What the Draghi effect will be on the Italian stock exchange

How and why Mario Draghi will have a significant impact on Italian markets and indicators. The comment by Michele Morra, Moneyfarm portfolio manager

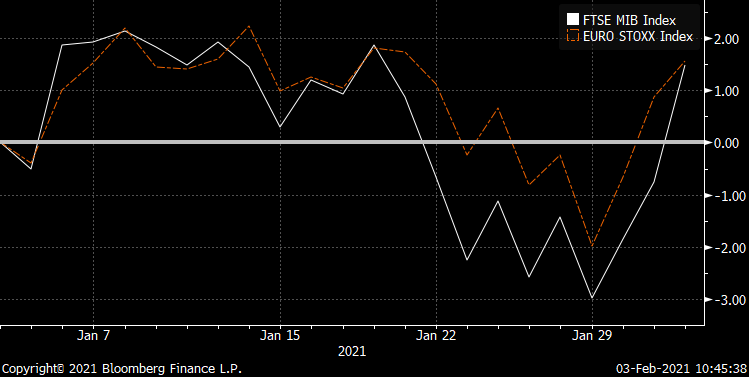

The news of Draghi's convocation at the Quirinale has certainly had a significant impact on the main Italian indicators. On a day that sees all the European lists in green (also influenced by the Asian and overseas closures) the return of the FTSE MIB is over 2%, with a considerable gap compared to the other European exchanges.

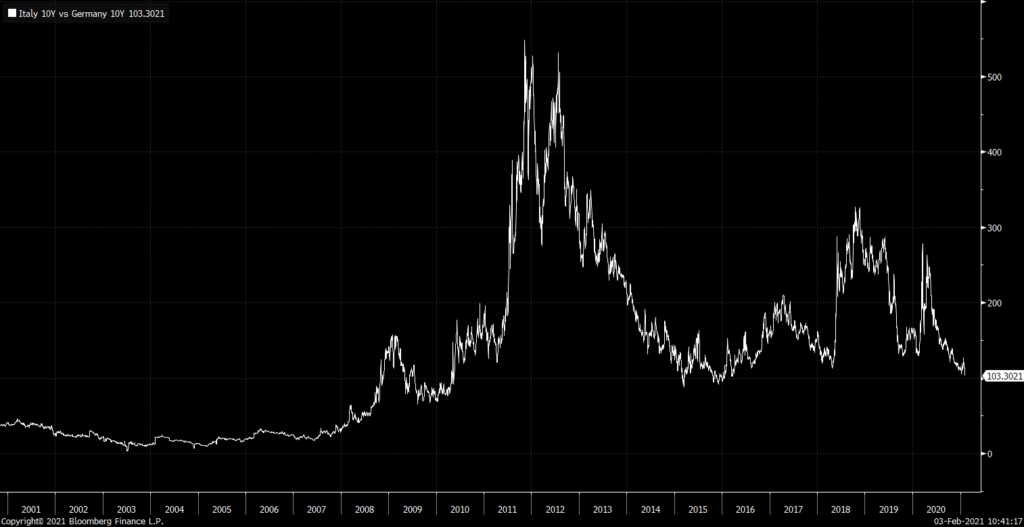

Even looking at the bond market, the spreads have undergone a considerable narrowing (about 0.10%) continuing a trend that had already been in place since March and bringing the Italian ten-year to about 0.55%. The market reaction, therefore, has been and has been positive. Investors seem to like the news.

We recall, however, that following the government crisis the spreads had undergone a similar widening and the FTSE MIB a symmetrical underperformance; therefore we understand that probably what investors like is above all the possibility of a resolution and a return to government stability, also necessary in order not to dissipate the aid deriving from the Recovery Fund.

In the medium term, a positive effect could be represented by Draghi's ability (or investors' perception of it) to exploit his authority and his negotiating skills at European level to facilitate dialogue on the European investment program, strengthening the relationship between the core countries of the Eurozone.

Today and tomorrow we could therefore continue to see a certain level of volatility in the succession of news relating to the acceptance or not of the office and the formation of a new government. Should Draghi become the new prime minister, it would still be early to draw medium-term conclusions on financial assets, since the positive sentiment will then have to be supported by concrete numbers on GDP growth, inflation and corporate profits, factors mainly linked to developments on the Covid side and to the Italian productive fabric.

In the long term, should investors' perception of the Italian system return to pre-2008 levels, we could expect an outperformance of BTPs compared to government bonds from other countries, thanks to the potential tightening of spreads (0.15% pre-crisis ) and a higher coupon component. A desirable but difficult scenario to predict in a context conditioned by a global pandemic and levels of debt that will bring new challenges (political and economic) in the coming years.

The effect on the FTSE MIB on the other hand, given the sectorial composition of the latter, seems to us more linked to the vaccination campaign than to political developments, even if obviously the two are interconnected.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/quale-sara-leffetto-draghi-sulla-borsa-italiana/ on Thu, 04 Feb 2021 11:20:29 +0000.