What is inflation due to?

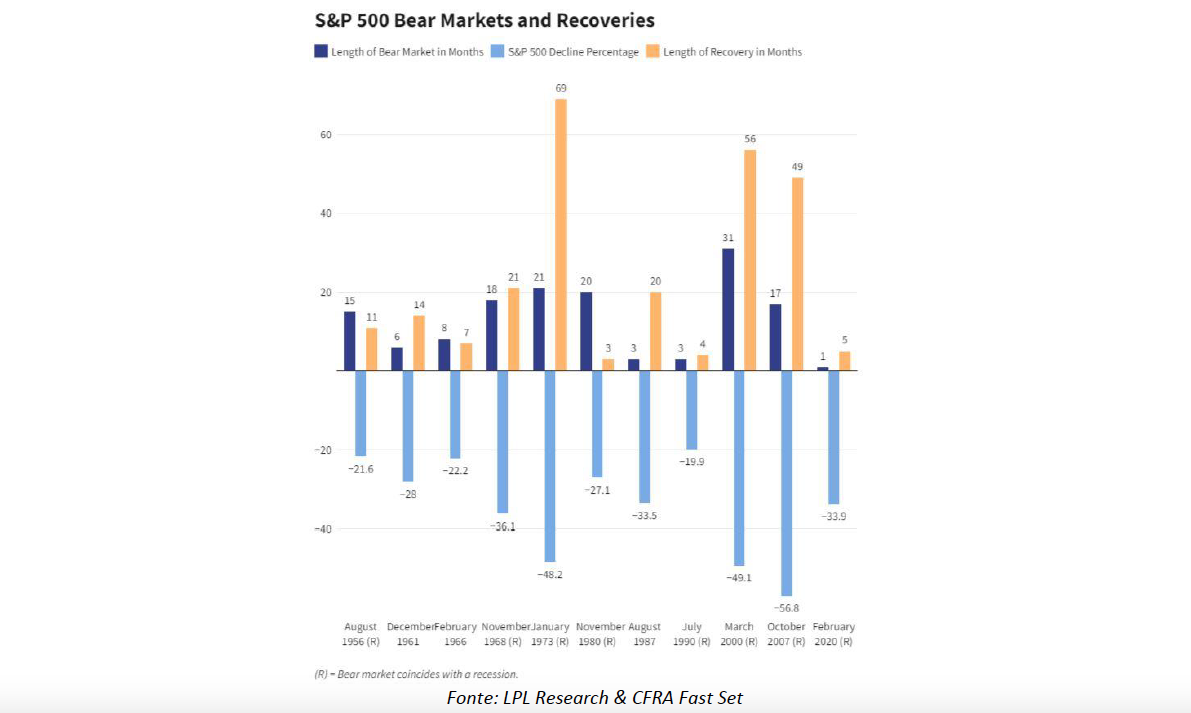

In the face of negative fluctuations, recovery times also depend on the behavior you choose to adopt. The comment by Gimme5 , a digital solution that allows you to set aside small amounts via smartphone and invest them in mutual funds

The perfect storm starts with rising inflation

After years of very low levels, starting from the second half of 2021, inflation has started to rise and today is at record levels not seen for over 20 years: 8.1% in Europe and 8.6% in the United States (both economies with an inflation target of 2%). This is a global phenomenon, which sees both advanced and emerging economies in a sort of "perfect storm" in which, on the one hand, the disposable income of consumers is eroded, and on the other, central banks adopt quantitative tightening policies. (QT) and rate hikes to reduce the amount of money in circulation.

What is inflation due to?

The origin of the current inflation levels can mainly be traced back to two factors:

- Pressures on commodity prices caused by the sudden recovery of economic and social activities after the closures of the Covid period and by the Russian-Ukrainian crisis, which exacerbated inflation dynamics, since both countries involved in the hostilities are important exporters of both energy ( especially Russia, which owns oil and natural gas) and food raw materials (Ukraine is one of the world's largest exporters of wheat). The geopolitical crisis led to a reduction in the supply of these goods and a consequent increase in their price, which was transmitted automatically and gradually to all intermediate and / or final goods and services, effectively pervading all sectors of the economy.

