What will happen to Bitcoins

“Some reflections on Bitcoin”: the analysis by Luca Paolini, chief strategist of Pictet Asset Management

With the boom in the price of Bitcoin, investors are showing more and more interest in this cryptocurrency. But how close is it to becoming a real investment tool?

It is no coincidence that Bitcoin made a comeback as soon as concerns about inflation arose.

This is because cryptocurrencies, among which Bitcoin stands out, have become sentiment barometers on aggressive central bank monetary policy and financial repression. Over the past decade, central banks have been supporting their economies in the wake of the global financial crisis, driving interest rates and bond yields below the rate of inflation and effectively forcing investors into negative returns once adjusted for inflation. . This became even more evident as they responded even more massively to the economic crisis caused by the COVID pandemic.

At the same time, distrust of government control grows more and more as our lives move online. An anonymous digital currency therefore becomes interesting.

But many things may not work for Bitcoin, so much so that it is difficult to judge the digital currency as anything other than a more speculative investment.

THE CHARM OF CRYPTOCURRENCIES

Bitcoin has had a particular time lately due to fears that central banks have gone too far with quantitative easing and other stimuli. The growing fear is that monetary authorities are gradually monetizing the government deficit, meaning that they are permanently funding overspending by governments as a tool to support their economies following the COVID pandemic.

This is a problem, as debt monetization has historically been a precursor to runaway inflation.

But even those who don't care about these kinds of extreme consequences have reasons to like Bitcoin. Just the fact that central banks are reducing government bond yields below the already low current rate of inflation – a phenomenon known as financial repression – has reduced the opportunity cost of holding non-income-generating assets, such as Bitcoin.

More recently, the cryptocurrency has shown modest positive correlation with stocks and gold and negative correlation with US Treasuries and the dollar.

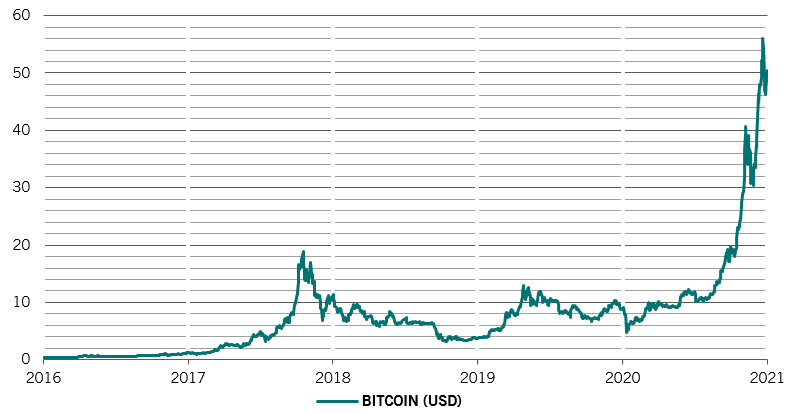

Source: Refinitiv Datastream, Bitstamp. Data as of 04.03.2021.

In the meantime, we have seen a greater propensity on the part of companies to use Bitcoin for its original purpose, which is as a medium of exchange. Tesla, the electric car company, has stated its intention to sell cars priced in Bitcoin and has converted some of its dollar cash into the cryptocurrency. And financial firms Mastercard and BNY are also considering whether to transact Bitcoin or hold it on behalf of customers, while US derivatives operator CME offers Bitcoin futures that could pave the way for a more liquid market in the future.

BRAKE TRANSACTIONS

While it is true that Bitcoin is making its way into the normal trading circuit, it will still have to go a long way before becoming a substitute for currencies. It is still inconvenient to use, it is not very widespread and there are countless cases of people who have forgotten their passwords or had hardware problems that prevented them from accessing their Bitcoin wallets – around 20% of the cryptocurrency is believed to be. be in this limbo.

Furthermore, the blockchain, the database used to record Bitcoin transactions, can perform a limited number of transactions, estimated at between three and nine per second. In addition to this, once the high transaction costs are considered, the appeal of Bitcoin wanes compared to more liquid assets.

US Secretary of the Treasury Janet Yellen recently reported that Bitcoin is extremely inefficient as a tool for executing transactions and, at the same time, added that it is a highly speculative activity.

Recent price swings have raised doubts about Bitcoin's potential as an alternative to safe assets or as a store of value. On February 21, it peaked at $ 58,000. The next day, it dropped to $ 47,000, the level of the previous week. A volatility that is not new: the price of Bitcoin in dollars has always been subject to strong fluctuations.

One of the main problems for investors is that Bitcoin is impossible to value. This is not a problem with the underlying asset, but with the asset itself. It does not generate income. And, unlike gold, it doesn't have a long history during which it has been able to build a widely recognized reputation as an alternative store of value. It is hardly traded, often associated with illicit transactions and subject to strong fluctuations.

And it is exposed to significant risks.

ATTRACTING ATTENTION THE WRONG WAY

The more Bitcoin attracts the speculative interest of amateur investors, the more likely the regulators tasked with protecting them will step in. At its recent peak, the total value of all existing Bitcoins is estimated to have reached $ 1 trillion. While not yet considered a potential systemic risk to the financial system, it is a market large enough to attract the attention of regulators. In addition to this, legal authorities are already taking an interest in its role in the "black economy". Meanwhile, Bitcoin mining is highly concentrated, especially among Chinese operators.

While the great appeal of Bitcoin is its anonymity, there is a possibility that existing authorities could undermine this if they were to offer something similar. Janet Yellen recently noted that although there are many issues to address before the creation of digital dollars, the project "is definitely worth considering". He added that a "digital dollar could lead to faster, safer and cheaper payments." A digital dollar that also offered anonymity to its users would be potentially attractive, depending on the kind of guarantees the government would be willing to provide.

"The more Bitcoin attracts the speculative interest of amateur investors, the more likely the regulators tasked with protecting them will intervene."

The main attraction for Bitcoin would therefore remain its limited availability, with a maximum limit of 21 million units. And it takes even more computing power to mine every further Bitcoin, making it immune to the kind of traditional currency depreciation that many of its proponents fear.

But even in this case, Bitcoin faces several risks. According to one estimate, Bitcoin mining already requires more electricity than Argentina consumes. The Iranian government has attributed the local blackouts to Bitcoin mining operations which consume a lot of electricity. This gives governments another reason to take aggressive measures against Bitcoin.

Cryptocurrency regularly hits the front pages of newspapers and has great resonance in Internet chat rooms. But it is increasingly difficult for it to become a real investment tool, much less a substitute for the dollar.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/bitcoin-cosa-succede/ on Sat, 10 Apr 2021 06:00:49 +0000.