US earnings growth will worsen. Analyses

The earnings season presents a possible catalyst for a renewed weakening of equities. In the second quarter, we expect US earnings per share (EPS) growth to continue to decline. The analysis of Tom Nelson, Head of Asset Allocation Portfolio Management and Miles Sampson, Senior Research Analyst of Franklin Templeton Investment Solutions.

The "running with the bulls" is a traditional event that takes place every summer in Spain and involves running in front of a group of bulls that have been let loose in the closed streets of a city, usually as part of a summer festival . Part of its appeal is the activity's inherent danger: miscalculations and timing could land you on the wrong side of a bull's horns.

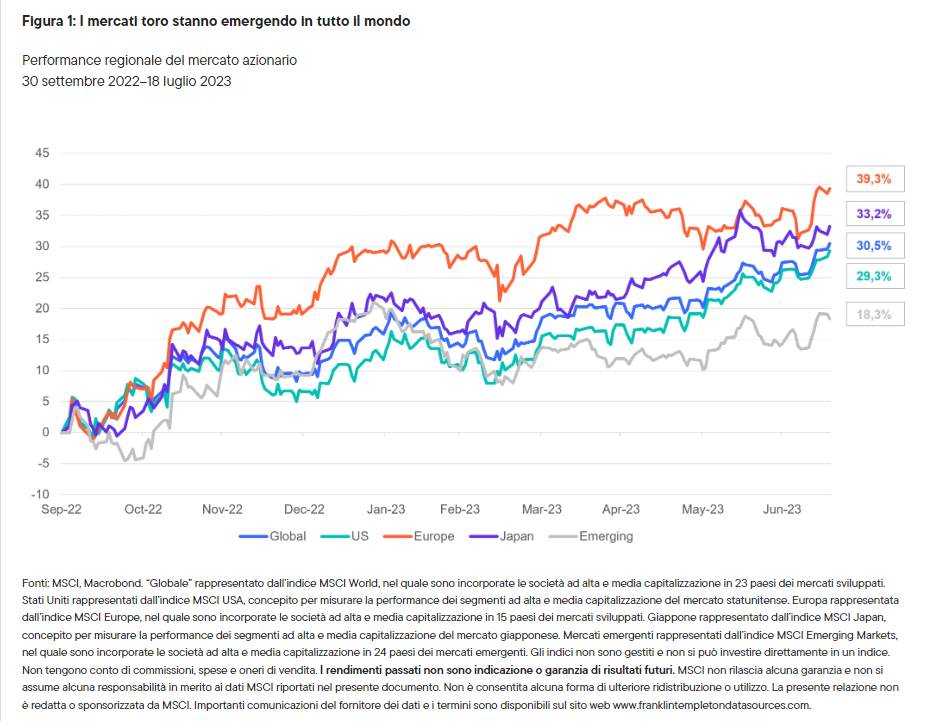

After the stock market fell to all-time lows in October, many regions entered a new bull market (Figure 1). As equity markets rallied, confidence increased and volatility decreased. A market that until then was obsessed with the risk of recession seems to have quickly left it behind.

