What will happen to inflation and world economies

The forecasts for the global economy are different from those of last June: on both sides of the Atlantic, expectations are for moderate growth and inflation under control. The analysis of Marco Piersimoni, Senior Investment Manager of Pictet Asset Management

The dark shadows of a possible autumn recession, which until June loomed threateningly over the global economy, seem to have vanished. The forecasts for 2024 are all in favor of a soft landing, characterized by moderate economic growth and inflation under control. For the USA, the Fed outlines a GDP growth projection of 1.5% and an inflation rate of +2.5%, with the consensus of analysts being slightly below these figures (+1% the GDP growth forecast and +2.7% inflation forecast). As for Europe, the ECB and analysts are aligned with these expectations, as they foresee moderate growth and unproblematic inflation. Specifically, the Eurotower estimates GDP to increase by 1%, inflation at +3.2% and the consensus at +0.7% and +2.7% respectively.

The International Monetary Fund, which met in Marrakech in October, confirmed similar forecasts in its latest outlook on the global economy: in 2024 the US GDP will increase by +1.5% and the European one by +1.2%. But the fact that must be underlined once again is that, especially for the United States, estimates suggest GDP growth accompanied by a decline in inflation, which represents one of the best possible combinations. Even in the Euro area, despite the delays in the cyclical phase and the new surge in energy prices, there are many indications that suggest a deflationary trend also in the Old Continent: a scenario that is starting to be shared even by the most hawkish economists.

Covid effect: the long wave of the pandemic still affects the markets

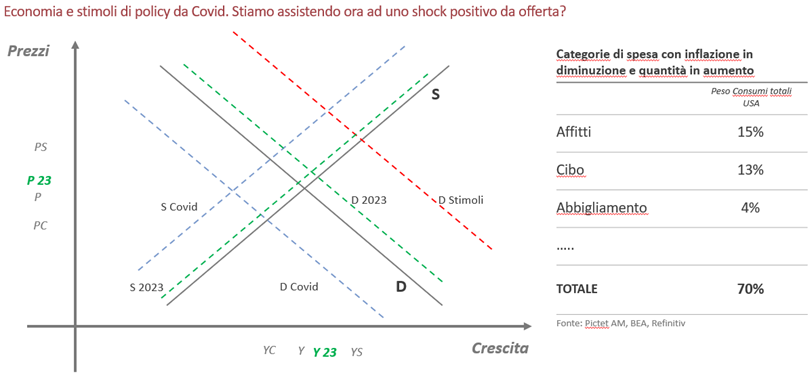

The forecasts on the retracement of inflation are also strengthened by the observation of the impact that COVID-19 has had on the dynamics of supply and demand. In other words, since inflation mainly derives from the extraordinary events of the two-year pandemic period, their conclusion should also be accompanied by a mitigation of prices. During the pandemic, in fact, demand was compressed by extended lockdowns, while supply was reduced due to interruptions in supply chains. In response, ultra-accommodative economic policies were adopted to lift the economy, spurring explosive growth and, as a result, higher inflation in 2021-2022.

In 2022, stimulus measures were gradually reduced and demand normalized. At the moment we are also seeing a normalization of supply, an entirely positive development because it helps to contain inflation without compromising economic growth. Currently, most spending items in the US consumer basket show increasing quantities and stable prices.

Some elements of uncertainty persist for companies, whose zero-cost emissions will expire in 2025

Although the general picture is quite positive, elements of concern persist, for two reasons. Firstly, it is believed that the robust economic growth retains residual traces of the legacy of the pandemic, that is, it may be partly due to the excess savings accumulated by families during the lockdowns and then massively poured into the economy at the end of the crisis . That liquidity then dried up as inflation arrived. On the corporate side, however, many of them issued corporate bonds at very low interest rates during the long phase of accommodating monetary policies. These bonds will mature and will have to be refinanced at higher rates between 2025 and 2026, with a consequent increase in costs for businesses, elements that could compromise growth: it is no coincidence that the attention of the financial market is shifting from fear of inflation to fear of insufficient economic growth.

