What happens to Italian current accounts. Report Fabi

After four years of constant increases, in 2022 the total balance of household current accounts in our country decreased by almost 20 billion euros. What emerges from the Fabi report led by Lando Maria Sileoni on the current accounts of Italian families. Facts, numbers, comparisons and scenarios

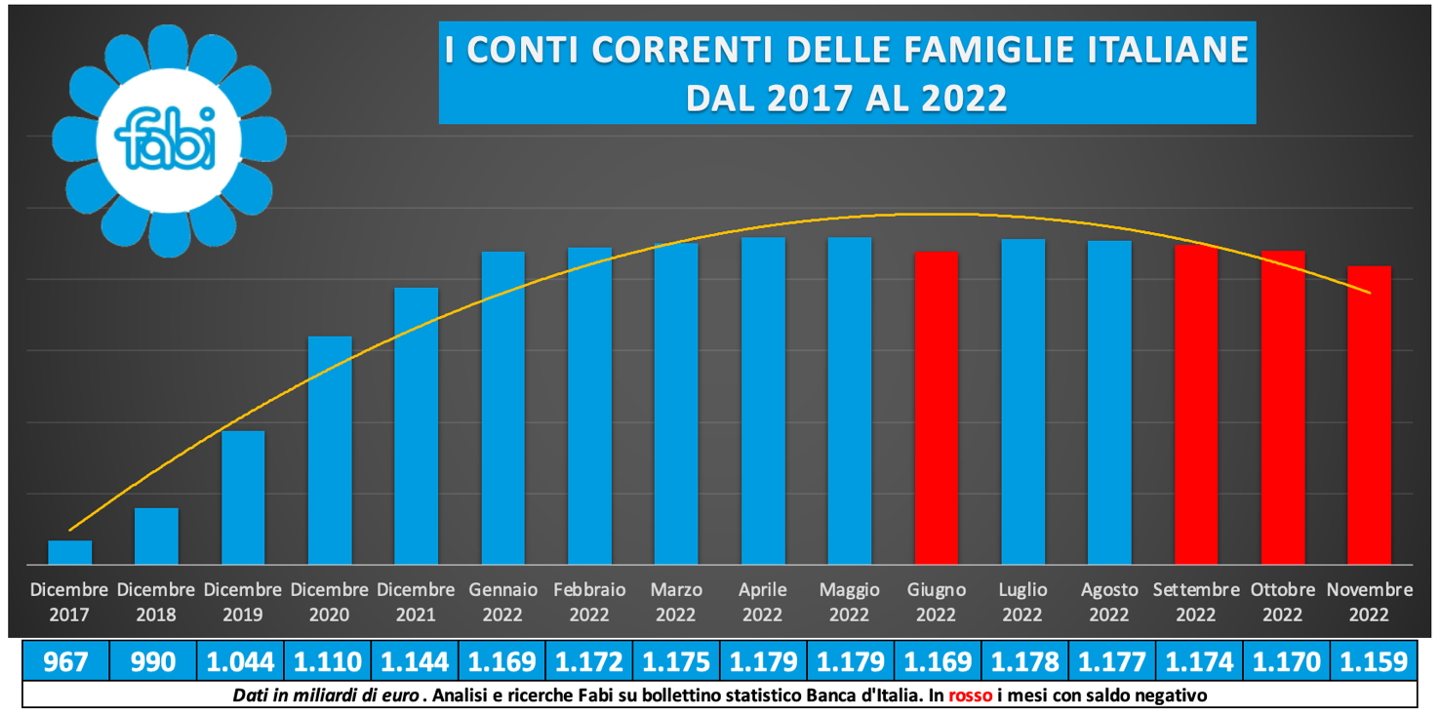

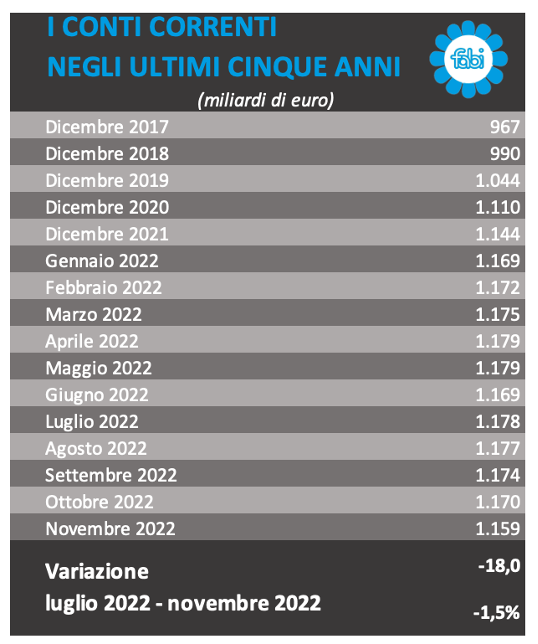

Inflation and the cost of living are inverting the saving trend of Italians: after four years of constant increases, in 2022 the total balance of household current accounts in our country decreased by almost 20 billion euros. From August to November there was, in fact, a drop of 18 billion from 1,177 billion to 1,159 billion, with a reduction of 1.5%. Already in June, compared to May, there was an initial decrease of 10 billion.

The conspicuous trend reversal in the accumulation capacity of account holders comes after a long period of increase in bank deposit balances: at the end of 2017 the total amount was 967 billion, at the end of 2018 it was 990 billion (+23 billion), at the end of 2019 at 1,044 billion (+54 billion), at the end of 2020 at 1,110 billion (+66 billion) and at the end of 2021 at 1,144 billion (+34 billion).

The data show almost five years of savings (since December 2017), but with a worrying change of course at the end of 2022: Italians' accounts have always grown and have exceeded 1,000 billion, with a tendency towards accumulation that has exceeded 212 billion euros (sum of savings accumulated from 2017 to May 2022).

The annual change was always positive and with a total budget of 1,044 billion at the end of 2019, 1,110 billion at the end of 2020, 1,144 billion at the end of 2021 and 1,179 billion at May 2022.

If in the first seven months of 2022 the liquidity accumulated by households almost touched 1,180 billion euros, with growth – albeit slower than in the past – of 0.9% since the beginning of the year, the data for the following four months confirm the fears , by now ascertained, of a collapse in purchasing power which forces Italians to draw on their reserves to meet the higher costs. From July to November, total current accounts fell by almost 20 billion euros. The total value was 1,178 billion euros in July and 1,159 billion euros at the end of November, with a reduction of almost two percentage points (-1.53%) and which demonstrates that the cost of the crisis is starting to be all in one's pockets Italians.

