What will be the next financial shock

We are not in 2008: banks are better regulated and better capitalised. However, stress in the banking sector is likely to force them to reduce risk-taking to safeguard balance sheets. The analysis of Ritu Vohora, Investment Specialist, Capital markets, T. Rowe Price

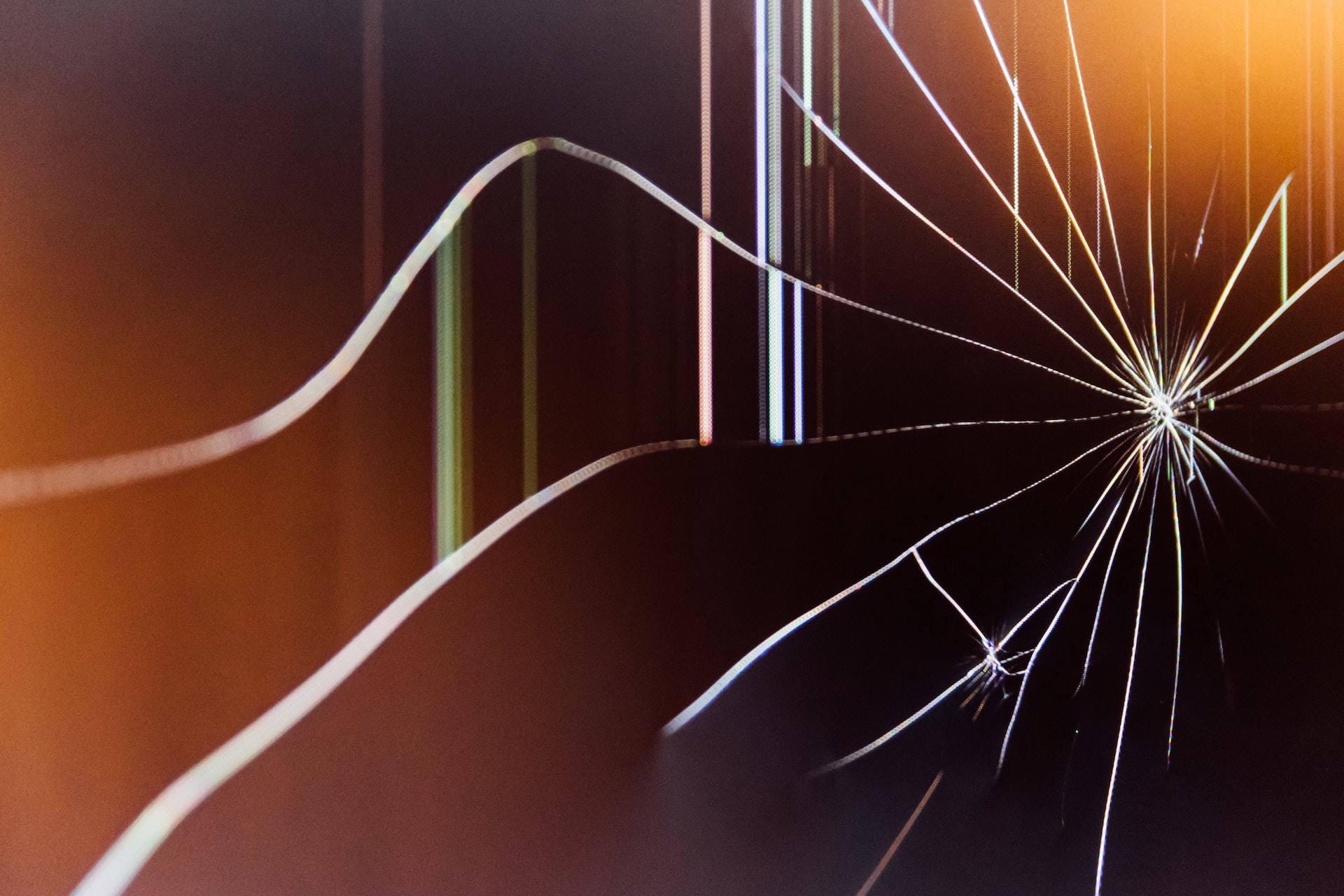

Historically, every time the Fed brakes, something smashes the windshield. A sad analogy, but one that turned out to be true. If 2022 was the year of inflation that forced global central banks to raise rates at the fastest pace in decades, 2023 was the year we expected to feel its economic effects. The most telegraphed recession in history seemed inevitable: the problem was the timing.

