What the pandemic will teach savers

How to mitigate the volatility of the markets due to the pandemic. The analysis by Andrea Rocchetti, Head of Investment Advisory Moneyfarm

The months of March and April 2020 will remain etched in the collective memory for a long time. The outbreak of the pandemic has caught the whole world off guard: since Covid became a global emergency no one knows how the crisis can evolve and what exactly the consequences of this situation can be from a health, economic and social point of view.

Overall, in March 2020, equity markets lost more than 30%, implied volatilities in equities (Vix index) reached record levels even higher than the levels reached in 2008 and the spreads of higher-risk corporate bonds they have widened considerably, due to an upward revision of the probabilities of default deriving from the suspension of economic activity. Given the lack of demand, the crisis has also affected the price of oil, the future of which touched the value of -37 dollars a barrel, a level previously considered unthinkable.

In short, the turbulent weeks between March and April 2020 represent a historic moment for the financial markets and the volatility we have witnessed will in all likelihood remain among the highest ever recorded. What happened in the following months is known history, the global economy has proven to be more resilient than expectations. The monetary and fiscal policies implemented by central banks and governments have allowed the financial system to get back into motion and the markets have embarked on a gradual recovery which has then turned into the important expansion we have witnessed to date.

How do you deal with phases of market volatility?

The outbreak of the epidemic and the 18 months that have passed since then can offer interesting food for thought to understand how to best manage the phases of volatility, even the less extreme ones that every investor periodically faces.

When uncertainty grows on the markets, the investor usually adopts one of these three behaviors: he remains invested, remaining faithful to his investment plan and perhaps continuing to invest new liquidity also through recurring payments (for example through a PAC, Capital Accumulation), or try to "beat the market", trying to sell to anticipate the presumed negative phase and then return at the moment it deems most favorable, or it still exits the market definitively, trying to capitalize on any profits accrued in the past.

The latter choice, net of the rare cases in which the invested capital becomes necessary for sudden expenses, is conditioned by very strong psychological pressures, especially when the volatility is more extreme. Nobody likes to see the value of their investments decrease or go negative and the temptation to divest or to enter and exit the market is very strong, as we noticed during the uncertain phase of March / April 2020.

That's why it pays to stay invested

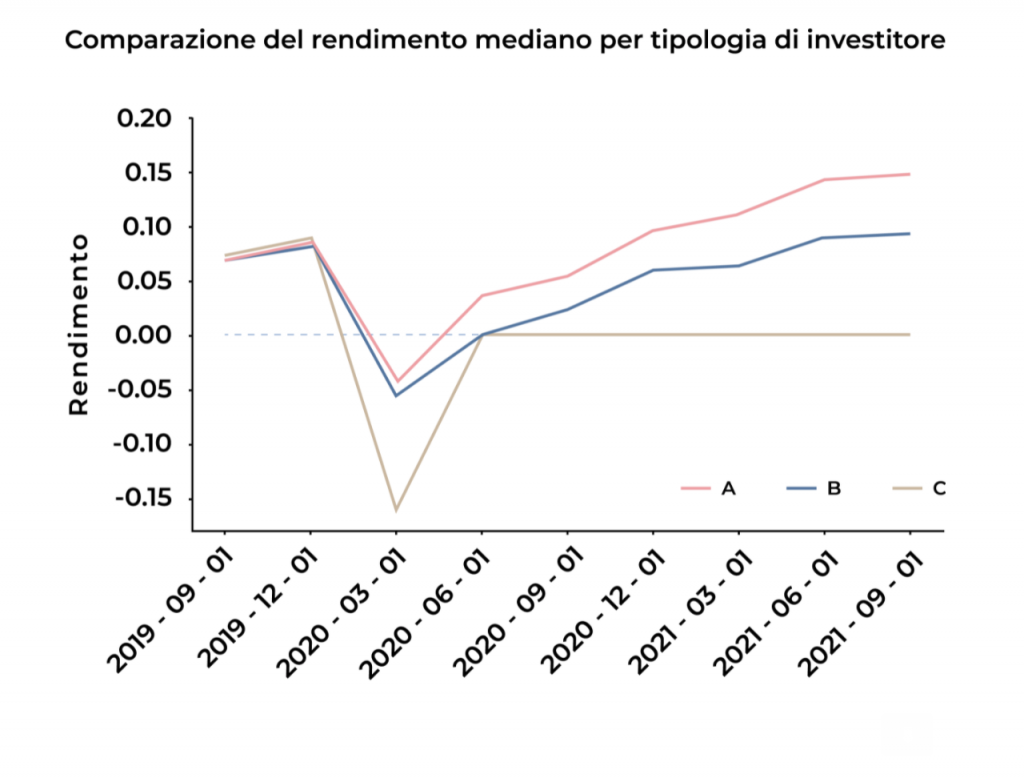

To demonstrate the concrete effects of these three behaviors, Moneyfarm has compared the median performance of portfolios subject to these three choices by 11,565 customers, in a time window ranging from January 2019 to November 2021. It has identified, in particular, three types of investors:

- investors who stayed true to their plan and never divested

- investors who have tried to "beat the market" by divesting at least 1/3 of their portfolio in March, April, May or June 2020 and then making at least one subsequent investment

- investors who have decided to fully disinvest their portfolio, i.e. to permanently exit the market, between 1 January 2020 and 1 July 2020 and have no longer invested

In November 2021, type 1 forward-looking investors – who make up 91% of the total, as is logical to expect from a Moneyfarm sample – had achieved a median return of 14.8%. Investors of type 2 (2.5% of the total) who divested temporarily and then reinvested, on the other hand, had achieved a median return of 9.3%, while investors of type 3 (6.5% of the total), who exited the market entirely, a median exit return of 3.2%.

While it is not surprising that the decision to exit the market, during or immediately after the outbreak of the pandemic, turned out to be the worst one because it did not allow these investors to benefit from the recovery of the following months, it is interesting the comparison between forward-looking investors and those who , more or less consciously, they tried to "beat the market" by divesting temporarily, and then trying to reinvest at a time they deemed more favorable. But identifying this moment, the really right time to capitalize on profits and take advantage of the recovery, is extremely complex and in fact the returns of these investors have been significantly lower than those of forward-looking investors.

In investments, of course, past scenarios cannot be taken as a reference to accurately predict the future. These data simply serve to realize that in phases of market volatility, even the most extreme and difficult to replicate ones like last year, acting in the wake of emotions or trying to "beat the market" can prove to be a very risky choice. A forward-looking investment strategy, which neutralizes volatility over time, and the support of professional advice that helps manage emotional pressure are the best antidote to even the most complex and unpredictable situations.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/cosa-insegnera-la-pandemia-ai-risparmiatori/ on Sun, 09 Jan 2022 06:13:48 +0000.