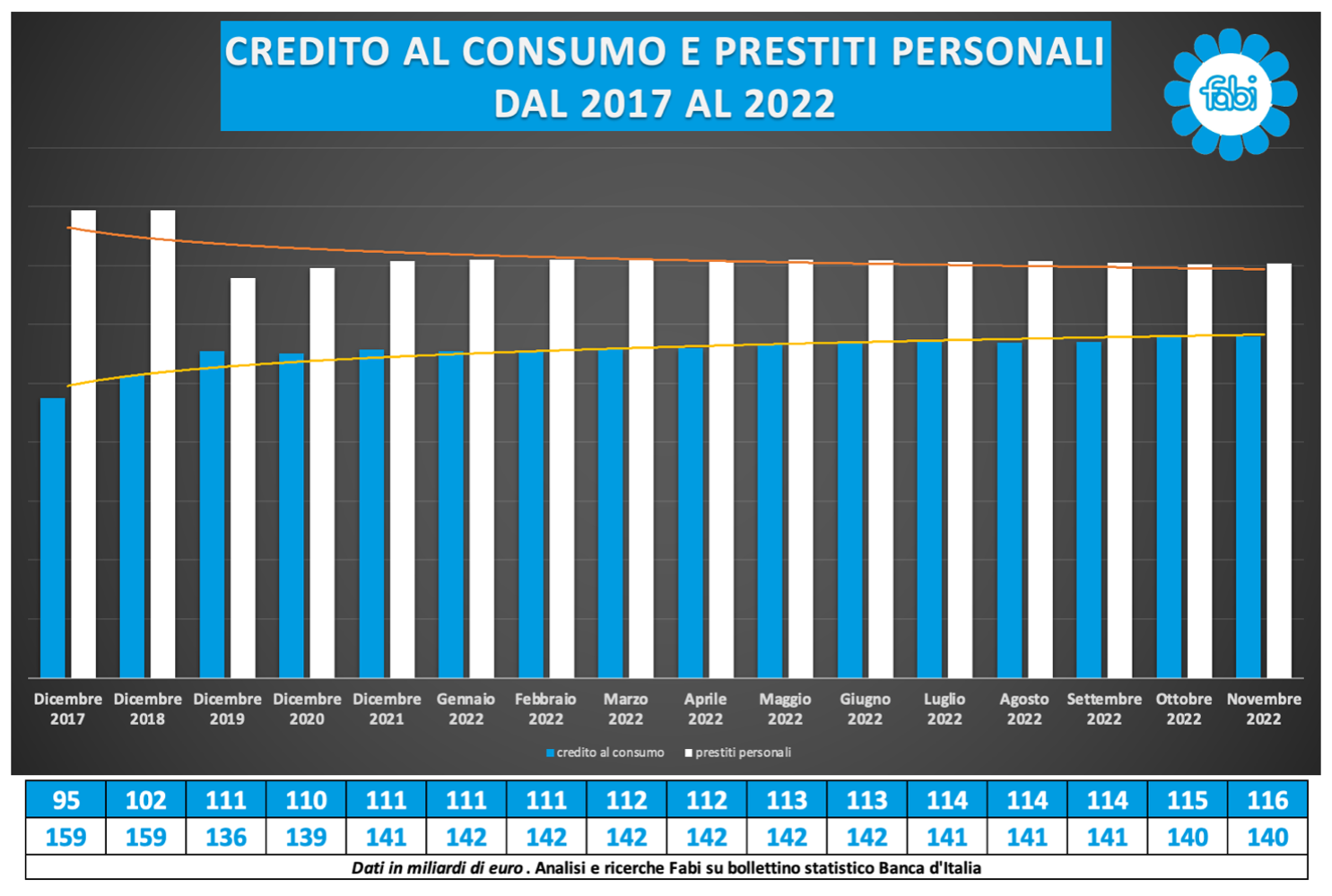

Confirmation of a difficult situation also comes from the trend of Italian household debts, which marks an increase in loans for consumption and the stability of loans for personal purposes. Overall, in November the amount of loans for both categories stood at 256 billion euros, up compared to January of the same year (+1.5%) and overcoming the trend of constant increase since 2017, equal to '1.2%. The growth numbers of the world of finalized and non-finalized loans come as a slap in the face compared to the market conditions, because it is certainly not the low interest rates that are driving requests, but rather the growing propensity to pay purchases in installments, which makes the relationship that Italians have with economy and savings contradictory. The sense of uncertainty and fear of those who do not give up liquidity or even expenses have made not only liquid deposits fly, but also loans.

In the last five years there has been an overall increase in personal loans and loans for consumer goods of 3.1 billion (+1.2%) from 253.6 billion to 256.7 billion: this increase largely regarded the loans aimed at the purchase of goods and services for 21.1 billion (+22.2%), and more than offset the reduction recorded on the side of loans aimed at personal expenses, which decreased by 17.9 billion (-11.3 %) in the same period of time. In just 11 months of 2022, the demand for consumer loans has not decreased and has increased by a good 5 billion euros, with a growth rate close to 5% and well above even the average increase in mortgages for purchase at home (3.8%). The flow of finalized loans exceeded the figure of 116 billion euros at the end of November and although there have already been more than two maneuvers on the rates of the European central bank, the effect of the rise in inflation obviously affects it to a greater extent on the spending power of citizens. If the growth trend of personal loans and consumer credit were to continue, the financial sustainability of Italian households could be jeopardized by the even more influential weight of price increases and rising interest rates, with social consequences that run the risk of becoming worrying for those families whose recourse to credit is already the tool to meet the costs of education, shopping, travel, sport, family and bills.

«Inflation will still remain at particularly high levels for the next two years: a first drop will only be recorded at the end of this year, but we will have to wait until 2025 to see the consumer price index return to an average of 2% in the euro area. It means that in 2023 and 2024 prices will continue to rise at a significant rate, with obvious negative consequences for all Italians. The answer cannot be only the increase in interest rates by the European Central Bank which, indeed, runs the risk of becoming a boomerang on credit. The government needs more incisive fiscal policies aimed at increasing disposable income, and I hope that answers in this direction can already arrive this year. But above all, the renewals of all expired collective labor agreements are essential, with significant increases in wages. I recall that over six million workers have been waiting for their collective agreements to be renewed, in some cases for more than five years. We will soon start negotiations for the contract of female and male bank workers, we are about to complete the union platform» declares the general secretary of Fabi, Lando Maria Sileoni.

