War Ukraine, Alibaba, Fed and more: all the consequences on the markets

The geopolitical risks between Ukraine, the USA and China; new expectations on Fed Fund Rates; the case of European equity exposure; the collapse of Alibaba: here are all the impacts on the markets in the analysis by the BG Saxo Study Centre

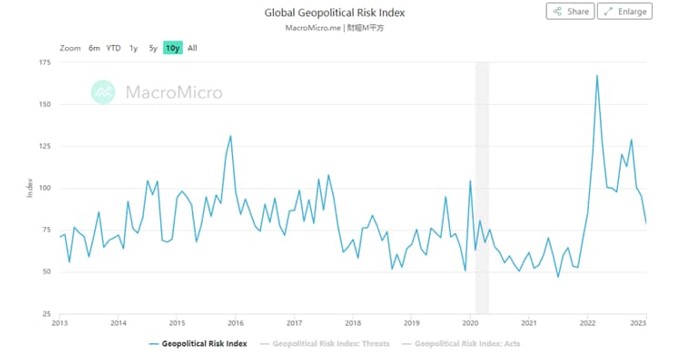

Geopolitical risks between Ukraine, USA and China

- US President Biden made a surprise visit to Ukraine on Monday to meet with Ukrainian President Zelensky on the first anniversary of the Russian invasion, declaring "unwavering support". Followed by a statement by Vice President Kamala Harrison about plans to accuse Russia of war crimes against humanity.

- Almost simultaneously, Anthony Blinken (former US National Security Advisor) said that the US has information that China is supplying weapons to Russia. While China itself tries to support its neutral stance on the war, State Councilor Wang Yi is ready to visit Moscow for a new peace proposal to end the conflict.

- As economic data suggests higher interest rates for an extended period and markets reassess the likelihood of a Fed pivot, geopolitical turmoil added further fuel to the fire with the S&P 500 down about 3.5% at the end of last year. week and safe haven trades such as the US dollar have all seen significant gains.

- China on Friday released a 12-point document outlining its position on a "political solution" to the war by calling for a ceasefire and a return to negotiations.

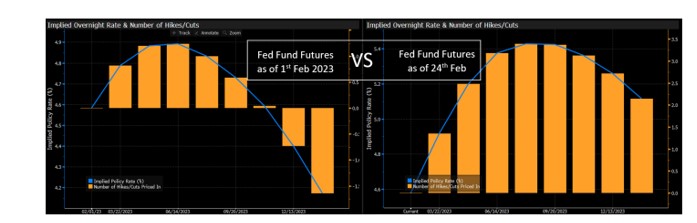

The new market expectations on the Fed Funds Rate

- Strong US economic data including CPI, PPI, retail sales, resilient jobless claims and improving Empire Manufacturing Index have been released in recent weeks. In addition to this, the talks of the Fed members which revealed the intention to continue with an aggressive policy which scared the market by lowering the probability of a Fed pivot.

- In addition, more positive data was released last week with the US February Preliminary PMI beating both expectations and previous data further easing recession fears.

- The FOMC minutes added fuel to the fire on Wednesday, despite being pre-January inflation data, sounding aggressive and suggesting there could be room for further escalation.

- The icing on the cake was Friday's PCE numbers, the feds' favorite inflation metric with numbers revised upwards. Personal spending was also stronger than expected for the month. These metrics tell us that there is still a lot of strength in the US economy and inflation is very sticky.

- Last week the market started to reassess its expectations on the Fed Funds Rate. At the beginning of the month, Fed Fund Futures were pricing in a rate spike below 5%. Last week that rate jumped to 5.29% and, following Friday's data, it jumped to over 5.40%.

- This is a sharp recalibration of market expectations with the US dollar seeing good strength, government bond yields surpassing year-to-date highs and risk aversion for equities. This, coupled with troubling geopolitical tensions, are leading investors to consider ways to protect their portfolio.

