What Central Banks Do About Digital Money

Digital currency will be the most relevant financial innovation of our time. Maurizio Sgroi's analysis for Aspenia

With a startling acceleration, the big central banks have begun to define the contours of what will be the future Central Bank Digital Currency (CBDC). On 9 October, the Bis of Basel, which is a sort of super central bank of the world, published a document that collects the contributions of seven central banks (Bank of Canada, European Central Bank, Bank of Japan, Sveriges Riksbank, Swiss National Bank , Bank of England, Fed) which lists the characteristics and requirements of a CBDC, without expressing preferences for a particular technical physiognomy.

THE RACE TO DIGITIZATION OF MONEY

However, significant information has reached the markets: the central banks of advanced countries are willing to proceed in a uniform manner in what will probably be the most important financial innovation of our time: the digitization of banknotes.

Also on October 9, the Bank of Japan published a paper on its website to justify the reasons for adopting a digital yen. On October 13, however, it was the turn of the Bank of Russia, which published a consultation document , which already illustrates in the premises the Institute's intention to proceed with the issue of a digital ruble. Even before the publication of the Bis, on 2 October, the ECB had published its report on the digital euro, just on the day when the European Council was talking about the "strategic autonomy" of the EU. Coincidence not to be underestimated.

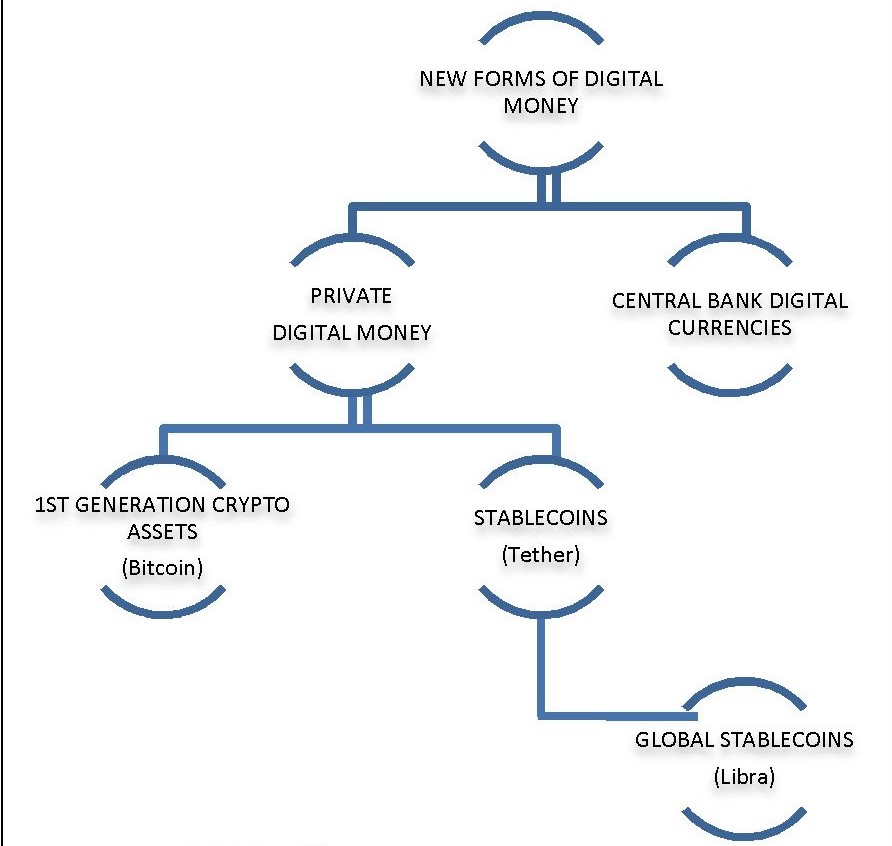

Last, but certainly not in order of importance, the International Monetary Fund published on October 19 a study (" Digital money across borders, Macro financial implicatons ") which focuses on some characteristics and peculiarities of digital currencies, starting with the distinction between one CBDC and one Global Stable Coins (GSCs). The latter is a payment instrument, usually issued by a large hi-tech company, which is designed to be "stable", therefore perhaps anchored to a basket of currencies, therefore different and distinct from crypto currencies such as Bitcoin subject to considerable volatility. The best known example of GSCs is certainly the Libra announced by Facebook.

