What happens to gas prices?

The letter from Paolo Becchi and Giovanni Zibordi and the reply from Gianfranco Polillo

We read with interest: " Energy, all the lies about the causes of the price increase " by Gianfranco Polillo. Polillo argues against one of our articles, published on Nicola Porro's website and not in “Libero” as Polillo writes. As is known, after the change of direction of the newspaper it was no longer possible for us to publish in this newspaper (perhaps some extracts were taken from the newspaper's online site, without our knowledge).

As you can see by clicking on the link and reading the original article and in its full form, we are talking about the 15-fold increase in the WHOLESALE price (for companies) of gas and then electricity (largely produced with gas). Wholesale prices are what companies pay and are what have exploded since last summer. Families have contracts for gas and electricity which in large part, at least for now, protect them from market trends.

Polillo, who was Undersecretary for the Economy with Monti and is now president of ENEL Stoccaggi, speaks of "bizarre theses that are circulating" and countered by writing that domestic bills have increased, but much less or little. Which is another interesting question to address, but in the specialized business press, like the Financial Times or Bloomberg , they talk about the wholesale price, what companies pay and we were referring to that very clearly in our post.

The opinion that some companies that resell Russian gas are making bumper profits is very common on the financial market. It is not a bizarre idea, it is confirmed today by the ENI quarterly report which increased its net profit by 7 times. The bulk of ENI's business is oil which increased from around 70-80 to around $ 113 according to the quarterly report. Production dropped slightly. How did you manage to increase your profits from 1 billion to 7 billion in just three months? By reselling Russian gas at 10 times as much to Italian companies. This is our thesis, hoping that sooner or later someone will prove to us that we are wrong on this.

It can also be read on Bloomberg . Bloomberg 's energy expert, for example, Javier Blas, wrote: "it is interesting that there are European utilities (which resell gas from Gazprom) that are taking advantage of the war .."

and also “there are utilities that are“ making a killing ”in the current situation“.

The mechanism of the wholesale price of energy is such that European utilities mark the hourly selling price of their MW to EU consumers on the basis of a marginal auction, where the price for all is practically that of last quantity exchanged to close the auction. It is entirely possible that the marginal power station or power company in the EU is currently paying 'TTF'-like price levels for their marginal MegaWatts. But this is why other energy retailers, who enjoy the lower prices embedded in the contracts that regulate current inflows from Russia, may be doing what Bloomberg refers to as "making a killing," which is a lot of money. But the English expression includes "kill" precisely because it happens at someone's expense.

In our article we have not, for reasons of space, indicated the marginal auction mechanism with which the wholesale price is formed, but in essence it means that some pay the maximum price that is formed at the "TTF" market in Rotterdam where the liquefied gas from the US and others, on the other hand, pay a lower price than gas that arrives via the Nordstream1 pipeline from Gazprom.

The situation of supply and demand matters, but there are also speculative positions with derivatives that determine the fluctuations of prices on the Nymex market in the USA and also for some years on that of the “TTF” in Europe. These are derivatives, futures and options and swaps markets for which the fluctuations even month by month are due to pure and simple speculation, in turn due to liquidity on the markets. It is naïve to assume that every time the price makes a new high or low for the month, the fundamental supply and demand situation has changed. For example, natural gas in the US first exploded from $ 3.5 to $ 9.5 because liquefied gas exports to Europe increased due to the Ukraine crisis, but then plummeted to $ 5.5 by more than $ 5.5. 40% for a reduction in exports equal to less than 2% of production due to a problem with a terminal. These price movements, as well as the much greater ones now in Europe than gas on the market, mainly reflect speculation with derivatives. The quantities produced and consumed have minimal variations and prices explode by 300% in the USA and 1,500% in Europe! Much more can be written on this topic, we are only giving examples, but ignoring the huge role of speculation with derivatives on the markets is a mistake.