INTEGRAL ANALYSIS

The survival of savings in today's times is no longer a guarantee and this is demonstrated by the data on the pockets of Italians, lightened by the waves of the continuous flare-ups in energy prices and by a generalized inflation that is increasingly on the rise. If the current accounts of Italians have never stopped growing since 2017, the data for the last quarter of 2022 in fact sound like a social alarm, demonstrating that the conditions of families could begin to be compromised in the immediate future. While Covid, in fact, accelerated and then sustained the growth of Italian piggy banks, the same reserves are now beginning to erode and be used as a defense against higher costs. The data show almost five years of savings (since December 2017), but with a worrying change of course at the end of 2022 (since December 2017): Italians' accounts have always grown and have exceeded 1,000 billion, with a tendency to accumulation that exceeded 212 billion euros (sum of savings accumulated from 2017 to May 2022). The annual change has always been positive and with a total budget of 1,044 billion at the end of 2019, 1,110 billion at the end of 2020, 1,144 billion at the end of 2021 and 1,179 billion at May 2022. At the end of November, the piggy bank of Italians continues to exceed the peak of 1,000 billion euros, but with a trend reversal that gave the first signals starting from the end of the first half of 2022 and which showed how – in just over a quarter – almost 20 billion euros were burned EUR.

PURCHASING POWER COLLAPSES, RESERVES FALL TO 1,159 BILLION

If in the first seven months of 2022 the liquidity accumulated by households almost touched 1,180 billion euros, with growth – albeit slower than in the past – of 0.9% since the beginning of the year, the data for the following four months confirm the fears , by now ascertained, of a collapse in purchasing power which forces Italians to draw on their reserves to meet the higher costs. From July to November, total current accounts fell by almost 20 billion euros. The total value was 1,178 billion euros in July and 1,159 billion euros at the end of November, with a reduction of almost two percentage points (-1.53%) and which demonstrates that the cost of the crisis is starting to be all in one's pockets Italians.

Confirmation also comes from the trend in the debts of Italian households, which marks an increase in loans for consumption and the stability of loans for personal purposes. Overall, in November the amount of loans for both categories stood at 256 billion euros, up compared to January of the same year (+1.5%) and overcoming the trend of constant increase since 2017, equal to '1.2%. The growth numbers of the world of finalized and non-finalized loans come as a slap in the face compared to the market conditions, because it is certainly not the low interest rates that are driving requests, but rather the growing propensity to pay purchases in installments, which makes the relationship that Italians have with economy and savings contradictory.

MORE DEBTS TO MEET CURRENT EXPENSES

The sense of uncertainty and fear of those who do not give up liquidity or even expenses have made not only liquid deposits fly, but also loans. It is very likely that debt is growing to meet current expenses. In the last five years there has been an overall increase in personal loans and loans for consumer goods of 3.1 billion (+1.2%) from 253.6 billion to 256.7 billion: this increase largely regarded the loans aimed at the purchase of goods and services for 21.1 billion (+22.2%), and more than offset the reduction recorded on the side of loans aimed at personal expenses, which decreased by 17.9 billion (-11.3 %) in the same period of time. If, in fact, loans for personal purposes continue to represent the most significant slice in the map of the use of installment credit by households – with a percentage that reached the peak of 25% in 2017 and which still exceeds 20% of the overall financial exposure at the end of 2022 – Italians' appetite for consumer credit continued to grow, standing at between 17% and 18% at the start of the pandemic.

THE FINANCIAL SUSTAINABILITY OF HOUSEHOLDS AT RISK

However, the data for 2022 – especially for the last part of the year – are starting to send out some alarm signals on the availability of immediate economic resources on the part of consumers, because the growing demand for targeted loans, at rates that are no longer unbeatable, it is an indication not only of an interest in non-durable goods, but the mirror of a financial distress of those who probably find it difficult to finance current expenses. In just 11 months of 2022, the demand for consumer loans has not decreased and has increased by a good 5 billion euros, with a growth rate close to 5% and well above even the average increase in mortgages for purchase at home (3.8%). The flow of finalized loans exceeded the figure of 116 billion euros at the end of November and although there have already been more than two maneuvers on the rates of the European central bank, the effect of the rise in inflation obviously affects it to a greater extent on the spending power of citizens. If the growth trend of personal loans and consumer credit were to continue, the financial sustainability of Italian households could be jeopardized by the even more influential weight of price increases and rising interest rates, with social consequences that run the risk of becoming worrying for those families whose recourse to credit is already the tool to meet the costs of education, shopping, travel, sport, family and bills.