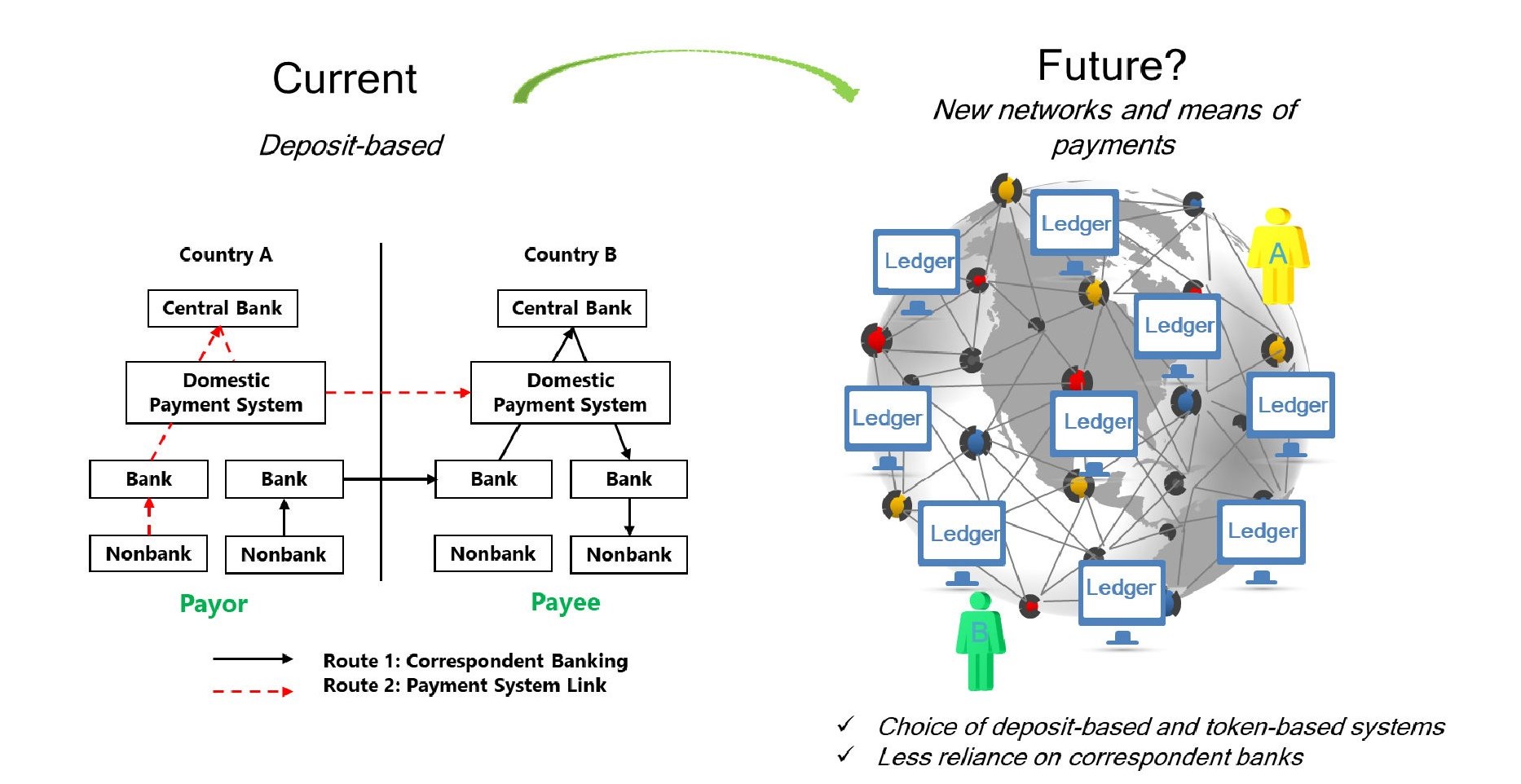

Why the IMF is interested in dealing with this matter is explained by the study already in the first pages: "The digitization of money and payments can generate a shock in the international financial system". The reason is obvious: thanks to these technologies, “making a payment abroad could be as simple as sending an e-mail”.

Digital currency terminology. Source: IMF.

Digital currencies, and in particular CBDCs which are the ones with the greatest “systemic” profile, seem to be a topic for insiders, and certainly they are from a technical point of view. But this is not the case with regard to practical outcomes. The entry of a central bank digital currency into the wallet of each of us is capable of marking a profound revolution in everyday behavior and a substantial transformation of the payment system. Wanting to draw a historical parallel, the importance of the diffusion of a central bank digital currency is comparable to the development of the circulation of banknotes and the diffusion of bank deposits.

