What are the effects of the Fed on the dollar?

Because the dollar is not that weak despite the Fed's action. The analysis by John Hardy, head of FX Strategy for Bg Saxo

The Fed's liquidity flow and some of the distortions it is creating in the markets are often discussed at this time, including what are likely unreliable signals, such as the 2-year Treasury bills auction a few days ago. it was heavily overridden and resulted in a yield close to 0.15%. On the surface, this would suggest market confidence which sees the Fed as unlikely to achieve rate hikes in the next couple of years. But in reality, it may just be a side effect of the overshoot linked to its asset purchase programs.

The Fed has stated that it is unwilling to decrease the stimulus in any of these programs for now fearing that it will destabilize confidence on the one hand and, on the other, that it worries that it has no idea what the economy will look like once the effects of the pandemic will begin to wear off.

The US dollar has weakened slightly over the past few days, partly due to a slight lack of the consumer confidence report and the larger shortfall on new home sales, but given the context, it is somewhat surprising that it is not yet. weaker.

This may be because most other currencies have failed to provide noteworthy yield compensation (note that German Bund yields are also veering down) and that energy was not affected by the movement. commodities in recent weeks, aided by China's efforts to crack down on what it sees as excessive domestic speculation. Those countries where central banks have bothered to indicate a trend towards tapering have seen their currencies rise, such as Norway earlier this year and more recently New Zealand, or Canada, which has actually tightened. politics with its tapering announcement on April 21st.

Other countries are using the Fed's playbook to express extreme caution, so it's hard to get the kind of differentiation that some of the smaller central banks in some of the developed countries mentioned above have provided. The gold that has risen in recent weeks, however, reflects the general concern that the Fed is conducting too accommodative policy and that other central banks do not want to be caught in a competitive devaluation game.

Another lower phase in the US dollar may require commodity prices to resume – especially the big kahuna – crude oil, which peaked in early March before its long, albeit relatively superficial, consolidation. . The two most likely things that could increase market volatility are: (1) the Fed finally capitulating and needs to send a signal and (2), a huge break-out of the higher price that sets the dynamics of the market in motion. 'inflation.

As long as the Fed continues to spread the message of transient inflation, the risk of a correction and capitulation rises precipitously, as the Fed's dovish message has led to risk appetite in every type of asset, from equities to the search for yield. in corporate credit, EM and really, everywhere.

Chart: NZDUSD

The New Zealand dollar jumped higher after the New Zealand central bank's new forecast that rate hikes could be set as early as mid-2022. The contrast with Fed and RBA guidance has pushed the dollar up sharply against USD and AUD. Note that the New Zealand dollar has broken out of the local resistance and only the top of the cycle at 0.7465 remains as the key resistance, furthermore one has to see a larger sell-off in the dollar to believe that something important is still going on. Note that New Zealand Central Bank Governor Orr is very willing to play competitive devaluation games and will be quick to come up with rhetoric to counter this.

Elsewhere, the market isn't exactly sending out signals outside of the clear enthusiasm for gold. The USD US Dollar / Jen Japanese JPY chart is hopelessly trapped (JPY supported by low yields, but the search for yield elsewhere is a contradictory signal), the AUD Australian Dollar / USD US Dollar chart has been so for even longer, and the EUR Euro / SEK Swedish Krona, which remains range-bound, suggests that the market is in trouble and is not generating enough excitement about the EU outlook and inflation to send the SEK through the 10.00 level (for those who believe in a movement in both directions, the long-term volume of the EURSEK is becoming more and more affordable, if it never was). The pound cannot find new momentum against the US dollar and the list goes on. Bottom line: The outlook looks quite negative for the US dollar, but its inability to experience a major downside contraction should scare the bears.

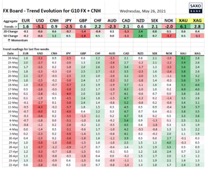

Table: FX Board of the G-10 + CNH evolution and strength of the trend

Note the jump in the dollar jumping to the positive, although it will still take days of rally for a broader trend to emerge. Gold is extremely positive and could soon be overloaded and very sensitive to any return of safe haven returns.

While the headlines speak of the USD US Dollar / CNY Chinese Renminbi falling to new cycle lows, the signal is still rather weak for the CNH Renmimbi Yuan overall, showing that this development is more about USD weakness.

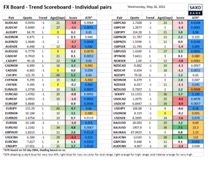

Table: FX Board Trend Scoreboard for individual pairs

Here, note the strength of USDCNH, which looks impressive and is not the result of a giant move, but rather the steady decline in price action since the pair peaked in early April. Unsurprisingly, the XAU USD trend reading is the strongest on the scoreboard. Note that AUDUSD and USDNOK are looking to enter a new dollar bearish trend – they need a strong move for confirmation.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/fed-dollaro-effetti/ on Sun, 06 Jun 2021 06:00:50 +0000.