What happens to inflation?

US inflation post Covid: consumption effect and bottlenecks. The comment by Antonio Cesarano, Intermonte's chief global strategist

Data on US inflation for April above expectations also in the core part, thanks to the sharp rise in various components linked to consumption, some of which are particularly emblematic of the various bottlenecks that are being experienced in the post Covid reopening phase.

Let me go in order: general inflation was above 4% even before May, when the comparison effect with last year could be even stronger.

The important rents component (weighing over 30%) recorded a limited increase given the context (+ 0.4% m / m).

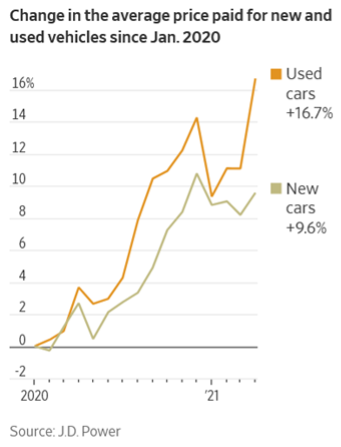

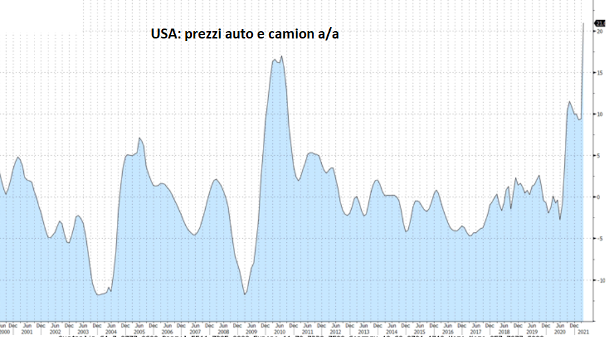

On the other hand, the sharp rise in the transport component, which recorded a + 2.5% m / m, impacted for about one third of the overall rise, mainly due to the very strong rise in the prices of used cars and trucks.

Reason for this strange phenomenon? Yet another impact of the chip shortage: the expectations for the delivery of a new car have become indeterminable and, consequently, potential customers are turning to the used fleet.

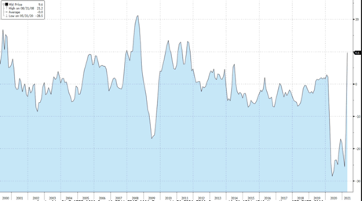

Another component that has marked a huge leap is that of air fares, as can be seen in the following graph in terms of y / y.

Fed member Clarida pointed out that inflation should fall within the 2% area between 2022 and 2023, adding that if the Fed believes that the rise in inflation should be read as non-transitory, then it will not hesitate to intervene.

All the more reason to increase the skepticism of the markets which by transitory must be understood not a few months but at least a quarter or more, also given the many bottlenecks that are emerging, including that of chips.

IN SUMMARY

Also in view of the inflation data for May (to be published in June), the scenario for the end of the half-year remains that of:

- Gradual rise in rates.

- Steeper curves in the US and the Euro area, with a more marked trend in the US.

- From this follows a potential appreciation of the dollar up to 1.16 / 1.18 area by June.

On the equity front, possible phases of turbulence, especially in the tech sector more sensitive to the rise in rates but with the parachute offered by the substantial buybacks, especially of the US companies which, in the first 4 months of 2021, announced buyback plans for about 480 billion $, the maximum amount for the same period of the last 20 years.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/che-cosa-succede-allinflazione/ on Thu, 13 May 2021 09:40:54 +0000.