What happens in the United States with inflation

US inflation is struggling to decline, with rents overheating the core part. Curated by Antonio Cesarano, Chief Global Strategist, Intermonte

In the US, inflation in August is above expectations (8.3% vs 8.1% expected), especially in the core part, reaching 6.3%, close to the record of 6.5% in March.

The consensus expected a more marked decline in general inflation (thanks mainly to the drop in the energy component) and a less strong increase in the core part.

More specifically, the above-expected figure was determined by:

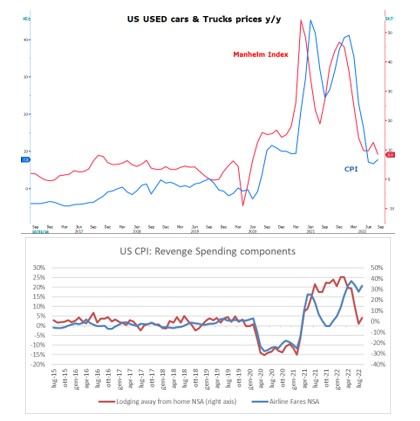

- a less pronounced decline in some categories (for example used car prices);

- curbing the decline in some categories of expenditure more linked to the post-pandemic phase.

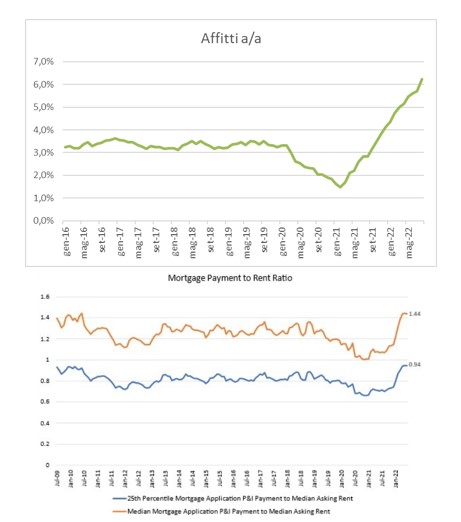

The rents component had a significant impact on the core part, weighing over 30% and continuing to show an upward trend (+ 6.2% y / y).

This is also because, at the moment, the median installment of the loan agreements stipulated in recent months is progressively higher and higher (thanks to the rise in rates) compared to the median rent, making the rent still relatively competitive with respect to the purchase of the home.

On the whole, these components balanced the negative contribution of the energy component (-5% m / m).

Looking ahead, some components could reverberate their effect with a certain delay (for example the price of used cars as shown in the graph). On the other hand, the decline in the important rents component is more difficult. A late variable par excellence, especially in a context of a markedly increasing loan installment / rent ratio due to the rise in interest rates. However, if we assume a constant trend in the monthly change in the CPI between 0 and 0.2%, at the end of the year inflation would gradually return to between 6.2 and 7.1%.

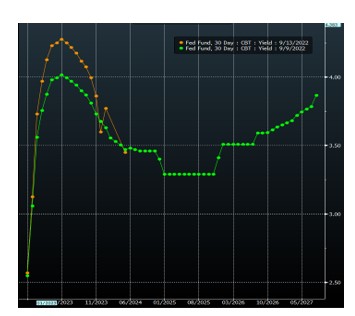

These considerations confirm the need for the Fed to proceed with the so-called frontloading , that is to accelerate the rate hike now to try to obtain a more marked brake on general inflation already at the end of the year. As a result, the assumption of a 75 bp hike on 21 September is consolidated.

Today's figure has led to the pricing of the Fed's final landing rate at 4.25% (from the previous 4%) during the first quarter of 2023, as evident from the following graph relating to the implicit rates in the prices of futures on Fed Funds.

In summary

The decline in US inflation is proceeding at a gradual pace, with the "thorn in the side" represented by the core part, influenced above all by the dynamics of rents, which could lead the Fed to consider the sale (given the absence of deadlines) of MBS securities to reduce this part of the budget as well, as reported for example by vice president Brainard.

Operationally:

- A sustained path of Fed hikes is already priced, canceling for the moment the discussion on the Fed pivot that had caught on over the summer. A theme that could return at the end of the year, provided that inflation is reduced towards the 6/7% area.

- In this context, between September and October US long-term rates could peak near the 3.5% area on the ten-year (level already reached last June) or slightly above, also thanks to the acceleration of the QT ( $ 60B of potential lower Treasury reinvestments on a monthly basis).

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/stati-uniti-inflazione-agosto-affitti/ on Wed, 14 Sep 2022 06:50:05 +0000.