Where will interest rates go? The restrictive cycle seems to have come to an end

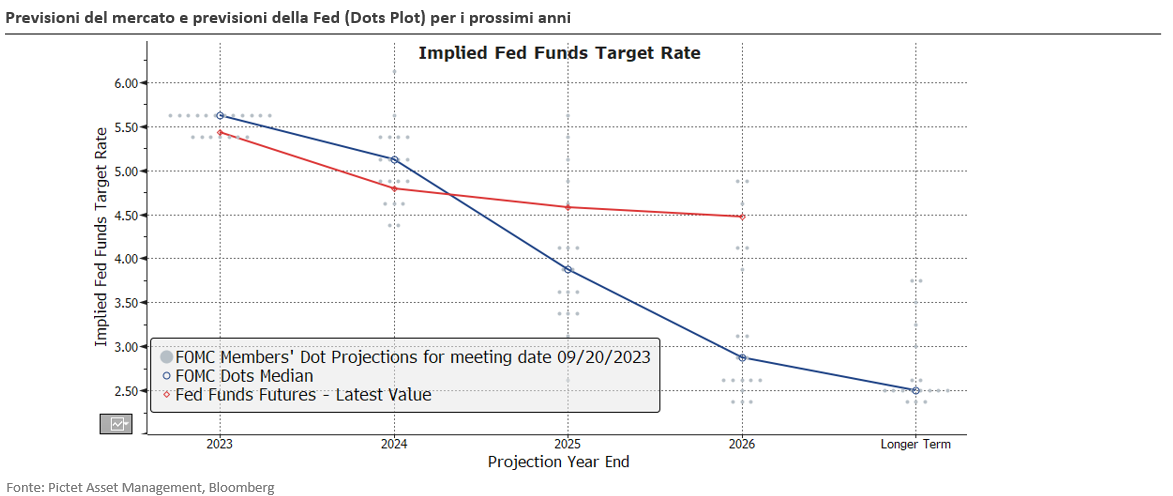

Interest rates are a key topic in this context. The ECB interrupted the cycle of increases for the first time since 2022; the Fed may have room for a final increase in 2023, but the useful data and Powell's latest communications suggest that the cycle of increases has ended in the USA too. There is a misalignment in the forecasts on the direction of monetary policy in the coming months: in 2024 the Fed expects two cuts and the market estimates more than three; while from 2025 the situation will reverse with the market placing itself at a rate level higher than that of the Fed, already looking at the terminal rate.

How to orient yourself, then? An answer can be found in bond curves. Bond markets have gone through a period of volatility since mid-August, with a rise in rates and a simultaneous correction in equity. It is important to understand the reasons for this turbulence. Contrary to expectations, the main cause of this situation is not inflation, which remained at lower levels than at the end of June; on the contrary, it is the real rate curve that exceeded 2.50% on all maturities. Long-term real rates depend on long-term considerations: they reflect the cruising speed of the economy, they depend on structural factors such as demographics and productivity. They are currently more than one point above the June values, despite the recovery in the first days of November. It is difficult to find convincing explanations, but it is important to note that a substantial part of these movements is due to technical factors (issues, behavior of foreign institutions). It is therefore legitimate to expect a stabilization of the bond market, especially with regard to the long maturities of the American curve.

In the medium term, stocks beat bonds

To understand how this macro picture will influence the markets we must start from the assumption that the extraordinary correlation condition between shares and bonds experienced in 2022 and in the past three months of 2023 (August-October) is destined not to be repeated. The scenario becomes manageable in terms of portfolio construction when we move from fear of inflation to concern for economic growth. Investors targeting decorrelation between different asset classes in 2024 can find opportunities in both the stock and bond markets, taking into account different risk and return factors.

A comparison of the expected returns of stocks and bonds highlights some key considerations. Currently, the expected return on stocks, with a price-to-earnings (P/E) ratio of 20, is 5%, while the real return on bonds is 2.3%. This difference implies an additional 2.7% yield over bonds, which is at its lowest since 2002 and seen alone would make buying bonds more attractive than stocks. This is true if we limit ourselves to the "demand" side, i.e. dynamically comparing two competing financial activities. However, moving to the supply side, another factor intervenes: the number of shares available on the market over the last 20 years has paradoxically reduced, while the number of sovereign, corporate and financial bonds has continued to increase.

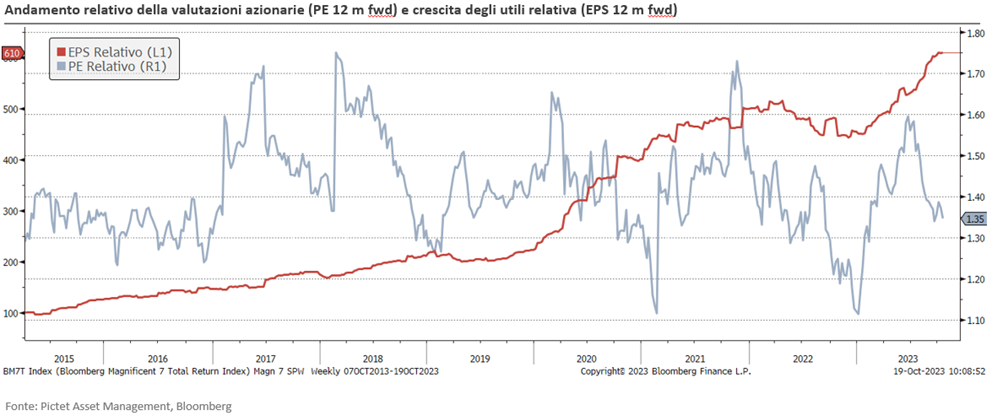

The tight supply of shares is largely attributable to share buyback programs conducted by large technology, pharmaceutical, banking and energy companies. Of the approximately 2 trillion dollars in profits of the S&P 500 companies, buybacks represent a figure equal to half: just under a trillion dollars of share buybacks per year. This aspect can alter the comparison of the relative return between stocks and bonds today compared to the last ten years. In fact, if we look at the multiples of companies like Google, which currently operates with an expected P/E ratio of 18 compared to 2024 earnings, or Meta (2024 P/E of 17) it is clear that they are slightly more expensive than the market in as a whole (at 14). But this is a difference in line with that of the last ten years. Extending the reasoning to the so-called "magnificent 7" (Apple, Microsoft, Google, Meta, Nvidia, Amazon, Tesla), we see how, in spite of generous valuations as they have been on average, vastly superior earnings growth is achieved.

On the other hand, on the bond front, high yields entail additional risks, in particular that of volatility, which has stood at around 10-15% for this asset class, not matching the moderate risk profile of those who purchase on the bond market. In conclusion, it is important to underline that there are opportunities on both the stock and bond markets: the possibility of investing in both assets is becoming increasingly concrete, given that a world of correlations that are more useful for portfolio construction is increasingly closer.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/inflazione-cosa-succedera/ on Sun, 19 Nov 2023 06:18:09 +0000.