- Imbalance in the global supply of goods and services. After the post-pandemic reopening, intense global freight traffic and lockdowns made it difficult to return to normal production levels, favoring the creation of so-called "bottlenecks" in production chains, with further upward pressure on prices of goods and services. The case of China is emblematic, where the zero-Covid policy has significantly slowed down – more than in other countries – the normalization of production chains, which are still below their potential.

In addition to today's inflation, there is a rise in central bank rates

Central banks have begun to raise interest rates and gradually drain liquidity from the system through QT (in contrast to the quantitative easing [QE] regime observed from 2015 to date), which can represent an "additional" measure aimed at accelerating the process of "cooling" the economy.

In fact, raising interest rates means making debt more expensive and therefore discouraging it, resulting in a slowdown in the economy and a fall in prices as a direct consequence.

The combination of a slowing economy and high inflation could lead to stagflation

Raising rates at a time when the economy is growing robustly is usually not a problem, but doing it when the economy is slowing is a lot of concern. The combination of a slowing economy, high inflation and rising interest rates could result in stagflation, which is a recession accompanied by high inflation.

The reaction of the markets

Financial markets are very sensitive to this type of movement: a context of economic deceleration reduces the chances of making profitable investments, discouraging investors and their use of financial resources; this is reflected in a decline in the valuations of both equity and bond securities, both government and private. A potential positive catalyst for the market would be a slowdown in inflation, which would lead central banks to slow down the cycle of interest rises.

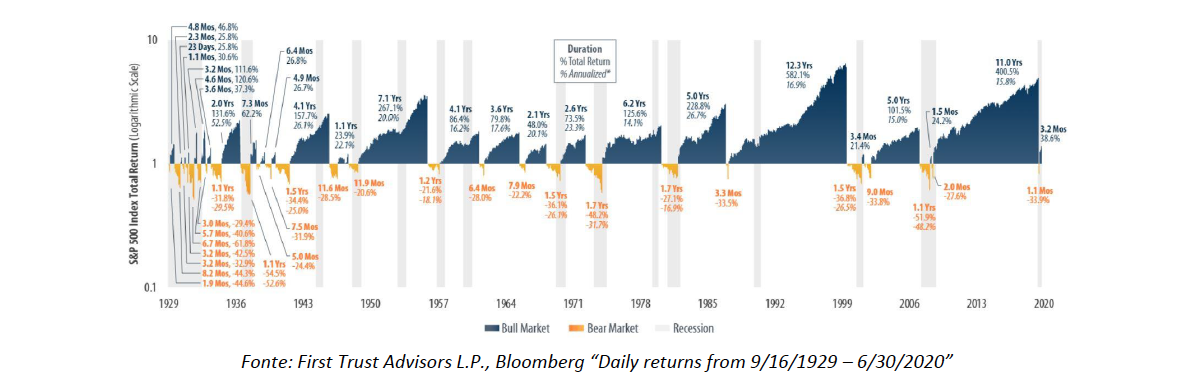

It should be remembered, however, that fluctuations are an intrinsic characteristic of financial markets:

- the Bear Markets represent those phases of descent of more than 20% that last for a sustained period of time (usually from two months onwards);

- Bull Markets represent the phases of prolonged and constant growth of the markets, leading to a rise equal to or greater than 20% of the share price.

History teaches that these phases have always alternated cyclically over the years: with each fall the market has always risen, as emerges from the following graph, which represents the trend of the American S & P500 index from 1929 to 2020 and its recovery times.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/a-cosa-e-dovuta-inflazione/ on Sat, 06 Aug 2022 05:37:10 +0000.