What will happen to commodity prices?

The end of 2022 will be dominated by multiple uncertainties that will continue to create a volatile environment for most commodities, but here are some predictions. The analysis by Ole Hansen , Head of Commodity Strategy for BG SAXO

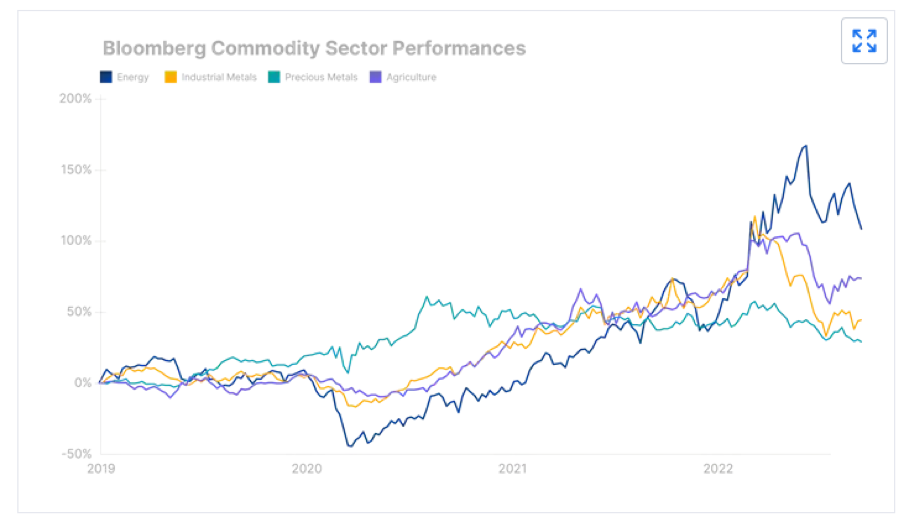

The Bloomberg Commodity Index which tracks a basket of 24 major commodities maintains its + 10% year-to-date gain. It highlights a commodity behavior where supply and demand ultimately determine the price.

While we see concerns about growth and demand, the supply of several important commodities remains equally under test. An explosive rally during the first quarter was driven by wars, sanctions and the post-pandemic tail of increased demand for consumer goods and the energy to produce them. The market subsequently retreated in June as the US Federal Reserve accelerated on rate hikes to fight uncontrolled inflation, while China's zero-Covid policy and real estate problems led to a sharp correction.

During the third quarter, however, the sector has reasserted itself and, although we will see pockets of weakness in demand, we see that the supply side is equally questioned: the developments we see support the long-lasting cycle of rising prices. of the commodities we first wrote about in early 2021.

In the coming months we can confirm the multiple uncertainties that will first of all mean a focus on the demand side. There is no doubt that the increased efforts of central banks around the world, led by the US Federal Reserve, to combat uncontrolled inflation, will lead to some weakness in demand. Additionally, China's month-long and hitherto unsuccessful battle against Covid and tough anti-virus restrictions, coupled with the real estate crisis, has resulted in a slowdown in the world's largest commodity consumer. However, we believe the current weakness in China is temporary and with domestic inflationary pressures easing, we expect the government and the People's Bank of China to step up their efforts to sustain an economic turnaround.

AGRICULTURE

With global food demand relatively constant, the supply side will continue to dictate the general direction of prices. We see multiple challenges in the winter and next spring. This is due to the cost of fertilizers due to high gas prices, climate change and the "triple dip" La Ninã during the Northern Hemisphere winter 2022/23, a meteorological phenomenon that resulted in a change in temperatures across the country. world and has led to several climate emergencies over the past two years.

Added to this is the war in Ukraine which resulted in a sharp decline in exports from a major supplier of grains and edible oils to the global market. With global stocks of key food products, from wheat and rice to soybeans and corn, already under pressure from weather and export restrictions, the risk of further spikes remains a clear and critical danger.

