What will Eni do with Venezuelan oil after Biden’s okay

The United States has granted Eni and Repsol the possibility of transporting Venezuelan oil, but only to Europe. Washington could also ease sanctions on Iranian crude. All the details

As revealed by the Reuters news agency, the US state department has granted energy companies Eni and Repsol the opportunity to resume transporting Venezuelan oil to Europe starting next month. The transfers had been interrupted two years ago due to the American sanctions against the regime of Nicolás Maduro; their recovery allows Washington today to favor the detachment of Europe from Russian crude oil, given the almost total embargo agreed by the countries of the Union last week.

MODEST VOLUMES

According to Reuters sources, the quantities of crude oil that Eni and Repsol will be able to receive will be modest, and the impact of the decision on global oil prices – Brent, the international reference, is above 120 dollars a barrel – will therefore be contained.

THE GOALS OF THE UNITED STATES

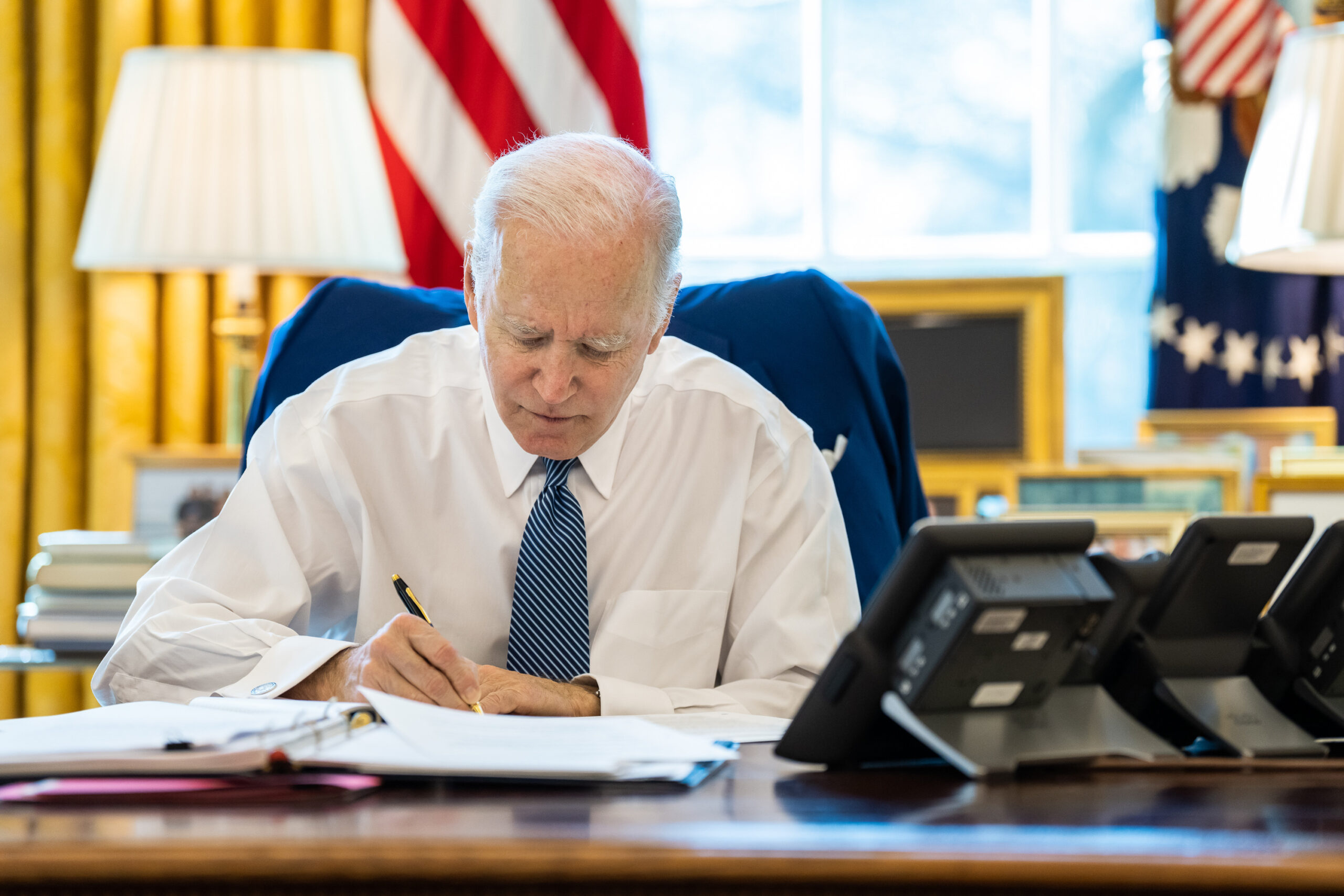

In addition to helping Europe to do without Russia, the move by Joe Biden's administration also aims to reduce the volumes of Venezuelan crude oil sent to China and to favor – through the slight easing of sanctions pressure – the resumption of negotiations between the Maduro regime and the opposition.

Beijing is the largest buyer of Venezuelan crude, absorbing up to 70 percent of Caracas' monthly oil cargoes.

VENETIAN OIL YES, BUT ON ONE CONDITION

Eni and Repsol – both own joint ventures with PDVSA, the Venezuelan state oil company – must however be subject to an important condition: the oil they will import from Venezuela must be destined for Europe, and cannot be resold in other parts of the world. Transactions between the parties will not be made in cash, but will follow an oil-for-debt exchange mechanism (PDVSA will use the cargoes of crude oil to repay its debts).

OTHER PERMITS

The United States has also issued similar permits to the American oil company Chevron, the Indian ONGC and the French Maurel & Prom. All of these, plus Eni and Repsol, stopped oil-for-debt exchanges with PDVSA in mid-2020 due to the "maximum pressure" campaign launched by the Donald Trump administration against Venezuela.

BIDEN'S APPROACH TO VENEZUELA

In March, the Biden administration held high-level talks with the Venezuelan government, winning the release of two jailed US citizens and promising to resume talks with the opposition (President Maduro, however, has not yet set a date for the return to negotiations). The United States has specified that the further easing of sanctions will depend on the progress achieved in the government-opposition talks for the restoration of democracy in the country.

Last month Washington, in addition to having issued a license to Chevron on opening talks for a "potential future business" in Venezuela, also sent letters to Eni and Repsol, saying it would have "nothing to object" on the matter. to a resumption of oil-for-debt trading with PDVSA.

OPENING TO IRAN?

According to oil trading company Vitol, the United States could also agree with Iran (another sanctioned regime) and allow the commercialization of some of its crude, even in the absence of a nuclear deal with the country. The reason is internal politics: the high international value of oil is also having repercussions on gasoline prices in the United States, which have reached record levels (over 4.8 dollars per gallon); the issue greatly affects American public opinion, which will vote in mid-term elections in November.

Last month the United States confiscated a cargo of crude oil from an Iranian oil tanker off the coast of Greece; a few days later, Tehran blocked two Greek oil tankers in the Persian Gulf. Most of Iran's oil exports end up in China.

According to analysts, Iran has a hundred million barrels of oil in its reserves, which it could sell shortly. An agreement between Washington and Tehran, therefore, could increase the supply of crude oil on the world market by 500,000-1 million barrels per day: this is a quantity, writes Bloomberg , capable of lowering the price of hydrocarbon.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/stati-uniti-petrolio-venezuela-iran/ on Mon, 06 Jun 2022 08:06:44 +0000.