What the markets expect from Biden’s fiscal policies

How and why operators are waiting for the fuel of fiscal policies, the first stage is the Biden plan. The analysis of Antonio Cesarano, chief global strategist of Intermonte Sim

The increase in volatility on global equity markets could be linked to an implicit demand for additional liquidity which, most likely, could come from fiscal policies, Biden plan in the first place. The timing of this plan remains one of the key points for the month of February.

If Congress actually gets to pass the $ 1900bn plan by early February, then the year-to-date rally could resume, albeit in a bumpy form. And this since, for a few weeks, China appears on the bench, struggling with the lockdowns necessary to quell the outbreaks of the virus. Also contributing to the ups and downs could be the growing fear that vaccines / monoclonals are not sufficiently effective against the newer variants, especially the South African one.

If the times are longer then the falls in the lists could be more marked in a context, however, positive for the semester, in view of the support above all of the US fiscal policy composed of the aforementioned $ 1900 billion plan – to which a further plan would subsequently be added. for infrastructures of at least $ 2000 billion.

To ride a scenario that is uncertain about the timing of fiscal policy but based on the hypothesis that Congress will have approved both plans by March, the feasible strategy could be to progressively bring the share of equity in the portfolio to the maximum level for each risk profile by March, taking advantage of any more marked drops (for example over 5% of the Russell 2000) to accelerate the pace.

As for the composition of the portfolios, preference is always for a thematic approach with a focus above all on fiscal spending lines.

TWO PRECAUTIONS FOR FEBRUARY

Beware of commodities in view of the expected Chinese slowdown: Brent, for example, could temporarily return to the $ 50 area, in a month in which no OPEC + meetings are scheduled (the next is scheduled for March 4).

The dollar could progressively appreciate (target 1.19 by March and 1.16 by June) in view of the perception of the US as a more attractive destination for investments (financial and non-financial), given the strong growth / tax expense differential (€ 750bn of the Recovery Fund vs over 4000Bn of rescue + Recovery Plan Us). In this context, therefore, any temporary returns in the 1.2250 / 1.2350 area appear to be USD buy opportunities.

The euro could be progressively used in an increasing dose as a funding currency for carry trades (and therefore depreciate), i.e. to finance itself in euro and invest elsewhere, also in light of the hypothesis advanced in recent days by some ECB members on a possible cut rates (presumably on TLTRO more than on deposit).

A FEW MORE DETAILS

The month of January is closing with an increase in volatility on the markets, after a vigorous start, especially with reference to some sectors.

The operators worked mainly on issues related to upcoming tax policies and on the good health of the Chinese economy.

In other words, the basic reasoning was:

• We invest in the issues that will benefit from flows thanks also to fiscal policies, as in the case of US SMEs, ESG / green issues (in various possible sub-declinations: batteries, New energy et cetera), semiconductors (investments in digital, demand and greater use of the cloud are creating a strong global shortage) and, more generally, China to take advantage of the good moment of the Dragon economy in view of the start of the new five-year plan

• As evidence of this, there is the good performance of some indices with more or less explicit thematic characteristics such as Russell 2000, FTSE 100 (linked in part to the good performance of commodities given that the weight of materials + energy reaches around 25%), CSI 300 (Chinese domestic market excluding big players often under the focus of the Dragon's regulators)

In recent days, using a metaphor borrowed from the world of uprisings, the global stock markets have given signs of "beating in the head" with a consequent increase in volatility.

Let's try to make a quick diagnosis of what the underlying mood could be before assuming a continuation of the bullish movement of the first weeks of the year.

