Tod’s, the delisting and cunning of the Della Valle

Tod's: all about takeover bid and delisting. Facts, numbers and comments

Augustan twist ( no sparks at Ferragn i) on the stock market and beyond: the Della Valle family has launched a public purchase offer (takeover bid) of 40 euros per share, for a value of 338.15 million euros, on Tod's shares not yet in portfolio, ie 25.5% of the capital.

Here are the objectives (the declared and the true ones) and the first comments on the values of the takeover bid.

OPA ON TOD'S AND DELISTING DEI DELLA VALLE

Diego Della Valle launches a takeover bid on Tod's at 40 euros per share to withdraw the stock from the Piazza Affari list. The voluntary purchase offer, a note reads, is promoted by DeVa Finance, a company wholly owned by DI.VI. Finanziaria di Diego Della Valle & C and indirectly controlled by Diego Della Valle, and is aimed at acquiring all the ordinary shares of Tod's not yet in the hands of the entrepreneur and equal to 25.55% of the capital.

THE NUMBERS OF THE TOD'S OPA

The consideration offered incorporates a premium equal to 20.37% with respect to the official price per Tod's share recorded on the trading day prior to the date of today's communication, equal to 33.23 euros.

THE DISCOUNT OF DELLA VALLE

The maximum disbursement in the event of full participation in the takeover bid will be 338,149,080 euros. The bidder, with the support of the Della Valle family, explains a note, “has decided to make a large investment in the fashion group to support its development.

THE OBJECTIVES OF DELISTING ACCORDING TO THE VALLEY

The goal is to enhance the individual brands (Tod's, Roger Vivier, Hogan and Fay), giving them strong individual visibility and great operational autonomy. Through this strategy, we intend to strengthen the positioning of the brands in the upper part of the quality and luxury market, with a high level of desirability ". In fact, it is believed that the pursuit of these medium and long-term objectives is less easy while maintaining the status of a listed company, with the limitations deriving from the need to obtain results in any case subject to short-term checks.

WHAT THE NOTE BY DELLA VALLE SAYS ABOUT TOD'S DELISTING

Consequently, Della Valle is determined to promote and support this project, aware of the quality of the group's managerial structure and the proven competence and experience of its artisans. Finally, the takeover bid is intended to give shareholders the opportunity to liquidate their investment in Tod's at more favorable conditions than those currently offered by the market.

THE POSITION OF LVMH

LVMH – in agreement with the Della Valle family, Mf points out – will not join the takeover bid promoted by Della Valle and will keep its 10% stake in the fashion company alongside the entrepreneur from the Marche region. Delphine, the subsidiary of Bernard Arnault's French giant, must be considered a person who acts in concert with the Offeror, reads the note announcing the voluntary bid on Tod's, "having signed an agreement under which it is committed, among other things, towards the Offeror and DI.VI. and up to the conclusion of the Offer, not to assign, transfer and / or otherwise dispose in favor of third parties, and not to accept the Offer, the total no. 3,309,900 shares held by the same ". The agreement with Delphine qualifies as a shareholders' agreement.

WHAT DELISTING REALLY HIDES

The motivations of takeover and delisting indirectly ring a death knell for the stock market. In fact, the Della Valle family “believes that the pursuit of these medium and long-term objectives is less easy while maintaining the status of a listed company, with the limitations deriving from the need to obtain results in any case subject to short-term checks”. As if to say that you grow in the long term better if you stay away from Piazza Affari: yet so far the opposite has been said. For this reason, there are those who think that since Tod's results will soon be negative, it is better to make the stock disappear from the stock market.

THE COMMENT OF SCOZZARI

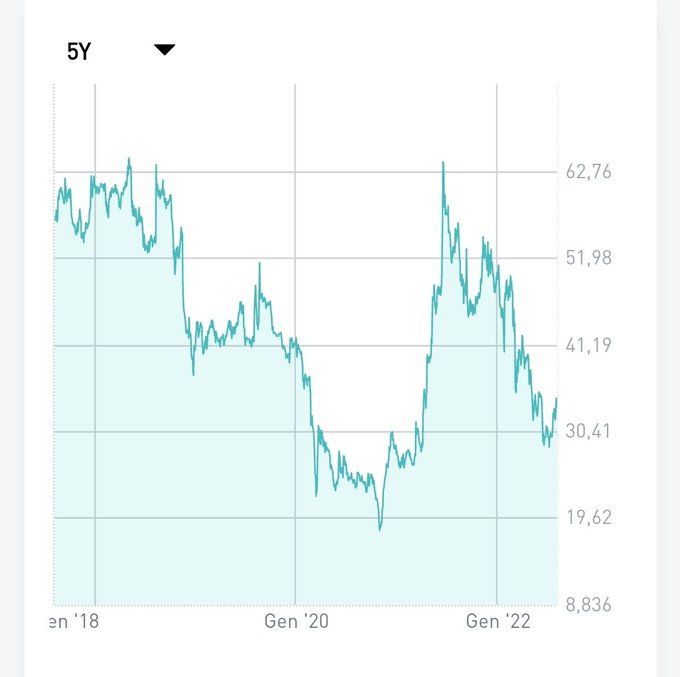

First comments also on values: "As for the offered price of 40 euros per share, in the last five years (see graph below, from Borsa Italiana), Tod's shares have largely exceeded 60 euros – noted Carlotta Scozzari , journalist on Linkedin Gedi – If we then wanted to extend the period to ten years, the shares were also above 140 euros. Of course, at the beginning of the pandemic they had collapsed even below 20 euros, but certainly with this move the Della Valle family is bringing the company home at prices that are, after all, advantageous. If they had waited a couple of months, could they have paid even less? Who can tell? There is no certainty of tomorrow ”.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/tods-il-delisting-e-le-furbizie-dei-della-valle/ on Wed, 03 Aug 2022 07:52:06 +0000.