What else will the Fed do?

Fed moves, announcements and strategies commented by Antonio Cesarano, Chief Global Strategist of Intermonte

The Fed therefore opted for an increase of 25 bps, keeping unchanged expectations for 2023 of a median terminal rate of 5.125%, i.e. a further increase of 25 bps on top of today's one.

In outlining future prospects, the Fed changed the previous sentence ("The Committee anticipates that ongoing increases in the target range will be appropriate") to "The Committee anticipates that some additional policy firming may be appropriate".

Powell also declared that the possibility of a stop to the rises was also discussed in the meeting held during the week.

Below are the Dots updated to the median in the March 2023 meeting:

![]()

Below, however, the Dots of the December 2022 meeting:

![]()

On the subject of regional banks, Powell said that the Fed is aware of the high concentration of their loans in the non-residential sector, adding: "Depositors should assume that their deposits are safe".

On this point, almost simultaneously, Yellen instead declared: "I have not considered or discussed anything having to do with blanket insurance or guarantees of deposits".

Furthermore, Yellen herself on the circulated hypothesis of raising the deposit guarantee threshold (currently $250,000) declared: “It's not time yet to say if FDIC insurance cap is appropriate”.

IN SUMMARY

The financial turbulence of the last few days has led the Fed to abandon the announced (just a few weeks ago) re-acceleration of the hike process with a higher terminal rate.

As Powell has explicitly stated, the maintenance of the expectations of the Fed members at levels equal to those of December is in fact a consequence of the fact that a part of the board has prudently already implemented in the scenario the possibility of more restrictive financial conditions as a result of what happened recently .

The Fed chairman himself acknowledged that a tightening of financial conditions would equate to rate hikes, thus suggesting that, if this scenario occurs, there will in fact be no need for many more hikes.

The 25 bp increase therefore appears to be partly attributable to the need to approach a terminal rate closer to 5% and partly also to the desire to signal that the Fed is not frightened by what happened, so as not to give an implicit alarm signal in the event of a total stop on the upside.

The base scenario therefore remains that of a terminal rate between 5.25/5.50% with a greater propensity at 5.25%, in consideration of the expectation that financial conditions will become progressively more restrictive after the recent turbulence, ultimately impacting on demand and progressively on the decline in inflation.

On the subject, QT Powell specified that the recent injections of liquidity have a different nature compared to the previous ones carried out through the purchase of assets.

However, these injections still represent an increase in the liquidity of the system.

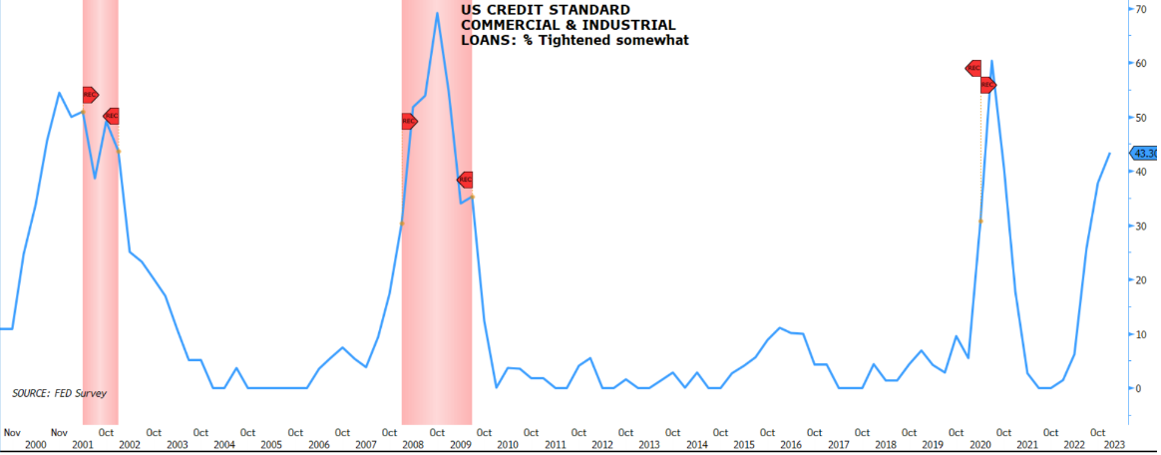

To this could be added the resumption of the downward trend in rates in view of a US recession induced by more restrictive financial conditions (mainly credit), amplified by recent events. Looking at the quarterly Fed surveys on this point, it can be seen that this process has actually already been underway for some quarters.

Over a 6/9 month horizon, these two factors could represent an element of support especially for the growth part of the share market, in the face of possible turbulence in the very short term, pending the arrival of a more structural solution on the banking front regional.

The market reaction initially took the form of a drop in rates and a rise in stock prices, Nasdaq in primis, above all after Powell declared that a pause in the hikes had also been discussed today.

Subsequently, Yellen's words (the extension of the guarantee to all deposits is not under consideration) took the stage away from Powell, partially denying the more reassuring words of the Fed president on this front, with rates remaining declining but stock exchanges in negative territory , on the resumption of fears for the evolution of the situation of US regional banks which, in the short term, still remains the main theme with a focus on the moves that will be implemented for the First Republic.

Thus summarizing the situation to date on the regional banks front:

- the liquidity issue was promptly addressed by the Fed;

- the topic of deposit guarantees: after the decision to guarantee total deposits by SVB , today Yellen denied the hypothesis of willingness to extend this guarantee;

- the capital shortage theme seemed to come up for the First Republic case, is waiting for a solution.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/che-cosa-combinera-ancora-la-fed/ on Sun, 26 Mar 2023 06:22:22 +0000.