The news helps us to understand the extent of this change. China's central bank recently issued its first digital yuan by drawing lots to residents of certain cities. With these tools, they will be able to make their purchases in the commercial circuits involved in the project, which they see among the giants of e-commerce and the Web . A first step, but of great importance.

TECHNICAL COMPLEXITY, SYSTEMIC IMPORTANCE

In fact, the CBDCs on which we are working foresee that these means of payment are also widespread among citizens for everyday needs. It is therefore a systemic tool destined to change economic habits at all levels, from the simple consumer to the large company, interfering in the payment system from the local to the cross-border level, especially in the era of great acceleration of e-commerce that we are experiencing. .

But what is a CBDC? A few technical premises are enough to deepen the meaning of this innovation. Let's start with a definition taken from the Bis document. A CBDC is a central bank money in digital format, therefore de-materialized, different from the balances of bank reserves. It is denominated in the national unit of account, and is a direct debt of the central bank to its owner.

What does it mean? Central banks issue two types of money, which correspond to their direct debt, therefore recorded in their balance sheets, and support the circulation of a third type of money which is instead a direct debt of the issuer, i.e. the commercial banking system . The two coins issued by the central bank are cash, i.e. physical banknotes, and the deposits of commercial banks which play the role of bank reserve. Physical cash is accessible to all and is exchanged directly between the parties for all economic transactions. Bank reserves circulate only among credit institutions.

The third type of money is what we can define as "private money", ie that generated by the banking system through deposits to the public. The central bank supports the "monetary" activity of commercial banks in many ways. For example, it holds their reserves and allows their settlement in central bank money, also functioning as a lender of last resort. But the debt of "private money", which corresponds to a credit of the holders of the deposits, remains with the institutions that issue it.

DIGITAL CURRENCY OF THE FOURTH KIND

A central bank digital currency would in fact be a fourth type of money. Just like a banknote, it would be a direct central bank debt to its holder, but it would be completely de-materialized without being a bank reserve. This means that in order to issue such a payment instrument, the central bank must favor the birth of an ecosystem in which entities operate who manage the data that make up the "digital banknote", provide and maintain the applications necessary for their circulation, and create points access to the economic system that accept these tools. A digital currency would be useless if there was no possibility to spend it.

From this point of view, a CBDC, unlike any “ stable coin ” or a crypto currency, having a central bank behind it, is naturally destined to have an audience of users. Everyone knows what a euro is without needing too many explanations. Only one niche knows about Bitcoin or Libra.

What changes in practice compared to today? The construction of an ecosystem that allows the circulation of CBDCs implies first of all that a citizen can have digital money, just like today with analog money, even if he does not have a bank account. It is sufficient that it has a means capable of storing its dematerialized currency. Something, in the age of smartphones and apps, is certainly not a problem. It is sufficient that the analog money is converted into digital money and deposited in the user's wallet . A bit like you do now when you top up your phone by buying a card in cash from a retailer. It is certainly no coincidence that telephone companies look, and sometimes participate – in the Chinese case but also in the original consortium of Facebook's Libra – in research on CBDC and innovative payment tools.