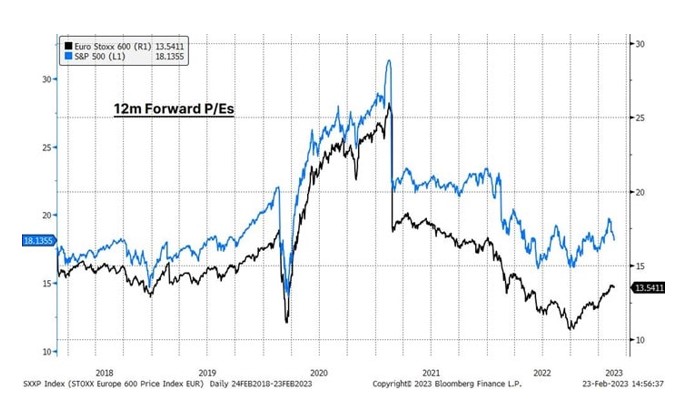

Diversification: the case of European equity exposure

- After a decent run since the start of the year, US stock indices are now in technical decline again. Fundamentally, the case for further rate hikes is strengthening and US equities are likely to remain under pressure from higher yields.

- The outperformance of European equities relative to US equities recently has also been driven, in the current high-inflation environment, by the rosier outlook for value stocks such as financials and commodities versus US heavy-weight indices. tech.

- The leading indicators for Europe have continued to strengthen since the beginning of this year. Lower gas prices and a faster-than-expected reopening of China significantly improved Europe's growth prospects.

- Despite the recent bull run in European indices, valuation still looks attractive. The Euro Stoxx 600 is currently trading at 13.5x forward P/E compared to its 10-year average of 14.4x.

Alibaba slumps, analysts cautious on sales growth

- Alibaba managed to beat third-quarter earnings estimates on cost-control efforts with a 69% year-over-year increase in net income while operating margin hits 14% versus 3% last year. It was the first earnings growth since 2020.

- Adjusted earnings per share of 19.26 yuan (on revenue of 247.76 billion yuan) was higher than the consensus of 16.63, reflecting sweeping cost-cutting measures. EBITDA grew 16% year over year on cost cuts and lower losses from Community market brand, Taocaicai.

- Cloud computing revenues rose only 3.3%, while China's commerce core business fell 1%. The eCommerce giant's ADRs closed 2.9% lower than Hong Kong's closing level amid management comments that it needed to ramp up investment to remain competitive in the year ahead.

- Competition against rivals JD.com and PDD is heightening as China's economy experiences a post-covid rebound, but executives have balked at the idea of price wars to fend off smaller competitors and expect a continued recovery in business. consumer activity.

- The BABA stock price is highly volatile: it has halved in value from $120 and then slowly recovered that loss over the past 12 months. The share price is down 23% in the past month and is currently trading at a forward P/E of 10.78.

Quarterly of the week

Monday 27 February 2023

USA: Occidental Petroleum Corp, Workday Inc, ONEOK Inc, Li Auto Inc, Zoom Video Communications Inc, HEICO Corp, BioMarin Pharmaceutical Inc, AES Corp/The Integrated Electric ,Viatris Inc, Essential Utilities Inc, Ovintiv Inc, Darling Ingredients Inc, Universal Health Services Inc

Canada: Ivanhoe Mines Ltd

Australia: Woodside Energy Group Ltd

Hong Kong: CLP Holdings Ltd, Xinyi Solar Holdings Ltd

Spain: Corp ACCIONA Energias Renovabl

UK: Bunzl PLC

Switzerland: Alcon Inc

Tuesday 28 February 2023

USA: Target Corp, Monster Beverage Corp, Sempra Energy, AutoZone Inc, Agilent Technologies Inc, Ross Stores Inc, HP Inc, Verisk Analytics Inc, Coupang Inc, First Solar Inc, Rivian Automotive Inc, JM Smucker Co/The, Rocket Cos Inc , Axon Enterprise Inc, Bentley Systems Inc, Builders, FirstSource Inc, Specialty Holdings Inc, Sarepta Therapeutics Inc, Endeavor Group Holdings Inc