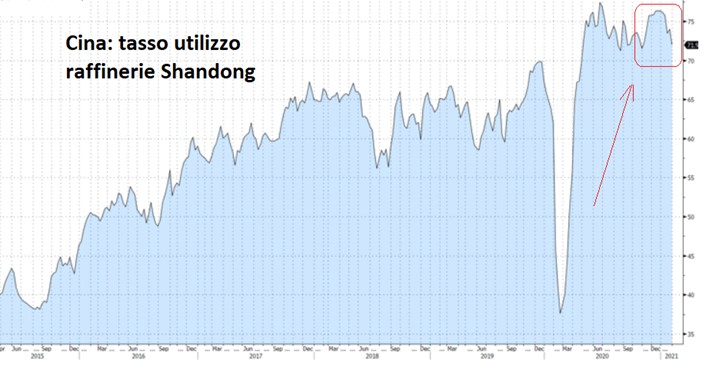

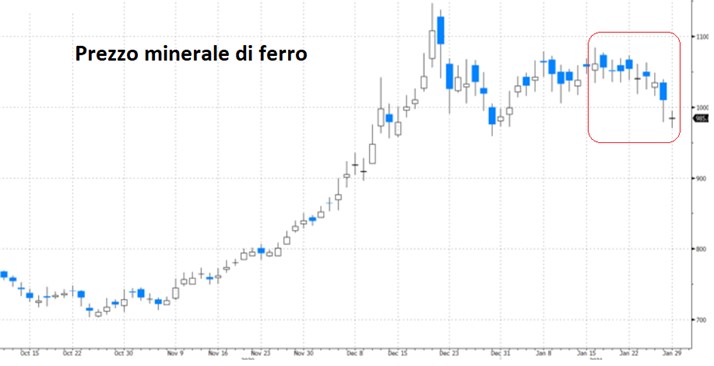

• China: widespread lockdown signals are arriving with a significant decrease in travel flows, to the point that the government of the country has invited citizens to limit travel to a minimum in view of the New Year (or Spring Festival, as it is called by the Chinese). mid-February. Thus, the first symptoms of a slowdown emerged, primarily represented by the decline in some industrial metals (copper, iron ore, etc.) as well as by the slowdown in the utilization rate of refineries, which are very important for oil demand (China is the leading importer global)

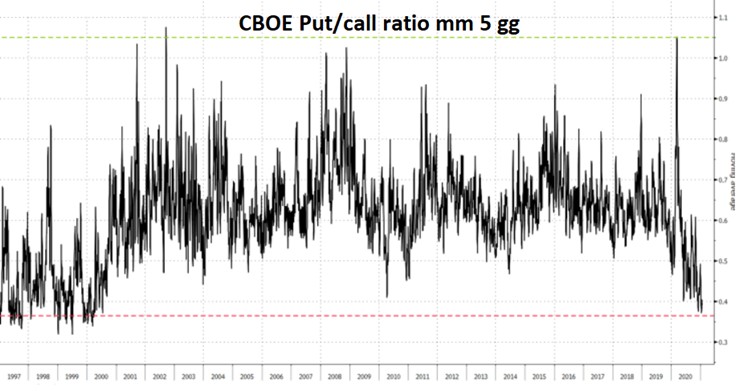

• Financial conditions that are starting to signal excesses such as, for example, the mkt cap S & P500 / M2 ratio or the low level of put / call ratios. In other words, a large part of the liquidity in circulation already appears to be in the equity markets while the optimism of the operators is such as to lead them to be historically very lacking in protection against downside risks

To these indications I add the alternating events on the vaccine / virus mutation front that contribute to fueling profit taking, especially at the end of the month.

From these indications it emerges that operators are looking for new sources of liquidity, once they have taken note of the following factors:

• There will be no acceleration in the pace of liquidity injections from central banks for now

• The contribution to growth on the Chinese side could stop for a few weeks, taking advantage of the mid-February holiday week to temporarily slow down activities / movements in order to contain infections at the first signs of onset

• From the US buyback front, no news of a significant increase has come, apart from the case of the US banking sector which recently received the green light in this regard.

• The protagonist of 2021 therefore remains: fiscal policies. On this point the timing is important and, more specifically, how long it will take Biden to pass the announced $ 1900 billion plan to Congress. The Democratic leader in the Senate said next week the plan will be under discussion in the Senate itself, with the aim of moving forward with or without the contribution of Republicans. This would be tantamount to opting for the faster approval procedure of "budget reconciliation", which would however have as a side effect a departure of the Biden administration not in a collaborative sense with the opposition.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/politiche-fiscali-biden/ on Sun, 31 Jan 2021 06:51:25 +0000.