What Powell says and doesn’t say about the Fed on rates and beyond

The most recent words of Powell (Fed) analyzed by Antonio Cesarano, chief global strategist of Intermonte

As an old advertisement proclaimed, Powell's speech ultimately turned out to be "10 floors of softness", partially belying the more aggressive statements of three authoritative Fed members of the caliber of Bullard, Williams and Mester, who especially emphasized the fact that markets must not underestimate the Fed's aggressive intentions to quell inflation

Powell in fact confirmed the three already well-known points, namely:

- we will slow down the pace in December

- the peak will be higher than that reported in December

- after the peak, we will hold rates steady for a while

But what surprised the markets above all were the additional words that I will try to list in the literal sense:

“We don't want to cause huge damage to the economy by raising rates”

“We don't want to exaggerate and for this reason we are slowing down the pace of rate hikes”

In other words, a speech tenor that reassured markets of the non-warlike intentions of the Fed starting the landing in final land around 5% on Feb. 1 (the first Fed meeting of 2023) before pausing on the rates for a certain time.

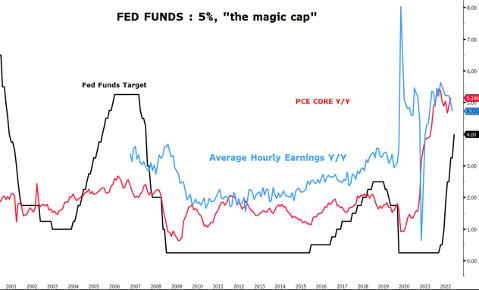

Powell himself recalled the "magic number of 5%" by announcing that the inflation figure monitored by the Fed (the core PCE) for October (due today) is expected at 5%:

Probably also the salary dynamics (published on Friday) will stand at around 5%.

So many clues that actually make more and more certain proof that the Fed will stop at 5% in the process of raising rates.

Ironically, 5% is a number that also resonated yesterday in the Euro preliminary inflation data: the overall figure dropped from 10.6% to 10% while the core figure (excluding energy and food) remained nailed right down to 5%.

In essence, even for the ECB there is the possibility of slowing down the rate of increases in December (based on the slowdown in inflation) in the face of the discussion on the start of quantitative tightening (i.e. allowing a part of the securities in the portfolio to lapse without reinvesting) due to the need to curb the core part of inflation, which still shows no sign of lowering its head.

The context of greater softness has also found the Chinese side today, with the announcement of measures that at least make the Covid containment measures more bearable: shorter quarantines and above all in one's own homes and no longer in the narrow places decided by the government.

A way to try to contain the winter contagion, placating the excesses of bad mood that emerged with the street protests, waiting to be able to reopen more widely with the lunar new year from February (the year of the rabbit for those who love the Chinese horoscope) .

In this phase, the yuan represents the most reliable and fastest thermometer of the expectation of reopening with the new winter year, with a marked appreciation against the dollar in recent days.

IN SUMMARY

Powell opened a potentially favorable December overall for stock lists and also for bonds.

In terms of S&P500, on a monthly basis October closed with +8%, November +5%.

December could at least partially emulate November.

There may be some curve, it won't be all rosy, especially if some macro data/event doesn't live up to the most optimistic expectations, also considering that we are at very low levels of volatility (area 20 of the VIX).

Overall, December should give a positive ending on a monthly basis.

On the interest rate front, the favorable phase could continue for both government and corporate maturities within 5 years, which could offer a fair risk/return ratio and make it possible to ride very flat and, in some cases, inverted interest rate curves, as in Germany.

In the first months of next year, the possible Chinese reopenings and the return of Europe to the gas market to start restocking stocks again could lead to an increase in the commodity sector (oil, copper and iron ore in the lead) with an increase in fears that central banks could become less soft, which could only temporarily interrupt this scenario.

Overall, these phases could prove to be entry opportunities in the first semester.

Central banks could probably accept a de facto compromise with reference rates well below inflation, to try to balance the difficult equation that should lead to a slowdown in the economy that is yes but not disastrous, together with that of trying to curb hyperinflation as soon as possible.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/cosa-dice-e-cosa-non-dice-powell-della-fed-su-tassi-e-non-solo/ on Sun, 04 Dec 2022 07:52:23 +0000.