What does Arm do when it lists on the Nasdaq

Arm's initial public offering, with a valuation of more than $54 billion, is the largest of 2023. But what's special about its technology?

Arm Holdings, the British microchip design company controlled by the Japanese holding company SoftBank, raised $4.8 billion yesterday: its initial public offering – the shares will begin trading today on the New York Stock Exchange – is the largest so far in the 2023 , given that the company's valuation is 54.5 billion.

A HALF SUCCESS FOR SOFTBANK

For SoftBank – which removed it from the stock exchange after acquiring Arm – it is a halfway success. Last month, in fact, the group directly acquired a 25 percent stake in Arm at a valuation of 64 billion. However, last year SoftBank had reached an agreement with NVIDIA (another semiconductor heavyweight) to sell the company to it for 40 billion, which was later abandoned due to opposition from antitrust authorities.

THIS IS HOW ARM WILL BE LISTED

Arm, the British chip group, has set the price of the IPO on Wall Street at 51 dollars per share, against the range between 47 and 51 dollars previously hypothesized and rumors for a value of up to 52 dollars. As mentioned, the placement price values the group at 54.5 billion dollars, on a fully diluted basis, in what is the highest listing of the year on the American stock exchange. Trading will begin today on Nasdaq, where the company is listed under the ticker “Arm”. SoftBank, the sole seller of the offering, is expected to raise about $5 billion. The Japanese technology investor had planned to sell the shares at a price between $47 and $51 each. The negotiations will be followed carefully to evaluate the health of the IPO market, which has suffered a setback since last year: according to the Wall Street Journal, it is the slowest period for traditional IPOs on Wall Street since at least two decades, due to the increase in interest rates and inflation which have distanced investors from riskier choices. However, this is the largest IPO of 2023.

CUSTOMERS-INVESTORS

Many of Arm's main customers, including technology companies and chip manufacturing companies, invested in the initial public offering: among them Apple, Alphabet, Intel, Samsung Electronics, Advanced Micro Devices and the aforementioned NVIDIA.

WHERE DO ARM CHIPS GO

The microchips designed by Arm are inserted into many electronic devices: washing machines, smartwatches, drones, smartphones, computers. They are present in sophisticated data center servers, and even in cars.

Arm literally dominates the mobile phone market with a 99 percent share. This market, however, is in a phase of stagnation which impacts chip orders and ultimately Arm's sales, which fell to $2.6 billion in the year ended last March.

The company has room to expand into the cloud computing market (its market share is 10 percent) and connected cars (41 percent). Forecasts say Arm's cloud segment will grow at an annual rate of 17 percent between now and 2025, spurred by advances in artificial intelligence that have already made NVIDIA's fortune . The automotive segment, on the other hand, is expected to grow at an annual rate of 16 percent. Forecasts for the smartphone market speak of growth of just 6 percent.

What worries Arm investors is its exposure to China, given tensions with the West – with the United States, mainly – over supplies of advanced chip technologies. In fiscal 2023, sales in China accounted for 24.5 percent of the company's revenue (2.68 billion).

WHAT IS SO SPECIAL ABOUT ARM?

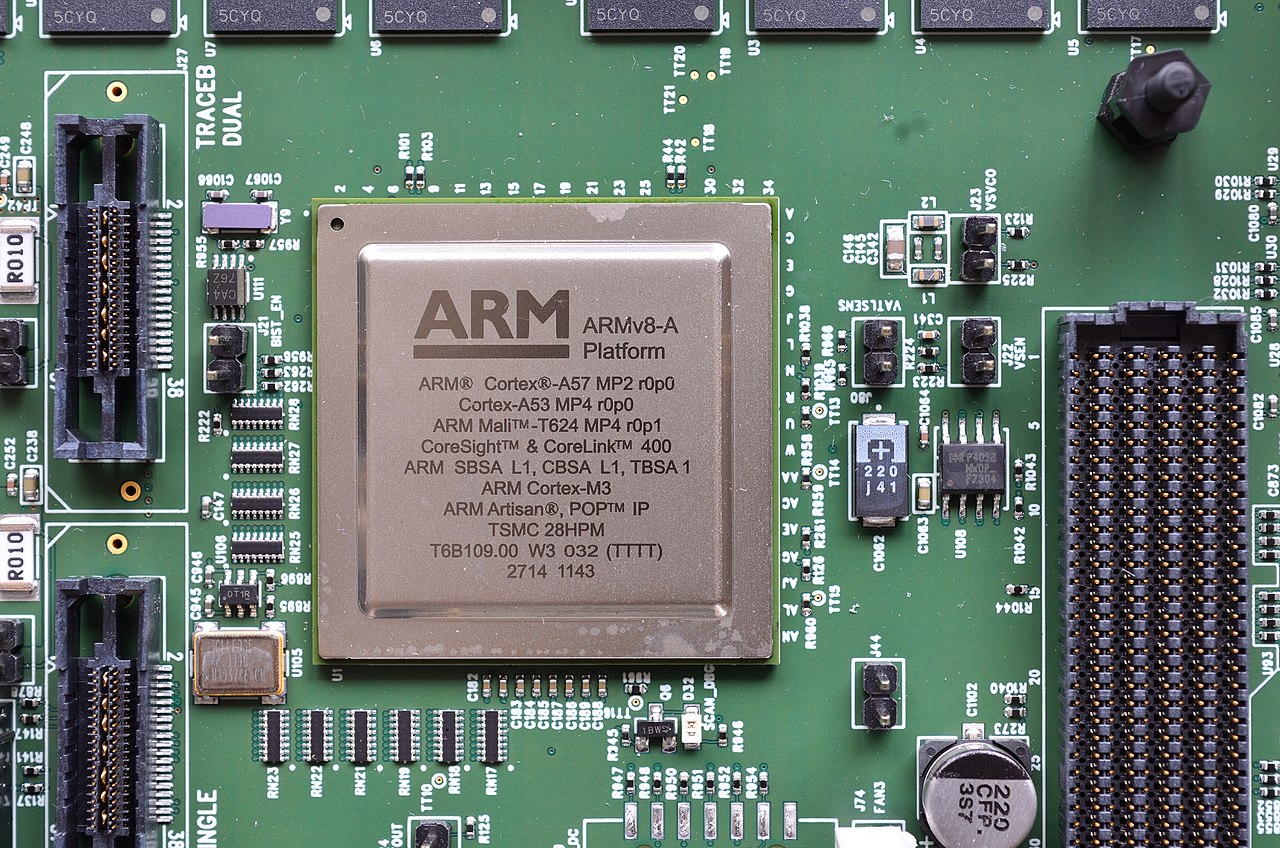

Worldwide, more than 240 billion microchips are made with Arm's technology. The interesting thing is that Arm does not produce its own chips: it does not own factories at all and has around six thousand employees (relatively few, for the sector). The company “limits itself” – so to speak – to the design phase and then licenses its designs to other companies, collecting a fee based on how many units are made with its models. Companies like Intel, for example, sell microchips that they both designed and manufactured.

The popularity of Arm is due precisely to its business model, explained the Economist , which removes the need for manufacturing companies to invest in chip design, a phase that requires very specific and advanced technical skills, also considering how these devices are increasingly becoming more complicated. As the specialized site ZDNET wrote, “Arm did the hard part for them [the companies that manufacture microchips, ed .]”.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/arm-quotazione-new-york/ on Thu, 14 Sep 2023 07:54:57 +0000.