What will happen to gas, oil and metals

All the effects of the war in Ukraine on raw materials. The comment by Ole Hansen, head of commodity strategy for BG SAXO

Markets always grappling with turmoil after last Thursday's invasion of Ukraine by Russia. The raw materials sector is no exception with the most severe US and European sanctions against Moscow that can lead to the cutting of part of supplies from Russia, namely gas, oil and various industrial metals, as well as wheat. The geopolitical risk and the scarce supply continue to grow, the potential for a solution, however remote, would trigger important movements.

Market turmoil continues following Russia's invasion of Ukraine last Thursday. In the commodities sector, the tougher US and European sanctions against Moscow may lead to the cutting of some supplies from Russia, thus affecting several key commodities, from gas and oil to several industrial metals and key crops such as wheat. .

Ukraine, often called the granary of Europe given its vast fertile lands, has witnessed the breakdown of supply chains with closed ports that prevent the export of key food products such as wheat, barley and corn.

The main risks, however, go both ways, and if the current crisis and war were to find a sudden solution, crude oil could fall by 10% to 15%, EU gas up to 50%, the Parisian wheat up to 25% while gold could see a softer downward reaction from 2% to 4%.

Brent crude oil travels at prices close to or above $ 100 a barrel (not since 2012) and, although the price now probably includes a Russian supply risk premium of close to $ 10, the outlook remains favorable as global demand it shows no signs of easing in the long term. The price jumped following the news of the invasion last Thursday and the market remains on offer with traders struggling to quantify a potential drop in supply from Russia among banks withdrawing funding and rising costs. shipping. These developments have pushed the front end of the futures curve sharply higher with fast and deferred spreads in all very tight market conditions for prices. One example is the six-month spread which jumped to $ 11.50, the highest since 2007.

The talks between the United States and the main consumer nations, on the release of up to 60 million barrels of oil from strategic reserves and yesterday's OPEC + meeting in which an increase in production of 400,000 barrels per day was confirmed. in April as expected. A disappointing decision as many producers struggle to reach their production targets while Russia, if allowed, risks reaching the production limit within a few months.

Meanwhile, the nuclear talks with Iran have reached the final and most difficult phase.

Indeed, Tehran is now in a position of strength after recent price developments that allow it to be less compliant towards a new deal.

With global supply not fully meeting strong energy demand, the result could be a continued rally in crude oil.

EUROPEAN GAS

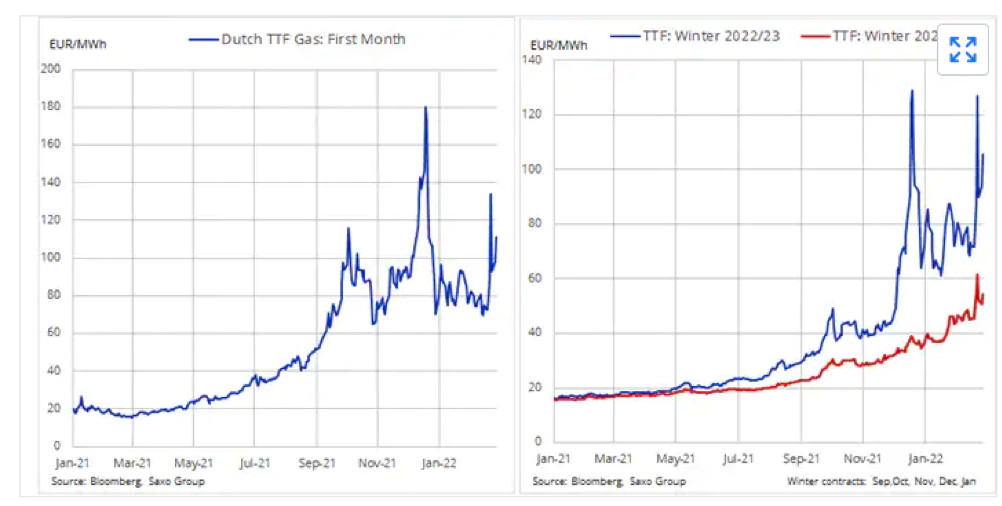

The European gas benchmark, the Dutch Title Transfer Facility (TTF) has been trading these days with a 12% rise (Saxo Ticker: TTFMJ1) to 110 € / MWh, or $ 203 per barrel of crude oil equivalent. The current price is seven times higher than the average price seen in the years leading up to the rally that began last August.