OPPORTUNITIES AND RISKS

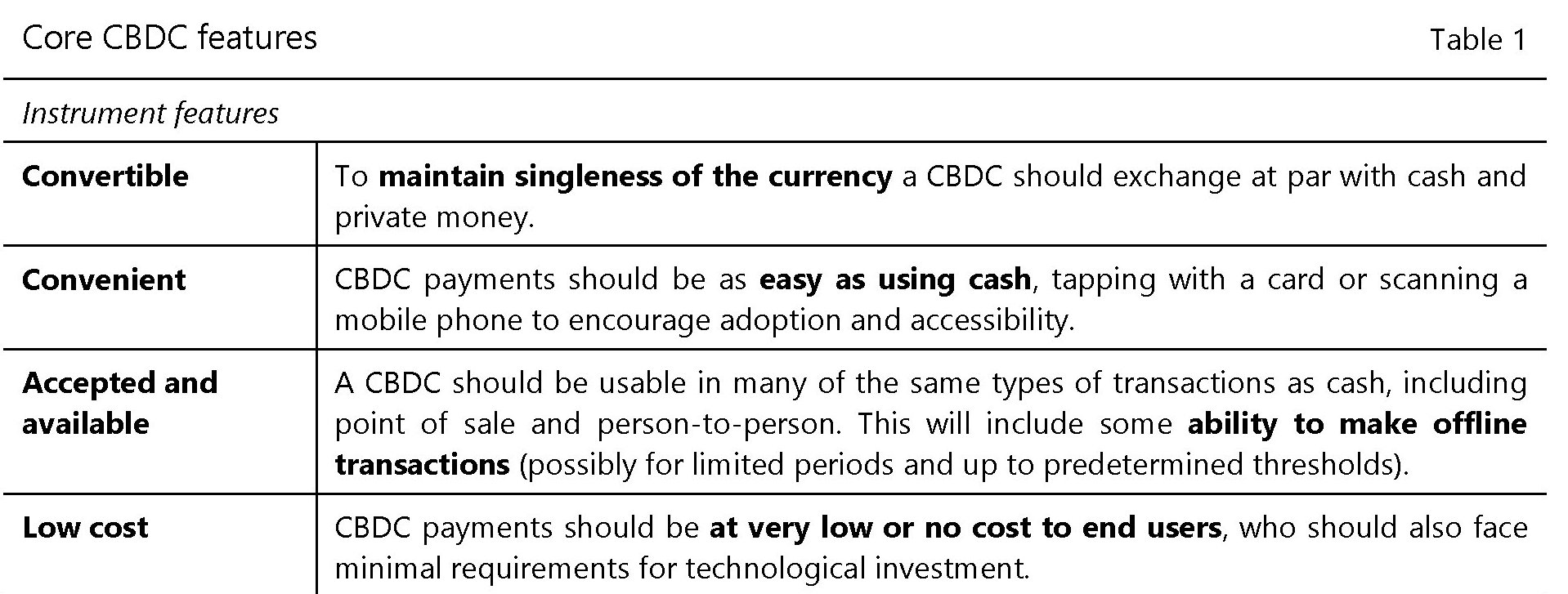

A CBDC, therefore, is the ideal tool to promote financial inclusion, "capturing" hundreds of millions of people who still do not have a bank account – it is estimated that 50% of the inhabitants of Sub-Saharan Africa, North Africa and the Middle East is outside the banking system – and massively introducing them into virtual markets without the need for a credit or debit card, therefore with conceivable benefits on the economic system. Unlike other digital payment instruments, which remain confined to the marketplace of the issuer (any stable coin or a Bitcoin-like crypto currency), central bank money would be accepted everywhere. The table below, taken from the Bis paper, lists some of its characteristics.

There is obviously no shortage of complexities. Aside from the technical issues, there are risks to financial stability, which could be compromised by poorly designed CBDC. Furthermore, there is the whole universe that revolves around privacy. A digital banknote, unlike an analog one, is theoretically fully traceable. It also depends on the choice between an “ account-based ” model and a “ token-based ” model. The first to work requires user identification, so for example that the wallet is linked to a verifiable digital identity. The second, that the object used for payment is verifiable. So a bank account is accont-based . A physical banknote is token-based .

Regardless, in the various documents released by central banks there is always talk of coexistence between digital and analogue money, at least as long as there is demand for physical cash. The latter is very different from country to country and has also changed as a result of the pandemic.

DOUBLE CIRCULATION, LIMITS AND PENETRATION

The health emergency, in fact, is one of the reasons that stimulated the acceleration of research and experimentation by central banks. The pandemic has not only increased the global share of electronic payments, but also raised the need to be able to get money directly to citizens without too many intermediaries. It is no coincidence that the Bis document also contemplates the possibility of "facilitating tax transfers". A very slippery matter though. "If the fiscal transfers were carried out with a CBDC – writes the Bis – there is the risk of blurring the boundary between monetary policy and fiscal policy, with a potential reduction in the independence of monetary policy".

Another effect of introducing a digital currency is to facilitate cross-border payments. A very central issue in the international debate, recently at the center of a document of the Financial Stability Board which set a road map in which the introduction of a digital currency could be strategic. And this brings us to the heart of the more purely political problem that impacts on international relations: can the adoption of a digital currency change the balance of the currency market? And in what way?

In general, it should be remembered that “the more liquid and developed a country's financial markets are, the more likely it is that other countries will use its currency”, for example “to denominate financial assets”, as the IMF recalls in its paper. At the same time, "the greater a country's share in world production and trade, the greater the likelihood that other countries will use its currency due to economies of scale." Finally, that "the status of an international currency is also influenced by the geopolitical relations between the issuing State and the countries that adopt and use the currency".