Reflecting on the first quarter of 2023, it has been a roller coaster ride, with the market narrative swinging between bullish and bearish assumptions. Despite the thrilling gyrations, the MSCI AC World Index and the S&P 500 ended the quarter up 7.4% and 7.5% respectively. In March, the US Treasury market rallied sharpest in history and rate volatility soared to its highest level since the global financial crisis (who said bonds are boring!) – with the two-year yield falling ended the quarter down 40 basis points. The year began in the spirit of optimism: China has reopened its doors and the mild winter in Europe has led to a recovery in activity. This fueled hopes of a no-landing scenario, amid solid economic data and a resurgent disinflationary trend. Markets have started pricing in a rate cut and equities have experienced a surge in euphoria. It seemed premature, and indeed it turned out to be premature, as very positive February CPI data and very strong labor market data challenged the bullish narrative. Markets began to reevaluate expectations for a Fed rate hike – further tightening and a higher final rate – as “sticky” inflation risked entrenching.

A week is a long time in the financial markets. As Lenin said, “there are decades in which nothing happens and weeks in which decades happen”. We were waiting for something to break and the rapid pace of rate hikes has finally exposed the weak links in the economy. The failure of Silicon Valley Bank and the merger of UBS and Credit Suisse sent shockwaves through the global economy in March. In just ten days, rate expectations have changed dramatically. A historic week for the UK, with the "mini budget" that shook the bond and currency markets and put LDI strategies in crisis. Perhaps it was the first shock in a series of future shocks. While central banks have stabilized the banking turmoil by acting swiftly and leveraging the tools at their disposal since the financial crisis, from back-stopping deposits to providing emergency funding, we are not out of the woods yet. We don't know what impact the turmoil will have on the real economy. We will likely be in economic limbo until the effects start to show in official data, which usually lag significantly by a few quarters.

We are not in 2008: banks are better regulated and better capitalised. However, banking sector stress is likely to force banks to reduce risk-taking to safeguard balance sheets. There is much talk of increased regulation, higher capital and liquidity requirements, and rising funding costs. Banks are a key conduit for the broader economy, and tightening lending standards will result in tighter conditions, such as rising borrowing costs for companies, further putting pressure on earnings. Research suggests that credit tightening may be a drag on growth over time and the outlook has deteriorated.

Liquidity has shrunk dramatically due to shrinking central bank balance sheets and policy tightening. While QE has served its purpose of reducing volatility and long-term returns, we are now likely to find ourselves in a tighter environment, which means we should expect higher volatility than we experienced in the last decade. The Fed is walking a tightrope between persistent inflation risks and financial stability. He has his foot on both the brake (rate hike) and the accelerator (liquidity injection). While the recent tightening of credit conditions has done some of the work, markets expect cuts in the second half of the year. History warns against too early easing. Tighter credit conditions have probably accelerated a recession and central banks may want the right weapons to act in a period of slowdown. As the Fed, ECB and BoE hiked rates in March to demonstrate their commitment to price stability, they may pause and continue to focus on data reliance. Inflation has not magically disappeared. Rates will likely be “higher for longer”, albeit with a lower peak.

While equity markets are off to a flying start, with financial stability risk seemingly averted, now is not the time to be complacent. Bear markets typically come in three stages: first, a rate shock (markets have largely repriced on this), second, an earnings or growth shock (we anticipated this, and although earnings have been too optimistic, they are starting to contract) and finally a liquidity shock (we have not had a capitulation yet). With the S&P500 trading at 18x on a price-earnings basis, equities aren't cheap and likely price recession risk too little. The equity risk premium has also declined, which makes the risk/reward picture less attractive. However, outside the US, emerging markets and Japan offer more reasonable valuation cushions. Bond markets have a more bearish view and the yield curve continues to be inverted (difference between two-year and ten-year Treasury yields). Historically, this has been an ominous sign and has preceded every recession. While yields are far from peaks, bonds still present an attractive opportunity for income and diversification in the event of a downturn.

2022 is a year many would like to forget, in which both bonds and stocks fell together. While the correlation is unstable over time, episodes of volatility and illiquidity are likely to persist. Diversification, a focus on quality and fundamentals will be important in navigating market swings and exploiting dislocations. Managing downside risk by avoiding losers will be as important as backing the winners.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/quale-sara-il-prossimo-choc-finanziario/ on Tue, 25 Apr 2023 05:25:20 +0000.