TPL auto, the accounts in the pocket of the insurance companies at the time of the pandemic

In the last quarter of 2020, the average price of TPL auto drops to 379 euros. Ivass data and the criticisms of consumer associations

Insurance companies saved 2.1 billion euros thanks to the decrease in claims during the pandemic according to Ania.

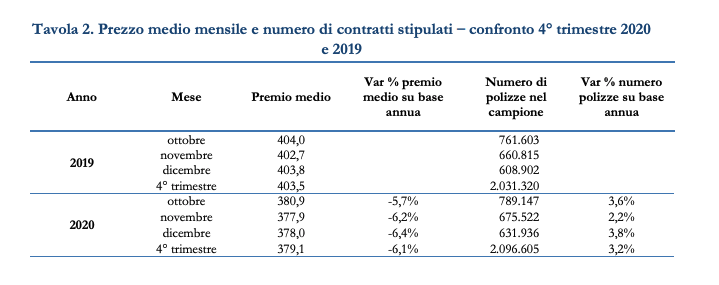

In the fourth quarter of 2020, the actual average price of the motor liability insurance was 379 euros, down by 6.1% on an annual basis (around 25 euros).Ivass notesthis in its statistical bulletin.

The price of the RC policy therefore falls but not enough according to the president of the National Consumers Union, Massimiliano Dona: “the lockdown should have caused the price of RC cars to fall”.

All the details that emerged from the IVASS report .

MOTOR TPL CONTRACTS INCREASE IN 2020

The number of contracts stipulated grew by 3.2% compared to 2019 while the "new risks", understood as new vehicles and / or new policyholders, decreased by 4.2% in the same period.

The premium differential between Naples and Aosta has fallen again, reaching 212 euros, underlines Ivass.

YOU SPEND LESS IN THE SOUTH CENTER

50 percent of policyholders pay less than € 339, 90 percent of policyholders less than € 594 and only 10 percent of policyholders less than € 206.

In the fourth quarter of 2020 the decreasing trend in the price for the motor liability insurance is confirmed with a reduction in the average price of -6.1 percent on an annual basis.

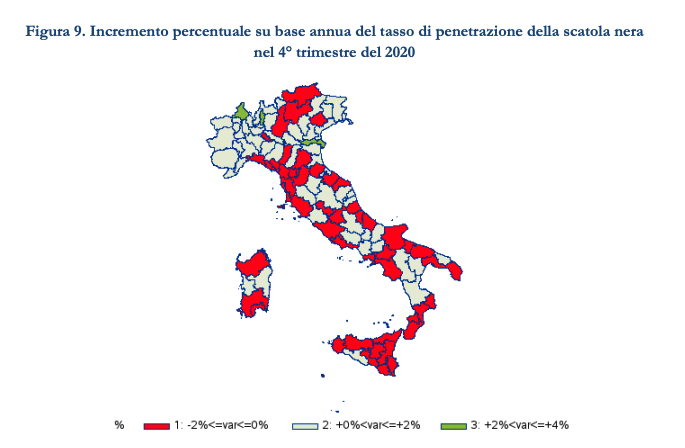

The reduction in the average price is more pronounced in the Center-South (Crotone -9.2%, Catanzaro -8.4%; Latina -8.1%) and in some provinces of the North (Bologna -7.3% Milan -7 , 1%), explains the Institute in the bulletin, adding that 23.1% of the contracts stipulated in the fourth quarter foresee a reduction in the premium linked to the presence of a black box.

HOW MUCH YOU SAVE WITH THE BLACK BOX

The discount linked to the black box alone varies between 9 and 11% and is higher in the South, where the premiums are generally higher.

Companies that do not have a black box have a cost of claims to premium ratio that is roughly 15 percentage points higher than companies that have at least 50% black box contracts.

“The penetration rate of the black box varies from 67.4% in the province of Caserta to 4.6% in the province of Bolzano”, highlights Ivass.

THE FREQUENCY OF CLAIMS

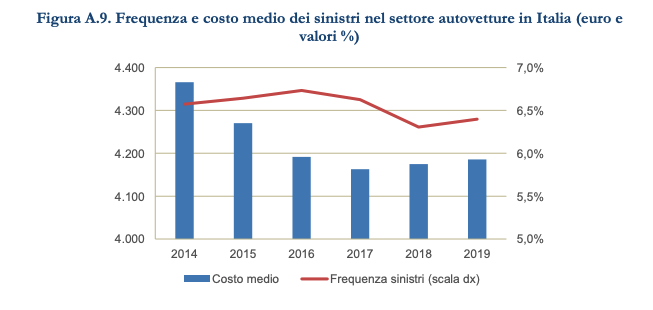

The average frequency of claims is stable at around 6.4% (7.1% in central Italy and 5.6% in the North-East), concludes the Supervisory Institute.

In the last year, against a frequency of claims remained stable (6.4% in 2019, 6.3% in 2018), the cost of the same amounted to 4,186 euros, 0.3% more than the last year; this average cost was 4% higher in 2014, when the frequency of claims was 6.6%.

NOT SUFFICIENT REDUCTION IN CAR TPL PRICE ACCORDING TO THE NATIONAL CONSUMER UNION

"The lockdown should have plunged the price of RC auto". This was stated by the president of the National Consumers Union, Massimiliano Dona, commenting on the IVASS data. "We recall that, again according to IVASS, between February and November 2020 there was a decrease in claims of 35%, equal to savings for insurance companies of between 2.5 and 3.6 billion euros that should have been produce a reduction in the motor liability insurance premium of at least 70 euros ”concludes Dona.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/smartcity/rc-auto-i-conti-in-tasca-alle-assicurazioni-al-tempo-della-pandemia/ on Sun, 28 Mar 2021 14:01:02 +0000.