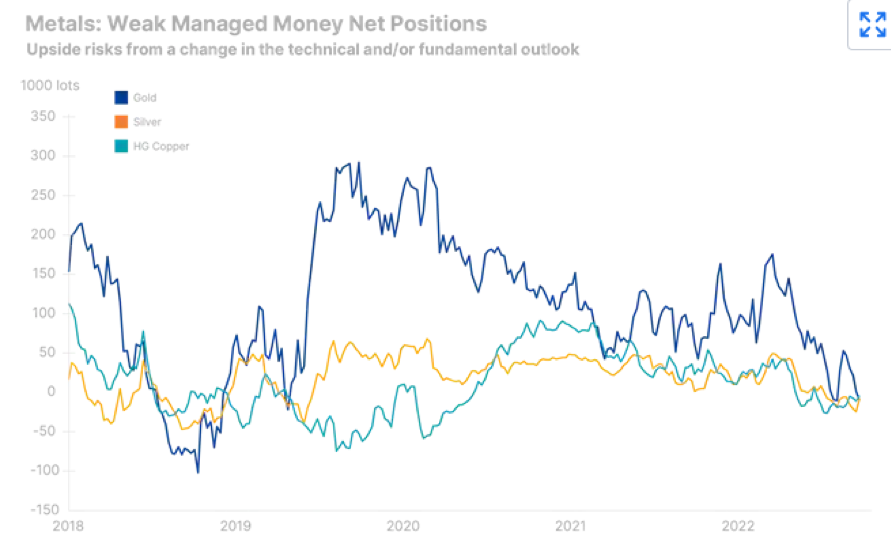

PRECIOUS METALS

Traders and investors in these assets will continue to focus on the direction of the dollar and US bond yields, in the certainty that they are both the main reason gold will potentially be trading lower against this currency. However, as we have seen the stronger dollar rally and the fastest pace of increase in real yields in recent decades, this weakness has generally only been seen against the dollar. Given this, we consider gold's performance so far in 2022 to be acceptable as it indicates some underlying strength that is likely to be confirmed when the dollar stops rising.

Looking instead at silver, given the current low interest of investors in this metal and also in consideration of the support for an industrial metallurgical sector in recovery, where the supply, in particular of aluminum and zinc, remains challenged by the punitively high prices of the gas and electricity. This has forced a reduction in production around the world, particularly in Europe but also in China, where a long period of drought has seen foundries suffer from electricity shortages.

INDUSTRIAL METALS

We maintain a positive long-term outlook on the industrial metals sector given the expected increase in demand towards global electrification. Regarding copper, we expect the prospect of a temporary increase in production capacity next year by miners around the world, particularly in Central and South America and Africa, is likely to dampen the near-term outlook for a new one. soaring to a new all-time high.

World copper-intensive electrification will continue to gain momentum after a year of intense weather stress around the world and the need to reduce dependence on Russian-produced energy, gas to oil and coal. But for power grids to be able to cope with the additional base load, a massive amount of new copper-intensive investments will be required in the coming years. Furthermore, we are already seeing producers such as Chile, the world's largest copper supplier, struggle to meet production targets due to declining mineral quality and water scarcity. China's slowdown is considered temporary, and economic push through stimulus measures is likely to focus on infrastructure and electrification, both areas that will require industrial metals.

PETROLEUM

It has returned to pre-Russian invasion levels of Ukraine as the market continues to discount the prospect of an economic slowdown that harms demand. The result is lower spot prices and a flattening of the forward curve to an extent that is not yet supported by a corresponding increase in inventories. The question arises whether the macroeconomic outlook has pushed prices to levels not yet justified by the current developments in supply and demand.

There is no doubt that demand has eased in recent months, especially after the end of the summer season, and the ongoing but temporary blockages in China that are damaging mobility and growth. In Europe, punisively high gas and electricity prices also contributed to a slowdown in fuel demand, but the region continues to import around 3 million barrels a day from Russia. The introduction of an import embargo on December 5 is likely to tighten the overall market with Russia struggling to find more buyers.

We view the current weakness in oil fundamentals as temporary and on the side of leading oil forecasters from the EIA, OPEC and IEA who, despite current growth concerns, have all kept their demand growth forecast for 2023. that during the last quarter prices will remain challenging and in a potential lower range of Brent between $ 80 and $ 100 dollars a barrel. The main developments that could affect prices are:

- China's ongoing battle with Covid against further stimulus to offset growth risks

- the shift from gas to fuel to support the demand for distillate products

- the EU embargo on Russian oil could potentially force a reduction in Russian production

- the United States starting to replenish its strategic reserves

- OPEC threatening to reduce production in the event of a further drop in prices

- the direction of US inflation and the dollar, both of which are key factors in the overall level of risk appetite

- US production growth, which shows signs of stalling, thus supporting prices

Liquidity-flooded oil majors and investors generally showing little interest in investing in new research suggest that the cost of energy may remain high for years to come.

This is also due to the green transformation which is receiving increasing and urgent attention and which will eventually begin to reduce the global demand for fossil fuels. It is the timing of this transition that keeps the propensity to invest low. Unlike new drilling methods such as fracking, which allows a well to be productive within months, traditional oil production projects often require years and billion-dollar investments before production can begin. Taking all this into account, oil companies looking to invest in new production are not making valuations on a price around $ 90 for Brent and lower for WTI, but instead on prices lower than at least + $ 30 currently traded. in the futures market with 5-year delivery.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/cosa-succedera-ai-prezzi-delle-materie-prime/ on Sun, 16 Oct 2022 05:18:18 +0000.