DIGITAL MONEY AND GEOPOLITICS ROUTES

Given this picture, we come to two recent facts. The first, to which we have already mentioned, is the ECB paper which, to the various reasons given for the adoption of a digital euro, also adds that of promoting the international role of the European currency. The second is a statement released to Reuters by a Japanese diplomat, alarmed by China's significant progress in its experimentation with a digital currency. "The first mover advantage is something we should be afraid of," said Kenji Okamura, Deputy Finance Minister for International Affairs. It is easy to understand the reasons for this fear. A well-designed digital currency that gives access to generalized markets can easily become a widespread payment instrument even in countries other than the one of issue. This means that a digital currency of one state can also spread to others if it is able to facilitate the lives of citizens. The "dollarization" of many economies, even if carried out with a traditional currency, illustrates this process well.

A widely trusted digital currency can have even more profound effects. One figure is enough to understand along which channels these effects can take place: the remittances of immigrants which, according to the IMF, exceeded 550 billion dollars in 2019. A figure higher than the flows of direct and portfolio investments surveyed by international authorities . A digital currency capable of bringing down the economic cost of these transactions can easily change the currency preferences of the subjects making such transfers.

Probably also the ECB which, as President Christine Lagarde recently recalled, “is looking seriously at the digital euro” has made reflections of this kind. Digitizing the euro is not just about preventing other digital currencies from finding hospitality in Europe. But above all to "export" European currency outside the EU. In fact, a digital euro, unlike the yuan which is not yet convertible, can very easily become a payment instrument widespread at an international level much more than it is now, however, this objective being among the actions promoted by the Union as part of its strategic autonomy plan. And this leads us to another question: How will the United States act?

Fed president Jerome Powell gave an initial response during the conference organized by the IMF on the topic of digital currencies. For the Fed, it is more important to "do a digital currency well than do it first". Even if "we do not want to wake up one day and understand that the dollar is no longer a store of value because we have not realized that technology has surpassed it". The dollar still has a competitive advantage over other currencies, which stems from its position in the international system that governs current globalization. But even the Fed is clear that it is no longer enough.

Last August Lael Brainard, member of the Fed board (and apparently a candidate to lead the Treasury Department with Joe Biden), provided an interesting update on the state of the art of building a digital currency within the American central bank . "Given the important role of the dollar, it is essential that the Federal Reserve remain on the frontier of research and development of CBDC policies," he said. The aim is clear, central banks need to offer "a digital equivalent of cash", which works "as a complement" for the moment. And as "there continues to be strong demand for US currency," adds Brainard, "we remain committed to ensuring that the public has access to a range of payment options."

The American banker's speech came a few months after the publication of a white paper published by the Digital Dollar Project , a consortium born from the partnership between Accenture and the Digital Dollar Foundation that is carrying out an intense lobbying activity to get to the construction of a CBDC for USA. This activity culminated in the presentation by a US senator of a bill asking the Fed to “provide digital accounts (for example, digital wallets in dollars) to residents and citizens and to companies domiciled in the United States. Among other things, these accounts should provide specific banking services to eligible people who choose to deposit funds into these accounts, including access to Covid-19 aid payments. Note the reference – certainly not accidental – to Covid aid.

Then the Fed joined the consortium of central banks that signed the report published in early October by the Bis and the circle was closed. The US certainly does not want to give up its leadership role in the currency market, but will play this game within a shared framework, certainly strengthened by the result that comes from their current hegemony.

This does not mean that this transition is destined to leave unchanged the balances that currently make up the game of currencies. What we can define as " incumbent" , in fact, will have to contend with the growing competition from very fierce currencies entirely willing to exploit the advantage that comes from innovation. That's why the IMF comes to the conclusion that "the US dollar could remain the dominant reserve currency for the foreseeable future," while stressing that "digitization could allow for change to happen faster in the future than previously anticipated."

Citizens-consumers will be the first to notice. The digital currency that will fill their wallet will be the one they will use more and more massively. And it is by no means the same as the region in which they live. It may not even be a central bank currency, but a global stable coin .

One of the scenarios developed by the IMF foresees precisely the possibility of a multipolar system where not only large reserve currencies compete on the currency market, but also payment instruments issued by large technology companies, which can easily exploit their vast registry archives to generate digital citizenships, and therefore also monetary, completely de-nationalized, to remember the title of a book by Friedrich Von Hayek from 1976 – The denationalization of money . In this case, the challenge for monetary hegemony will no longer be just a matter for states.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/moneta-digitale-banche-centrali/ on Sun, 13 Dec 2020 06:17:42 +0000.