Intraday price fluctuations of 25% over the past three days highlight the market's difficulty in assessing the risk of a potential further loss of supply from Russia, a supplier of nearly 40% of European gas.

Storage facilities across Europe are currently around 30% full, a little more than initially feared after withdrawals slowed in February due to warmer weather. The refueling season normally starts at the end of March, and although the worst risk of a drop in supply this winter is almost over, a prolonged conflict with Russia nevertheless increases the risk for the coming winter, with the price of winter gas ( from October 2022 to March 2023) is currently trading close to € 100 / MWh while the following winter 2023/24 has a price of € 51 / MWh.

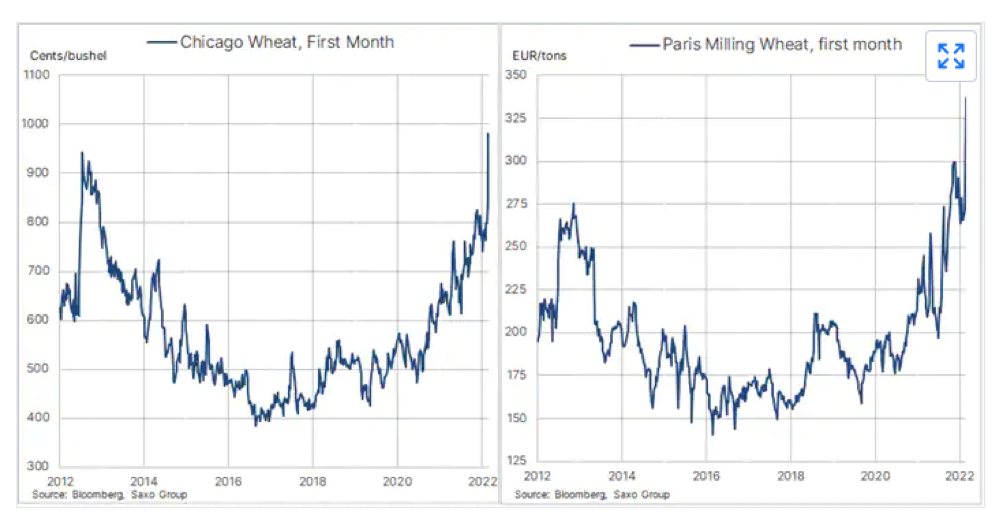

GRAIN

Global wheat prices ended February on a positive note with the Chicago price showing the largest monthly jump in six years. Today, prices in Europe and Chicago have risen again with Paris Milling wheat (EBMH2) trading close to the record € 341.75 per tonne reached last Thursday, while Chicago wheat (ZWH2) continues to run towards $ 10 per ton. bushel, a level never higher since March 2008.

Wheat is one of the most important food reserves in the world, the other is rice, and the current explosive rally will continue to pose a problem for consumers around the world, particularly for people in emerging market countries.

Russia and Ukraine supply over 25% of the world's wheat. However, with Kiev already shipping two-thirds of its expected exports by November last year, the short-term impact is expected to be limited even as strong concerns remain for the upcoming season and the impact a prolonged war will have on the availability of laborers. agricultural.

Against this backdrop, the good news is that Australia, another major wheat producer, has improved its already record harvest by 5.5%. Although the prospect of a continuing rise in global food price inflation remains real with the negative consequences it could have on stability and growth.

GOLD AND SILVER

Gold and silver have both managed to hold on to most of their recent strong gains. After last Thursday's $ 100 top-to-bottom support, gold is now at the highest close of the last 13 months. Indeed, a world in turmoil continues to drive investor interest in a safe haven.

Sanctions against Russia potentially increase an already high risk to global growth and thereby fuel a bullish outlook for the yellow metal as, as inflation is likely to remain high for longer, the risk of a period grows. of stagflation favorable to gold.

In the short term, the market will continue to seek direction from developments in Ukraine, as well as further news on sanctions and the hitherto useless talks between Russia and Ukraine. The prospect of a US rate hike on a 50 basis is out of the question with the market cutting the number of rate hikes this year to less than six. Although support has been established at $ 1877, the 50% retracement of the recent rally, a sign of further gains to the upside could emerge on a break above $ 1937.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/che-cosa-succedera-a-gas-petrolio-e-metalli/ on Sun, 06 Mar 2022 06:42:50 +0000.