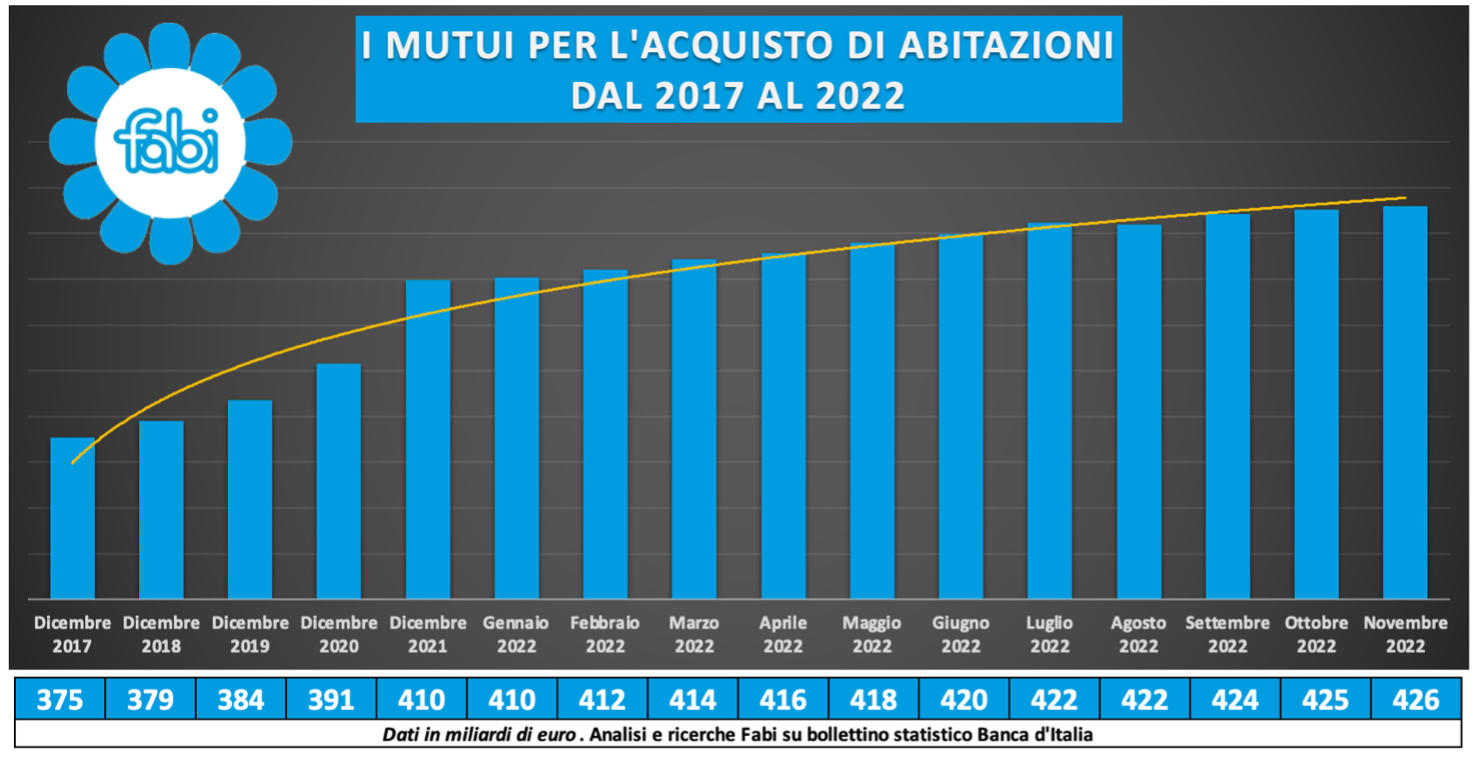

IN FIVE YEARS MORTGAGES GROWN BY OVER 50 BILLION

As for mortgages, more specifically, between 2017 and 2022 there was a growth of over 50 billion euros (+13.5%), with the stock of disbursements rising from 375 billion to 425 billion. Growth was constant throughout the five-year period observed: at the end of 2018, total loans for the purchase of homes had reached 379 billion, at the end of 2019 at 383 billion, at the end of 2020 at 391 billion, at the end of 2021 at 409 billion. In the first 11 months of last year, therefore, there was an increase of over 16 billion (+3.9%); in the same period, personal loans and consumer credit grew by over 3 billion (+1.2%), going from 252 billion to 256 billion. The increase in interest rates, caused by the increase in the cost of money, brought by the European Central Bank to 2.5%, could, in the coming months, have repercussions on the mortgage market: with higher rates, even the amount of the installments and the higher cost of debt could curb both requests from consumers and disbursements from the banks.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/cosa-succede-ai-conti-correnti-degli-italiani/ on Sat, 21 Jan 2023 06:47:32 +0000.