What (not) the IMF says about digital currency

The IMF in Washington has published a document on digital currency, raising problems and options without indicating which should be the most appropriate choices.

After the BIS in Basel and the OECD in Paris (but this one on even broader issues), the IMF in Washington has published a document on digital currency, raising problems and options without indicating which should be the most appropriate choices.

On 2 October the ECB published its analyzes on the subject; immediately afterwards the European Commission published a document on the EU Digital Finance Strategy, which also includes the much more difficult issue to deal with compared to digital currency on how to deal with financial crypto assets (cryptoassets).

The IMF document concludes by stating that this historic international monetary institution has raised the question of whether it (I quote verbatim) can play a role in propitiating (the English term used is enhancing) of a system of international payments (cross-border) and in promote the security and solidity of the digital currency of central banks (characterized by the acronym CBDC) and private individuals (GSC); he goes on to say that these issues will require further research from his staff and discussions with other relevant stakeholders (ie people interested in the problem).

These conclusions cause me profound disturbance, because what one should face with a precise idea in mind is, for the authorities, still at the level of the problem to be addressed, while it is an already operating reality which, if not regulated in time, will be difficult to bring back to order; as the same document points out, it can also create confusion on the market and policies and new financial crises.

The institutional architecture to be given to money and digital activities had already been decided in recent years; the time for doubts and hesitations has now passed and it is necessary to decide what to do and move on to define adequate legislation.

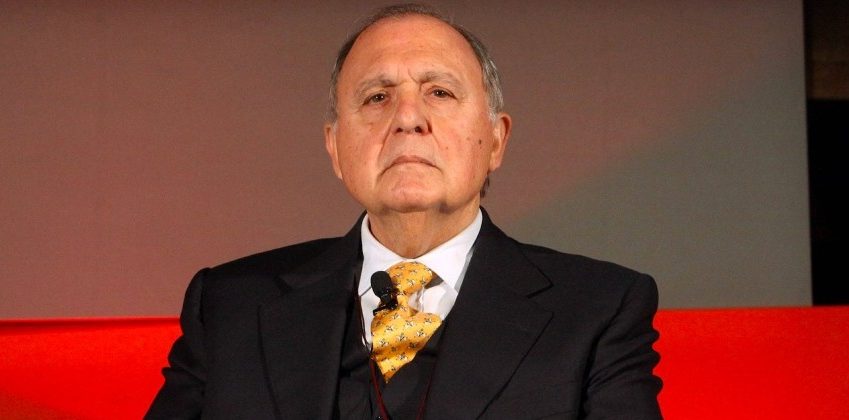

No document cited or comment on the subject indicates this urgency. As president of Consob, I have already expressed my opinion on the solution to be given to the problem of cryptocurrencies and financial crypto-assets in my two speeches to the market of 14 June 2019 and 16 June 2020.

Here it would take too long to repeat the reasons for the proposals I put forward, which, however, I summarize: 1) the cryptocurrency cannot but be public and, therefore, the only one to have legal value as a means of freeing up debts, including "instant "Linked to the means of payment to be used in the purchase of goods and services; the risk is that private agreements will spread that upset the old monetary and financial rules; 2) financial crypto-assets must be regulated to allow supervision in the use of savings, the protection and development of which is guaranteed by our constitutional provisions, but not by other European and international institutional arrangements; 3) monetary and financial relations in digital form between sovereign states must be agreed during an international conference to be convened. On the third point, I would have expected at least a claim of competence from the IMF and a mention in the two important European documents.

It is believed that there is time to decide, but in the meantime, as happened with the derivatives that led to the disastrous crisis of 2008, private digital money is making its way benefiting from delays and benign neglect (if the use of the term is lawful) of the authorities. Instead, it is possible to collect deposits in bitcoin and yuan-renminbi, which thus become part of the European monetary creation (M2), legitimizing their existence even before the eurodigital was born and the legal ranking between private and public currencies was established, i.e. between private and public law. It also allows you to "ensure" the possession of bitcoin, giving them legitimacy as a financial product, a concept that has a precise regulation in our legislation. We are entering the financial infosphere with the private sector more prepared and ready to act than the public sector.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/che-cosa-non-dice-il-fmi-sulle-monete-digitali/ on Sun, 25 Oct 2020 07:45:32 +0000.