Canada: Bank of Montreal, Bank of Nova Scotia/The

Austria: Erste Group Bank AG

Germany: Large Pharma

Italy: Moncler SpA, Saipem SPA

UK: Croda International PLC

Holland:

ASM International N.V

Portugal:

EDP Renovaveis SA

Spain: Aena SME SA, Ferrovial SA, Acciona SA

Wednesday, March 1, 2023

USA: Salesforce Inc, Lowe's Cos Inc, Snowake Inc, Dollar Tree Inc, Veeva Systems Inc, Horizon Therapeutics Plc, Splunk Inc, NIO Inc, Okta Inc

Canada: Royal Bank of Canada, National Bank of Canada. George Weston Ltd, Tourmaline Oil Corp

Singapore: Hong Kong Land Holdings Ltd

Hong Kong: Budweiser Brewing Co APAC Ltd, Techtronic Industries Co Ltd

Italy: Juventus

France: Eurofins Scientific SE

Germany: Beiersdorf AG

Portugal: EDP – Energias de Portugal SA

Spain: Cellnex Telecom SA

Switzerland: Kuehne + Nagel International A, Swiss Life Holding AG

UK: Reckitt Benckiser Group PLC

Thursday 2 March 2023

USA: Kroger Co/The, Dell Technologies Inc, Hormel Foods Corp, Hewlett Packard Enterprise Co, Zscaler Inc, Best Buy Co Inc, Cooper Cos Inc/The, AerCap Holdings NV, Burlington Stores Inc, Polestar Automotive Holding UK, Broadcom Inc, Costco Wholesale Corp, VMware Inc, Marvell Technology Inc

Canada: Toronto-Dominion Bank/The

Hong Kong: China Tower Corp Ltd

China: Yunnan Energy New Material Co

Belgium: Anheuser-Busch InBev SA/NV, Argenx SE

Finland: Fortum Oyj

France: Veolia Environnement SA

Germany: Merck KGaA, Hapag-Lloyd AG, Evonik Industries AG

Italy: Wireless Infrastructures Italy, Ferragamo

Friday 3 March 2023

Canada: Canadian Natural Resources Ltd

Germany : Deutsche Lufthansa AG

Italy : Acea, Azimut

UK: Jardine Matheson Holdings Ltd

BG SAXO Macroeconomic Calendar

Monday 27 February 2023

- Major Durable Goods Orders – Monthly – US (2:30pm)

- Pending Home Sales Contracts – Monthly – US (4pm)

Tuesday 28 February 2023

- Retail Sales – Monthly – Australia (01.30am)

- GDP – Monthly – Canada (2.30pm)

- Consumer Confidence Report – US (4pm)

Wednesday, March 1, 2023

- GDP – Quarterly – Australia (01:30)

- Manufacturing Purchasing Managers Index – China (02:30)

- Manufacturing PMI – China (02:45)

- Manufacturing Purchasing Managers Index – Germany (09:55)

- Unemployment Change – Germany (09:55)

- Manufacturing Purchasing Managers Index – UK (10:30)

- Speech by Gov. From the BoE Bailey – UK (11:00)

- GDP Italy (annual change) – (12:00)

- CPI in Germany (14:00)

- ISM Manufacturing Purchasing Managers Index – US (16:00)

- Crude Oil Inventories – US (4:30pm)

Thursday 2 March 2023

- CPI – annual – Europe (11:00)

- Inflation Italy (monthly change) – (11:00)

- ECB publishes minutes of monetary policy meeting – Europe (1.30pm)

- Initial Jobless Claims – US (2:30pm)

Friday 3 March 2023

- Composite PMI – UK (10.30am)

- Service Sector Purchasing Managers Index – UK (10.30am)

- UK Composite PMI (10.30am)

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/mercati-outlook-bg-saxo/ on Sun, 05 Mar 2023 08:29:00 +0000.