably neglecting – and, as will be seen later, disastrously – take into account the reality of the Italian network.

The newborn company, initially controlled by Enel, changed its name to Open Fiber in December 2016 with the entry into the share capital of 50% of Cdp Equity SpA, a company of the Cassa depositi e prestiti Group, which took place at the same time as the incorporation into Enel Open Fiber of Metroweb, a specialist company in optical fiber controlled by Cdp Equity and by the infrastructure fund F2i, whose stake is simultaneously liquidated and which withdraws from the shareholding, not even subsequently exercising the repurchase option reserved for it. Subsequently, and we come to the present day, Enel will exit the capital realizing an interesting capital gain with the sale of the shares to the international Macquarie fund which agrees to operate in the minority with respect to Cdp (60%) which for this purpose exercises the pre-emption on 10% of the society.

ERRORS MATERIALIZE: THE DISASTROUS EXPERIENCE OF OPEN FIBER

To date, more than six years after the launch of the public plan, Open Fiber's coverage of white areas is largely incomplete. From the comparative analysis between the progress of the works published monthly by the grantor Infratel Italia, on the one hand, and the three agreements signed by Open Fiber as state concessionaire, on the other, there is reason to believe that the concessionaire has fallen in the "essential" violation of the terms of the concession lex specialis which causes de jure forfeiture of the concession title. It therefore seems necessary, albeit very late, to start an investigation in order to ascertain the possible violation. If this forecast, based on the analysis of data published regularly in recent years, were to be confirmed, as is likely, it would obviously be a very serious fact and it would be really difficult to assign any responsibility to Open Fiber alone, with a clear “culpa in vigilando” of previous governments.

The optical fiber coverage that was to be concluded in 2020 – i.e. within three years of the signing of the three agreements – is now declared at around 40% and reasonable projections lead us to believe that it cannot be completed in the short term (a reasonable estimate leads to 1Q26 , i.e. nine years after the launch of the programme). In this regard, it is enough to examine the monthly progress reports available on the Infratel Italia website, available from March 2021.

In fact, the official data of the Municipalities tested show a substantially linear trend in the growth of Fiber Municipalities delivered and tested. The average monthly growth in the period is 1.4%. The growth curve of the tests is very likely and can be projected forward with a good degree of confidence, as the cause that determines the slowly increasing trend consists in the almost constant intensity of personnel and companies that can be recruited to carry out construction site works. This shortage of human resources has been denounced several times and has worsened in recent times due to: a) building work for superbonus; b) construction sites for the PNRR (not only for telecommunications), c) shortage of personnel specialized in laying optical cables. Every attempt by past governments to increase the number of workers has come up against serious problems in finding skills.

However, it is not just a problem related to the gross temporal planning error of the plan: there is more and even worse.

The wholesale-only public fiber network entrusted to Open Fiber, even if we can ever see its end, will be incomplete by design, both because it does not reach buildings (that is, it is not FTTH) and because it offers interconnection points (the so-called POPs or points of presence) to retail operators in insufficient numbers and far from their networks. For its completion it would be necessary to mobilize additional investments that no one has taken the trouble to calculate and which are, in any case, colossal (many billions of €). The real times lengthen and, for the eventual complete network, move around the end of the decade. Finally, the network is not built according to the best standards, it is not compatible with Telecom Italia's network architecture and therefore, in the event of a merger of the two companies, it risks being completely abandoned.

Open Fiber also creates its own optical network in the most populous areas of the country, where Telecom Italia has also been operating for some time: the duplication of networks in the event of a corporate merger will cause the disposal of redundant network trunks. It is clear to everyone that the "dream" of the Renzi government and its consultants in 2015 has shattered against the reality of the difficulty of creating a national optical network in a short time (only three years) and without the necessary skills (Open Fiber was born as startup without rooting and is launched with only 400 employees).