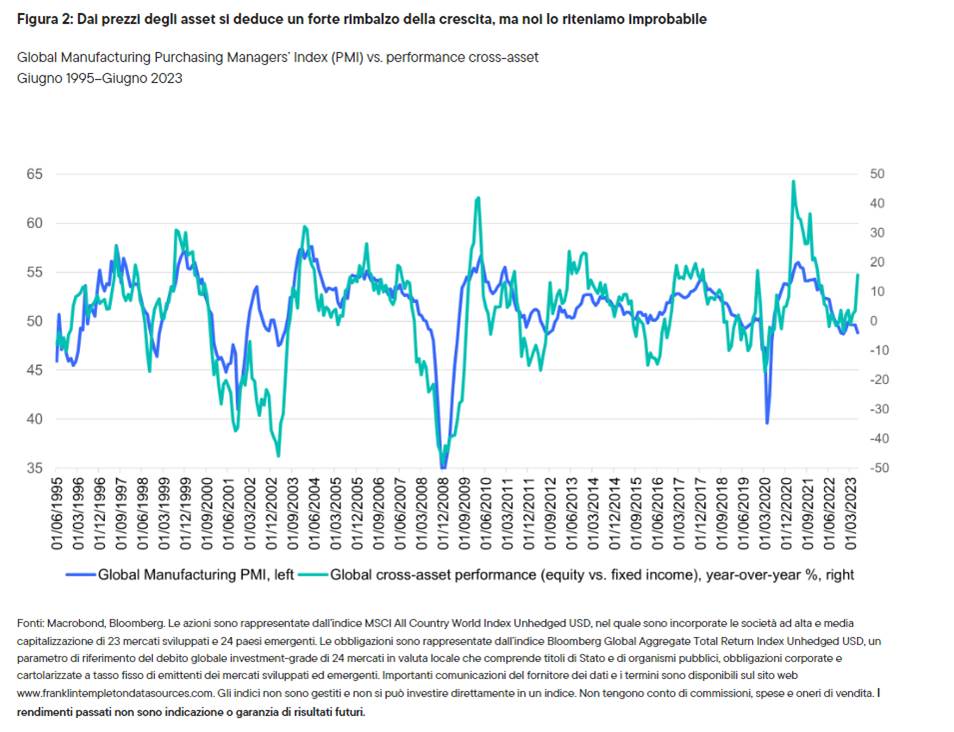

Trying to ride the current bull markets involves risk in our view. From asset prices it can be deduced that cyclical growth will not only remain positive, but will accelerate even more than the trend rate in the coming months. For our part, we believe this is unlikely, considering that central banks are still restrictive and the momentum of cyclical growth, apart from asset prices, remains subdued (Display 2). Our view is that for inflation to continue to normalize slowly, even bullish macro forecasts should include positive growth, but below trend.

IS THERE A CATALYST?

Tight central banks and weak growth momentum are nothing new; So what is the catalyst that could drive markets down in the near term? There are a few reasons why the upcoming earnings season will play a key role.

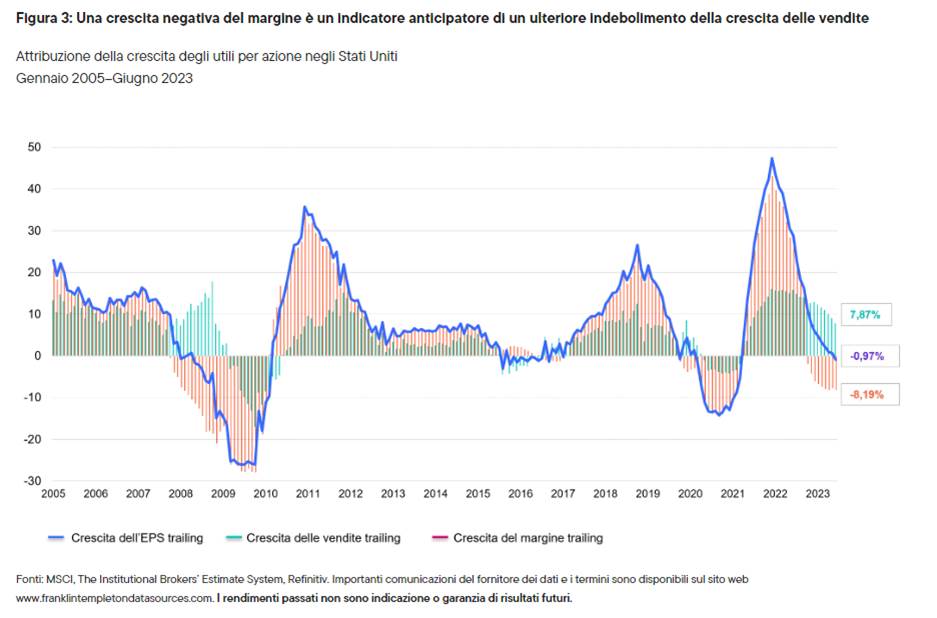

Earnings growth in the US could worsen. In the US, earnings margins fell 8% year over year, but a contraction in EPS growth was entirely negligible considering still strong sales growth. There are a few reasons why we expect this momentum to weaken going forward. First, profit margins routinely depress sales growth when earnings go negative (Figure 3). We expect that even if margins do not worsen, they will still remain weak. Second, a decline in inflation is contributing to a weakening of corporate pricing power. We expect inflation to continue to normalize, possibly stifling sales growth and reinforcing pressure on margins.