In Europe now with natural gas and then electricity, there is also a mechanism by which gas supplies are “indexed” to a derivatives market through which a very small quantity of the gas consumed passes. As we have explained, the reason why natural gas has movements now 5 or 10 times those of oil is that the gas market is that of liquefied gas that arrives by ship which is actually very limited and therefore more subject to speculation, while the oil market is in fact a real market.

However, the opinion that we have expressed in informative form for the public of an online site that has a good circulation is shared, as we have mentioned above, also by Bloomberg commentators and by CEOs of companies that consume a lot of energy, for example in tiles. either in concrete or steel. And that is, when the wholesale price increases tenfold and what Gazprom charges instead increases but much less, something is wrong. And if ENI simultaneously increases its profits seven times, should we be talking about speculation, or is it just a weird idea?

Dear Doctor Polillo, the answer to you. However, we thank you for the attention you have dedicated to us.

Paolo Becchi and Giovanni Zibordi

+++

POLILLO'S REPLY TO THE LETTER OF BEAKS AND ZIBORDI

I'm sorry for the oversight, in citing “Libero”, instead of Nicola Porro's website. I hope Paolo Becchi and Giovanni Zirboli don't want me.

On the merits of the question raised: it is obvious that the prices for domestic gas consumption and those paid by businesses are different; but the divergence cannot assume the dimension indicated in the article in question.

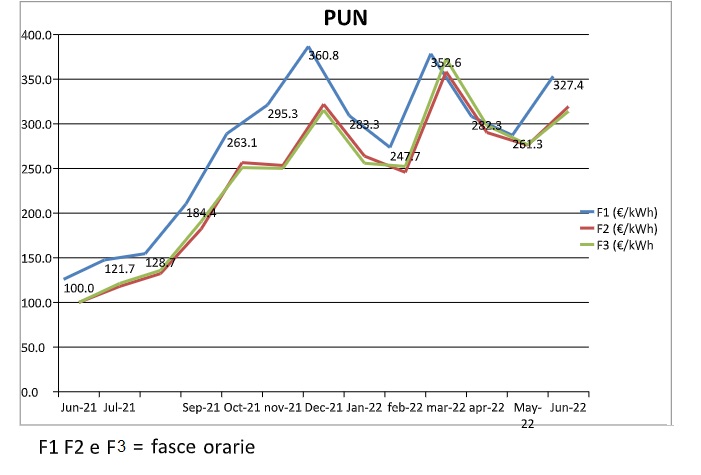

Attached is the graph relating to the PUN (acronym for Single National Price) which is the wholesale reference price of electricity, which is purchased on the Italian Power Exchange (IPEX – Italian Power Exchange).

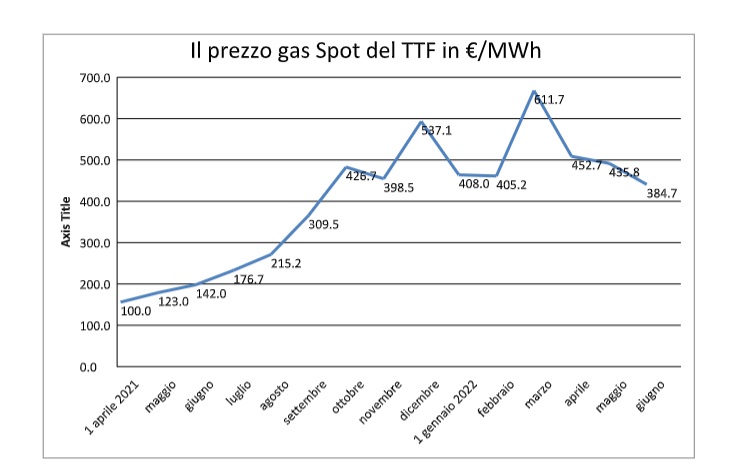

And that relating to the TTF (Title Transfer Facility), relating to the virtual market for the exchange of natural gas based in the Netherlands: one of the main reference markets for the exchange of gas in Europe.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/che-cosa-succede-ai-prezzi-del-gas/ on Mon, 01 Aug 2022 04:58:04 +0000.