Minister Colao of the previous government, instead of posing the problem of how to remedy this experience, actually aggravated the situation by entrusting the majority of the lots of the new public fiber optic development project with PNRR funds to Open Fiber. The tight deadlines for the delivery of the PNRR projects give the virtual certainty that the Open Fiber lots will unfortunately not be completed in time, with the consequence of the loss of funds and the payment of the stringent penalties envisaged. If the previous governments, no less than five, over the course of two legislatures, have "put their heads in the sand", now this is no longer possible. The present legislature will see all the disastrous consequences of the choices of others emerge clearly.

WE MUST GET FREE OF THE UTOPIA OF THE SINGLE NETWORK

All the governments that have followed since 2015, variously aware of the anomaly created with the creation of Open Fiber, have attempted to eliminate it by promoting a merger with Telecom Italia that is still far from materializing and not even desirable. It is clear that the sum of two weaknesses does not make a strength (Cdp should declare the amount of Open Fiber's multi-billion dollar debt, probably unsustainable). In any case, Open Fiber should change its business model, finally launching its own retail division, i.e. selling its products to end customers like all fans: only in this way can it hope to emerge from a deep crisis due, in addition to the mistakes made, also the low profitability of the wholesale market. If CDP proceeds with a serious restructuring of the company, it could put it on the market as a small OLO looking for a private buyer. Naturally, many of the ineffective and incomplete infrastructures built up to now and what has been planned up to now "on paper" and unfeasible or unprofitable should be abandoned for a serious rationalization of the business. This, finally, plus the decisive cut of the wholesale-only Gordian knot, would close the old refrain of the CD. "single network".

At the same time, subject to competition in its core business and forced to direct investments according to strategies not always dictated by correct economic principles, but to avoid being undermined by a competitor artfully created by the State, Telecom Italia itself experiences a serious crisis from which no one seems able to get her out. The shareholders of Telecom Italia, and Cdp in the forefront, should review the company plans for a relaunch which requires, also in this case, the revision of the company business model.

The main road is not that of separating the network from the services (another legacy of the past to be freed from with courage). Even if in difficulty, as we have seen, no European operator ventures on this risky road, full of unknowns and serious risks of survival.

The current trend in the telco world is, on the contrary, that of looking for integrations to grow; in some cases of the horizontal type (as in the case of T Mobile US which as the third operator acquired the fourth in 2021 – Sprint Corporation – thus leaping to first place in the USA and in the world), in other cases of the vertical type (as in the case of AT&T which acquired Time Warner in 2021).

Why is this the trend of successful traders? We have finally realized that telco operators must free themselves from the yoke represented by the mere supply of connectivity, fixed and/or mobile, which having become a "commodity" does not allow for the achievement of a sustainable economic equilibrium (in brackets: this is the reason reason why the few national wholesale-only experiments, including Open Fiber, have all failed). Today the attempt under way is to become "data-driven" companies (see TM Forum, From Telco to TechCo, May 2022), certainly without the pretension of replicating the OTT models, but in any case leveraging on the network-services integration (and, as seen above in the case of AT&T, sometimes even attempting the gamble of further integration with content). Telco companies, therefore, are finally realizing that in order to grow, they must embark on a digital transformation process, without giving up the network. Network-service integration, new business models, data-driven enterprise: these are the watchwords to get out of the crisis and start growing again.

I want to hope that whoever has taken over our country's telecommunications "dossier" has the courage and foresight to abandon old models that have proven to be inadequate in the field and to re-examine this important sector "with a fresh mind", without the contribution of the which a stable recovery of our economy is unthinkable.

(The text is a reworking and integration of the article by the present author "The liberalization of telecommunications in Europe: twenty years later", published in the volume Un Ingegnere in Senato: Essays in Honor of Franco Debenedetti, Edizioni IBL, 2023)

[2] Note: Including the top 7 European operators by Market Cap, except DT (1st), namely: Vodafone (2nd), Orange (3rd), Telefonica (6th), BT Group (7th), Telnor (8th), Telia (10th), KPN (11th), Swisscom (4th), which is not in the EU, Cellnex (5th) and Vantage towers (9th) which were not listed in 2013 were excluded . Telecom Italia (TIM) does not appear since it has long been no longer among the top European operators.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/reti-tim-open-fiber/ on Sun, 19 Feb 2023 06:48:07 +0000.