WEAK PROFITABILITY MAY LEAD TO WEAKENING OF LABOR MARKETS

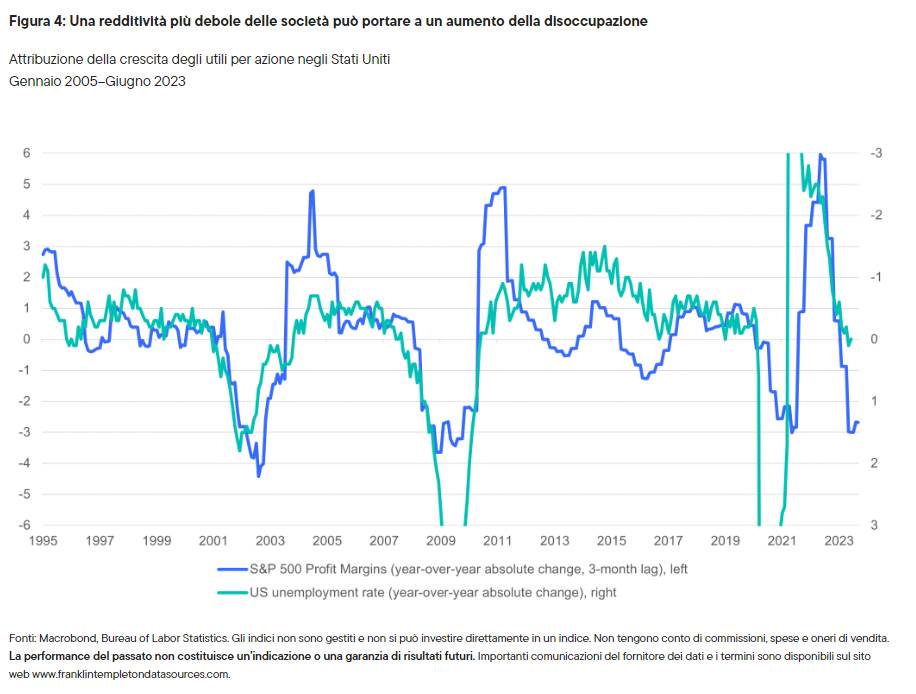

Resilient labor markets have underpinned equity markets, and this resilience by nature pushes back the likelihood of a recession, whereas labor market weakness is usually a prerequisite for a recession to occur. So far the strength of the labor market can be explained: companies entered the growth slowdown with profits at record highs and a low supply of workers.

Recently, however, there has been a correction of these factors. Profit margins in the US have fallen sharply, and earnings growth has turned negative. Job supply for full-age adults is currently stronger than pre-COVID levels. Indeed, many leading indicators in the US labor market suggest that some weakening has already begun, including a slight increase in initial jobless claims, a reduction in hours worked, weakness in hiring intentions, and subdued growth in envelopes. pay. We believe further weakness in earnings and profitability will further weigh on these employment trends.

MULTI-ASSET ALLOCATION: OVERALL PICTURE

In general, our tactical view calls for a defensive positioning of multi-asset portfolios; we currently prefer bonds to stocks. While our macro outlook supports this positioning, as we outlined, we also believe relative valuations support bonds. The equity risk premium, which measures the relative interest rate attractiveness of equities, is currently more supportive of government bonds. Cash is another more attractive option than equities, in our view. Many liquidity rates are close to cyclical highs and currently offer positive real yields – a rare occurrence in the last decade.

There are also various sentiment and positioning indicators that suggest that equity markets have overextended and are now poised for a downturn. With a growing number of investors increasingly confident in their ability to run with the bulls, we prefer to exercise caution. Going forward, we will continue to monitor leading economic indicators and company fundamentals.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/la-crescita-degli-utili-negli-usa-peggiorera-analisi/ on Sun, 27 Aug 2023 05:39:59 +0000.