What will Engineering and Tinaba do

All the details on the partnership between Engineering and Tinaba in the credit field

Partnership between Engineering and Tinaba, here are all the details.

Engineering, active in digital transformation processes for PA and businesses, and Tinaba, an Italian fintech app, have signed a partnership that allows them to offer the Italian and foreign banking system a unique solution to accelerate the digital transformation process.

All the details.

WHAT IS THE PARTNERSHIP ENGINEERING-TINABA

The offer is aimed at all banks that aim to quickly acquire digital services for the benefit of their customers and without the need to modify their legacy system, offering a new service model that includes products and technological services – reads a note from the two companies – such as robo-advisor, crowdfunding, app-based payment services and cryptocurrencies, which are based on secure technology and already tested in regulated markets.

It is precisely from the needs of financial institutions and their customers that the partnership between Engineering and Tinaba is born, which provides banks with a “plug and play” solution “capable of improving their positioning in the digital innovation market”. The advantages for banks are manifold: higher revenues, new services and increased attractiveness towards younger customers, is written in the note of the two companies.

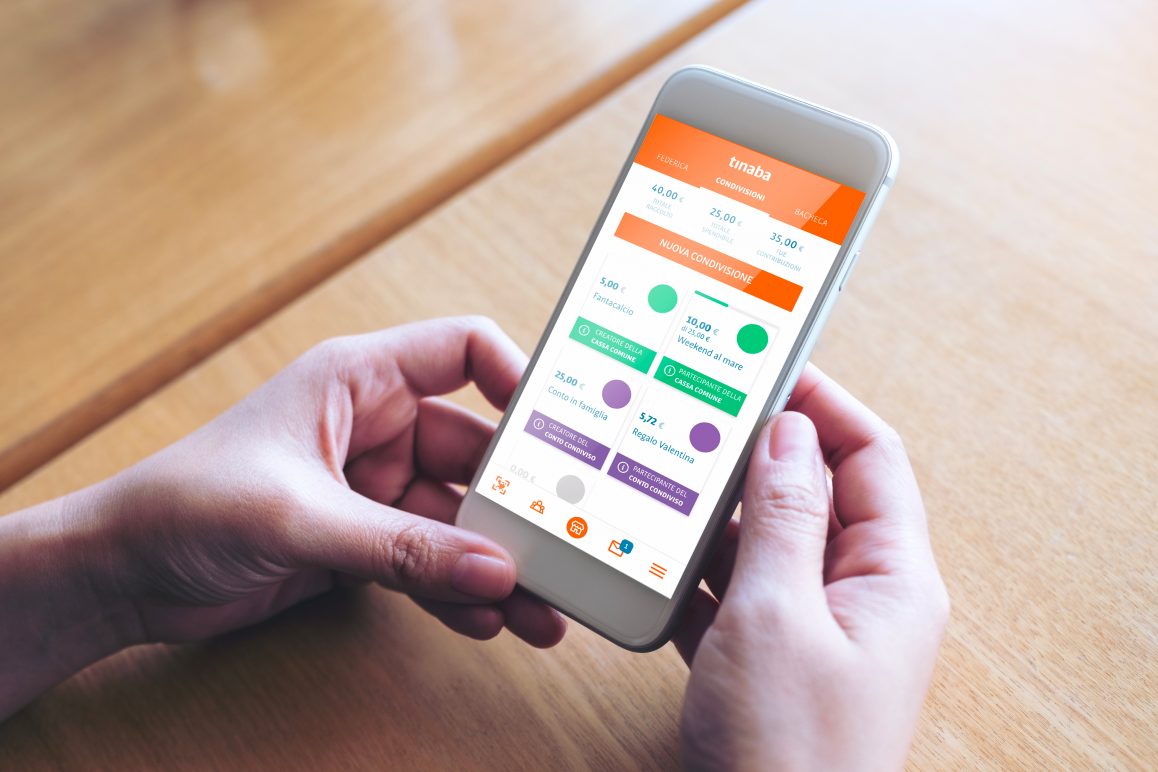

WHAT IS TINABA

Tinaba is an Italian fintech founded in 2015 by Matteo Arpe integrated with the banking system since its inception thanks to the partnership with Banca Profilo. Fintech enables access with a single integration to all traditional and new generation banking services: account, card, money exchange and sharing, investment service through robo-advisor, charity & crowdfunding, purchase and sale of cryptocurrencies and many other services and technological solutions guaranteeing maximum freedom in managing your money.

“The partnership between Engineering and Tinaba”, commented Matteo Arpe, President and Founder of Tinaba, “is unique on the international scene. Together we want to contribute to a clear digital change in banking services by offering all players in the credit system the possibility of adopting the most advanced technologies in a simple and reliable way. The agreement, which arises from the growing demand for digital services by bank customers, aims to create a renewed banking service model created through technological and innovative products and services such as robo-advisor, crowdfunding, community management, payment services and app based money sharing, cryptocurrencies. I am particularly proud of the partnership with Engineering, a leading international operator in digital transformation. An extraordinary team of recognized great professionalism and competence. "

WHAT THE DIGITAL COMPANY LEADED BY IBARRA DOES

Engineering is a Digital Transformation Company that operates at the forefront in assisting customers in defining new services through the adoption of the most advanced technologies. It is a company that sees the financial sector as one of its leading markets with the mission of being an aggregator of highly technological realities to grow and enhance the innovative footprint of its customers.

“The speed of digitization processes is now an essential factor of competitiveness for all economic sectors. The banking sector is central to Engineering's strategy, since it was among the first to believe in the potential of the digital transition for the efficiency of internal processes and to improve services aimed at customers, both Corporate and Retail, for the benefit of Country ”commented Maximo Ibarra, CEO & General Manager of Engineering. “Today, one of the main challenges facing banks is to be able to accelerate the interconnection with innovative realities, to create new business models capable of creating value for customers. I am enthusiastic about the work done by Giuseppina Volpi, head of the Group's Finance Department, who strongly believed in the collaboration between two Italian digital excellences such as Engineering and Tinaba, defining an agreement that goes exactly in the direction of supporting the bank in hiring a leading role within an ecosystem aimed at creating synergies between different players, so as to broaden its boundaries and serve its customers in an end-to-end manner. Continuous innovation and cross-industry expertise will therefore allow us to build new services that will make the relationship with the customer more and more digital ”concluded Ibarra.

THE DIGITAL TRANSFORMATION OF BANKS

The agreement between the two players takes shape in a challenging context in which there are still many banks that need a further technological push. The banks will carry investments for digital transformation with a focus on improving the customer experience and on the evolution of their digital multichannel platform for approximately € 5.3 billion in 2022, further growing in the period 2023-2026.

FINTECH-AS-A-SERVICE GOAL

Engineering and Tinaba, thanks to an approach defined as fintech-as-a-service, are able to create an ecosystem that is flexible, customizable and open to integration. The offer model is divided into two autonomous but in some way connected areas: Financial services and services for the Territory & Community. The services offered are modular, modular, integrable and oriented towards an excellent customer experience.

The offer deriving from the partnership has obtained positive feedback from some banking groups attracted mainly by the breadth of digital services which they would have access to from the perfect compatibility with their management systems and last but not least by the speed of integration.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/che-cosa-faranno-engineering-e-tinaba/ on Tue, 13 Sep 2022 08:39:36 +0000.