What happens to the Walgreens pharmacy chain in Pessina-Barra?

Closing of the first quarter of the fiscal year 2024 in red for the US pharmaceutical company Walgreens Boots Alliance, directed by the Pessina-Barra couple, which halves the dividend and sees the shares collapse. Facts, numbers and expert predictions

The Italian-Monegasque (by adoption) couple (in life and in business) Pessina-Barra are back in the news about the US pharmaceutical company Walgreens Boots Alliance which they lead. And the news is not good. After the turbulence of recent months , yesterday the group closed the first quarter of the current financial year in the red. To save money he cuts the dividend and the shares collapse.

THE CLOSING OF THE QUARTER

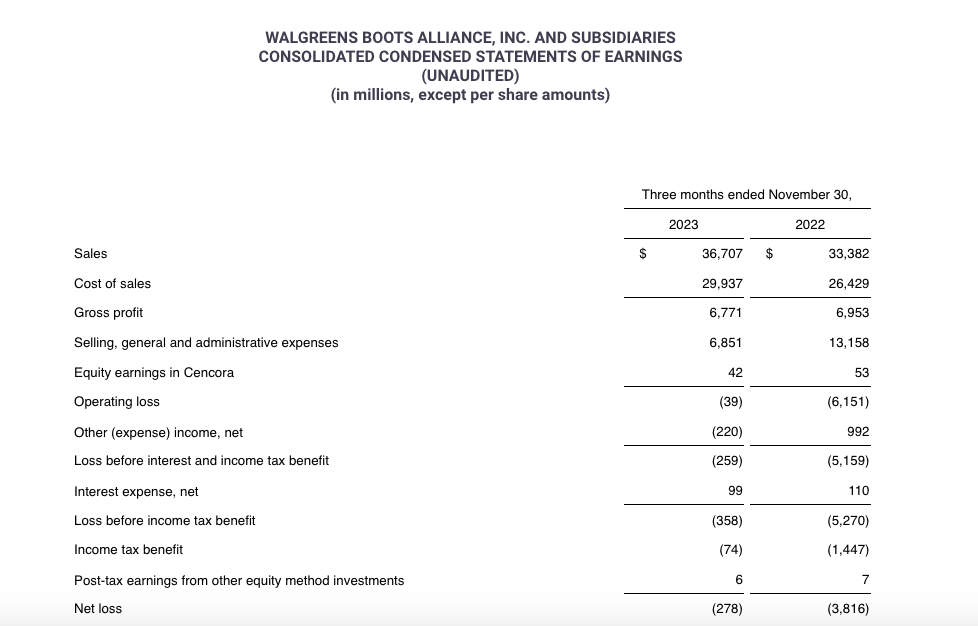

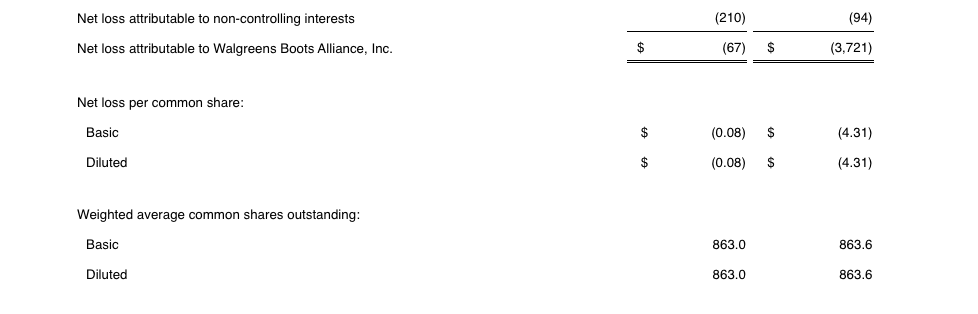

Walgreens Boots Alliance ended the first quarter of fiscal 2024 (as of November 30, 2023) with a loss per share of $0.08, compared to a loss per share of $4.31 in the prior-year quarter. Net loss was then $67 million, compared to a net loss of $3.7 billion in the year-earlier quarter.

The first quarter results, recalls a note , included a pre-tax charge of $278 million related to Cencora shares.

Adjusted earnings per share fell 43.1% to $0.66, down 43.7% on a constant currency basis, “reflecting challenging U.S. retail market trends as well as a 21% impact caused by a higher tax rate.”

DIVIDEND ALMOST HALVED

As a result, Walgreens, under pressure to strengthen its results, announced a 48% reduction in its quarterly dividend payment. “An important move for a company known for its generous dividends and which has paid them for more than 90 years,” comments the Wall Street Journal .

The decision, Reuters wrote yesterday, caused the pharmacy chain's shares to fall by 11% and the drop was destined to wipe out more than $2 billion in Walgreens' market capitalization, which is now just over $20 billion. dollars.

The cut, according to chief executive Tim Wentworth , who took over from Roz Brewer last October, “strengthens the objective of increasing cash flow, while freeing up capital to invest in sustainable growth initiatives”.

Stefano Pessina, president of the company, then added that there is no intention to eliminate the dividend, which the board of directors "continues to consider as a key component of WBA's overall attractiveness for many of the shareholders".

THE END OF COVID AND INFLATION ARE WEIGHING ON SALES

Walgreens, which said the reduction in consumer spending was more severe than previously expected and forecast a single-digit drop in U.S. retail sales compared to its previous forecast of stable sales, is indeed grappling with both the decline in demand for Covid vaccines and tests which with the decrease in spending on personal care and beauty products by consumers, in difficulty due to inflation, notes Reuters .

First quarter sales, the note said, increased 10.0% year over year to $36.7 billion, up 8.7% on a constant currency basis. Notably, the retail pharmacy unit reported quarterly revenue of $28.9 billion, “far beating estimates, partly due to brand-name drug inflation and an increase in prescriptions ”, specifies Bloomberg .

WALGREENS' FUTURE MOVES

Since Brewer left his post at Wentworth, “investors have been looking for a change,” writes the business newspaper . “We are evaluating all strategic options to drive sustainable long-term shareholder value by focusing on rapid actions to reduce costs and increase cash flow, with a balanced approach to capital allocation priorities,” the CEO said.

At the end of October, Bloomberg recalls, the group had announced a cost reduction program of one billion dollars, closing unprofitable offices and slowing down non-essential projects. Executives also said they plan to reduce capital expenditures by about $600 million, with the expectation of seeing the impact starting in early 2024. And finally, the company also revived discussions on a potential sale of its international Boots chain, which could bring in around $8.8 billion.

FORECASTS AND ANALYSTS COMMENTS

“It's still a tough year for them,” said Jeff Jonas, portfolio manager at Gabelli Funds. “Earnings will be down for the current year, which ends in August. Let's hope this is the bottom." Walgreens, Reuters recalls, had long-term debt of $7.59 billion as of November 20, 2023.

But shareholders, Bloomberg writes, “may be impatient.” The 48% dividend cut to 25 cents is “just another step in the financial recovery process,” commented Edward D. Jones analyst John Boylan, “and seeing predictable, sustained growth may take time.”

For Elizabeth Anderson, an analyst at Evercore, the cut could help "shore up" the company's balance sheet and save around $800 million on an annual basis.

Finally, Wentworth is returning to expanding its community pharmacy business, according to Bloomberg Intelligence analyst Jonathan Palmer. But in a call with analysts, company executives anticipated weakening retail sales and prescriptions, leaving investors with little sense of where growth might go.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/che-succede-alla-catena-di-farmacie-walgreens-di-pessina-barra/ on Fri, 05 Jan 2024 10:17:44 +0000.